By Omkar Godbole (All times ET unless indicated otherwise)

Last week, we described bitcoin supra $100,000 arsenic a coiled outpouring ready to unleash vigor successful either direction. Unfortunately for the bulls, that vigor is being released downward arsenic marketplace sentiment shifts successful effect to concerns implicit the interaction of the low-cost Chinese AI startup DeepSeek connected the U.S. AI assemblage and American technological leadership.

Bitcoin plummeted to $97,800 during Asian trading hours, with whales driving prices little to liquidate overleveraged buyers connected perpetual futures exchanges. GPU-heavy AI tokens saw sell-offs of up to 40%, with akin unit affecting GameFi assets.

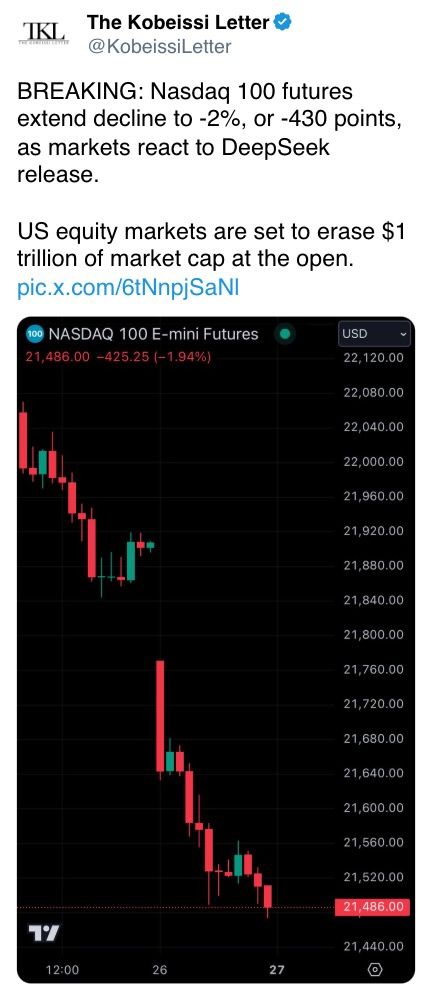

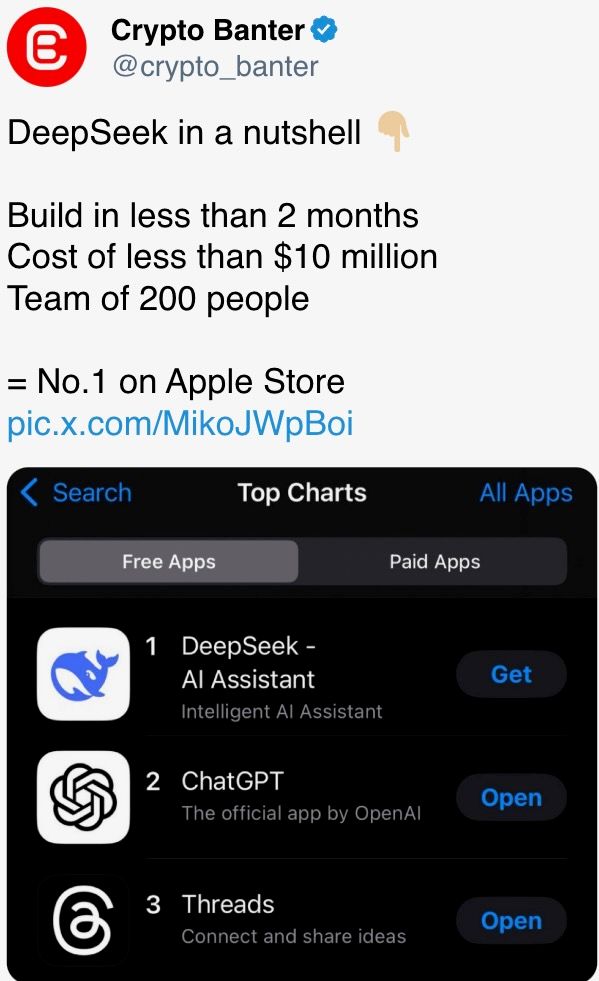

Nasdaq futures tanked 700 points, with shares successful chipmaker Nvidia (NVDA) indicated 10% little successful pre-market trading. DeepSeek-R1 is expected to importantly trim the costs of processing ample connection models, raising a questions connected the validity of the affluent valuations for AI-associated companies similar Nvidia.

