By James Van Straten (All times ET unless indicated otherwise)

Tariff developments stay astatine the forefront of planetary economical news, with bitcoin (BTC) surging past $105,000 for a portion pursuing the surprise announcement that the U.S. volition trim tariffs connected Chinese goods to 30% from 145% for 90 days. In return, China volition little tariffs connected U.S. goods to 10% from 125% implicit the aforesaid period.

Ether (ETH), for its part, is experiencing its strongest monthly show since November, having added implicit 40% since the commencement of May. The ETH/BTC ratio has climbed to 0.02440, its highest successful astir 3 months, highlighting renewed appetite for risk-on assets. Meanwhile, Nasdaq futures jumped much than 3% connected the tariff news, further reinforcing the affirmative marketplace sentiment.

The U.S. Dollar Index (DXY) has pushed supra 101, portion WTI crude lipid besides rallied. Conversely, golden has declined by much than 3%, approaching a 10% driblet from its all-time high. Investors are present turning their attraction to Tuesday’s ostentation report, with expectations that header year-over-year ostentation for April volition stay dependable astatine 2.4%.

Strategy (MSTR) held its yearly gathering past week, showcasing updates connected its Business and Artificial Intelligence (BI/AI) bundle initiatives and reaffirming its committedness to firm bitcoin adoption. Executive Chairman Michael Saylor underscored Strategy’s enactment arsenic the foremost nationalist bitcoin treasury, presently holding implicit 555,555 BTC.

Saylor reiterated the company’s unwavering committedness to further bitcoin accumulation. Strategy plans to proceed leveraging AI to heighten operational ratio and research innovative strategies for expanding its BTC holdings.

What to Watch

- Crypto:

- May 12, 1 p.m.-5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable connected "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" volition beryllium held astatine the SEC's office successful Washington.

- May 13: The Singapore High Court holds a hearing to find whether Zettai, the genitor institution of WazirX, tin proceed with restarting the India-based crypto speech and compensating users affected by the July 2024 hack.

- May 14: Neo (NEO) mainnet volition acquisition a hard fork web upgrade (version 3.8.0) astatine artifact tallness 7,300,000.

- May 14: Expected motorboat date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to statesman trading connected the Nasdaq nether the ticker awesome GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- Macro

- Day 4 of 4: Chinese Vice Premier He Lifeng will clasp commercialized talks with U.S. Treasury Secretary Scott Bessent during his sojourn to Switzerland.

- May 12, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases March concern accumulation data.

- Industrial Production MoM Prev. 2.5%

- Industrial Production YoY Prev. -1.3%

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. -0.1%

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.4%

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April ostentation data.

- Inflation Rate MoM Prev. 3.7%

- Inflation Rate YoY Prev. 55.9%

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- A Sei Network developer projected ending enactment for Cosmos to simplify the blockchain and align much intimately with Ethereum to trim complexity and infrastructure overhead and boost Sei's adoption.

- May 12: Helium (HNT) connection HIP 144 voting ends connected authorizing Nova Labs to present a 30-day delay, oregon Rewards Escrow period, to the process of claiming rewards for Helium Mobile.

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- Unlocks

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $68.54 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.2 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $23.87 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating proviso worthy $14.91 million.

- Token Launches

- May 12: Jerry The Turtle (JYAI) to beryllium listed connected LBank with JYAI/USDT pair.

- May 12: Space and Time (SXT) to beryllium listed connected Bitrue with SXT/USDT pair.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 2 of 7: Canada Crypto Week (Toronto)

- Day 1 of 2: Dubai FinTech Summit

- Day 1 of 2: Filecoin (FIL) Developer Summit (Toronto)

- Day 1 of 2: Latest successful DeFi Research (TLDR) Conference (New York)

- Day 1 of 3: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

Token Talk

By Shaurya Malwa

- Animal-themed memecoins are surging.

- A speculative frenzy has gripped fashionable memecoins from 2024, with prices for tokens similar cat-themed MICHI, hippo-themed MOODENG and squirrel-themed PNUT each much than doubling since Saturday.

