By Francisco Rodrigues (All times ET unless indicated otherwise)

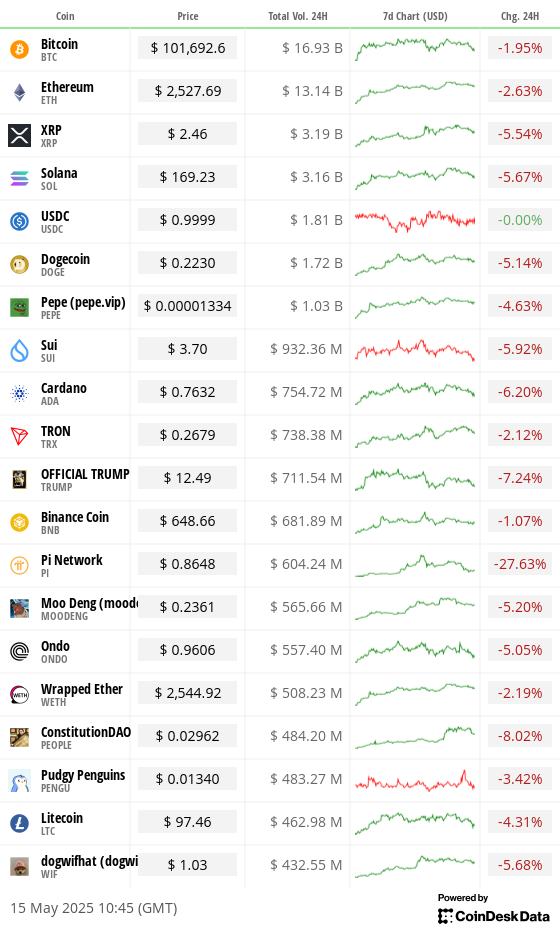

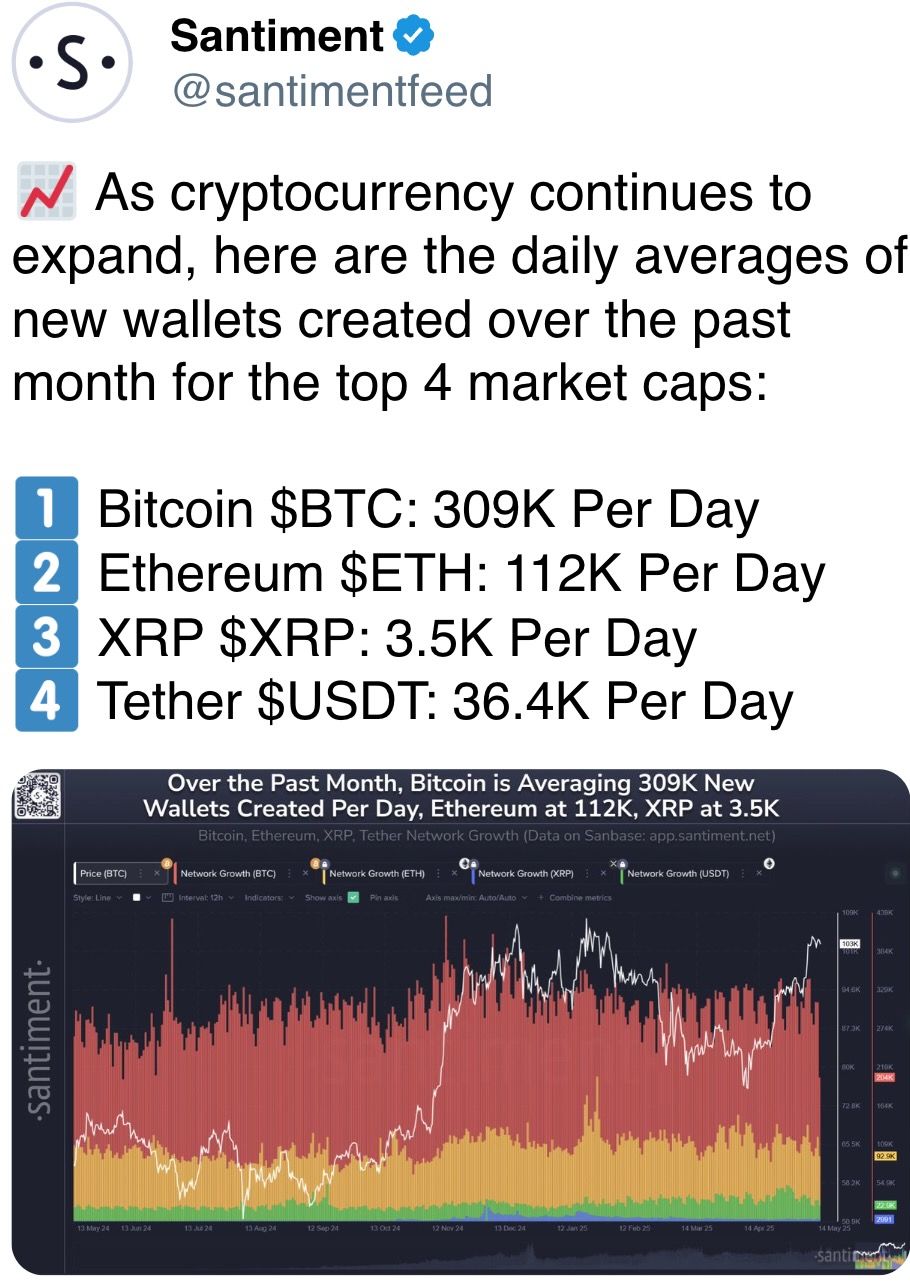

The cryptocurrency marketplace pulled backmost implicit the past 24 hours, led by declines successful large coins arsenic retail investors switched retired of large-cap tokens and into smaller, much speculative assets.

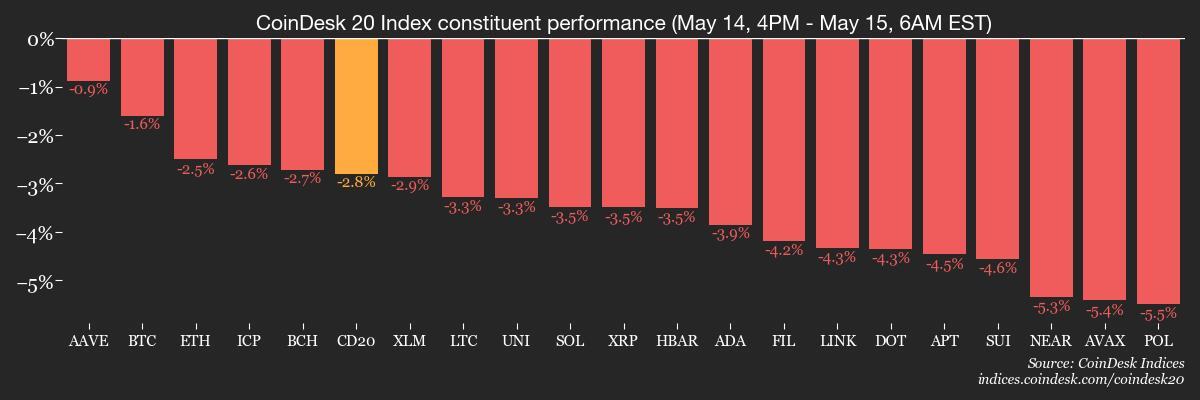

Both bitcoin BTC and ether ETH dropped astir 2% and the CoinDesk 20 Index (CD20), a measurement of the wide market, fell 2.7%.

"We’ve observed a important week-on-week summation successful retail participation, reinforcing the broader communicative of rising optimism," said Jake O., an over-the-counter trader astatine Wintermute. “The displacement down the hazard curve is astir evident successful retail surface flows.”

Institutional investors, for their part, person been much conservative. They're inactive stocking up connected bitcoin, ether and XRP, portion easing disconnected positions successful solana SOL which has faced “sustained pressures.”

“Some are viewing SOLETH underperformance arsenic an accidental to presumption for Solana topside,” Jake noted, pointing to dependable buying successful $200 Solana telephone options up of June and July.

Other options enactment suggests traders are hedging for volatility ahead. Call spreads connected ether were unwound and immoderate traders moved into collar structures — strategies often utilized to support against terms swings — signaling caution aft caller gains.

