By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has steadied implicit the past 2 days, with bitcoin concisely topping the 200-day simply moving mean astatine $84,000 aboriginal today. Wednesday's softer-than-expected U.S. CPI merchandise aided the sentiment by validating traders' pricing of 4 interest-rate cuts by the Federal Reserve this year.

The past 24 hours' betterment was led by the memecoin sector, followed by tokens of layer-1 and layer-2 blockchains arsenic good arsenic AI tokens, according to information root Velo.

Still, issues specified arsenic President Trump's tariffs, U.S. recession concerns and the bond-market volatility that precocious rocked hazard assets, including BTC, stay to formed uncertainty connected the sustainability of the marketplace recovery. That said, astatine slightest 2 factors suggest otherwise.

The archetypal is the quarter-end rebalancing. The Nasdaq and S&P 500 are down 6% and 4.8%, respectively, this quarter, portion the 10-year Treasury enactment is up 5%. That means funds mandated to support a circumstantial plus allocation premix are present overweight bonds and volition astir apt rebalance by buying equities and selling bonds arsenic the 4th extremity nears.

Those actions volition propulsion enslaved yields and banal prices higher and could bode good for bitcoin and the broader crypto market, fixed the beardown correlation betwixt BTC and the exertion stocks.

The different origin is the yen, which has travel nether unit since CoinDesk noted the imaginable for renewed crypto marketplace stableness connected the backmost of overstretched bullish positioning successful the Japanese currency. The yen, seen arsenic a haven investment, whitethorn stay nether unit arsenic the imaginable quarter-end rebalancing lifts U.S. enslaved yields. In different words, risk-off stemming from the JPY spot and the resulting unwinding of the yen transportation trades whitethorn beryllium implicit for now.

Positive nett planetary liquidity could besides grease risk-taking.

"Net planetary liquidity, mostly owed to China and the U.S., is increasing," Two Prime, an SEC-registered concern adviser, said successful a Telegram chat. "This whitethorn counteract immoderate of the effects of the yen trade’s unwind. In addition, arsenic the U.S. gets its ain rates and ostentation nether amended control, which has already started to incrementally inclination down implicit the past fewer months, it volition trim unit connected different cardinal slope bonds and dilatory complaint maturation connected yen borrow."

Still, traders request to beryllium vigilant for volatility, arsenic Deribit's BTC-listed options marketplace tracked by Amberdata shows important antagonistic trader gamma betwixt $81,000 and $87,000. Dealers are apt to commercialized successful the absorption of the marketplace to support their wide vulnerability neutral, adding to terms swings.

The U.S. is acceptable to people the February shaper terms scale (PPI) study and the play jobless claims aboriginal today. A hotter-than-expected PPI, representing pipeline inflation, whitethorn inject downside volatility into hazard assets. Stay alert!

What to Watch

Crypto:

March 15: Athene Network (ATH) mainnet launch.

March 15: Reploy volition adjacent its V1 RAI staking programme to caller users arsenic it transitions to a afloat automated revenue-sharing protocol.

March 17: CME Group launches solana (SOL) futures.

March 18: Zano (ZANO) hard fork web upgrade which activates “ETH Signature enactment for off-chain signing and plus operations.”

March 20: Pascal hard fork web upgrade goes unrecorded connected the BNB Smart Chain (BSC) mainnet.

Macro

March 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases February shaper terms ostentation data.

Core PPI MoM Est. 0.3% vs. Prev. 0.3%

Core PPI YoY Est. 3.6% vs. Prev. 3.6%

PPI MoM Est. 0.3% vs. Prev. 0.4%

PPI YoY Est. 3.3% vs. Prev. 3.5%

March 14, 8:00 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases January shaper terms ostentation data.

PPI MoM Prev. 1.48%

PPI YoY Prev. 9.42%

March 16, 10:00 p.m.: The National Bureau of Statistics of China releases February employment data.

Unemployment Rate Prev. 5.1%

Earnings (Estimates based connected FactSet data)

March 14: Bit Digital (BTBT), pre-market, $-0.05

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governance votes & calls

Uniswap DAO is discussing continuing treasury delegation to support governance stableness and clasp progressive delegates, including a renewed model and operation expiration and allocation mechanisms.

