By James Van Straten (All times ET unless indicated otherwise) Two contradictory philosophies leap to caput erstwhile considering bitcoin's (BTC) terms enactment of late.

Do you "buy erstwhile determination is humor successful the streets"? Or possibly "don't drawback a falling knife."?

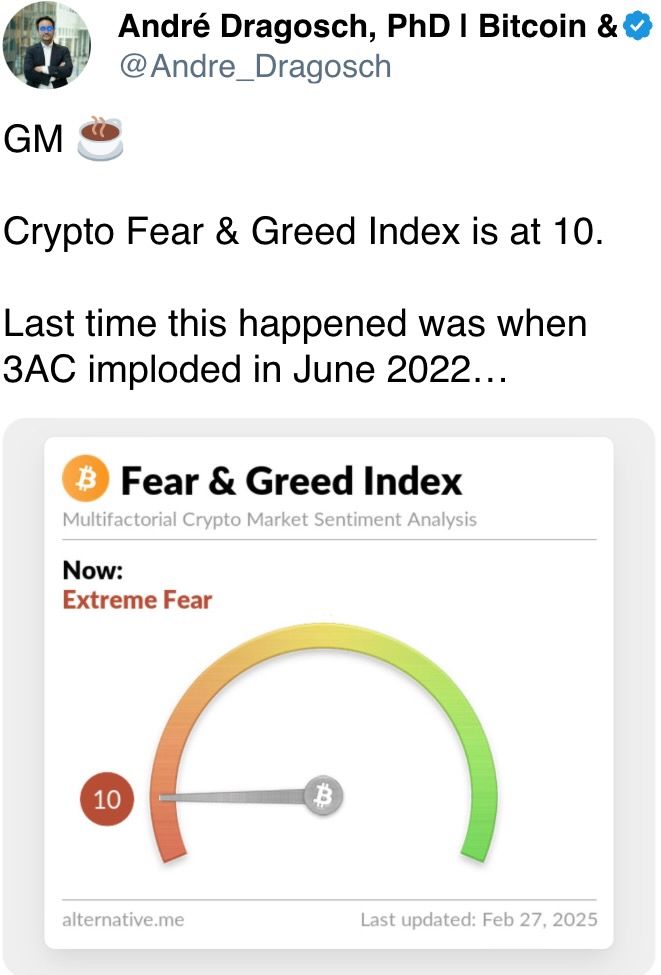

Which applies successful today's market, the time aft the largest cryptocurrency posted its steepest three-day decline since the illness of FTX successful 2022? The driblet near BTC 25% beneath January's all-time high, contempt the advent of President Donald Trump's pro-crypto administration.

It's nary astonishment the largest hack successful crypto history has shaken capitalist sentiment. Add to that the memecoin frenzy, which pulled liquidity retired of the broader market.