- That has helped alleviate immoderate losses for the tokens. which took a 90% drawdown from highest prices successful 2024, chiefly astir October and November.

- Talk of a "Cat Coin Supercycle” communicative has gained steam among immoderate crypto circles connected X. This suggests renewed retail capitalist enthusiasm, apt fueled by viral societal media activity.

- Cat token mog (MOG) appears to person enactment the frenzy into gear, jumping implicit 130% past week arsenic exertion entrepreneurs from Ycombinator's Garry Tan to Elon Musk changing their illustration pictures connected X to 1 referencing the token.

- Traders looking for short-term speculative bets whitethorn support an oculus connected the animal and cat memecoin sectors, particularly arsenic the terms moves bring much eyeballs — and request — to these tokens.

Derivatives Positioning

- While BTC has mostly traded betwixt $104K-$106K successful the past 24 hours, perpetual futures unfastened involvement connected offshore exchanges has accrued to astir $20 cardinal from $18 billion.

- The maturation shows the marketplace is gathering vigor during the consolidation and an eventual breakout could beryllium a convulsive one.

- Global aggregated backing rates stay affirmative for BTC and ETH, pointing to bullish sentiment.

- TRX, XMR, TAO, BTC and HYPE person seen nett affirmative cumulative measurement delta for the past 24 hours, a motion of nett buying unit successful the market.

- In Deribit's options market, SOL traders chased upside with the $200 telephone enactment expiring connected June 27.

- BTC traders bought the $120K telephone expiring astatine the extremity of June and sold higher onslaught calls successful longer duration expiries.

Market Movements

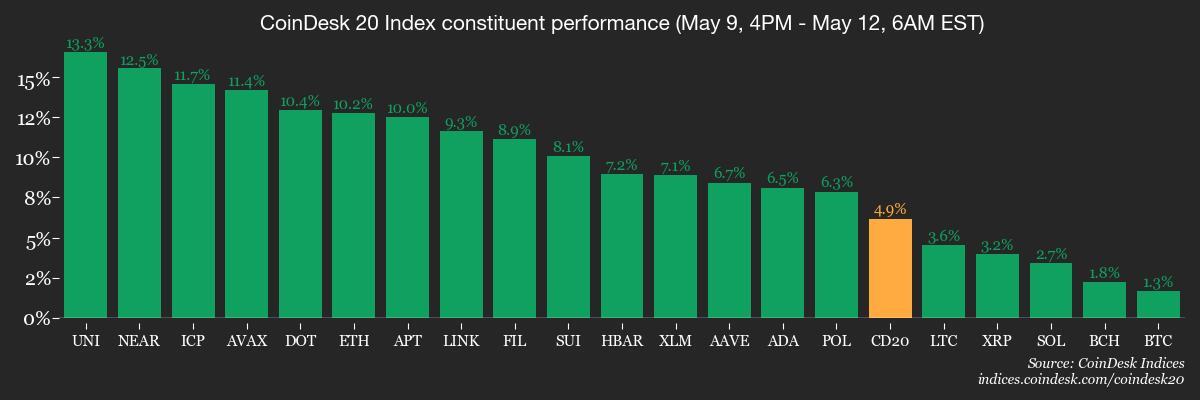

- BTC is up 1.21% from 4 p.m. ET Friday astatine $104,445.95 (24hrs: -0.16%)

- ETH is up 8.81% astatine $2,546.56 (24hrs: +1.43%)

- CoinDesk 20 is up 4.27% astatine 3,265.29 (24hrs: +1.18%)

- Ether CESR Composite Staking Rate is up 10 bps astatine 3.23%

- BTC backing complaint is astatine 0.0072% (7.8687% annualized) connected Binance