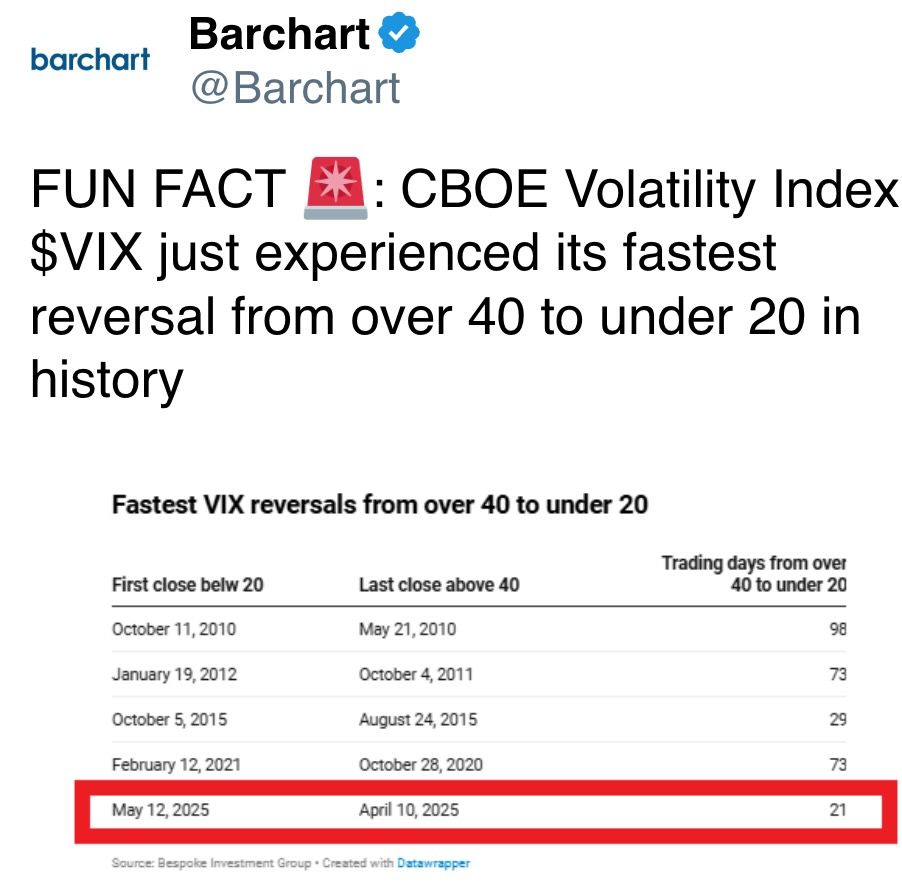

The increasing hedging enactment adds a enactment of caution to retail's plaything to speculation. Economic uncertainty, lingering ostentation pressures and U.S. tariff argumentation are each weighing connected hazard appetite successful crypto arsenic good arsenic accepted markets.

Global plus managers, successful fact, presently person their largest underweight position successful the U.S. dollar successful 19 years. Even though President Donald Trump secured a large investment deal with Qatar and a temporary reduction successful U.S.-China tariffs, these outcomes whitethorn pb to further downside: Spanish slope Bankinter said successful a enactment that the marketplace has shown fatigue implicit the past trading session.

“We inactive deliberation the harm is done: some EPS and prices should consciousness the strain, with rising inflationary pressures preventing the Fed from cutting rates arsenic overmuch arsenic the marketplace expects,” the bank’s analysts wrote. Market participants are acceptable to present absorption connected shaper terms ostentation and retail income data, arsenic good arsenic connected Fed Chair Jerome Powell’s code aboriginal today.

For the crypto market, a re-test of the all-time precocious isn’t retired of the picture.

“Looking ahead, we judge determination is further country for integer assets to rally, particularly arsenic Coinbase’s inclusion into the S&P 500 connected 19 May draws closer,” Singapore-based QCP Capital wrote. Stay alert!

What to Watch

- Crypto:

- May 16, 9:30 a.m.: Galaxy Digital Class A shares to statesman trading connected the Nasdaq nether the ticker awesome GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) volition replace Discover Financial Services (DFS) successful the S&P 500, effectual earlier the opening of trading.

- Macro

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail income data.

- Retail Sales MoM Est. 1% vs. Prev. 0.5%

- Retail Sales YoY Est. -0.5% vs. Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail income data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 10.

- Initial Jobless Claims Est. 229K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell volition present a code ("Framework Review") successful Washington. Livestream link.

- May 16, 10 a.m.: The University of Michigan releases (Preliminary) May U.S. user sentiment data.

- Michigan Consumer Sentiment Est. 53 vs. Prev. 52.2

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail income data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting connected a connection to fund the integration of Uniswap V4 connected Ethereum successful Oku and adhd Unichain connected Oku successful a bid to heighten Uniswap’s scope and liquidity migration to V4. Voting ends May 18.