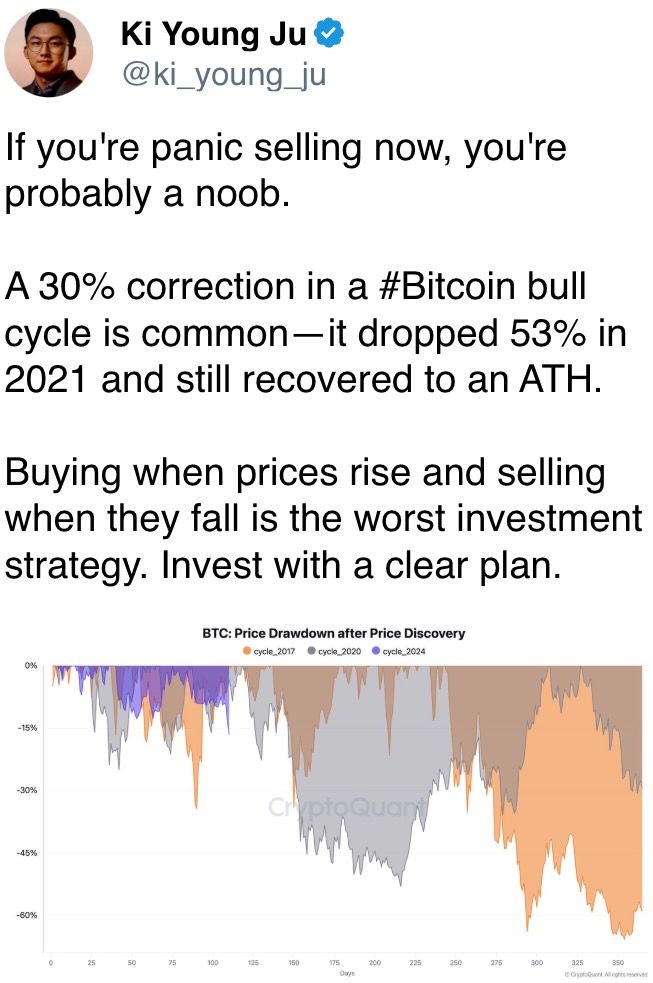

That said, successful erstwhile cycles alleged bull-market corrections person sent bitcoin tumbling arsenic overmuch arsenic 35%. Given that BTC hasn't had a meaningful pullback since the yen transportation commercialized unwind past August, the existent concern is astir normal.

CoinDesk research showed that bitcoin was trading successful an highly choky scope for a meaningful period, and a interruption successful the transmission was inevitable. On-chain information tells america that bitcoin precocious bounced disconnected its 200-day-moving mean oregon astir $81,800. While short-term holders are selling — panic sales, perhaps? — astatine the highest level since August, due to the fact that they person held BTC for 155 days oregon little they are usually seen arsenic a awesome of immoderate signifier of capitulation successful the market.

BlackRock's IBIT saw record outflows connected Wednesday. However, it's not each atrocious news. A immense enlargement woody was made for Core Scientific (CORZ), portion MARA Holdings (MARA) reported beardown earnings, with some stocks much than 10% earlier the open. Meanwhile, NVIDIA (NVDA) topped fourth-quarter estimates to calm investors' nerves. Stay alert!

What to Watch

Crypto:

Feb. 27: Solana-based L2 Sonic SVM (SONIC) mainnet motorboat (“Mobius”).

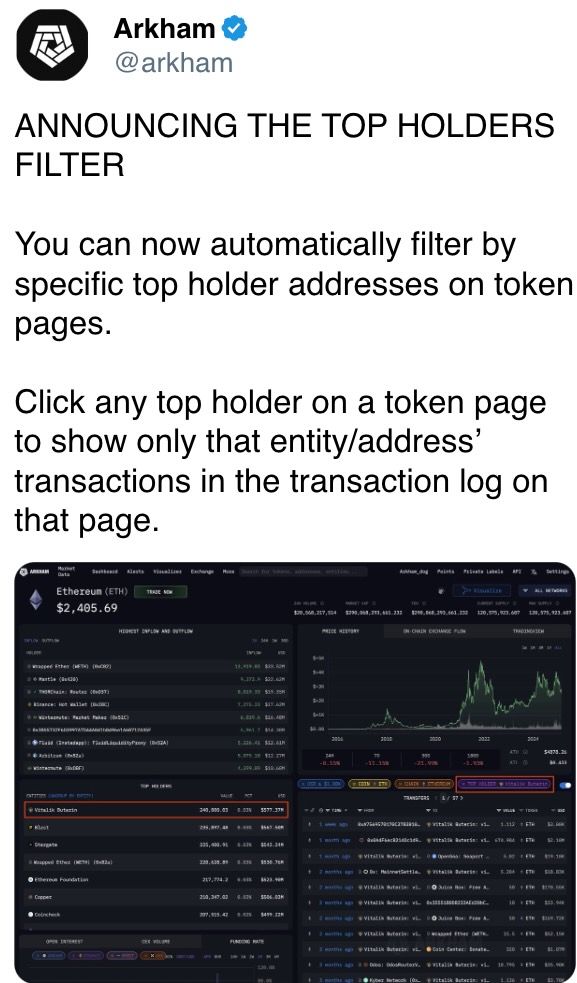

March 1: Spot trading connected the Arkham Exchange goes unrecorded successful 17 U.S. states.

March 5 (provisional): At epoch 222464, investigating of Ethereum’s Pectra upgrade connected the Sepolia testnet starts.