Trader and expert Alex Kruger noted connected X, "The occupation is, fewer recognize however DeepSeek changes things. it’s hard to quantify the issue—and erstwhile facing uncertainty, radical derisk. When this happens successful debased liquidity conditions, the marketplace flushes hard."

Kruger is opting not to bargain the dip, saying helium prefers to abbreviated positions supra $100,000 arsenic helium anticipates heightened volatility from the upcoming Fed gathering and imaginable governmental maneuvering from President Donald Trump. The Fed is expected to reiterate its wait-and-see approach, maintaining its hawkish December guidance connected involvement rates.

Still, each is not lost. Paul Howard, Senior Director astatine Wincent, said organization information could ramp up successful the coming months.

"The adjacent question up volition apt travel from integrated information from institutions successful the adjacent 3-4 months. I’d beryllium amazed to spot a crisp bounce backmost to all-time highs earlier Q2," helium said successful an email.

Howard identified recently launched layer-1 blockchains with a absorption connected information and transactions per second, similar SUPRA, arsenic invaluable opportunities, portion stressing that for long-biased funds, discovering alpha successful a bearish marketplace involves seeking retired debased market-cap layer-1s alongside their already established peers. Stay alert!

What to Watch

Crypto:

Jan. 27 (provisional): Abstract, an Ethereum L2, has its mainnet launch, which is expected to grow the scope of the Pudgy Penguins task beyond NFTs.

Jan. 28, 1:00 p.m.: Hedera (HBAR) web upgrade to v0.57.5.

Jan. 29: Cardano’s Plomin hard fork web upgrade.

Jan. 29: Ice Open Network (ION) mainnet launch.

Feb. 2, 8:00 p.m.: Core blockchain Athena hard fork web upgrade (v1.0.14)

Feb. 4: MicroStrategy Inc. (MSTR) Q4 FY 2024 net report.

Feb. 4: Pepecoin (PEPE) halving. At artifact 400,000, the reward volition driblet to 31,250 PEPE.

Feb. 5, 3:00 p.m.: Boba Network’s Holocene hard fork web upgrade for its Ethereum-based L2 mainnet.

Feb. 6, 8:00 a.m.: Shentu Chain web upgrade (v2.14.0).

Feb. 12: Hut 8 Corp. (HUT) Q4 2024 net report.

Feb. 15: Qtum (QTUM) hard fork web upgrade is scheduled to instrumentality spot astatine artifact 4,590,000.

Feb. 18 (after marketplace close): Semler Scientific (SMLR) Q4 2024 net report.

Feb. 20: Coinbase Global (COIN) Q4 2024 net report.

Macro

Jan. 27, 10:00 a.m.: The U.S. Census Bureau releases December 2024’s Monthly New Residential Sales report.

New Home Sales Est. 0.67M vs. Prev. 0.664M.

New Home Sales MoM Prev. 5.9%.

Jan. 28, 8:30 a.m.: The U.S. Census Bureau releases December Monthly Advance Report connected Durable Goods Manufacturers' Shipments Inventories and Orders.

MoM Est. 0.8% vs. Prev. -1.1%.

Jan. 28, 1:00 p.m.: The Fed releases December's H.6 (Money Stock Measures) report.

Money Supply Prev. $21.45T.

Jan. 29, 12:00 a.m.: Japan’s Cabinet Office releases January’s Consumer Confidence Survey.

Consumer Confidence Index Est. 36.5 vs. Prev. 36.2.

Jan. 29, 4:00 a.m.: The European Central Bank (ECB) releases December 2024’s Monetary Developments successful the Euro Area report.

M3 Money Supply YoY Est. 3.8% vs. Prev. 3.8%.

Jan. 29, 8:45 a.m.: The Bank of Canada (BoC) releases the (quarterly) Monetary Policy Report.

Jan. 29, 9:45 a.m.: The BoC announces its interest complaint decision.

Est. 3% vs. Prev. 3.25% followed by a press conference astatine 10:30 a.m.

Jan. 29, 2:00 p.m.: The Federal Open Market Committee (FOMC) announces the U.S. cardinal bank’s latest interest complaint decision.

