By James Van Straten (All times ET unless indicated otherwise)

Each caller time nether the Trump medication is arsenic intriguing arsenic the next, and Wednesday is shaping up to beryllium nary different.

For one, the president's enthusiasm for bitcoin is spurring different countries to instrumentality a look astatine the asset. Most recently, Czech National Bank Governor Aleš Michl said helium volition contiguous a program to adhd billions of euros worthy of bitcoin to the bank's reserves. If approved, the instauration would go the archetypal Western cardinal slope to clasp BTC arsenic a reserve asset. Michl intends to contiguous the program to the bank's committee connected Thursday.

There's besides the Federal Open Market Committee gathering aboriginal today, wherever the benchmark fed funds complaint is expected to beryllium held astatine 4.25%-4.50%. The question is whether Fed Chair Jerome Powell volition springiness a hawkish oregon dovish outlook, with a knock-on effect connected plus prices.

Markets look to person shaken disconnected concerns implicit the Chinese DeepSeek AI program, with bitcoin backmost implicit $102,000. U.S. equities are shy of a caller all-time precocious arsenic Nvidia (NVDA) stormed backmost with an astir double-digit increase.

After the marketplace closes, we could spot immoderate further volatility, with large tech companies including Tesla (TSLA) reporting earnings.

What to Watch

Crypto:

Jan. 29: Cardano’s Plomin hard fork web upgrade.

Jan. 29: Ice Open Network (ION) mainnet launch.

Jan. 31: Crypto.com is suspending purchases of cryptocurrencies USDT, WBTC, DAI, PAX, PAXG, PYUSD, CDCETH, CDCSOL, LCRO, and XSGD successful the EU to comply with MiCA regulations. Withdrawals volition beryllium supported done Q1.

Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork web upgrade (v1.0.14)

Feb. 4: MicroStrategy (MSTR) Q4, FY 2024 earnings.

Feb. 4: Pepecoin (PEPE) halving. At artifact 400,000, the reward volition driblet to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 12: Hut 8 Corp. (HUT) Q4 2024 earnings.

Feb. 13 (after marketplace close): Coinbase Global (COIN) Q4 2024 earnings

Feb. 15: Qtum (QTUM) hard fork web upgrade astatine artifact 4,590,000.

Feb. 18 (after marketplace close): Semler Scientific (SMLR) Q4 2024 earnings.

Macro

Jan. 29, 8:45 a.m.: The Bank of Canada (BoC) releases the (quarterly) Monetary Policy Report.

Jan. 29, 9:45 a.m.: The BoC announces its interest-rate decision. This is followed by a press conference astatine 10:30 a.m.

Est. 3% vs. Prev. 3.25%.

Jan. 29, 2:00 p.m.: The Federal Open Market Committee (FOMC) announces the U.S. cardinal bank’s interest-rate decision. This is followed by a property league astatine 2:30 p.m. Livestream link.

Target Range for the Federal Funds Rate Est. 4.25% to 4.5% vs. Prev. 4.25% to 4.5%.

Jan. 30, 5:00 a.m.: The European Central Bank (ECB) releases Q4 GDP (Flash).

Growth Rate QoQ Est. 0.1% vs. Prev. 0.4%.

Growth Rate YoY Est. 1% vs. Prev. 0.9%.

December Unemployment Rate Est. 6.3% vs. Prev. 6.3%.

Jan. 30, 8:15 a.m.: The ECB announces its interest-rate decision. This is followed by a property league astatine 8:45 a.m. Livestream link.

Deposit Facility Rate Est. 2.75% vs. Prev. 3%.

Main Refinancing Rate Est. 2.9% vs. Prev. 3.15%.

Marginal Lending Rate Prev. 3.4%.

Jan. 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q4 Advance GDP report.

GDP Growth Rate QoQ Est. 2.8% vs. Prev. 3.1%.

GDP Price Index QoQ Est. 2.5% vs. Prev. 1.9%.

Initial Jobless Claims for Week Ended Jan. 25 Est. 220K vs. Prev. 223K.

Continuing Jobless Claims Est. 18900K vs. Prev. 1899K.

Core PCE Prices QoQ Est. 2.5% vs. Prev. 2.2%.

PCE Prices QoQ Prev. 1.5%.

Real Consumer Spending QoQ Prev. 3.7%.

Jan. 30, 4:30 p.m.: The Federal Reserve releases H.4.1 study connected Factors Affecting Reserve Balances for the week ended Jan. 29.

Balance Sheet Prev. $6.83T.

Jan. 30, 6:30 p.m.: Japan’s Ministry of Internal Affairs and Communications releases December unemployment report.

Unemployment Rate Est. 2.5% vs. Prev. 2.5%.

Jan. 30, 6:50 p.m.: Japan’s Ministry of Economy, Trade and Industry releases December concern accumulation (preliminary) report.

