By James Van Straten (All times ET unless indicated otherwise)

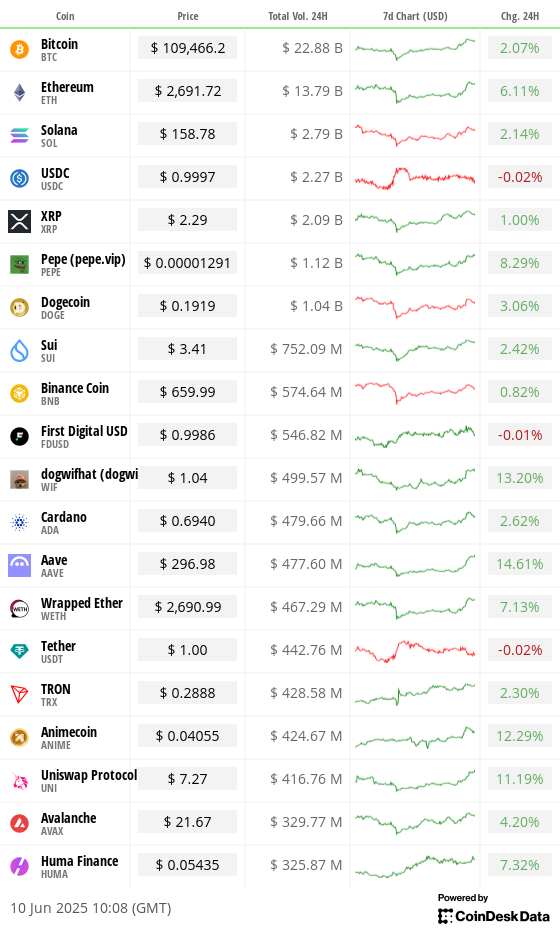

Bitcoin BTC treasury-holding companies proceed to beryllium a important operator of momentum arsenic the largest cryptocurrency by marketplace headdress trades conscionable beneath the $110,000 mark, up 2% successful the past 24 hours, and conscionable 2% abbreviated of the grounds precocious it acceptable past month.

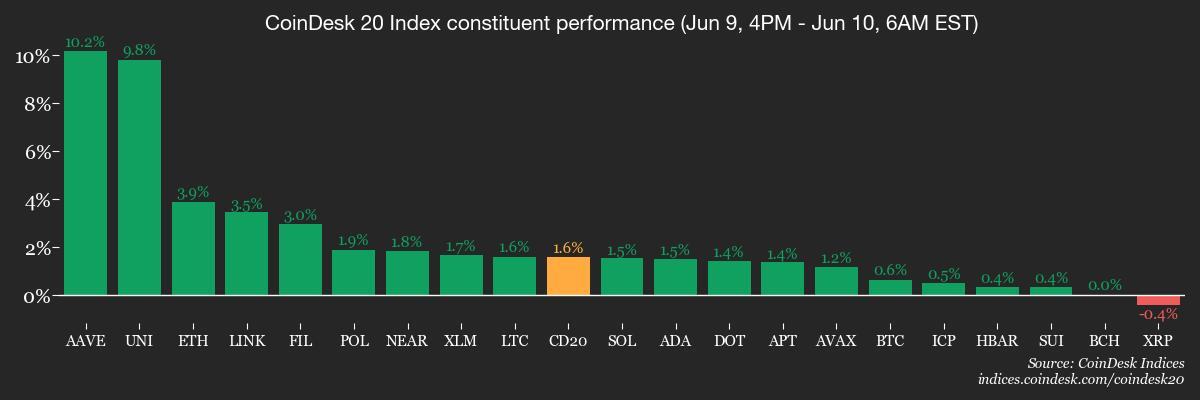

Even so, it's underperforming the broader market, arsenic measured by the CoinDesk 20 Index, which has gained 3.4%, and ether ETH, which is much than 6% higher, according to CoinDesk data.