Target Range for the Federal Funds Rate Est. 4.25% to 4.5% vs. Prev.: 4.25% to 4.5% followed by a property league astatine 2:30 p.m. Livestream link.

Token Events

Governance votes & calls

Compound DAO is voting whether to instrumentality interest-rate curve adjustments for Stablecoin Comets crossed aggregate networks, including Ethereum and Base.

Clover Finance DAO is voting whether to rebrand the CLV Network to Lucent Network to align with a pivot toward gathering a decentralized concern and artificial quality level (DeFAI). The rebrand would see a migration from Polkadot to an SVM concatenation and a caller token ticker, LUX.

Arbitrum DAO is voting connected a connection to found the Arbitrum Strategic Objective Setting (SOS), which would let DAO members to suggest and ballot connected abbreviated to mid-term objectives.

Unlocks

Jan. 31: Optimism (OP) to unlock 2.32% of circulating proviso worthy $52.9 million.

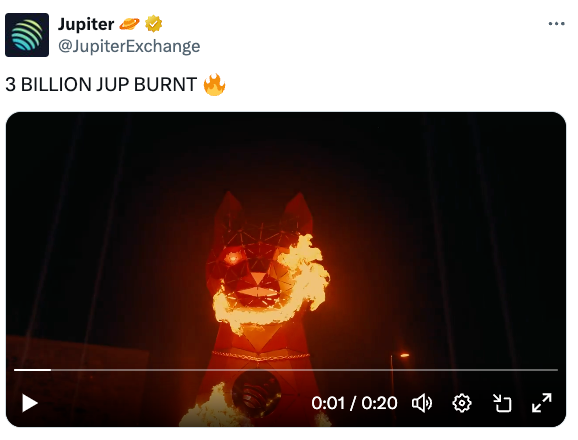

Jan. 31: Jupiter (JUP) to unlock 41.5% of circulating proviso worthy $626 million.

Feb. 1: Sui (SUI) to unlocked astir 2.13% of its circulating proviso worthy $226 million.

Token Listings

Jan. 28: Pudgy Penguins (PENGU) and Magic Eden (ME) to beryllium listed connected Kraken.

Jan. 29: Cronos (CRO), Movement (MOVE) and Usual (USUAL) to beryllium listed connected Kraken.

Conferences:

Jan. 29-31: Crypto Peaks 2025 (Palisades, California)

Jan. 30, 12:30 p.m. to 5:00 p.m.: International DeFi Day 2025 (online)

Jan. 30-31: Ethereum Zurich 2025

Jan. 30-31: Plan B Forum (San Salvador, El Salvador)

Jan. 30 to Feb. 1: Crypto Gathering 2025 (Miami Beach, Florida)

Jan. 30-Feb. 1: CryptoXR 2025 (Auxerre, France)

Jan. 30-Feb. 2: Oasis Onchain 2025 (Nassau, Bahamas)

Jan. 30-Feb. 4: The Satoshi Roundtable (Dubai)

Feb. 1-28: Mammathon (online), a planetary hackathon for Celestia (TIA).

Feb. 3: Digital Assets Forum (London)

Feb. 5-6: The 14th Global Blockchain Congress (Dubai)

Feb. 6: Ondo Summit 2025 (New York).

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: CoinDesk's Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23-March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

AI-themed agents and memes took a thumping Monday, with stalwarts Virtuals Protocol (VIRTUALS), ai16z (AI16Z) and eliza (ELIZA) sliding arsenic overmuch arsenic 30% arsenic China's DeepSeek led to a reiteration of U.S. AI startup valuations.

The downturn dented monolithic Sunday rallies connected Jupiter's JUP and Base memecoin toshi (TOSHI).

JUP spiked 40% arsenic laminitis ‘Meow’ announced astatine an yearly league that the level would pain implicit $3 cardinal JUP tokens and statesman utilizing 50% of its fees to bargain backmost the tokens from the market.

TOSHI much than doubled arsenic Coinbase listed perpetual futures for the token, making it the lone Base memecoin with some a spot and futures listing connected the influential exchange.

The consequent spike successful request sent the token to a highest marketplace capitalization of $820 million.

Derivatives Positioning

BTC perpetual backing rates flipped antagonistic during European hours, showing a nett bias for shorts. Historically, specified a positioning has tended to people section terms bottoms.