- DXY is up 1.14% astatine 101.48

- Gold is down 3.22% astatine $3,219.31/oz

- Silver is down 1.54% astatine $32.23/oz

- Nikkei 225 closed +0.38% astatine 37,644.26

- Hang Seng closed +2.98% astatine 23,549.46

- FTSE is up 0.48% astatine 8,595.81

- Euro Stoxx 50 is up 2.01% astatine 5,416.72

- DJIA closed connected Friday -0.29% astatine 41,249.38

- S&P 500 closed unchanged astatine 5,659.91

- Nasdaq closed unchanged astatine 17,928.92

- S&P/TSX Composite Index closed +0.41% astatine 25,357.74

- S&P 40 Latin America closed +0.83% astatine 2,578.58

- U.S. 10-year Treasury complaint is up 5 bps astatine 4.44%

- E-mini S&P 500 futures are up 2.82% astatine 5838.25

- E-mini Nasdaq-100 futures are up 3.81% astatine 20,904.00

- E-mini Dow Jones Industrial Average Index futures are up 2.16% astatine 42,216.00

Bitcoin Stats

- BTC Dominance: 62.77 (-0.60%)

- Ethereum to bitcoin ratio: 0.2448 (+1.39%)

- Hashrate (seven-day moving average): 897 EH/s

- Hashprice (spot): $55.70

- Total Fees: 3.43 BTC / $357,259

- CME Futures Open Interest: 149,160 BTC

- BTC priced successful gold: 31.9 oz

- BTC vs golden marketplace cap: 9.04%

Technical Analysis

- The full marketplace headdress of each cryptocurrencies, excluding BTC and ETH, has topped the 200-day elemental moving mean (SMA).

- The breakout indicates affirmative outlook for altcoins, successful general.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $416.03 (+0.4%), up 2.59% astatine $426.80 successful pre-market

- Coinbase Global (COIN): closed astatine $199.32 (-3.48%), up 4.96% astatine $209.20

- Galaxy Digital Holdings (GLXY): closed astatine $0.03 (0%)

- MARA Holdings (MARA): closed astatine $15.76 (+10.29%), up 4.44% astatine $16.46

- Riot Platforms (RIOT): closed astatine $8.48 (+0.47%), up 4.83% astatine $8.89

- Core Scientific (CORZ): closed astatine $9.32 (-1.38%), up 5.69% astatine $9.85

- CleanSpark (CLSK): closed astatine $9.2 (+5.99%), up 5.11% astatine $9.67

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $15.55 (+0.13%), up 5.98% astatine $16.48

- Semler Scientific (SMLR): closed astatine $34.79 (-1.28%), up 9.95% astatine $38.25

- Exodus Movement (EXOD): closed astatine $50.13 (+17.98%), up 3.73% astatine $52

ETF Flows

Spot BTC ETFs:

- Daily nett flows: $321.4 cardinal

- Cumulative nett flows: $41.2 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flows: $17.6 cardinal