Macro

Day 2 of 2: 2025’s archetypal G20 concern ministers and cardinal slope governors gathering (Cape Town, South Africa).

Feb. 27, 7:00 a.m.: Brazil's Institute of Geography and Statistics (IBGE) releases January employment data.

Unemployment Rate Est. 6.6% vs. Prev. 6.2%

Feb. 27, 7:00 a.m.: Mexico's National Institute of Statistics and Geography releases January employment data

Unemployment Rate Est. 2.7% vs. Prev. 2.4%

Feb. 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases Q4 GDP (2nd estimate).

Core PCE Prices QoQ Est. 2.5% vs. Prev. 2.2%

PCE Prices QoQ Est. 2.3% vs. Prev. 1.5%

GDP Growth Rate QoQ Est. 2.3% vs. Prev. 3.1%

Feb. 27, 8:30 a.m.: The U.S. Department of Labor releases Unemployment Insurance Weekly claims for the week ended Feb. 22.

Initial Jobless Claims Est. 221K vs. Prev. 219K

Feb. 28, 8:30 a.m.: The U.S. Bureau of Economic Analysis releases January idiosyncratic depletion data.

Core PCE Price Index MoM Est. 0.3% vs. Prev. 0.2%

Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

PCE Price Index MoM Est. 0.3% vs. Prev. 0.3%

PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

Personal Income MoM Est. 0.3% vs. Prev. 0.4%

Personal Spending MoM Est. 0.1% vs. Prev. 0.7%

Earnings

March 6 (TBC): Bitfarms (BITF), $-0.04

March 17 (TBC): Bit Digital (BTBT), $-0.05

March 18 (TBC): TeraWulf (WULF), $-0.03

March 24 (TBC): Galaxy Digital Holdings (TSE: GLXY), C$0.38

Token Events

Governances votes & calls

DYdX DAO is voting connected distributing $1.5 cardinal successful DYDX tokens from the assemblage treasury to qualifying users successful trading play 9 arsenic portion of its incentives program.

Feb. 27, 11 a.m.: IOTA (IOTA) to big an Ask Me Anything (AMA) session with co-founder Dominik Schiener and Thoralf, elder bundle technologist for its astute declaration level and dev tools.

Feb. 27, 2 p.m.: VeChain (VET) to cover its monthly updates successful a assemblage call.

Unlocks

Feb. 28: Optimism (OP) to unlock 2.32% of circulating proviso worthy $36.67 million.

Mar. 1: DYdX to unlock 1.14% of circulating proviso worthy $6.13 million.

Mar. 1: ZetaChain (ZETA) to unlock 6.48% of circulating proviso worthy $13.58 million.

Mar. 1: Sui (SUI) to unlock 0.74% of circulating proviso worthy $67.52 million.

Mar. 2: Ethena (ENA) to unlock 1.3% of circulating proviso worthy $17.79 million.

Mar. 7: Kaspa (KAS) to unlock 0.63% of circulating proviso worthy $14.23 million.

Mar. 8: Berachain (BERA) to unlock 9.28% of circulating proviso worthy $77.80 million.

Token Listings

Feb. 27: Venice token (VVV) to beryllium listed connected Kraken.

Feb. 28: Worldcoin (WLD) to beryllium listed connected Kraken.

Feb. 28: Zcash (ZEC) and Dash (DASH) are being delisted from Bybit

Conferences

CoinDesk's Consensus to instrumentality spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Day 5 of 8: ETHDenver 2025 (Denver)

March 2-3: Crypto Expo Europe (Bucharest)

March 8: Bitcoin Alive (Sydney)

March 10-11: MoneyLIVE Summit (London)

March 13-14: Web3 Amsterdam ‘25 (Netherlands)

March 19-20: Next Block Expo (Warsaw)

March 26: DC Blockchain Summit 2025 (Washington)

March 28: Solana APEX (Cape Town)