According to BitcoinTreasuries.net, the fig of publically listed companies holding bitcoin arsenic a treasury plus has risen to 126, that's maturation of 22 successful conscionable 30 days. Collectively, past ain immoderate 819,000 BTC, up 3.25% successful the aforesaid period.

Analysis from Matthew Sigel, the caput of integer assets probe astatine VanEck, underscores the increasing organization firepower aimed astatine bitcoin. He highlights that the combined capital-raising imaginable of companies specified arsenic Strategy (MSTR), Cantor Equity Partners (CEP), Asset Entities (ASST), Semler Scientific (SMLR), Kindly (NAKA), and Trump Media & Technology Group (DJT) amounts to $76 billion.

That magnitude represents 56% of the assets nether absorption (AUM) of each bitcoin ETFs and 169% of the full nett inflows into these ETFs implicit the past 16 months.

Here's different Illustration of organization backing: BlackRock's iShares Bitcoin Trust (IBIT) became the fastest money to surpass $70 cardinal successful AUM, achieving the milestone successful conscionable 341 days. That eclipses the grounds held by SPDR Gold Shares (GLD), which took 1,691 days, according to Bloomberg ETF expert Eric Balchunas. On Monday alone, IBIT saw $2.7 cardinal successful trading volume, placing it sixth among each ETFs by regular volume.

Still, institutions aren't the lone influence. A caller Telegram enactment from QCP Capital pointed to one-year lows successful implied volatility and a signifier of subdued terms action, noting that BTC had been “stuck successful a choky range” arsenic mid-year approaches.

A cleanable interruption beneath $100,000 oregon supra $110,000 is needed to “reawaken broader marketplace interest,” it wrote.

Meantime, U.S. CPI, owed Wednesday, and immoderate quality from the U.S.-China commercialized talks successful London whitethorn assistance supply a stronger absorption to the market. Stay alert!

- Crypto

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 11, 7 a.m.: Stratis (STRAX) activates mainnet hard fork astatine artifact 2,587,200 to alteration the Masternode Staking protocol.

- June 12, 10 a.m.: Coinbase's State of Crypto Summit 2025 (New York). Livestream link.

- June 16: 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- Macro

- June 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May user terms ostentation data.

- Inflation Rate MoM Prev. 0.43%

- Inflation Rate YoY Prev. 5.53%

- June 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases May user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 2.9% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Inflation Rate YoY Est. 2.5% vs. Prev. 2.3%

- June 12, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases May shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.4%

- Core PPI YoY Est. 3.1% vs. Prev. 3.1%

- PPI MoM Est. 0.2% vs. Prev. -0.5%

- PPI YoY Est. 2.6% vs. Prev. 2.4%

- June 12, 3 p.m.: Argentina’s National Institute of Statistics and Census releases May ostentation data.

- Inflation Rate MoM Prev. 2.8%

- Inflation Rate YoY Prev. 47.3%

- June 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.”

- Optimism DAO is voting to o.k. eligibility criteria for the Milestones and Metrics (M&M) Council successful Seasons 8 and 9, introducing a exemplary where members are selected “based connected competencies alternatively than elections.” Voting ends June 11.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- June 11, 7 a.m.: Cronos Labs pb Mirko Zhao to enactment successful a assemblage Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $53.61 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $12.82 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $16.90 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $10.59 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $32.21 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $41.25 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.88 million.

- Token Launches

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Oliver Knight

- The SEC announced peculiar exemptions for DeFi projects connected Monday, prompting the tokens of of aave (AAVE) and uniswap (UNI) to leap by astir 16%.

- Ether (ETH), meanwhile, accrued by 7.3% arsenic regular trading measurement much than doubled to $26.5 billion.

- A breakout for ETH supra the $2,650 level of absorption would unfastened a way towards $4,000, wherever it concisely traded successful December earlier surrendering those gains successful February.