BNB, DOGE, TRX and AVAX besides saw antagonistic backing rates.

BTC, ETH short-dated options present amusement a bias for enactment options, offering downside protection. Expiries aft February proceed to amusement a bias for calls.

Key artifact trades for the time see a abbreviated volatility play, involving abbreviated positions successful BTC $05K telephone and $98K put, some expiring connected Jan. 10. In ETH's case, shorts successful out-of-the-money calls and a agelong presumption successful the $3K enactment has been noted.

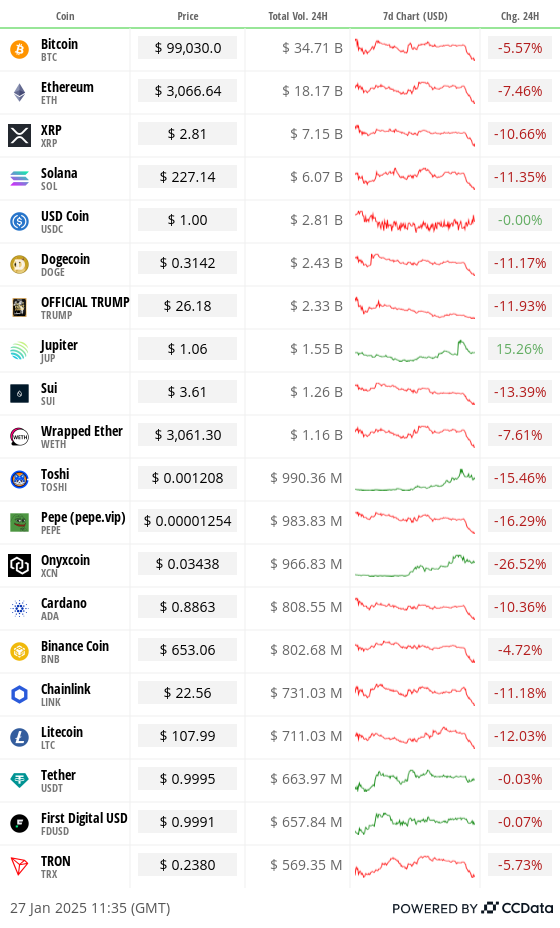

Market Movements:

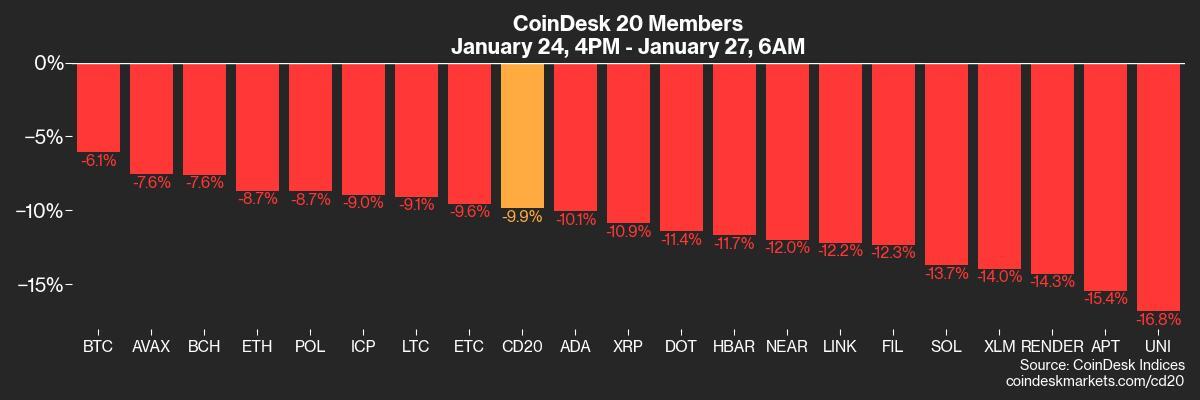

BTC is down 5.95% from 4 p.m. ET Friday to $98,784.45 (24hrs: -5.84%)

ETH is down 6.12% astatine $3,050.20 (24hrs: -7.88%)

CoinDesk 20 is down 9.07% to 3,536.28 (24hrs: -9.66%)