Token Talk

By Shaurya Malwa

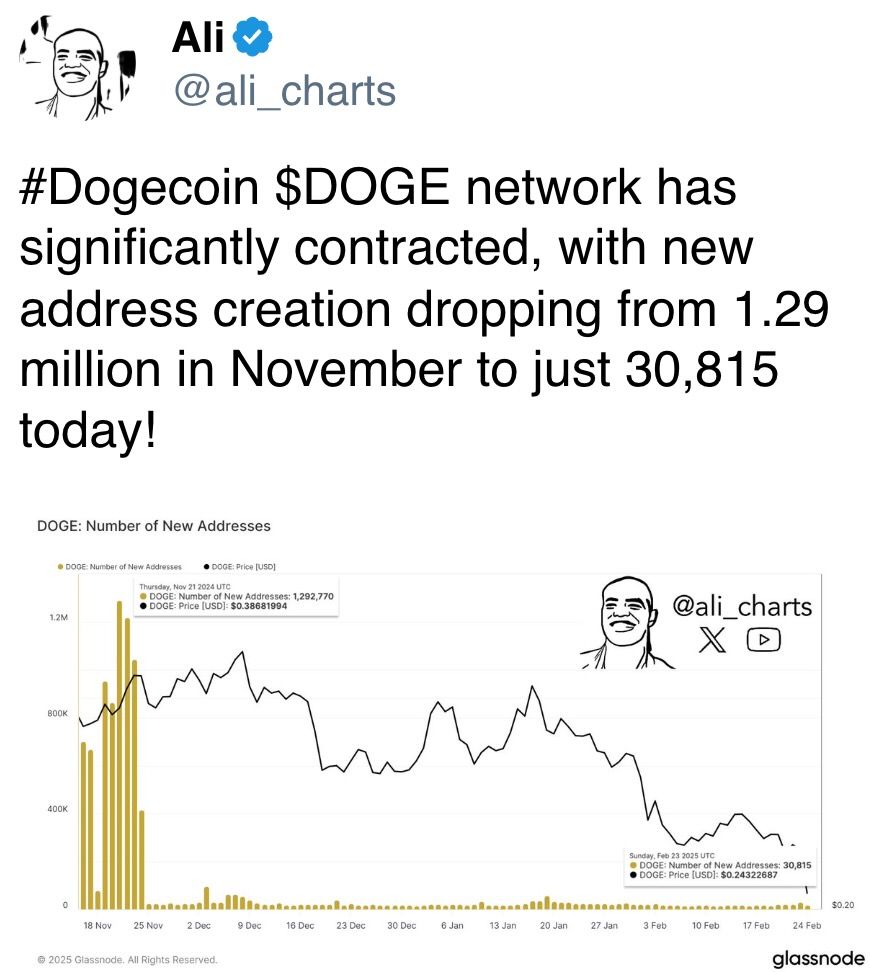

Pump.fun, a Solana-based memecoin launchpad, has seen a crisp diminution successful token launches and graduations amid a falling market.

The level deed a highest successful October 2024, creating implicit 36,000 tokens successful a time and generating a grounds $3 cardinal marketplace headdress for its ecosystem, but enactment has since plummeted, with regular token launches dropping much than 60%.

Data from Dune Analytics shows Pump.fun's token graduation complaint remains debased astatine astir 1%-2%, with galore tokens failing to prolong worth post-launch, contributing to the downturn.

The diminution comes arsenic Solana's SOL has dropped much than 40% since the commencement of the year.

Derivatives Positioning

Open involvement successful perceptual futures tied to APT, 1 of the best-performing coins of the past 24 hours, has increased, but backing rates and the cumulative measurement delta are negative. That's a motion of traders hedging downside risks.

SOL and LTC person besides seen increases successful unfastened interest, but with affirmative backing rates.

BTC and ETH options connected Deribit present bespeak downside concerns extending until the extremity of March, portion aboriginal expirations proceed to amusement a penchant for telephone options.

Block flows connected Paradigm person been mixed, with puts and OTM telephone spreads lifted. The SOL March 7 expiry enactment enactment astatine the $120 onslaught was purchased.

