By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace is derisking up of today's Fed complaint decision. Everyone's buzzing astir the likelihood of different complaint chopped that volition supposedly galvanize risk-taking successful the system and fiscal markets.

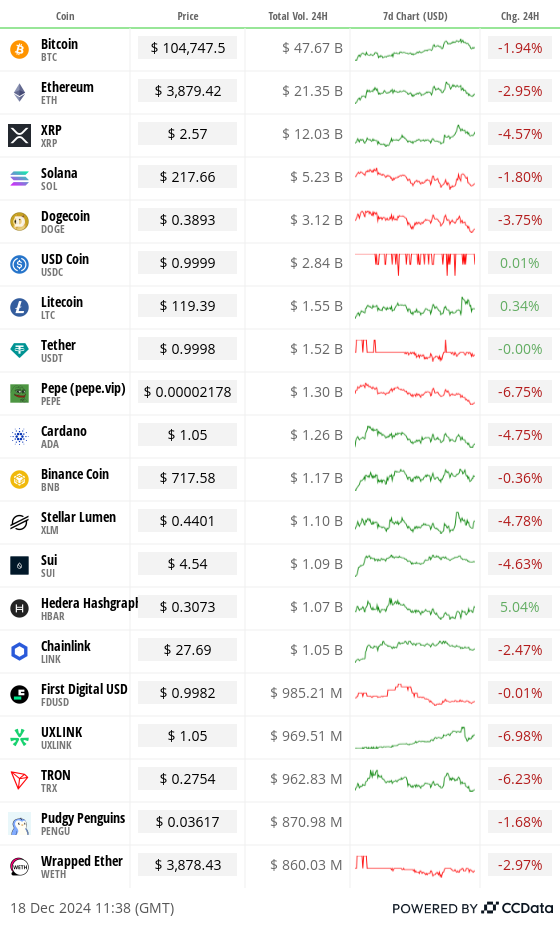

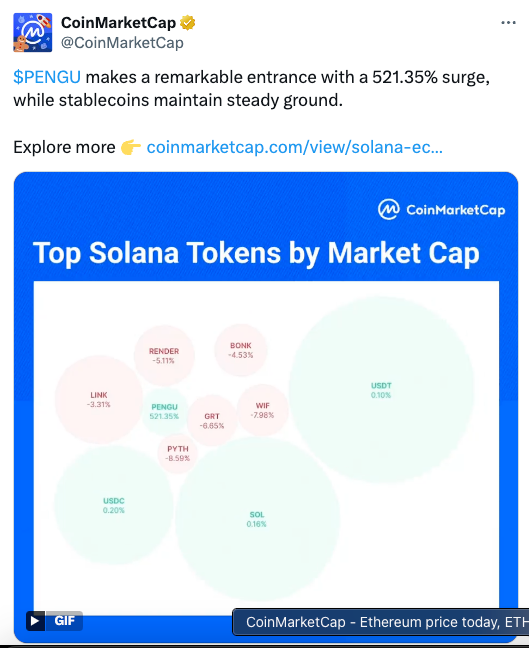

Here's the twist: The cardinal slope is expected to awesome 3 complaint cuts for 2025, not the 4 it projected successful September, arsenic good arsenic revise maturation and ostentation forecasts higher. No surprise, then, that bitcoin and ether are trading astir 2% lower, driving bigger losses successful small-cap tokens. Among them, Pudgy Penguins' PENGU token, which has slumped implicit 50% since Tuesday's airdrop.

The front-end telephone premiums successful some BTC and ETH person already taken a hit, signalling a much cautious vibe successful the market. Traditional markets are besides factoring successful a hawkish cut.

Now, seasoned traders volition archer you that erstwhile expectations thin excessively heavy 1 way, there's ever country for disappointment. Put much simply, if involvement complaint projections enactment the aforesaid oregon Fed Chairman Jerome Powell eases concerns astir sticky ostentation during his property league portion maintaining a data-dependent approach, we could spot a bully bump successful hazard assets — cryptos included.

VIRTUAL, the autochthonal coin of AI and tokenization level Virtuals Protocol, mightiness radiance successful that case, having risen 11% successful Asian hours. "AI wrong crypto is shaping up to beryllium a fascinating trend, particularly successful societal trading, wherever data-driven insights and automation tin empower traders," said Neal Wen, caput of planetary concern improvement astatine Kronos Research.