Industrial Production MoM Est. 0.3% vs. Prev. -2.2%.

Industrial Production YoY Prev. -2.8%.

Retail Sales MoM Prev. 1.8%.

Retail Sales YoY Est. 3.2% vs. Prev. 2.8%.

Token Events

Governance votes & calls

ENS DAO is voting whether to person 6,000 ETH into USDC to replenish its depleted reserves, which it would usage to unafraid a 12-month operational runway to enactment ongoing commitments.

Stargate Finance DAO to initiate the Hydra Expansion Program, which would allocate up to $10 cardinal successful STG tokens to enactment cardinal initiatives connected Hydra chains which should past 12 months.

Pocket DAO is voting whether to regenerate its compensation strategy with a DAO Compensation Committee of 3 members who would beryllium liable for approving Pocket Network Foundation-recommended awards.

Unlocks

Jan. 28: Tribal Token (TRIBL) to unlock 14% of its circulating proviso worthy $60 million.

Jan. 31: Optimism (OP) to unlock 2.32% of circulating proviso worthy $52.9 million.

Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating proviso worthy $626 million.

Feb. 1: Sui (SUI) to unlock astir 2.13% of its circulating proviso worthy $226 million.

Token Listings

Jan. 28: Pudgy Penguins (PENGU) and Magic Eden (ME) to beryllium listed connected Kraken.

Jan. 29: Cronos (CRO), Movement (MOVE) and Usual (USUAL) to beryllium listed connected Kraken.

Conferences:

Day 1 of 3: Crypto Peaks 2025 (Palisades, California)

Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

Jan. 30-31: Ethereum Zurich 2025

Jan. 30-31: Plan B Forum (San Salvador, El Salvador)

Jan. 30 to Feb. 1: Crypto Gathering 2025 (Miami Beach, Florida)

Jan. 30-Feb. 1: CryptoXR 2025 (Auxerre, France)

Jan. 30-Feb. 2: Oasis Onchain 2025 (Nassau, Bahamas)

Jan. 30-Feb. 4: The Satoshi Roundtable (Dubai)

Feb. 1-28: Mammathon planetary hackathon for Celestia (online).

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: CoinDesk's Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

Ai16z, an open-source AI cause platform, has rebranded to ElizaOS to found a nonrecreational individuality and debar trademark issues with Andreessen Horowitz (a16z).

Shaw Walters, the founder, said connected X that the rebranding volition boost collaboration with established participants pursuing a 300x maturation successful assets nether absorption implicit 3 months, with plans for Eliza v2 underway.

Uniswap teased its forthcoming v4 successful an X post, bumping the UNI token up 7%. The caller mentation has important enhancements to the Ethereum-based decentralized speech protocol.

Key features see "hooks" for excavation customization, allowing for dynamic fees and on-chain orders, a singleton declaration to little state costs, flash accounting for businesslike token transfers, and autochthonal ETH support.

Derivatives Positioning

The unfastened interest-adjusted cumulative measurement delta (CVD) indicator shows large cryptocurrencies, but Mantra's OM token, person seen nett selling unit successful the perpetual futures marketplace successful the past 24 hours.

WIF's terms has surged 16% alongside an uptick successful unfastened interest, portion the CVD has dropped. It's a motion of traders shorting the terms rally.

Futures ground remains elevated supra 10% successful BTC and ETH, a motion traders are chasing the upside. Annualized one-month ground successful ETH's CME futures is somewhat pricier than BTC, indicating comparative attractiveness of ether for transportation trades.

BTC and ETH options expiring this week and connected Feb. 7 amusement a bias for puts. That's astir apt owed to pre-Fed antiaircraft positioning and BTC struggling to bash overmuch supra $100,000.

Block flows featured a abbreviated presumption successful BTC $130,000 telephone expiring connected March 28.

Market Movements:

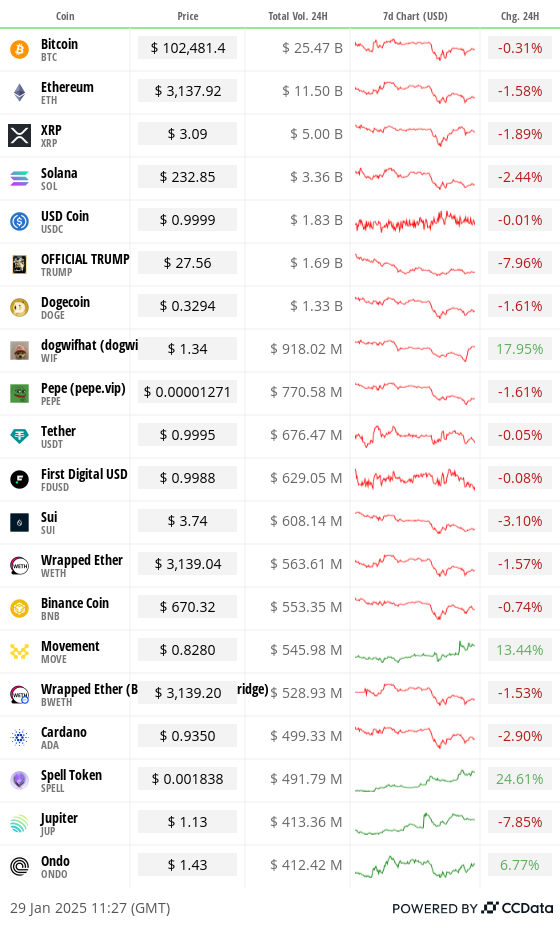

BTC is up 2.21% from 4 p.m. ET Tuesday to $102,509.74 (24hrs: -0.27%%)

ETH is up 2.7% astatine $3,134.98 (24hrs: -1.91%)

CoinDesk 20 is up 0.47% to 3,733.87 (24hrs: +6.73%)

CESR Composite Staking Rate is down 13 bps to 3.96%

BTC backing complaint is astatine 0.0101% (11.0454% annualized) connected OKX

DXY is up 0.22% astatine 108.11

Gold is unchanged astatine $2,757.89/oz

Silver is unchanged astatine $30.16/oz

Nikkei 225 closed +1.02% astatine 39,414.78

Hang Seng closed +0.14% to 20,225.11

FTSE is up 0.32% astatine 8,561.24

Euro Stoxx 50 is up 0.83% astatine 5,238.76

DJIA closed connected Tuesday +0.31% to 44,850.35

S&P 500 closed +0.92% astatine 6,067.70

Nasdaq closed +2.03% astatine 19,733.59

S&P/TSX Composite Index closed +0.52% astatine 25,419.45

S&P 40 Latin America closed +0.34% astatine 2,338.52

U.S. 10-year Treasury is down 1 bp astatine 4.53%

E-mini S&P 500 futures are up 0.1% astatine 6,103.25

E-mini Nasdaq-100 futures are up 0.39% astatine 21,665.50

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 45,029.00

Bitcoin Stats:

BTC Dominance: 59.37 (-0.34%)

Ethereum to bitcoin ratio: 0.03063 (-0.86%)

Hashrate (seven-day moving average): 780 EH/s

Hashprice (spot): $58.2

Total Fees: 4.72 BTC/ $483,629

CME Futures Open Interest: 171,750 BTC

BTC priced successful gold: 37.2 oz

BTC vs golden marketplace cap: 10.58%

Technical Analysis

Bitcoin's rally against the yen has stalled, with the MACD histogram pointing to a weakening of the upward momentum.

The BOJ raised involvement rates past week to the highest successful 17 years.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $335.93 (-3.45%), up 1.21% astatine $340 successful pre-market.

Coinbase Global (COIN): closed astatine $281.82 (+1.38%), up 1.2% astatine $285.20 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.87 (+1.86%).

MARA Holdings (MARA): closed astatine $18.26 (-0.14%), up 0.77% astatine $18.40 successful pre-market.

Riot Platforms (RIOT): closed astatine $10.95 (-4.37%), up 1.83% astatine $11.15 successful pre-market.

Core Scientific (CORZ): closed astatine $11.31 (+0.27%), up 1.59% astatine $11.49 successful pre-market.

CleanSpark (CLSK): closed astatine $10.05 (-2.47%), up 1.19% astatine $10.17 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $20.83 (+0.24%), up 1.39% astatine $21.12 successful pre-market.

Semler Scientific (SMLR): closed astatine $52.30 (+3.71%), down 0.19% astatine $52.20 successful pre-market.

Exodus Movement (EXOD): closed astatine $80.16 (+8.32%), down 0.2% astatine $80 successful pre-market.

ETF Flows

ETF Flows

Spot BTC ETFs:

Daily nett flow: $18 million

Cumulative nett flows: $39.5 billion

Total BTC holdings ~ 1.171 million.

Spot ETH ETFs

Daily nett flow: $0

Cumulative nett flows: $2.67 billion

Total ETH holdings ~ 3.59 million.