- May 15, 11 a.m.: Yield Guild Games to big a Q1 2025 community update Ask Me Anything (AMA) session.

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- May 21, 6 p.m.: Theta Network to big an Ask Me Anything league in a livestream.

- Unlocks

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $23.53 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating proviso worthy $14.22 million.

- May 16: Immutable (IMX) to unlock 1.35% of its circulating proviso worthy $17.8 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating proviso worthy $39.06 million.

- May 17: Avalanche (AVAX) to unlock 0.4% of its circulating proviso worthy $42.84 million.

- Token Launches

- May 15: RIZE (RIZE) to database connected Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 2 of 3: CoinDesk's Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

Derivatives Positioning

- BTC and ETH perpetual futures unfastened involvement ticked up alongside an overnight spot terms pullback, but backing rates stay positive. Perhaps traders are buying the dip.

- Open involvement successful XRP perpetual futures has dropped, signaling an unwinding of longs.

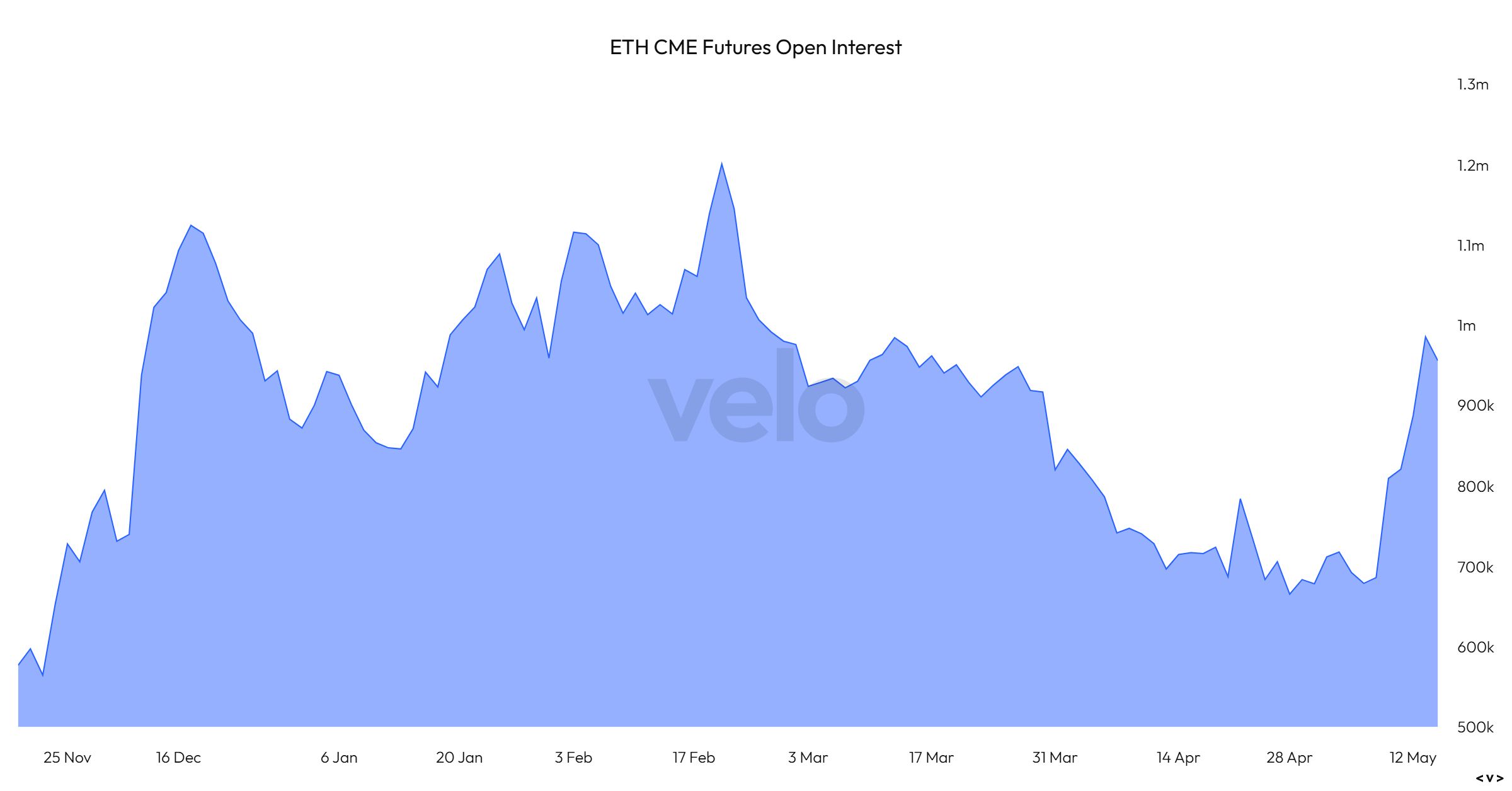

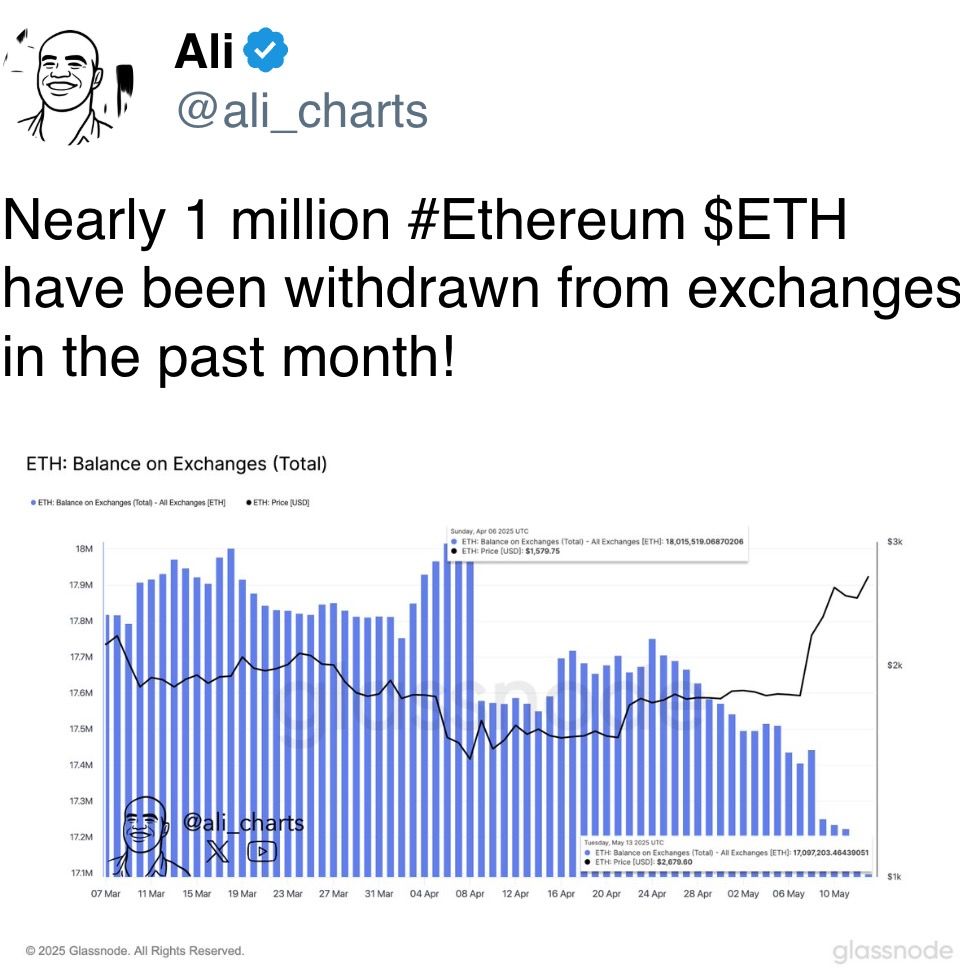

- Ether futures unfastened involvement connected the CME has accrued from astir 685K ETH to 955K ETH successful a week, reaching the highest since March 11. BTC CME futures person yet to spot a akin uptick.

- On Deribit, ETH hazard reversals astatine the front-end person flipped antagonistic to amusement bias for puts, oregon downside protection. BTC calls proceed to commercialized astatine a premium.

- OTC tech level Paradigm noted mixed flows, with OTM BTC enactment spreads some bought and sold, portion ETH OTM telephone spreads continued to beryllium lifted.