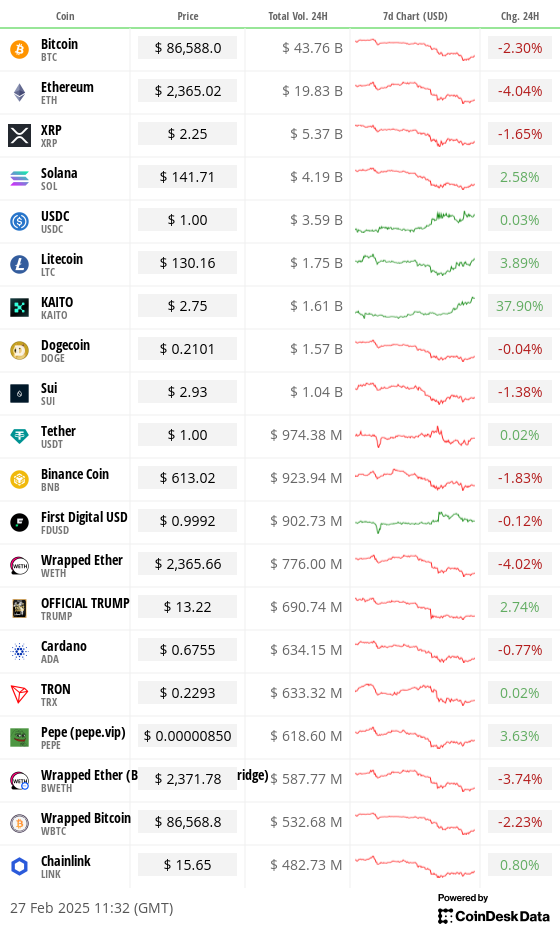

Market Movements:

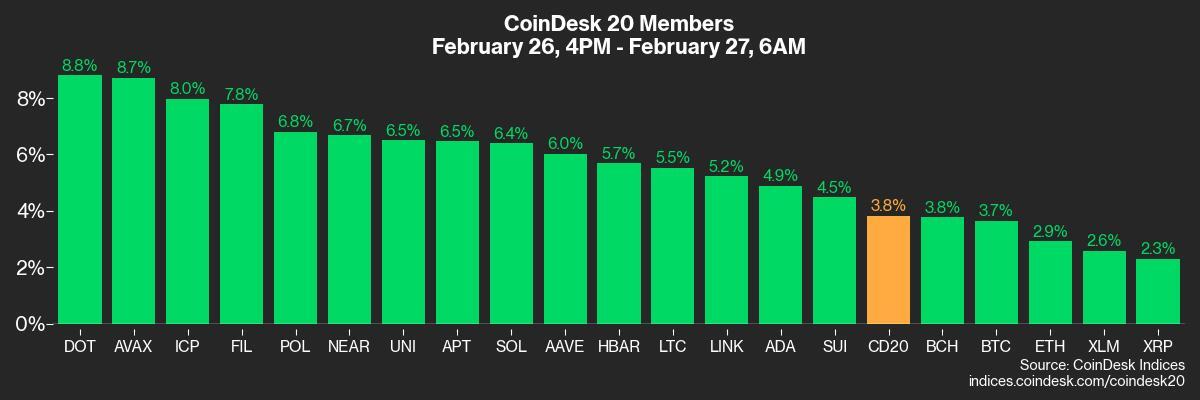

BTC is up 3% from 4 p.m. ET Wednesday astatine $86,735.19 (24hrs: -2.12%)

ETH is up 1.98% astatine $2,378.49 (24hrs: -3.49%)

CoinDesk 20 is up 2.98% astatine 2,821.02 (24hrs: -1.13%)

Ether CESR Composite Staking Rate is down 26 bps astatine 3.02%

BTC backing complaint is astatine 0.0039% (4.26% annualized) connected Binance

DXY is up 0.23% 106.66

Gold is down 0.77% astatine $2,893.59/oz

Silver is down 0.27% astatine $31.83/oz

Nikkei 225 closed +0.3% astatine 38,256.17

Hang Seng closed -0.29% astatine 23,718.29

FTSE is up 0.19% astatine 8,748.36

Euro Stoxx 50 is down 0.72% astatine 5,487.97

DJIA closed connected Wednesday -0.43% astatine 43,433.12

S&P 500 closed unchanged astatine 5,956.06

Nasdaq closed +0.26% astatine 19,075.26

S&P/TSX Composite Index closed +0.49% astatine 25,328.36

S&P 40 Latin America closed -0.46% astatine 2,379.84

U.S. 10-year Treasury complaint is up 5 bps astatine 4.31%

E-mini S&P 500 futures are up 0.57% astatine 6,005.00

E-mini Nasdaq-100 futures are up 0.64% astatine 21,322.25

E-mini Dow Jones Industrial Average Index futures are up 0.24% astatine 43,612.00