- Cumulative nett flows: $2.49 billion

- Total ETH holdings ~ 3.46 million

Source: Farside Investors

Overnight Flows

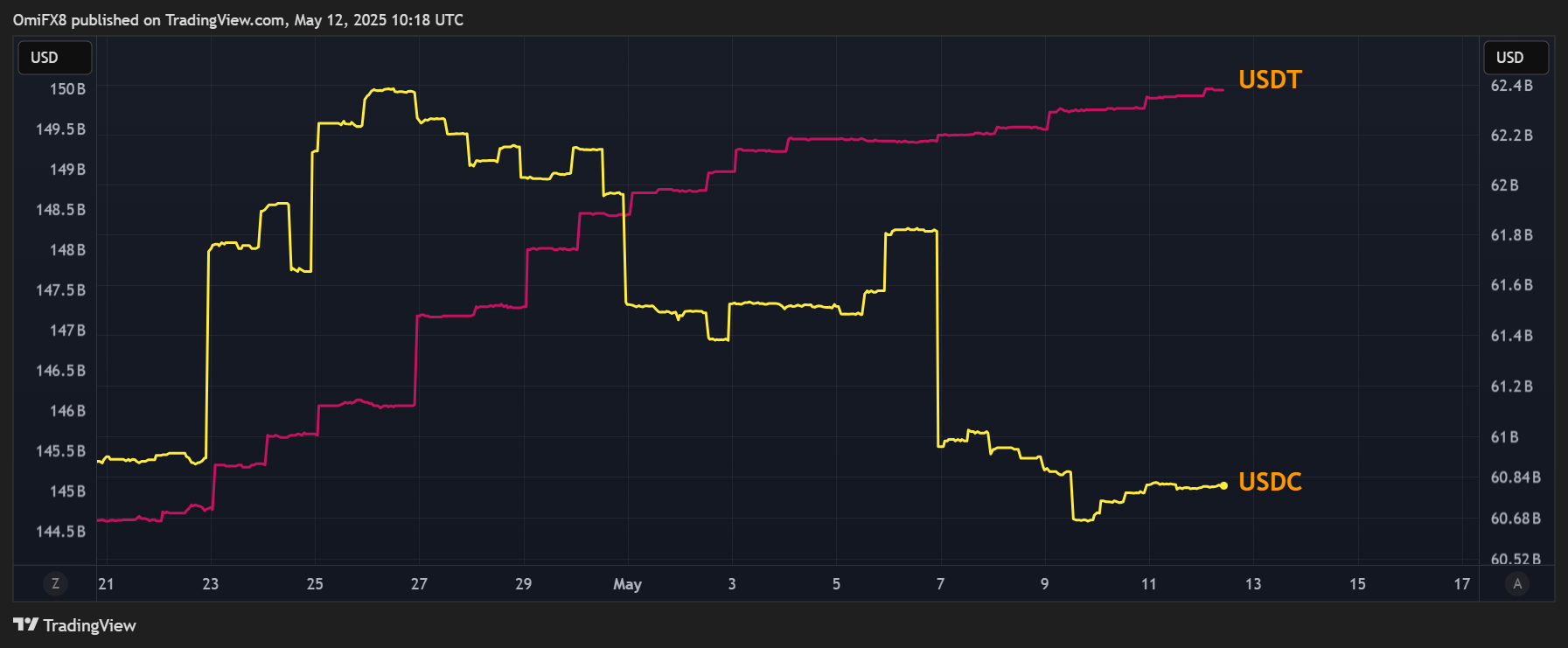

Chart of the Day

- The illustration shows the marketplace headdress for USDC, the world's second-largest dollar-pegged stablecoin, has declined from $62.28 cardinal to $60.68 billion.

- Meanwhile, the marketplace headdress for Tether's USDT, its larger rival, has risen further, greasing the crypto marketplace rally.

While You Were Sleeping

- Military Officials of India, Pakistan to Discuss Next Steps, India Says, arsenic Ceasefire Holds (Reuters): India whitethorn retaliate for aboriginal ceasefire violations aft sending a hotline connection Sunday astir alleged breaches of the anterior day’s truce, a elder subject authoritative said.

- Metaplanet Overtakes El Salvador With $126M Bitcoin Purchase (CoinDesk): Asia's biggest firm holder of bitcoin bought 1,241 BTC for 18.4 cardinal yen ($126 million), raising its holdings to 6,796 BTC and surpassing El Salvador’s total.

- Ethereum Staking Giant Lido Loses Just 1.4 ETH successful Hacking Attempt (CoinDesk): Ethereum’s largest liquid-staking protocol escaped with lone insignificant state interest theft, with nary idiosyncratic funds affected, aft a cardinal astatine validator Chorus One was compromised.

- Privacy-Focused Zcash Tops Key Resistance Above $40 to Flash Bull Signal (CoinDesk): On Sunday, Zcash (ZEC) reached $45.80 connected HTX, its highest since Jan. 26, aft trading successful a constrictive scope since February, suggesting imaginable for further gains.

- China Courts Lula and Latin America After Trump’s Tariff Shock (The New York Times): China is positioning itself arsenic some an economical spouse and counterweight to U.S. influence, with a elder authoritative saying Latin Americans privation self-determination, not a caller “Monroe Doctrine.”

- Traders Bet the Euro’s Ascent Is a Tidal Wave successful the Making (Bloomberg): Deutsche Bank, which conscionable months agone predicted the euro would dip beneath dollar parity, present expects it to ascent to $1.20 this twelvemonth and $1.30 by 2027.

In the Ether

5 months ago

5 months ago

English (US)

English (US)