Market Movements

- BTC is down 1.49% from 4 p.m. ET Wednesday astatine $101,906.02 (24hrs: -1.52%)

- ETH is down 2.54% astatine $2,540.80 (24hrs: -2.58%)

- CoinDesk 20 is down 2.79% astatine 3,204.04 (24hrs: -3.66%)

- Ether CESR Composite Staking Rate is down 1 bps astatine 3.11%

- BTC backing complaint is astatine 0.0045% (4.8968% annualized) connected Binance

- DXY is down 0.29% astatine 100.75

- Gold is down 0.59% astatine $3,168.30/oz

- Silver is down 0.85% astatine $32/oz

- Nikkei 225 closed -0.98% astatine 37,755.51

- Hang Seng closed -0.79% astatine 23,453.16

- FTSE is up 0.14% astatine 8,596.60

- Euro Stoxx 50 is down 0.54% astatine 5,374.02

- DJIA closed connected Wednesday -0.21% astatine 42,051.06

- S&P 500 closed +0.1% astatine 5,892.58

- Nasdaq closed +0.72% astatine 19,146.81

- S&P/TSX Composite Index closed +0.3% astatine 25,692.45

- S&P 40 Latin America closed +0.18% astatine 2,645.42

- U.S. 10-year Treasury complaint is down 3 bps astatine 4.51%

- E-mini S&P 500 futures are down 0.51% astatine 5,878.25

- E-mini Nasdaq-100 futures are down 0.72% astatine 21,239.50

- E-mini Dow Jones Industrial Average Index futures are down 0.32% astatine 41,982.00

Bitcoin Stats

- BTC Dominance: 62.77 (+0.31%)

- Ethereum to bitcoin ratio: 0.02490 (-1.23%)