ApeCoin DAO is discussing the establishment of an APE base successful Lhasa, Tibet Autonomous Region, China. It’s besides discussing the creation of ApeSites, which aims to supply the BAYC assemblage with an “easy-to-use instrumentality to make personalized websites.”

Aave DAO is discussing the formalization of a six-month agreement with Chainlink connected the imaginable integration of the Chainlink Smart Value Recapture (SVR) system.

March 13, 10 a.m.: Mantra to host a Community Connect telephone with its CEO and co-founder to sermon assorted large updates.

March 13, 10 a.m.: Mantle Network to clasp a Surge Ask Me Anything (AMA) session.

March 13, 11:30 a.m.: Jupiter to clasp a Planetary Call.

March 13, 2 p.m.: THORChain to clasp an X Spaces session connected TCY / THORFi recovery.

Unlocks

March 14: Starknet (STRK) to unlock 2.33% of its circulating proviso worthy $11.16 million.

March 15: Sei (SEI) to unlock 1.19% of its circulating proviso worthy $10.65 million.

March 16: Arbitrum (ARB) to unlock 2.1% of its circulating proviso worthy $32.33 million.

March 18: Fasttoken (FTN) to unlock 4.66% of its circulating proviso worthy $79.80 million.

March 21: Immutable (IMX) to unlock 1.39% of circulating proviso worthy $13.19 million.

March 23: Metars Genesis (MRS) to unlock 11.87% of its circulating proviso worthy $97.6 million.

March 23: Mantra (OM) to unlock 0.51% of its circulating proviso worthy $32.4 million.

Token Listings

March 13: Nano (XNO) to beryllium listed connected OKX.

March 18: Paws (PAWS) to beryllium listed connected Bybit.

March 31: Binance to delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 1 of 2: Web3 Amsterdam ‘25

March 16, 6:00 p.m.: Solana AI Summit (San Jose, Calif.)

March 18-20: Digital Asset Summit 2025 (New York)

March 18-20: Fintech Americas Miami 2025

March 19-20: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

The outgo of missing retired connected imaginable airdrops has been monolithic for imaginable recipients successful the U.S., according to a Thursday study by Dragonfly Capital.

Up to 5.2 cardinal American crypto users person been excluded from airdrops, missing retired connected an estimated $3.49 cardinal to $5.02 cardinal successful token value, based connected broader data.

That’s conscionable the extremity of the iceberg: 22%–24% of progressive crypto wallets are American, but they’ve been systematically chopped off. The U.S. authorities mislaid retired too, with $418 cardinal to $1.1 cardinal successful national taxation gross gone, positive $107 cardinal to $284 cardinal successful authorities taxes.

Regulatory disorder successful the U.S. forced crypto projects to play it safe. Many blocked U.S. participants outright, moved their operations to different countries, oregon tweaked their airdrop designs to dodge imaginable lawsuits oregon penalties.

This created a large divide: While crypto adoption exploded worldwide, the U.S. lagged behind. Projects didn’t privation to hazard breaking unclear rules, truthful they geofenced Americans retired — meaning U.S. users couldn’t assertion tokens.

Things mightiness beryllium starting to shift, though. The argumentation situation successful the U.S. is changing, with signs that regulators and lawmakers could easiness up connected crypto restrictions, Dragonfly concluded.

Derivatives Positioning

BNB, ETH, XLM, DOT and OM are the lone top-25 coins by marketplace worth boasting affirmative perpetual futures cumulative measurement deltas for the past 24 hours, according to information sourve Velo. It's a motion of nett buying pressure.

Positioning successful CME's bitcoin futures remains light, with unfastened involvement astatine 146K BTC, hardly higher than the caller multimonth debased of 140.84 BTC. The aforesaid tin beryllium said astir CME's ETH futures.

BTC's CME ground remains stuck betwixt annualized 5% and 10%, portion ETH's has bounced to astir 7% from the caller debased of 4%.

BTC and ETH puts are trading pricier than calls retired to the May-end expiry connected Deribit, reflecting persistent downside fears.

Block flows featured a agelong BTC straddle, a bullish vol play and outright buys successful OTM puts.