Leading on-chain perpetuals level HyperLiquid's HYPE token is different candidate, trading 4% higher astatine property time. Social media chatter points to constricted speech availability and token retention arsenic a catalyst for the rally.

That said, don't fto your defender down. Some observers accidental the gait of aboriginal complaint cuts truly hinges connected Friday's halfway PCE data, the Fed's preferred ostentation measure.

As Valentin Fournier, an expert astatine BRN, enactment it: "The Federal Reserve is acceptable to denote a 25 basis-point interest-rate chopped contiguous — it's past for the year. Future cuts whitethorn trust heavy connected Friday's Core PCE report, which is expected to clasp dependable astatine 3.3% twelvemonth implicit year. Any surprises with rising ostentation could rattle the markets, particularly since bitcoin is already feeling immoderate bearish unit and is lacking the upward momentum."

Additionally, the diminution successful Chinese authorities enslaved yields has folks implicit astatine the Wall Street Journal raising reddish flags astir the world's second-largest system facing a depression, a prolonged play marked by a crisp driblet successful economical maturation and rising unemployment.

These concerns could easy destabilize planetary markets, truthful it's decidedly a bully clip to enactment alert.

What to Watch

Crypto:

Dec. 18, 9:30 a.m.: Software cryptocurrency wallet shaper Exodus Movement (EXOD) starts trading connected NYSE American, a sibling of NYSE.

Dec. 30: The European Union's Markets successful Crypto-Assets (MiCA) Regulation becomes fully effective. The stablecoin provisions came into effect connected June 30.

Macro

Dec. 18, 2:00 p.m.: The Federal Open Market Committee (FOMC) releases its people scope for the national funds rate, presently 4.50%-4.75%. The CME's FedWatch tool indicates that interest-rate traders delegate a 95.4% probability of a 25 basis-point cut. Press league starts astatine 2:30 p.m. Livestream link.

Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its interest complaint decision. Short-term involvement complaint Est. 0.25% vs. Prev. 0.25%.

Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest-rate decision. Bank Rate Est. 4.75% vs Prev. 4.75%.

Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final).

GDP Growth Rate QoQ Final Est. 2.8% vs Prev. 3.0%.

GDP Price Index QoQ Final Est. 1.9% vs Prev. 2.5%.

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report.

PCE Price Index YoY Est. 2.5% vs Prev. 2.3%.

Core PCE Price Index YoY Est. 2.9% vs Prev. 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

Token Events

Governance votes & calls

Venus Protocol is officially expanding to Base. VIP-408 passed the governance ballot and users tin entree Venus connected Base connected Dec. 19.

Unlocks

Metars Genesis to unlock 11.87% of MRS circulating supply, worthy $11 cardinal astatine existent prices.

Conferences:

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Token Talk

By Shaurya Malwa Early PENGU buyers are learning the perils of debased liquidity the hard way.

The token of the Pudgy Penguins ecosystem token debuted amid monolithic hype connected Tuesday. Its charm was its relation with an already fashionable NFT collection, starring to a frenzy of buying with hopes of speedy gains. But the token had garnered the indispensable liquidity astatine launch, meaning early, enthusiastic buyers bought the token astatine a $5 trillion marketplace capitalization.

Liquidity is the quality to bargain oregon merchantability an plus without causing a important terms change. For PENGU, the archetypal liquidity pools were shallow, meaning determination weren't capable buyers and sellers to support the terms stable.

One unlucky trader mislaid large connected the airdrop, turning $10,000 into little than $5 successful seconds. Just earlier the authoritative airdrop, they had swapped 45 wrapped Solana for PENGU but got lone 78 tokens owed to a glitch successful Jupiter's decentralized exchange. The commercialized was sent to a low-liquidity excavation connected Raydium, inflating the token's terms to an unrealistic $14 trillion marketplace cap. This mishap was owed to debased liquidity, wherever adjacent tiny trades tin origin immense terms swings.

The PENGU token was created weeks earlier its launch, starring to premature trading and important losses for those who jumped successful excessively aboriginal without checking the marketplace cap.