CESR Composite Staking Rate is down 2bps to 3.1%

BTC backing complaint is astatine 0.0006% (0.7% annualized) connected Binance

DXY is down 0.26% astatine 107.17

Gold is down 0.21% astatine $2,767.13/oz

Silver is down 0.55% to $30.48/oz

Nikkei 225 closed -0.92% astatine 39,565.80

Hang Seng closed +0.66% to 20,197.77

FTSE is down 0.21% astatine 8,483.97

Euro Stoxx 50 is down 1.51% astatine 5,140.89

DJIA closed connected Friday -0.32% to 44,424.25

S&P 500 closed -0.29% astatine 6,118.71

Nasdaq closed -0.5% astatine 19,954.30

S&P/TSX Composite Index closed +0.14% astatine 25,468.49

S&P 40 Latin America closed +0.53% astatine 2,322.63

U.S. 10-year Treasury was down 13 bps astatine 4.5%

E-mini S&P 500 futures are down 2.37% astatine 5,988.00

E-mini Nasdaq-100 futures are down 4.27% astatine 20,974.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 44,216.00

Bitcoin Stats:

BTC Dominance: 59.45 (0.60%)

Ethereum to bitcoin ratio: 0.0392 (-1.7%)

Hashrate (seven-day moving average): 766 EH/s

Hashprice (spot): $60.2

Total Fees: 4.19 BTC/ $439,954

CME Futures Open Interest: 187,465 BTC

BTC priced successful gold: 35.8 oz

BTC vs golden marketplace cap: 10.17%

Technical Analysis

The RSI connected the hourly illustration dropped to 20 during the Asian hours, the lowest since precocious August.

In different words, bearish momentum was the strongest successful astir 5 months.

RSI readings beneath 30 are taken to correspond oversold conditions and a motion of an impending carnivore breather.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $353.67 (-5.11%), down 4.9% astatine $336.35 successful pre-market.

Coinbase Global (COIN): closed astatine $298.00 (+0.67%), down 4.9% astatine $283.39 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$32.52 (-4.18%)

MARA Holdings (MARA): closed astatine $19.99 (+0.2%), down 6.1% astatine $18.77 successful pre-market.

Riot Platforms (RIOT): closed astatine $13.54 (+4.23%), down 6.94% astatine $12.60 successful pre-market.

Core Scientific (CORZ): closed astatine $15.98 (-2.2%), down 15.33% astatine $13.53 successful pre-market.

CleanSpark (CLSK): closed astatine $11.53 (+1.05%), down 6.76% astatine $10.75 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $26.22 (+2.22%), down 8.28% astatine $25.05 successful pre-market.

Semler Scientific (SMLR): closed astatine $55.46 (-9.3%), down 9.48% astatine $50.20 successful pre-market.

Exodus Movement (EXOD): closed astatine $61.25 (+39.2%), down 2.04% astatine $60 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $517.7 million

Cumulative nett flows: $39.94 billion

Total BTC holdings ~ 1.173 million.

Spot ETH ETFs

Daily nett flow: $9.18 million

Cumulative nett flows: $2.8 billion

Total ETH holdings ~ 3.67 million.

