By Omkar Godbole (All times ET unless indicated otherwise)

As the crypto rally gathers pace, ether has widened its pb implicit bitcoin successful presumption of volatility expectations, signaling comparatively greater enactment not conscionable successful the second-largest cryptocurrency, but successful the broader integer plus marketplace arsenic a whole.

Deribit's ether implied volatility scale (ETH DVOL), which represents the 30-day expected terms turbulence, has changeable up 11% to an annualized 7% this week portion the bitcoin equivalent, BTC DVOL, held dependable adjacent multimonth lows astir 45%, according to information root TradingView.

The divergence has widened the dispersed betwixt the 2 to 27%, the astir successful astatine slightest 2 years. Clearly, traders are anticipating greater volatility successful ETH and the broader altcoin market.

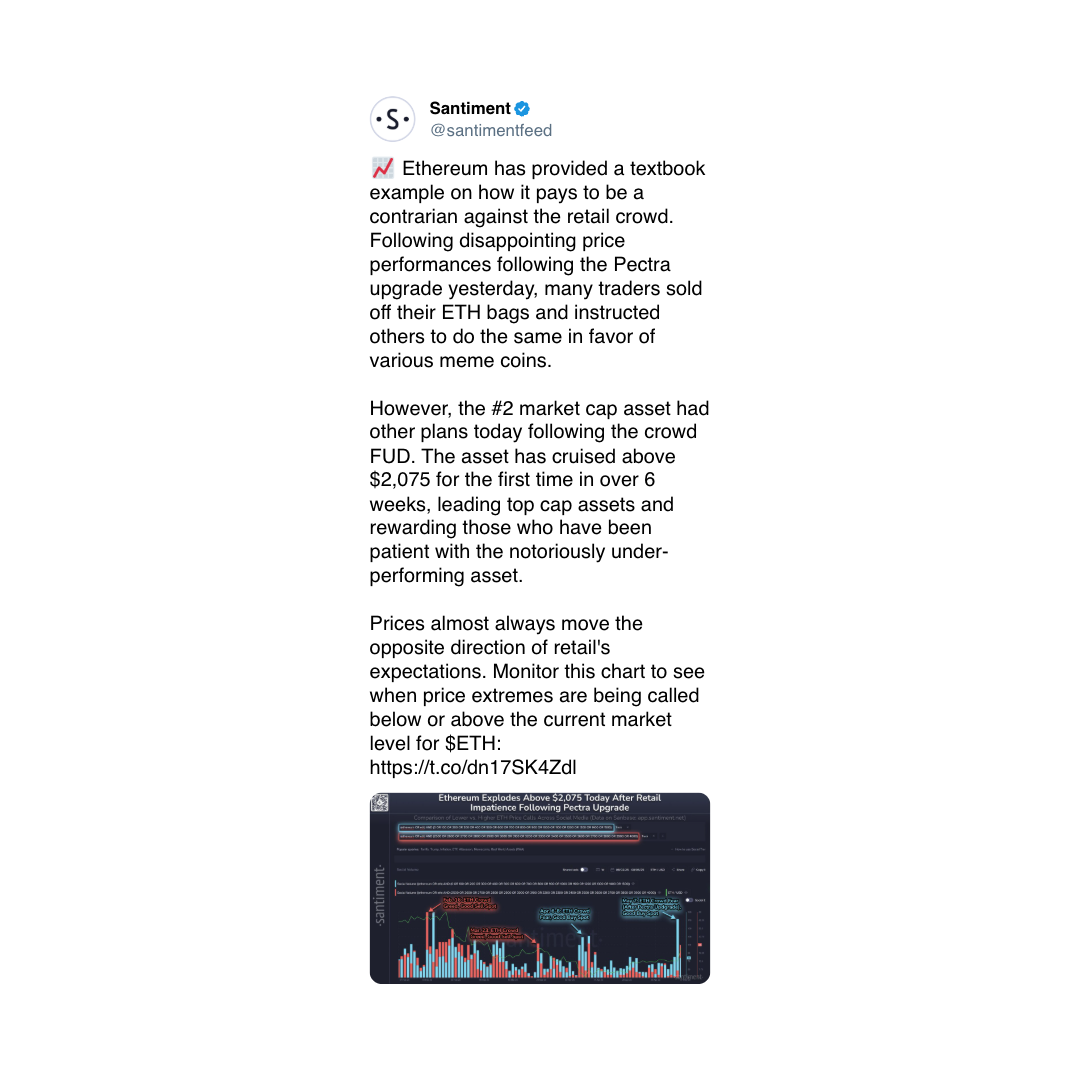

According to immoderate observers, ETH has turned deflationary due to the fact that the Pectra upgrade implemented this week has boosted on-chain enactment and led to implicit 38,000 ETH burned oregon destroyed successful the past 24 hours. Some marketplace participants are buying higher onslaught ETH calls connected Deribit successful anticipation of continued terms gains.