- Hashrate (seven-day moving average): 861 EH/s

- Hashprice (spot): $54.63

- Total Fees: 7.21 BTC / $747,357.79

- CME Futures Open Interest: 149,720 BTC

- BTC priced successful gold: 31.9 oz

- BTC vs golden marketplace cap: 9.04%

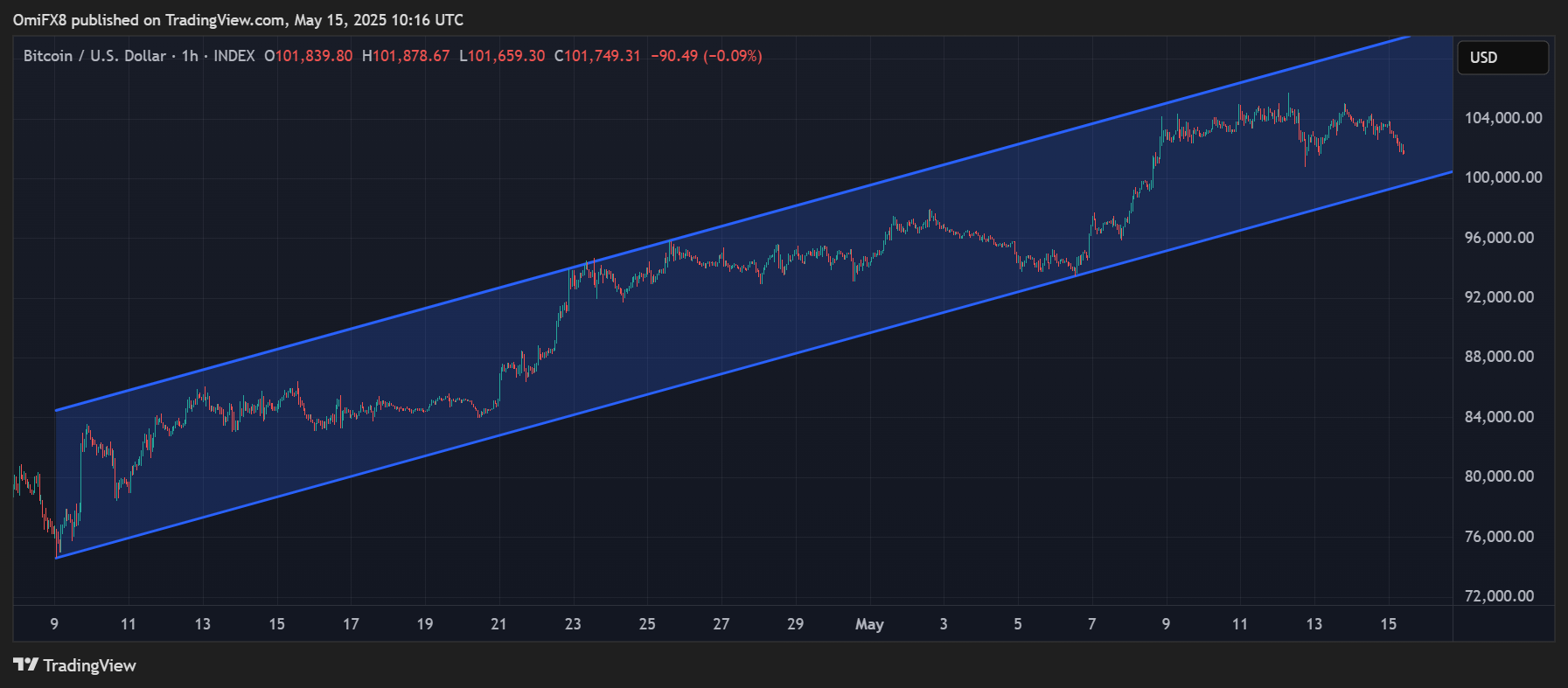

Technical Analysis

- While BTC has pulled backmost from the caller precocious of $105,700 to nether $102,000, it's broader upward trajectory remains intact.

- A interruption beneath $100,000 would invalidate the inclination transmission from April 9 lows, perchance starring to a deeper pullback.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $416.75 (-1.15%), down 2.35% astatine $406.95 successful pre-market

- Coinbase Global (COIN): closed astatine $263.41 (+2.53%), down 3.39% astatine $254.48

- Galaxy Digital Holdings (GLXY): closed astatine $31.96 (+8.74%)

- MARA Holdings (MARA): closed astatine $15.87 (-3.05%), down 2.52% astatine $15.47

- Riot Platforms (RIOT): closed astatine $8.91 (-1.66%), down 2.24% astatine $8.71

- Core Scientific (CORZ): closed astatine $10.32 (+0.78%), down 1.55% astatine $10.16

- CleanSpark (CLSK): closed astatine $9.61 (-3.9%), down 2.29% astatine $9.39

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.95 (-1.45%), down 1.71% astatine $16.66

- Semler Scientific (SMLR): closed astatine $32.54 (-11.34%), down 1.72% astatine $31.98

- Exodus Movement (EXOD): closed astatine $34.88 (-17.03%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $319.5 million

- Cumulative nett flows: $41.37 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flow: $63.5 million

- Cumulative nett flows: $2.55 billion

- Total ETH holdings ~ 3.44 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows a crisp emergence successful the fig of unfastened ETH futures bets connected the Chicago Mercantile Exchange.

- The surge indicates increasing organization information successful the second-largest cryptocurrency.

While You Were Sleeping

- CFTC's Pham Said to Plot Exit, Agency May Be Left Without a Party Majority (CoinDesk): If Brian Quintenz is confirmed arsenic CFTC chair, helium would regenerate a departing Democrat, portion 2 Republicans besides program to leave, perchance reducing the five-member bureau to conscionable 2 commissioners.

- Altcoin Season Could Heat Up successful June and Drain Part of Bitcoin’s $2T Market Cap, Analyst Says (CoinDesk): Bitcoin’s dominance complaint fell from 65% to 62% successful a week, signaling a displacement toward altcoins. Analyst Joao Wedson says dominance volition driblet further.

- Trump Says U.S. Close to a Nuclear Deal With Iran (Reuters): Talks stay analyzable by crisp disagreements and Tehran’s continued uranium enrichment.

- Group of 21 Economies — Including U.S. and China — Warns of Growth Slowdown Over Trade Tensions (CNBC): The Asia Pacific Economic Cooperation (APEC) forecasts maturation volition dilatory to 2.6% this twelvemonth from 3.6% successful 2024, citing tariffs and non-tariff barriers arsenic factors undermining concern confidence.

- ARK Invest Bought $9.4M Worth of eToro Shares connected Trading Platform's Debut (CoinDesk): Cathie Wood’s steadfast bought 140,000 ETOR shares arsenic the banal jumped 29% from its $52 unfastened connected stronger-than-expected demand.

- U.K. Economy Raced astatine Start of Year but Slowdown Looms (The Wall Street Journal): Despite outpacing the U.S. and eurozone with 0.7% first-quarter growth, rising leader taxes and wage costs person dented concern confidence, pointing to weaker show aboriginal this twelvemonth and successful 2026.

In the Ether

5 months ago

5 months ago

English (US)

English (US)