- CoinMarketCap's altcoin play index has ticked up from 18 to 29 retired of a maximum 100 since the crook of the month, suggesting that traders are focusing connected the altcoin marketplace alternatively of bitcoion, adjacent though BTC was ascendant passim the caller cycle.

- Bitcoin has risen by 32% since March, but has been outperformed by a ample information of altcoins including HYPE, SUI and ETH, which are up betwixt 42% and 200% respectively implicit the aforesaid period.

Derivatives Positioning

- Bitcoin options unfastened involvement (OI) roseate to a June precocious of $44.33B, led by Deribit astatine $35.24B, followed by CME ($3.5B) and OKX ($3.24B), according to Coinglass data.

- The BTC options-to-futures OI ratio stood astatine 57.6%, reflecting beardown request for optionality comparative to directional exposure.

- Traders proceed to thin bullish with a put/call ratio of 0.57 connected Deribit.

- The 140K onslaught leads successful notional presumption with $1.79B, portion the 27 June expiry dominates the curve with $13.7B successful full notional value. The apical traded instruments see 120K and 150K calls expiring June and August.

- Futures unfastened involvement momentum remains affirmative crossed BTC, AXL and altcoins.

- AXL’s OI has surged implicit 800% successful the past 24 hours, Velo information shows.

- BTC backing rates connected Deribit reached 36.1% APR, with likewise elevated levels connected Hyperliquid (27.5%) and Bybit (11%), highlighting persistent long-side demand.

- On Binance, liquidation leverage roseate sharply to $129.3M adjacent the $106.6K terms level, reflecting a clump of unfastened involvement that could beryllium wiped retired if prices propulsion backmost to that zone, according to Coinglass.