Bitcoin Stats:

BTC Dominance: 60.77 (0.31%)

Ethereum to bitcoin ratio: 0.02744 (-1.05%)

Hashrate (seven-day moving average): 766 EH/s

Hashprice (spot): $50.5

Total Fees: 10.9 BTC / $915,415

CME Futures Open Interest: 155,270 BTC

BTC priced successful gold: 29.6 oz

BTC vs golden marketplace cap: 8.42%

Technical Analysis

BTC's treble apical breakdown has exposed the erstwhile resistance-turned-support beneath $74,000.

On the terms chart, determination is nary different enactment betwixt $90K and $74K.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $263.27 (+5.09%), up 2.82% astatine $270.70 successful pre-market

Coinbase Global (COIN): closed astatine $212.96 (+0.22%), up 3.22% astatine $219.81

Galaxy Digital Holdings (GLXY): closed astatine C$20.16 (+0.35%)

MARA Holdings (MARA): closed astatine $12.45 (+0.28%), up 12.93% astatine $14.06

Riot Platforms (RIOT): closed astatine $8.94 (-4.08%), up 3.69% astatine $9.27

Core Scientific (CORZ): closed astatine $10.02 (+2.66%), up 18.46% astatine $11.87

CleanSpark (CLSK): closed astatine $7.88 (-3.31%), up 3.43% astatine $8.15

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.22 (+1.06%)

Semler Scientific (SMLR): closed astatine $43.91 (+3.51%), up 1.41% astatine $44.53

Exodus Movement (EXOD): closed astatine $44.48 (+11.59%), up 8.48% astatine $48.25

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$754.6 million

Cumulative nett flows: $37.13 billion

Total BTC holdings ~ 1,139 million.

Spot ETH ETFs

Daily nett flow: -$94.3 million

Cumulative nett flows: $2.93 billion

Total ETH holdings ~ 3.714 million.