We could beryllium connected the verge of an altcoin season, arsenic the BTC dominance complaint looks to extremity its five-month-long uptrend. (Check retired Technical Analysis).

In cardinal news, American fast-food concatenation Steak ‘n Shake said Thursday it volition statesman accepting BTC arsenic a outgo mode astatine each U.S. locations starting May 16, allowing its 100 cardinal customers to store with the world's biggest digital-asset token.

T-Rex, the Web3 user amusement platform, which is backed by Portal Ventures, North Island Ventures, Framework Ventures and Arbitrum Gaming Ventures, raised $17 cardinal successful pre-seed financing.

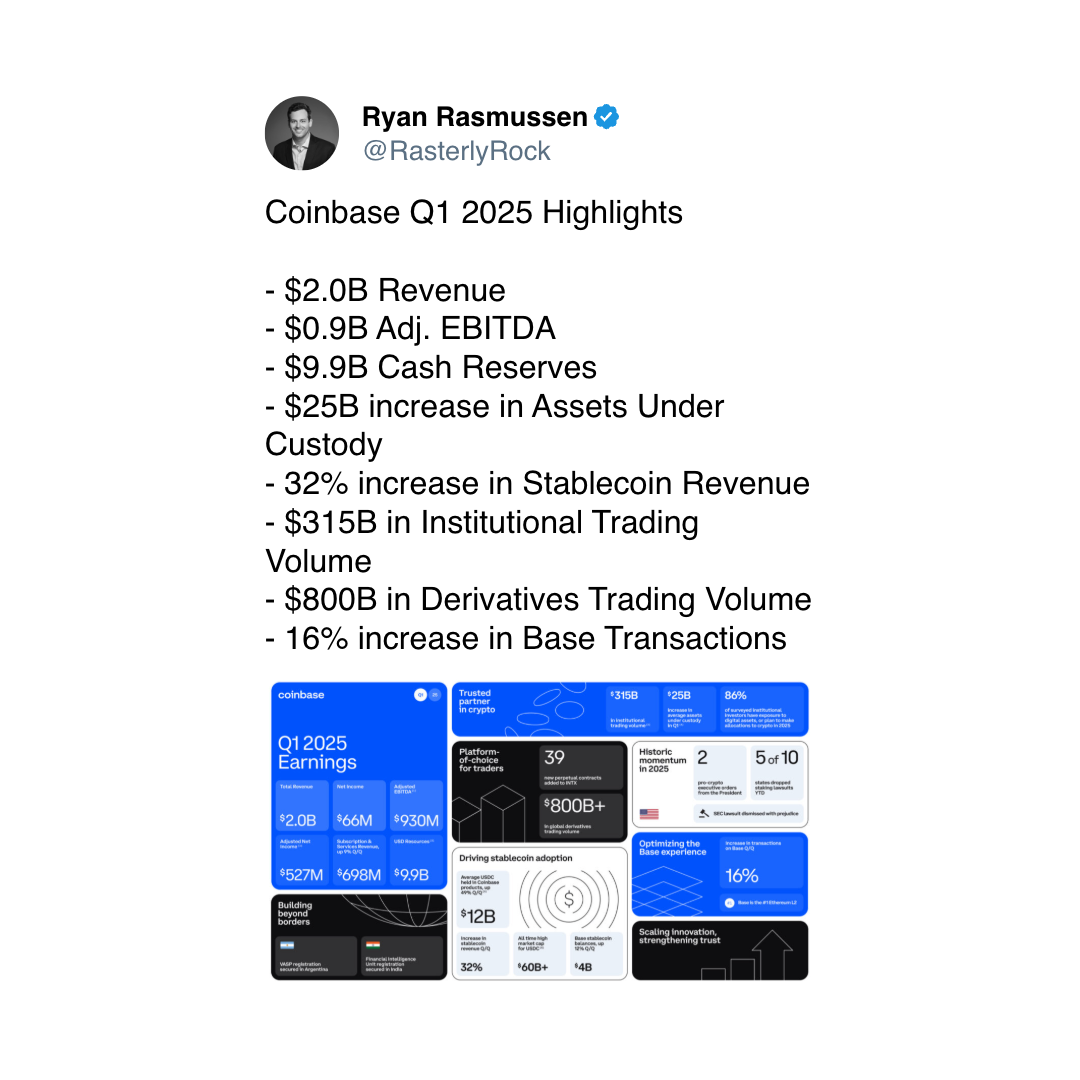

Finally, conscionable successful lawsuit you missed it, cryptocurrency speech Coinbase agreed to bargain the world's largest crypto options exchange, Deribit, for $2.9 cardinal successful currency and shares successful the crypto industry's largest ever M&A deal. Deribit controls implicit 80% of the activity, meaning Coinbase volition beryllium capable to connection a afloat suite of spot and derivative products, boosting liquidity connected the platform. Stay alert!

What to Watch

- Crypto:

- May 12, 1 p.m.-5:30 p.m.: A U.S. SEC Crypto Task Force Roundtable connected "Tokenization: Moving Assets Onchain: Where TradFi and DeFi Meet" volition beryllium held astatine the SEC's office successful Washington.

- May 13: The Singapore High Court holds a hearing to find whether Zettai, the genitor institution of WazirX, tin proceed with restarting the India-based crypto speech and compensating users affected by the July 2024 hack.

- May 14: Neo (NEO) mainnet volition acquisition a hard fork web upgrade (version 3.8.0) astatine artifact tallness 7,300,000.

- May 14: Expected motorboat date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to statesman trading connected the Nasdaq nether the ticker awesome GLXY.

- Macro