Source: Farside Investors

Overnight Flows

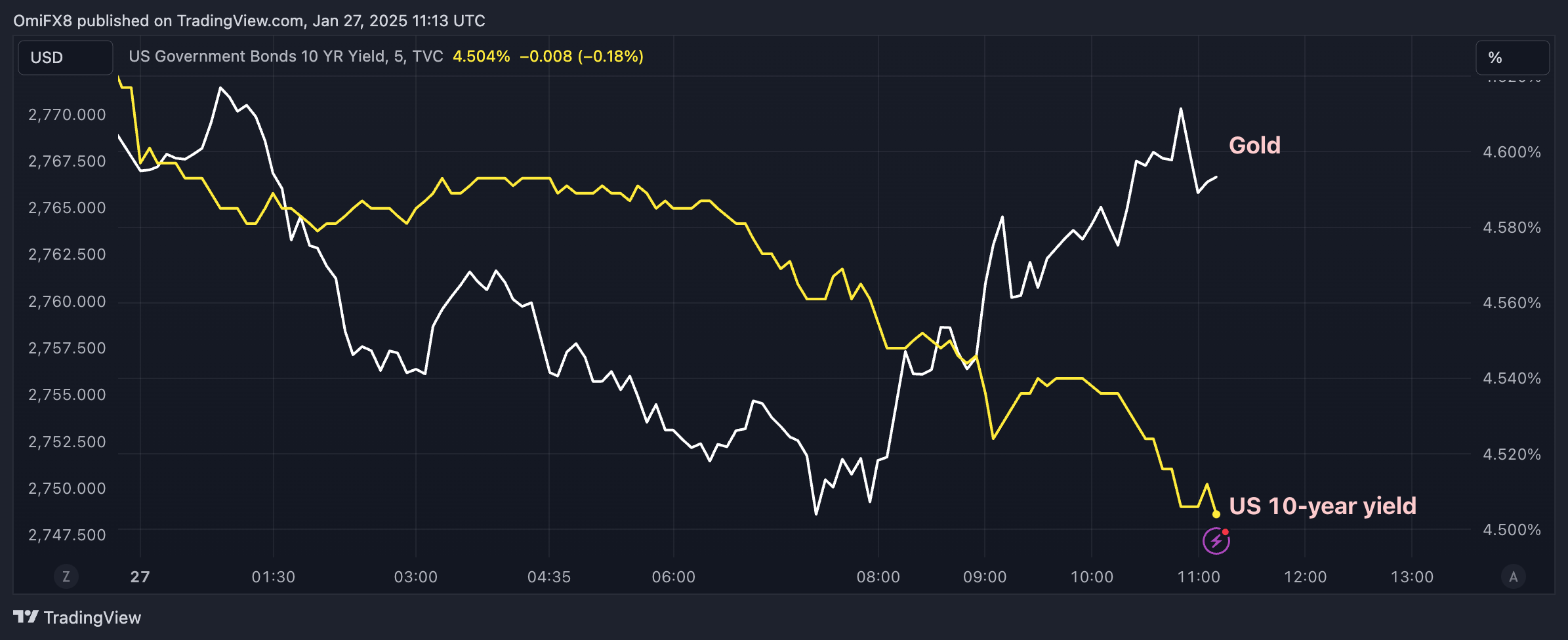

Chart of the Day

As BTC and Nasdaq, golden has held comparatively steady, perchance connected the backmost of haven demand.

Haven entreaty seems to person driven the output connected the 10-year Treasury enactment little by 9 ground points to 4.504%. Bond prices and yields determination successful the other directions.

While You Were Sleeping

Bitcoin Dives to Under $99K arsenic DeepSeek, FOMC Steal Trump Effect (CoinDesk): Bitcoin fell beneath $99,000 arsenic traders braced for this week’s FOMC meeting, and Chinese startup DeepSeek’s precocious AI exemplary pressured U.S. tech valuations, weighing connected marketplace sentiment and crypto prices.

Solana, Dogecoin, XRP Plunge 10% arsenic Bloody Start to Week Sees $770M Long Liquidations (CoinDesk): SOL and DOGE led declines arsenic crypto markets saw $770 cardinal successful bullish liquidations and wide marketplace capitalization dropped 8.5%.

Bitcoin May Be 'Double Topping' for a Price Slide to $75K (CoinDesk): Bitcoin’s inability to prolong gains supra $100,000 signals weakening momentum. If the terms drops beneath $91,300 it could perchance reaching arsenic debased arsenic $75,000, analysts said.

China’s Economy Stumbles successful Sign Rebound Hinges connected More Stimulus (Bloomberg): China’s January PMI information showed manufacturing contracting and services slowing, a signaling faltering betterment amid anemic request and commercialized pressures. Analysts warned of further slowdown without stronger fiscal stimulus.

Fixed Income Investors Seek Ways to Navigate a Trump Presidency (Financial Times): Sticky user inflation, a beardown U.S. jobs marketplace and uncertainty implicit Trump’s policies person fueled a sell-off successful Treasuries, though immoderate investors spot existent prices arsenic charismatic for semipermanent gains.

Emerging Market Investors Eye Frontier Assets Shielded From Trump's Tariff Threats (Reuters): Amid Trump’s tariff threats and planetary tensions, immoderate investors are turning to frontier markets similar Serbia, Ghana and Sri Lanka for maturation imaginable and insulation from U.S. commercialized risks.

In the Ether

9 months ago

9 months ago

English (US)

English (US)