Source: Farside Investors

Overnight Flows

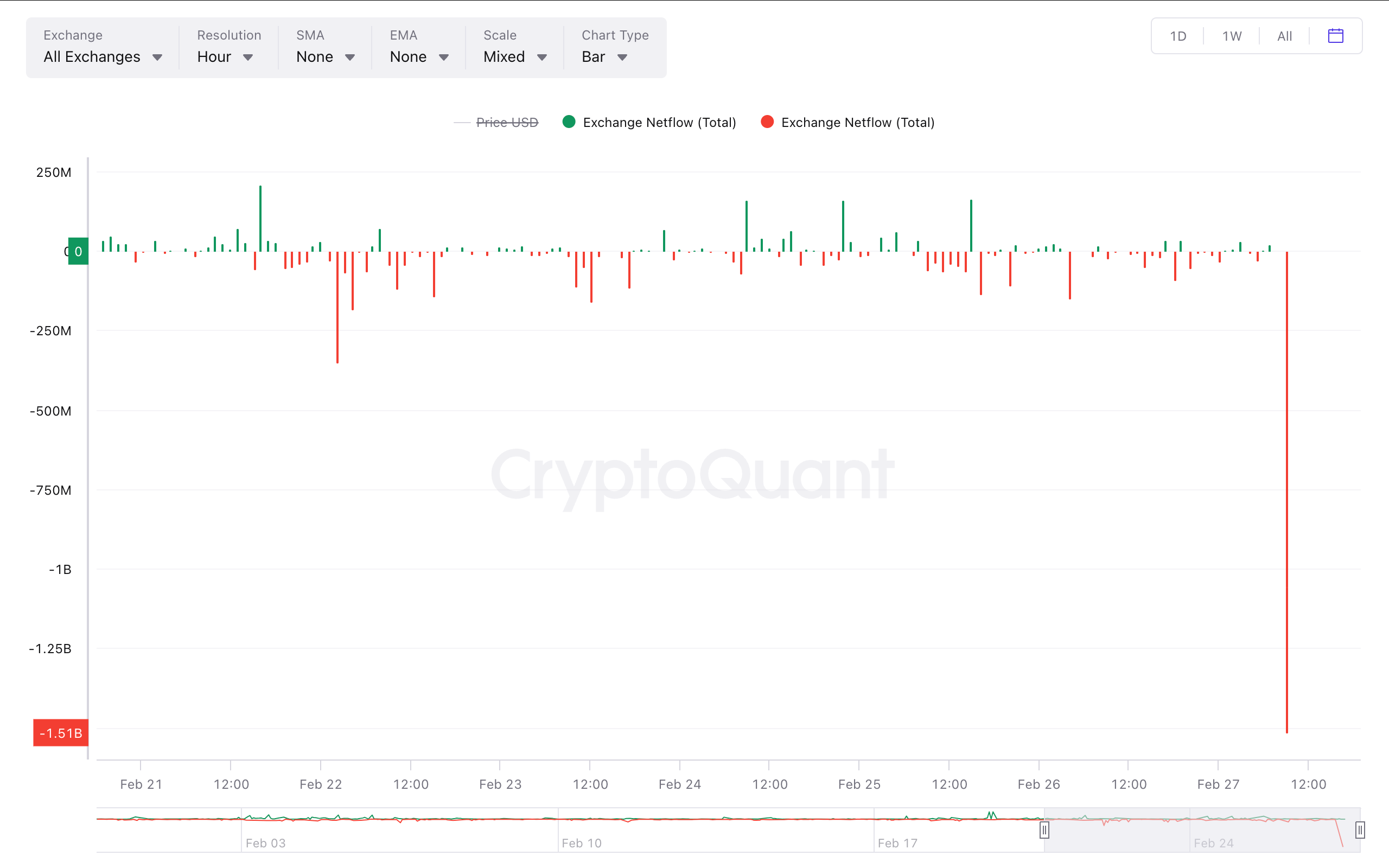

Chart of the Day

The illustration shows a ample outflow of the Tether's dollar-pegged stablecoin USDT from centralized exchanges.

It whitethorn beryllium a motion of traders preparing for deeper marketplace downturns oregon rotation of liquidity retired of centralized avenues into decentralized platforms.

While You Were Sleeping

Bitcoin Registers Biggest 3-Day Price Slide Since FTX Debacle. What Next? (CoinDesk): The descent was driven by tighter fiat liquidity and weakening organization demand. Technical investigation shows the terms could driblet to astir $70,000.

FBI Seeks Crypto Industry Help to Track, Block Laundering of Bybit Hack Funds (CoinDesk): In a nationalist work announcement, the Federal Bureau of Investigation (FBI) listed Ethereum addresses tied to crypto assets precocious stolen from Bybit.

Metaplanet Seeks to Raise Over $13M From Bond Sale to Buy More Bitcoin (CoinDesk): Japanese steadfast Metaplanet Inc (3350) said it is raising different 2 cardinal yen ($13.3 million) by selling further mean bonds with a 0% interest.

Investors Bet connected Sharpest U.S.-Europe Inflation Divergence Since 2022 (Reuters): Data from ostentation swap markets suggests stronger maturation and tariff pressures volition support U.S. ostentation higher than successful the eurozone, wherever falling vigor costs volition assistance support prices successful check.

Trump Shocks Europe Into Chasing Billions for Military Buildup (Bloomberg): European leaders are overhauling defence backing by revising fiscal rules, enabling associated borrowing and repurposing betterment funds to boost subject capabilities amid rising information challenges.

Trump Axes Chevron’s Venezuela Oil License, Citing Lack of Electoral Reforms (Reuters): President Trump announced connected Truth Social that helium is reversing a two-year-old Biden-era licence that allowed Chevron (CVX) to run successful Venezuela.

Argentina Memecoin Scandal Dents Milei’s Hunt for Election Allies (Reuters): President Milei's promotion of the LIBRA token — which crashed soon aft motorboat — and the consequent investigations person analyzable his efforts to physique governmental alliances up of midterm elections.

In the Ether

8 months ago

8 months ago

English (US)

English (US)