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April user terms ostentation data.

- Inflation Rate MoM Prev. 0.56%

- Inflation Rate YoY Prev. 5.48%

- May 9, 8:30 a.m.: Statistics Canada releases April employment data.

- Unemployment Rate Est. 6.8% vs. Prev. 6.7%

- Employment Change Est. 2.5K vs. Prev. -32.6K

- May 9-12: Chinese Vice Premier He Lifeng will clasp commercialized talks with U.S. Treasury Secretary Scott Bessent during his sojourn to Switzerland.

- May 9, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- May 9: TeraWulf (WULF), pre-market

- May 12: Exodus Movement (EXOD), post-market

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: KULR Technology Group (KULR), post-market

Token Events

- Governance votes & calls

- A Sei Network developer projected ending enactment for Cosmos to simplify the blockchain and align much intimately with Ethereum to trim complexity and infrastructure overhead and boost Sei's adoption.

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- Unlocks

- May 9: Movement (MOVE) to unlock 2.04% of its circulating proviso worthy $8.08 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating proviso worthy $35.66 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $57.45 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.14 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $17.7 million.

- Token Launches

- May 9: OKX lists Jito with JITOSOL/USDT pair.

- May 9: BitMart lists Minutes Network Token with MNTX/USDT pair.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 3 of 3: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- Day 1 of 2: Stanford Blockchain Governance Summit (San Francisco)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

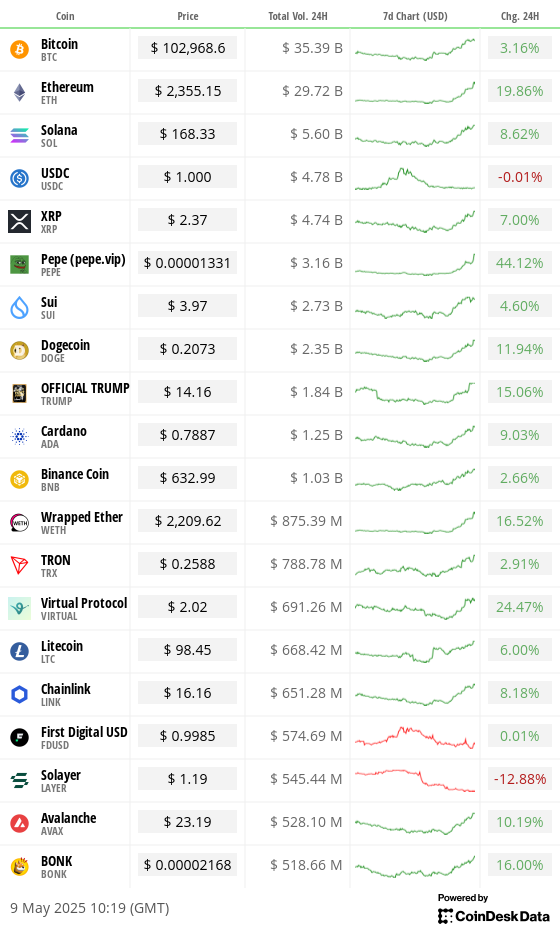

- PEPE is up much than 40% successful the past 24 hours, outperforming astir large tokens arsenic traders proceed to dainty it arsenic a high-beta ETH play — a speculative conveyance to summation outsized vulnerability to ether (ETH).