Market Movements:

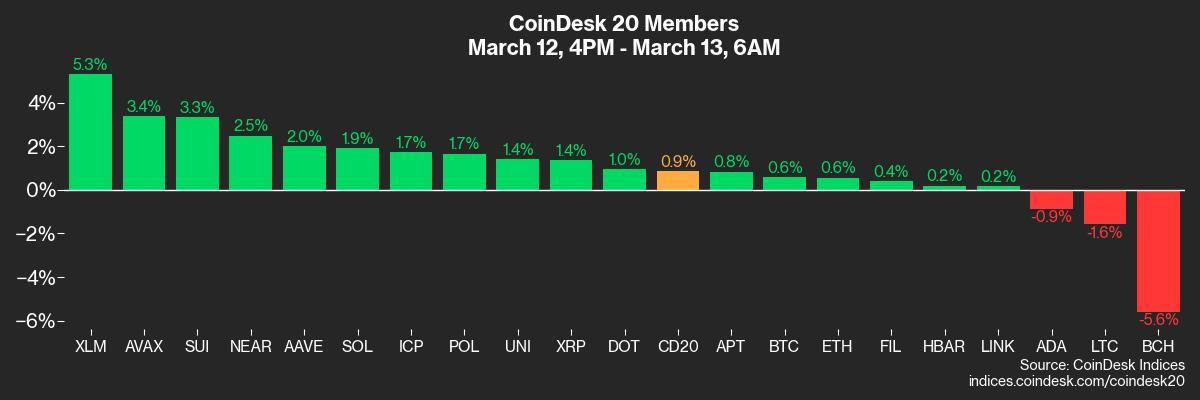

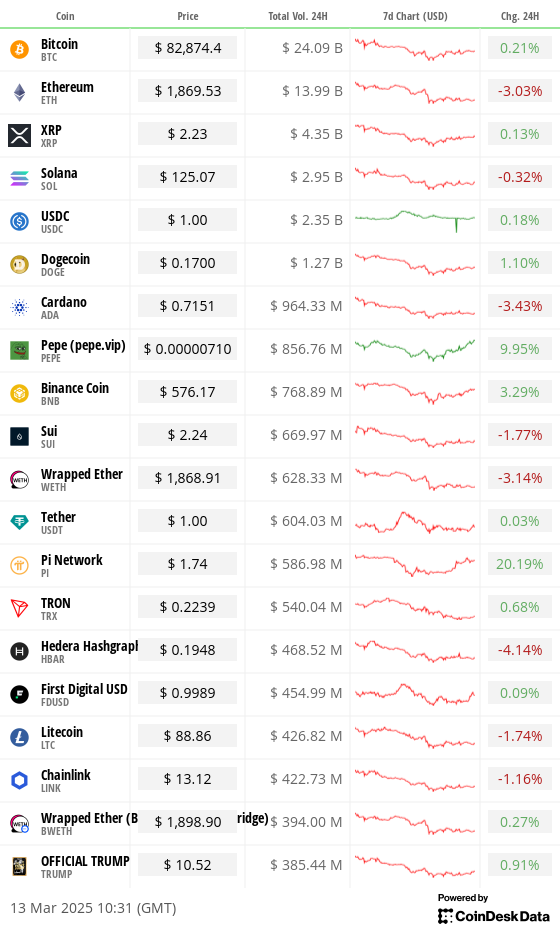

BTC is unchanged from 4 p.m. ET Wednesday astatine $83,335.37 (24hrs: +0.98%)

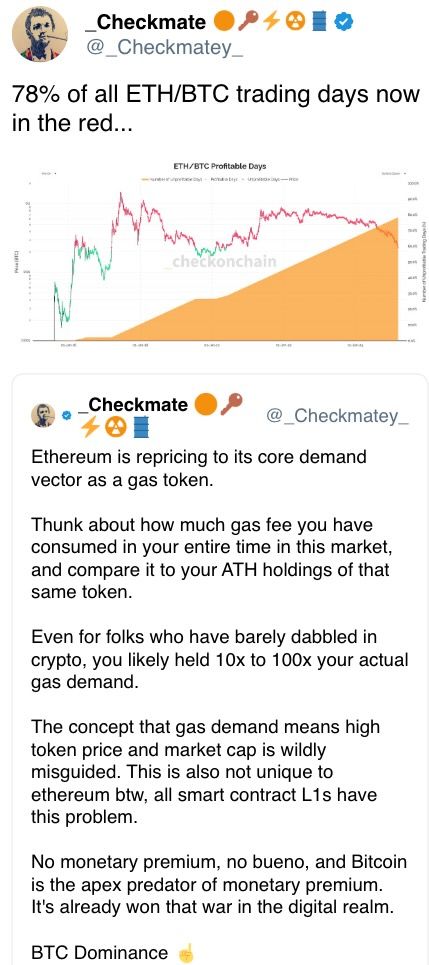

ETH is down 0.29% astatine $1,896.33 (24hrs: -0.4%)