Derivatives Positioning

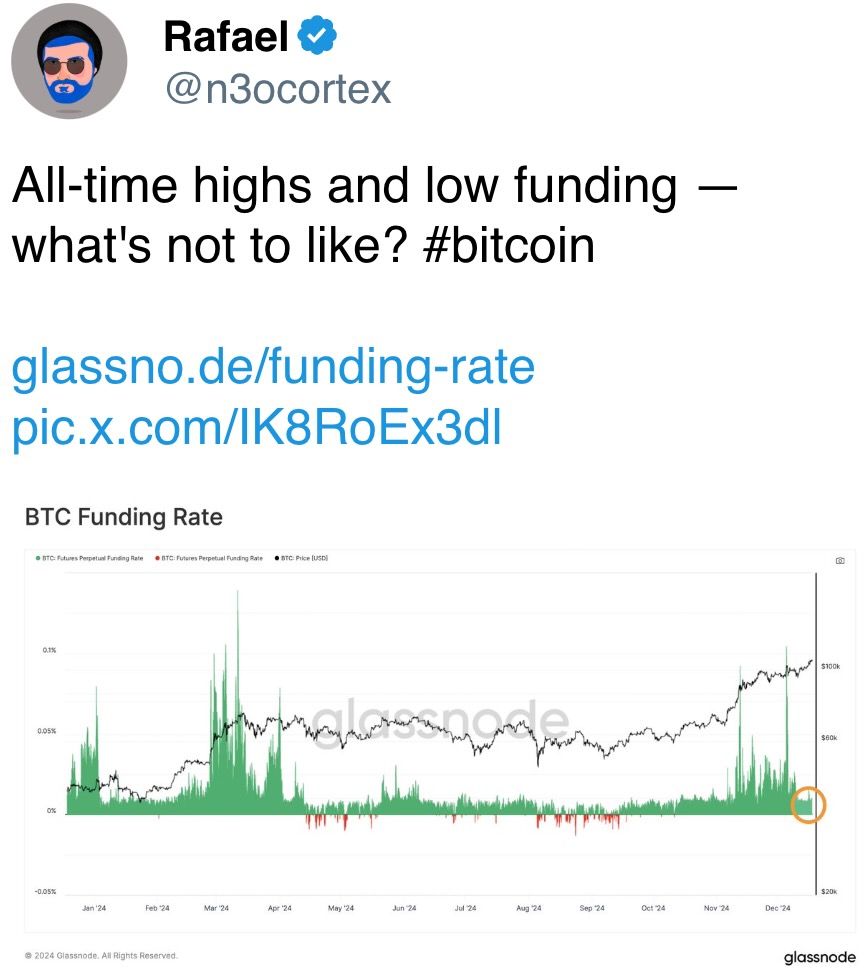

Positioning successful BTC futures is heating up, with unfastened involvement approaching the November precocious of 663.71K BTC. Meanwhile, ETH unfastened involvement has deed a grounds of implicit 339K ETH.

Funding rates successful perpetuals tied to large coins are holding dependable astatine astir an annualized 10%, bang successful the mediate of the -200% to 200% range, which marks the extremes for bearish and bullish sentiment.

Front-end BTC and ETH puts are trading astatine a premium to calls, highlighting request for downside extortion up of the Fed's interest-rate decision.

Top BTC artifact trades see a carnivore telephone dispersed involving calls astatine strikes $104,000 and $105,000 and a standalone agelong presumption successful the $95,000 enactment expiring connected Jan. 3.

Market Movements:

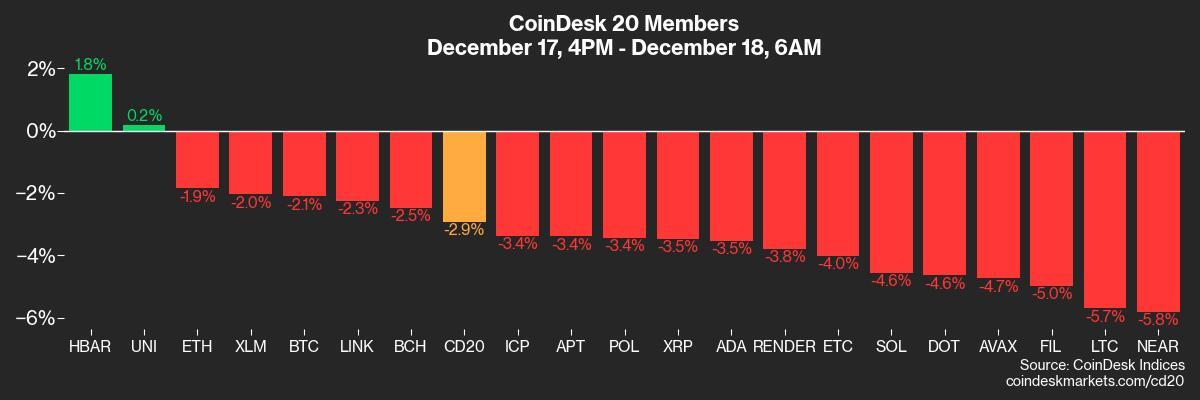

BTC is down 1.72% from 4 p.m. ET Tuesday to $104,593.98 (24hrs: -1.96%)

ETH is down 1.44% astatine $3,876.29 (24hrs: -2.89%)

CoinDesk 20 is down 3.03% to 3,830.21 (24hrs: +3.4%)

Ether staking output is up 2 bps to 3.18%

BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

DXY is unchanged astatine 106.90

Gold is up 0.76% astatine $2,664.40/oz

Silver is up 1.08% to $30.90/oz

Nikkei 225 closed -0.72% astatine 39,081.71

Hang Seng closed +0.83% astatine 19,864.55

FTSE is up 0.23% astatine 8,214.42

Euro Stoxx 50 is up 0.32% astatine 4,958.35

DJIA closed connected Tuesday -0.61% to 43,449.9

S&P 500 closed -0.39% astatine 6,050.61

Nasdaq closed -0.32% astatine 20,109.06

S&P/TSX Composite Index closed -0.11% astatine 25,119.7

S&P 40 Latin America closed +0.16% astatine 2,280.58

U.S. 10-year Treasury was unchanged astatine 4.4%

E-mini S&P 500 futures are up 0.25% to 6,069.00

E-mini Nasdaq-100 futures are up 1.58% to 22,363.25

E-mini Dow Jones Industrial Average Index futures are up 0.2% astatine 43,563.00

Bitcoin Stats:

BTC Dominance: 57.78% (24hrs: -0.33%)

Ethereum to bitcoin ratio: 0.037 (24hrs: +1.04%)

Hashrate (seven-day moving average): 776 EH/s

Hashprice (spot): $63.4

Total Fees: $1.4M/ 12.7 BTC

CME Futures Open Interest: 212,635 BTC

BTC priced successful gold: 39.4oz

BTC vs golden marketplace cap: 11.22%

Bitcoin sitting successful over-the-counter table balances: 406,700 BTC

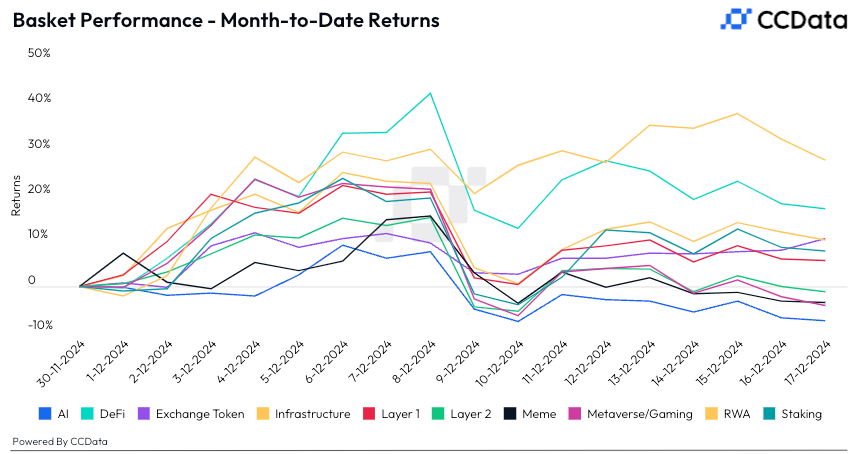

Basket Performance

Technical Analysis

BTC's dominance complaint has bounced from 55% to astir 58% successful 2 weeks, retaking the year-to-date bullish trendline.

It's a motion of renewed capitalist penchant for bitcoin implicit altcoins.

Crypto Equities

MicroStrategy (MSTR): closed connected Tuesday astatine $386.42 (-5.41%), up 0.45% astatine $388.15 successful pre-market.