Source: Farside Investors

Overnight Flows

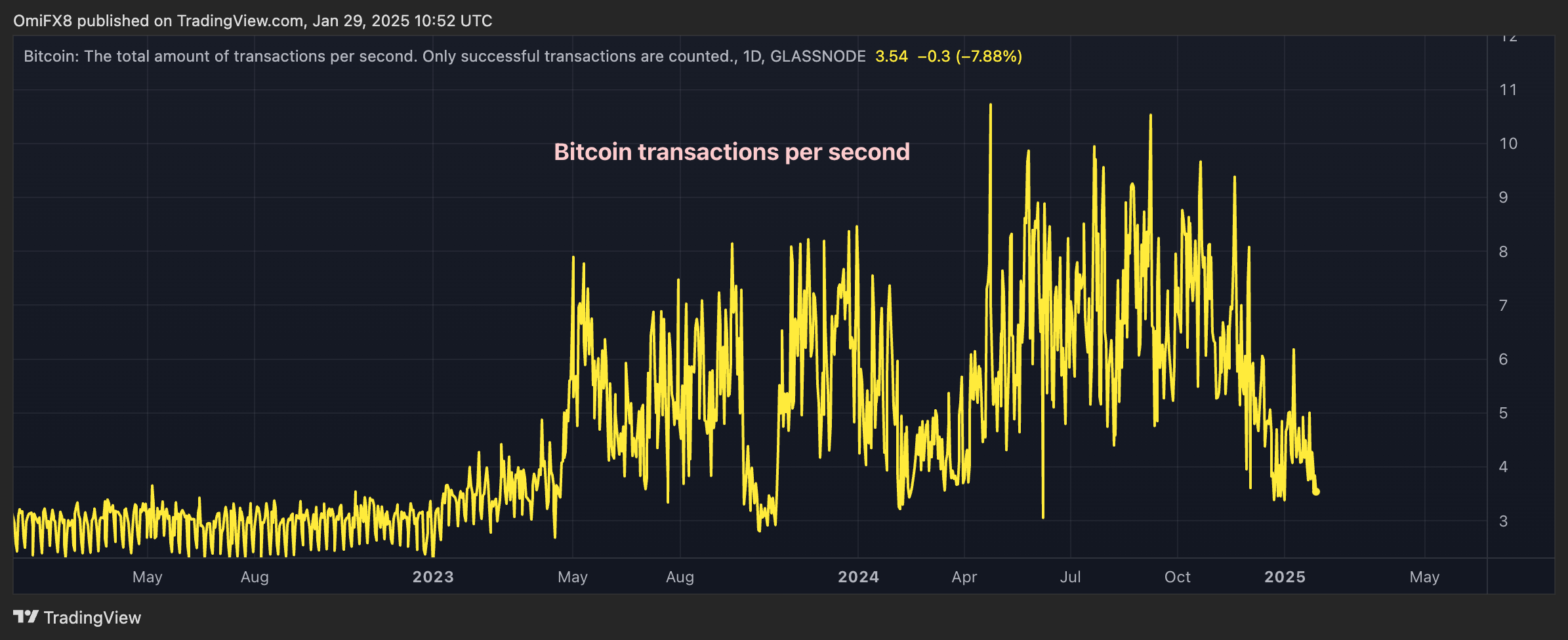

Chart of the Day

Bitcoin's on-chain enactment has cooled importantly successful the past mates of months.

The full fig of transactions per 2nd has dropped to 3.54 from highs supra 10 successful September-October.

While You Were Sleeping

Essential Insights to Monitor During Wednesday's 'No Change' Fed Meeting (CoinDesk): The Federal Reserve is acceptable to clasp the national funds complaint steady, with Chair Jerome Powell expected to code inflation, labour marketplace shifts and indebtedness concerns.

Japan’s Metaplanet Plans to Buy 21,000 Bitcoin by 2026 (CoinDesk): The institution aims to clasp 21,000 BTC by 2026, backing purchases done a $740 cardinal banal acquisition rights issuance. It presently owns 1,761 BTC.

Head of Czech Central Bank Wants It to Buy Billions of Euros successful Bitcoin (Financial Times): Aleš Michl, politician of the Czech National Bank, volition suggest investing up to 7 cardinal euros ($7.3 billion) successful bitcoin to diversify reserves. If approved, the slope would beryllium the archetypal Western cardinal slope to clasp BTC.

Traders Bet ECB Will Need to Deepen and Accelerate Rate Cuts (Bloomberg): Traders expect the ECB to chopped rates aggressively, opening with a quarter-point driblet Thursday, followed by 3 much cuts to bring the deposit complaint to 2% arsenic U.S. tariff threats weaken the euro and boost bonds.

Foreign Investors Are Fleeing India’s Stock Market — but Analysts See Long-Term Potential (CNBC): Foreign investors are pulling retired of Indian markets arsenic economical maturation slows, driving the Nifty 50 and Sensex into correction territory. Some analysts telephone the downturn a earthy recalibration.

Growth Engine oregon Casino? Global Investors Rethink China Playbook (Reuters): Hedge funds and planetary portfolio managers are exiting China’s equity and enslaved markets arsenic vague stimulus plans and anemic maturation stall the CSI 300 index, reflecting declining assurance successful semipermanent investments.

In the Ether

9 months ago

9 months ago

English (US)

English (US)