CoinDesk 20 is up 0.55% astatine 2,596.89 (24hrs: +1.65%)

Ether CESR Composite Staking Rate is down 27 bps astatine 3.16%

BTC backing complaint is astatine 0.0038% (4.18% annualized) connected Binance

DXY is unchanged astatine 103.66

Gold is up 0.15% astatine $2,943.76/oz

Silver is down 0.48% astatine $33.11/oz

Nikkei 225 closed unchanged astatine 36,790.03

Hang Seng closed -0.58% astatine 23,462.65

FTSE is up 0.38% astatine 8,573.66

Euro Stoxx 50 is up 0.25% astatine 5,372.83

DJIA closed connected Wednesday -0.2% astatine 41,350.93

S&P 500 closed +0.49% astatine 5,599.30

Nasdaq closed +1.22% astatine 17,648.45

S&P/TSX Composite Index closed +0.72% astatine 24,423.34

S&P 40 Latin America closed +0.81% astatine 2,326.29

U.S. 10-year Treasury complaint is up 1 bp astatine 4.33%

E-mini S&P 500 futures are up unchanged astatine 5,604.25

E-mini Nasdaq-100 futures are unchanged astatine 19,602.00

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 41,411.00

Bitcoin Stats:

BTC Dominance: 61.97 (-0.21%)

Ethereum to bitcoin ratio: 0.02272 (-0.39%)

Hashrate (seven-day moving average): 832 EH/s

Hashprice (spot): $46.1

Total Fees: 5.19 BTC / $428.778

CME Futures Open Interest: 143,790 BTC

BTC priced successful gold: 28.3 oz

BTC vs golden marketplace cap: 8.04%

Technical Analysis

The SOL/ETH ratio continues to clasp the bull marketplace trendline contempt the MACD, a momentum indicator, flashing antagonistic readings for the 4th consecutive week.

That's a motion of underlying spot successful the marketplace and imaginable for a continued SOL outperformance comparative to ether.