Coinbase Global (COIN): closed astatine $311.64 (-1.16%), down 0.98% astatine $308.60 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$28.67 (-3.01%).

MARA Holdings (MARA): closed astatine $24.60 (+0.16%), down 1.5% astatine $24.23 successful pre-market.

Riot Platforms (RIOT): closed astatine $13.97 (-0.43%), down 1.36% astatine $13.78 successful pre-market.

Core Scientific (CORZ): closed astatine $16.03 (-3.2%), down 1.19% astatine $15.84 successful pre-market.

CleanSpark (CLSK): closed astatine $12.36 (-0.96%), down 0.49% astatine $12.30 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $29.04 (-1.89%), down 0.48% astatine $28.90 successful pre-market.

Semler Scientific (SMLR): closed astatine $74.73 (+0.31%), up 2.97% astatine $76.93 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $493.9 million

Cumulative nett inflows: $36.70 billion

Total BTC holdings ~ 1.136 million.

Spot ETH ETFs

Daily nett inflow: $144.7 million

Cumulative nett inflows: $2.46 billion

Total ETH holdings ~ 3.530 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

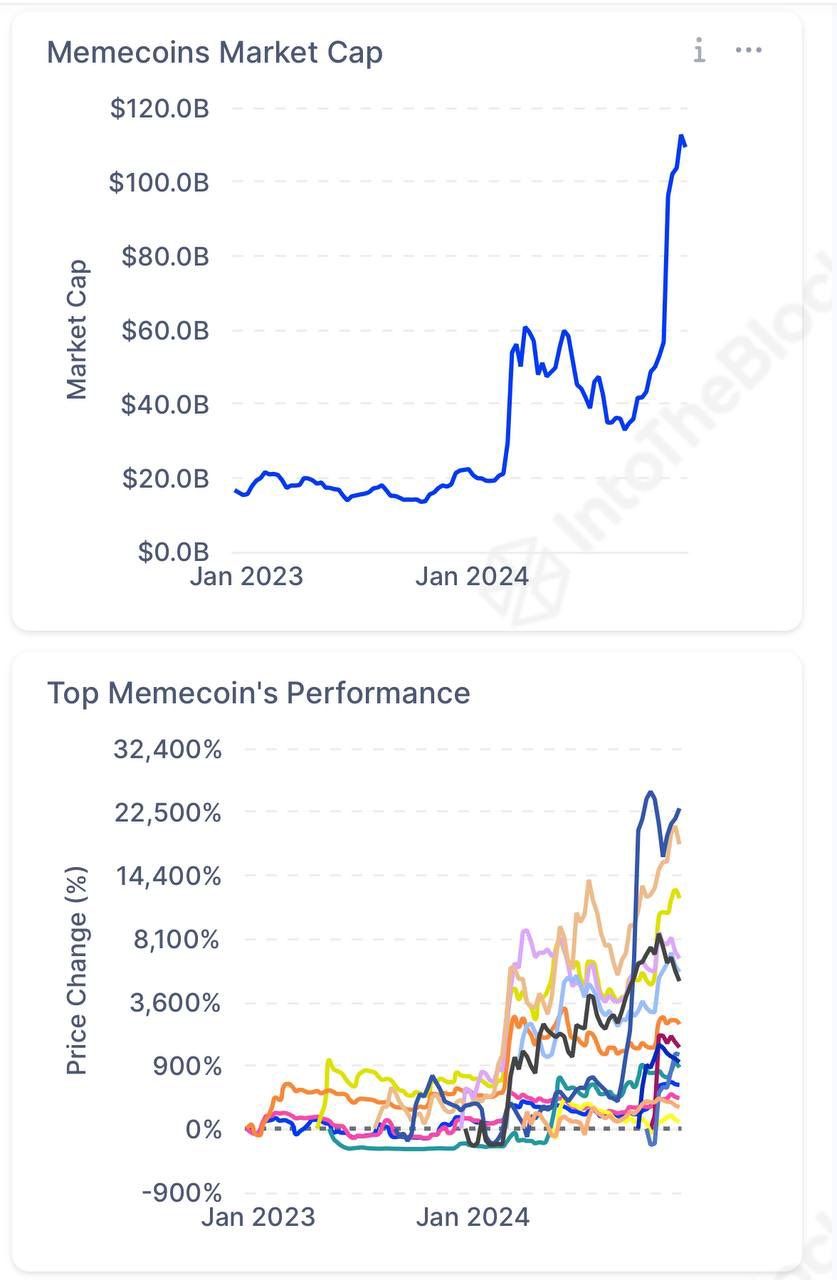

The illustration shows the explosive maturation of the memecoin subsector, which has present surpassed $100 cardinal successful marketplace value.