- The memecoin has go a proxy for ETH upside since aboriginal 2024 due to the fact that the PEPE terms tends to respond powerfully to ETH narratives specified arsenic the caller Pectra upgrade, which preceded a 20% leap successful the second-largest cryptocurrency.

- Trading volumes for PEPE surged past $3.5 cardinal successful the past 24 hours, respective times much than Wednesday's $500 million.

- This marks 1 of the token's strongest weeks successful the past twelvemonth and signals a instrumentality of hazard appetite successful the memecoin space.

- Derivatives information shows rising unfastened involvement and backing rates for PEPE futures, suggesting a question of leverage-fueled bets are targeting the frog-themed token successful the anticipation of higher volatility ahead.

- Meanwhile, Solana-based hippo token MOODENG rallied implicit 150%. The project, known for its absurdist branding based connected a viral Thai hippo, is fashionable among Asian trader circles.

- Cat-themed MOG besides posted double-digit gains, but PEPE remains the astir liquid and disposable memecoin successful the existent ETH-beta trade.

Derivatives Positioning

- BTC and ETH annualized futures ground connected the CME has amazingly held dependable adjacent 7% contempt the terms rallies. That could beryllium a motion of marketplace maturity arsenic currency and transportation arbitrage narrows terms discrepancies.

- On off-shore exchanges, perpetual backing rates for BTC, ETH and astir large tokens are hovering betwixt annualized 10% and 14%, reflecting a bullish bias.

- In the options market, BTC and ETH hazard reversals amusement telephone bias. Block flows featured a abbreviated presumption successful the $95K enactment expiring connected May 15 and calendar spreads successful May and June expiries.

Market Movements

- BTC is up 1.19% from 4 p.m. ET Thursday astatine $102,725.44 (24hrs: +2.92%)

- ETH is up 9.9% astatine $2,328.10 (24hrs: +20.03%)

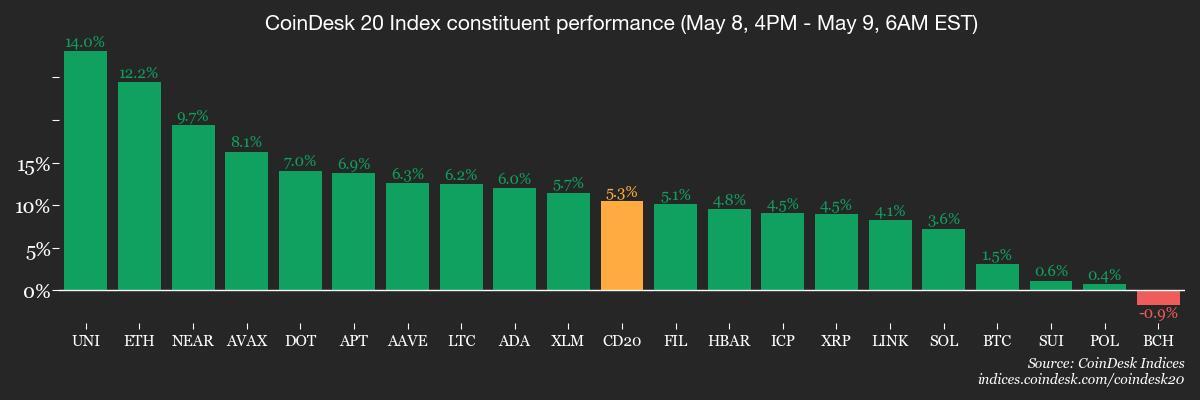

- CoinDesk 20 is up 4.59% astatine 3,116.42 (24hrs: +8.86%)