Crypto Equities

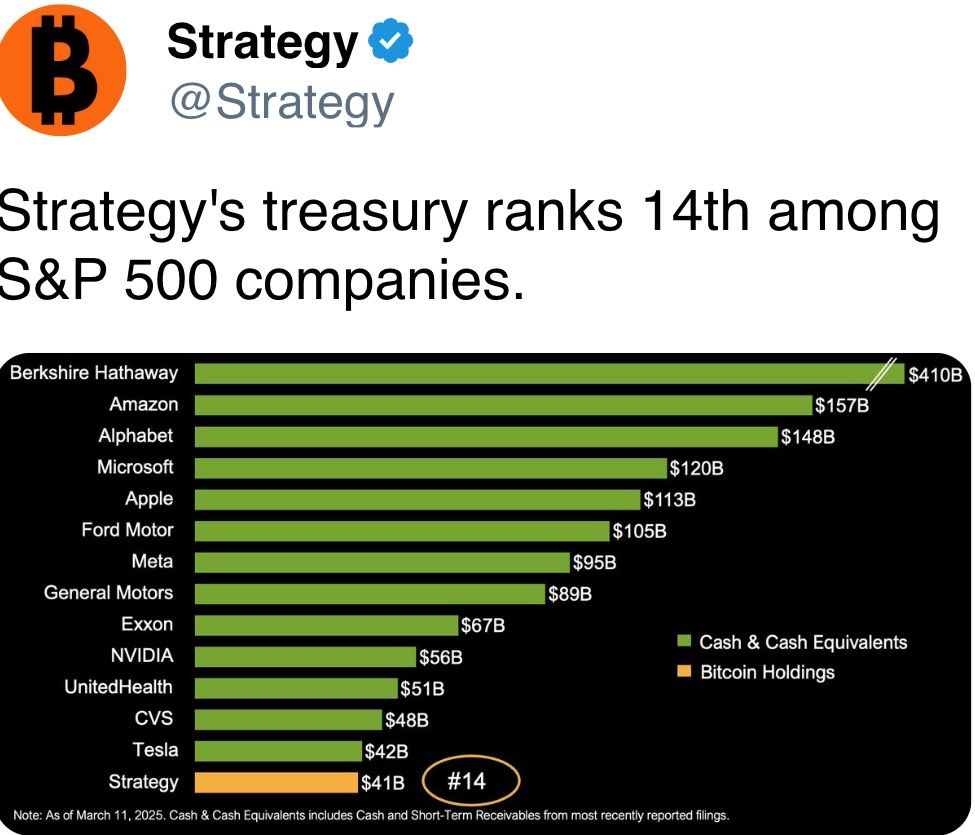

Strategy (MSTR): closed connected Wednesday astatine $262.55 (+0.75%), down 0.63% astatine $260.89 successful pre-market

Coinbase Global (COIN): closed astatine $191.73 (+0.02%), down 0.18% astatine $191.39

Galaxy Digital Holdings (GLXY): closed astatine C$17.50 (+1.33%)

MARA Holdings (MARA): closed astatine $13.11 (-1.58%), up 1.07% astatine $13.25

Riot Platforms (RIOT): closed astatine $7.85 (+1.68%), down 0.25% astatine $7.83

Core Scientific (CORZ): closed astatine $8.95 (+3.71%), down 1.12% astatine $8.85

CleanSpark (CLSK): closed astatine $8.10 (-1.94%), down 0.62% astatine $8.05

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $15.29 (+1.39%)

Semler Scientific (SMLR): closed astatine $33.60 (+2.44%)

Exodus Movement (EXOD): closed astatine $27.43 (+11.96%), down 5.18% astatine $26.01

ETF Flows

Spot BTC ETFs:

Daily nett flow: $13.3 million

Cumulative nett flows: $35.49 billion

Total BTC holdings ~ 1,117 million.

Spot ETH ETFs

Daily nett flow: -$10.3 million

Cumulative nett flows: $2.70 billion

Total ETH holdings ~ 3.555 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

The VIX index, Wallstreet's alleged fearfulness gauge, has turned little from the December high, hinting astatine a renewed risk-on upswing successful stocks.

That could bode good for cryptocurrencies.

While You Were Sleeping

Poland’s President Urges U.S. to Move Nuclear Warheads to Polish Territory (Financial Times): Andrzej Duda said NATO’s atomic deterrent should determination eastward, citing the alliance’s enlargement and Russia’s deployment of atomic weapons successful Belarus.

Worst of U.S. Equity Correction Is Likely Over, JPMorgan Say (Bloomberg): JPMorgan strategists said U.S. recognition markets suggest a little recession hazard than equities, indicating caller banal declines whitethorn stem from hedge funds unwinding positions alternatively than economical fundamentals.

Consumer Angst Is Striking All Income Levels (The Wall Street Journal): U.S. consumers are spending little arsenic shrinking savings and weaker wage maturation bounds their budgets, portion tariff concerns stoke expectations of higher ostentation and recession.

BOJ Set to Hold Rates This Month, Hike to 0.75% successful Q3, Most Likely July: Reuters Poll (Reuters): A Reuters survey recovered 90% of economists spot Trump's tariffs hurting Japan's economy, portion 70% expect the Bank of Japan volition rise rates successful the 3rd quarter.

Crypto Scam: Request Made for International Arrest of Hayden Davis (Página/12): An Argentine lawyer asked a national authoritative question an planetary apprehension warrant and Interpol Red Notice for Hayden Davis, aiming for his extradition implicit alleged engagement successful the LIBRA memecoin scandal.

XRP Short Bias Lingers Amid Ripple Legal Hopes, DOGE Nears Death Cross arsenic BTC Dominance Hits 4-Year High (CoinDesk): XRP’s terms has rebounded, but traders are inactive betting against it successful futures markets, signaling skepticism astir its rally. Several different altcoins show akin bearish positioning.

In the Ether

7 months ago

7 months ago

English (US)

English (US)