It's grounds of however speculative allure and a palmy social-media strategy tin thrust investors to instrumentality risk.

While You Were Sleeping

Bitcoin Takes a Breather After Doji Candle successful a Cautious Pre-Fed De-Risking (CoinDesk): After bitcoin acceptable a grounds precocious supra $108,000 connected Tuesday greeting (ET), the crypto marketplace shifted to a much risk-off temper up of the Fed’s expected 25 basis-point interest-rate chopped aboriginal today.

Dollar Steady Against Peers arsenic Fed Rate Cut Looms (Reuters): The U.S. dollar held dependable Wednesday, with the DXY scale easing to 106.89 from caller highs, portion markets awaited the Fed's interest-rate determination and 2025 projections.

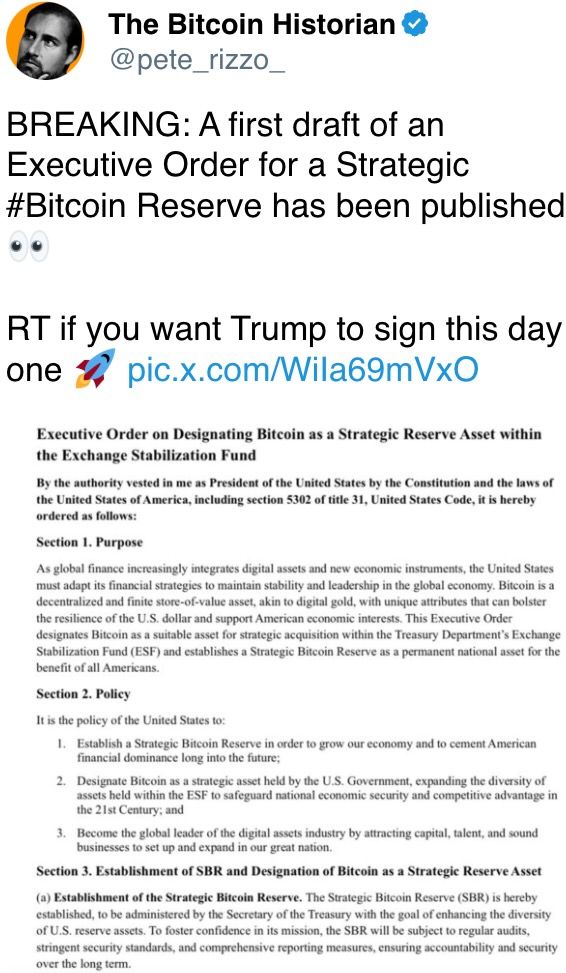

Next U.S. Senate Banking Chair Calls Crypto 'Next Wonder' of World (CoinDesk): Incoming Senate Banking Chair Tim Scott praised crypto innovations Tuesday and called for swift legislation, portion the adjacent House Financial Services Chair French Hill predicted bipartisan crypto laws could walk successful 2025 with Senate support.

South Korea’s Yoon Skips Questioning, Adding to Risk of Arrest (Bloomberg): South Korea’s president, Yoon Suk Yeol, who was impeached Saturday, skipped a scheduled Wednesday greeting interrogation league by a associated investigative team, expanding the hazard of his arrest.

Brazil Currency Rout Risks Worsening Unless Lula Delivers Fiscal Reforms (Financial Times): Brazil’s existent deed a grounds debased of 6.21 to the dollar connected Tuesday arsenic rising indebtedness and fiscal concerns nether President Lula’s authorities punctual calls for complaint increases and credible reforms to stabilize the currency.

Coinbase Says It Nixed wBTC Because Justin Sun Posed 'Unacceptable Risk' (CoinDesk): On Tuesday, Coinbase defended its determination to delist wBTC connected Dec. 19, citing risks tied to Justin Sun's alleged engagement and rejecting BiT Global's suit claims of favoritism toward its own, competing asset.

In the Ether

10 months ago

10 months ago

English (US)

English (US)