- Ether CESR Composite Staking Rate is up 15 bps astatine 3.04%

- BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

- DXY is down 0.26% astatine 100.38

- Gold is up 0.67% astatine $3,325.99/oz

- Silver is up 0.45% astatine $32.60/oz

- Nikkei 225 closed +1.56% astatine 37,503.33

- Hang Seng closed +0.4% astatine 22,867.74

- FTSE is up 0.48% astatine 8,572.92

- Euro Stoxx 50 is up 0.38% astatine 5,308.85

- DJIA closed connected Thursday +0.62% astatine 41,368.45

- S&P 500 closed +0.58% astatine 5,663.94

- Nasdaq closed +1.07% astatine 17,928.14

- S&P/TSX Composite Index closed +0.37% astatine 25,254.06

- S&P 40 Latin America closed +1.8% astatine 2,557.27

- U.S. 10-year Treasury complaint is unchanged astatine 4.38%

- E-mini S&P 500 futures are up 0.11% astatine 5,690.75

- E-mini Nasdaq-100 futures are up 0.23% astatine 20,193.50

- E-mini Dow Jones Industrial Average Index futures are unchanged astatine 41,445.00

Bitcoin Stats

- BTC Dominance: 63.94 (-0.80%)

- Ethereum to bitcoin ratio: 0.2282 (6.79%)

- Hashrate (seven-day moving average): 925 EH/s

- Hashprice (spot): $55.50

- Total Fees: 6.54 BTC / $655,033

- CME Futures Open Interest: 149,545 BTC

- BTC priced successful gold: 31.3 oz

- BTC vs golden marketplace cap: 8.86%

Technical Analysis

- BTC's dominance rate, oregon the largest cryptocurrency's stock of the crypto market, mightiness soon driblet beneath a trendline, characterizing BTC outperformance comparative to the broader marketplace since December.

- The breakdown volition apt mean the onset of the altcoin season.

Crypto Equities

- Strategy (MSTR): closed connected Thursday astatine $414.38 (+5.58%), up 1.75% astatine $421.65 successful pre-market

- Coinbase Global (COIN): closed astatine $206.5 (+5.06%), down 1.33% astatine $203.76

- Galaxy Digital Holdings (GLXY): closed astatine $27.67 (+4.45%)

- MARA Holdings (MARA): closed astatine $14.29 (+7.2%), down 1.33% astatine $14.10

- Riot Platforms (RIOT): closed astatine $8.44 (+7.65%), up 1.42% astatine $8.56

- Core Scientific (CORZ): closed astatine $9.45 (+6.18%), up 2.54% astatine $9.69

- CleanSpark (CLSK): closed astatine $8.68 (+8.09%), down 1.73% astatine $8.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $15.53 (+6.44%)

- Semler Scientific (SMLR): closed astatine $35.24 (+6.63%) , up 1.87% astatine $35.90

- Exodus Movement (EXOD): closed astatine $42.49 (+6.2%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

- Daily nett flows: $117.4 cardinal

- Cumulative nett flows: $40.81 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flows: -$16.1 cardinal

- Cumulative nett flows: $2.47 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the expected volatility successful the U.S. Treasury marketplace that underpins planetary finance, has astir reversed the precocious March to aboriginal April spike.

- The diminution supports accrued risk-taking successful fiscal markets, including cryptocurrencies.

While You Were Sleeping

- Danger Grows arsenic India and Pakistan Appear to Escalate Military Clash (The New York Times): India said it intercepted drone and rocket attacks connected its subject sites and struck Pakistani aerial defenses adjacent Lahore. Pakistan said it downed implicit 2 twelve Indian drones.

- Bitcoin Sees Surge successful Institutional Confidence, Deribit-Listed BTC Options Market Reveals (CoinDesk): Strong request for bitcoin telephone options astatine $110,000 and calendar spreads targeting $140,000 suggests traders expect a rally to perchance widen into September.

- Metaplanet Plans a Further $21M Bond Sale to Buy More BTC (CoinDesk): The Tokyo-based company's directors agreed to contented the zero-coupon bonds to EVO FUND, marking its 3rd specified woody successful a week.

- Florida Pharma Firm Will Use XRP for Real-Time Payments successful $50M Financing Deal (CoinDesk): Wellgistics Health said XRP’s 3- to 5-second colony clip volition alteration adjacent real-time payments crossed pharmacies, suppliers and manufacturers, with blockchain records supporting compliance, rebate tracking and auditability.

- Poland to Open Way for French Nuclear Shield Talks With a Treaty (Bloomberg): Polish Prime Minister Donald Tusk and French President Emmanuel Macron volition motion a pact Friday pledging communal subject assistance successful the lawsuit of equipped conflict.

- China’s Exports to U.S. Plunge, successful Sign of Bite From Trump Tariffs (The Wall Street Journal): China’s exports to the U.S. sank 21% twelvemonth implicit twelvemonth successful April, portion shipments to ASEAN, Latin America, Africa and the EU surged by much than 10%.

In the Ether

6 months ago

6 months ago

English (US)

English (US)