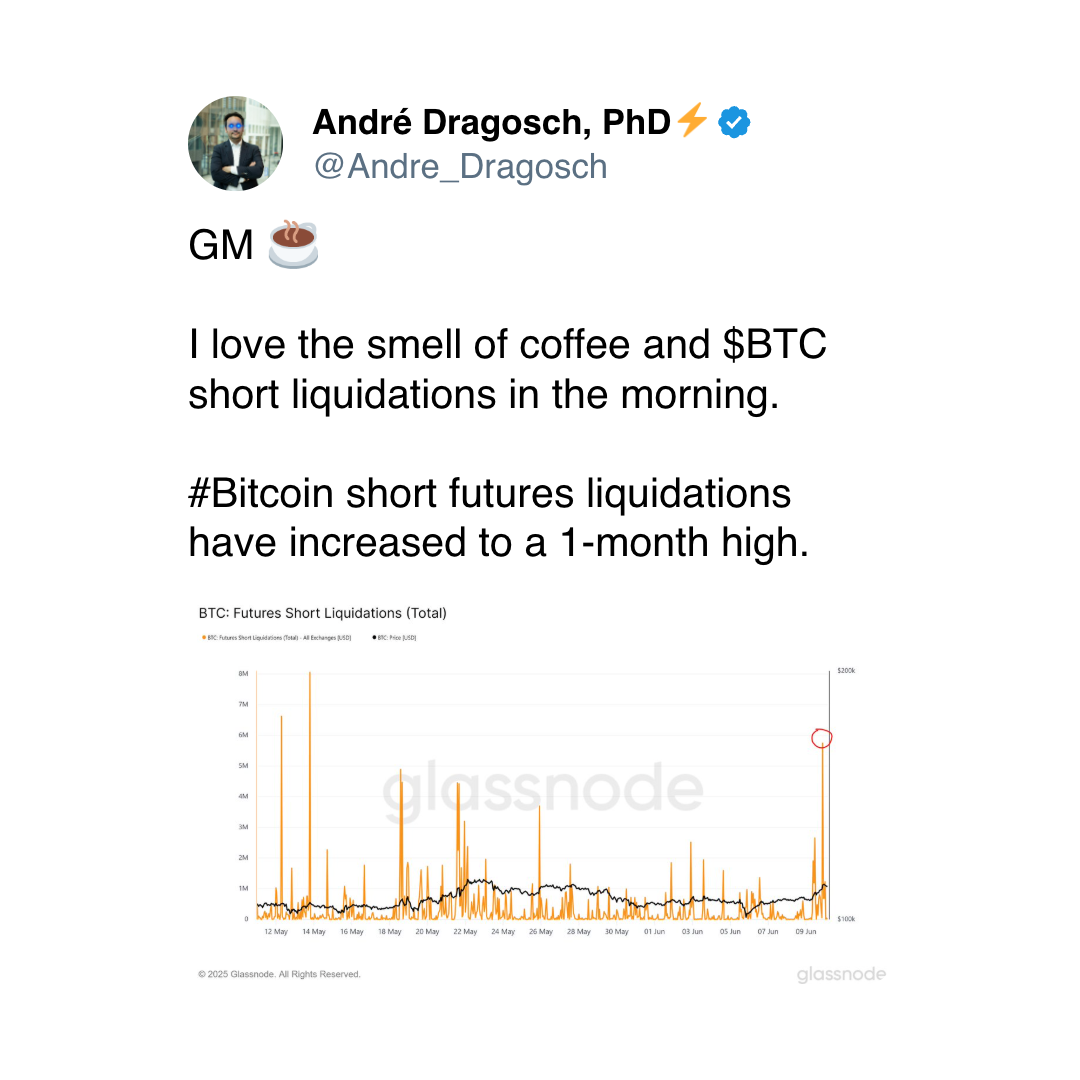

- Over the past 24 hours, existent BTC liquidations totalled $170.74M, dominated by abbreviated liquidations of $160.93M, signaling assertive forced buying arsenic the terms surged done cardinal levels.

Market Movements

- BTC is up 0.71% from 4 p.m. ET Monday astatine $109,535.95 (24hrs: +2.14%)

- ETH is up 3.92% astatine $2,692.82 (24hrs: +6.18%)

- CoinDesk 20 is up 1.52% astatine 3,210.97 (24hrs: +3.21%)

- Ether CESR Composite Staking Rate is up 14 bps astatine 3.08%

- BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

- DXY is up 0.21% astatine 99.15

- Gold futures are down 0.13% astatine $3,350.60

- Silver futures are down 0.44% astatine $36.63

- Nikkei 225 closed up 0.32% astatine 38,211.51

- Hang Seng closed unchanged astatine 24,162.87

- FTSE is up 0.32% astatine 8,860.46

- Euro Stoxx 50 is down 0.32% astatine 5,404.14

- DJIA closed connected Monday unchanged astatine 42,761.76

- S&P 500 closed unchanged astatine 6,005.88

- Nasdaq Composite closed up 0.31% astatine 19,591.24

- S&P/TSX Composite closed down 0.20% astatine 26,375.80

- S&P 40 Latin America closed down 0.38% astatine 2,574.85

- U.S. 10-Year Treasury complaint is down 3 bps astatine 4.45%

- E-mini S&P 500 futures are unchanged astatine 6,006.50

- E-mini Nasdaq-100 futures are unchanged astatine 21,805.50

- E-mini Dow Jones Industrial Average Index are down 0.16% astatine 42,728.00

Bitcoin Stats

- BTC Dominance: 64.53 (-0.18%)

- Ethereum to bitcoin ratio: 0.02445 (+0.99%)

- Hashrate (seven-day moving average): 878 EH/s

- Hashprice (spot): $54.72

- Total Fees: 5.00 BTC / $535,990

- CME Futures Open Interest: 151,915

- BTC priced successful gold: 32.7 oz

- BTC vs golden marketplace cap: 9.27%

Technical Analysis

- After trading into the play orderblock, Solana has reclaimed the 50-day exponential moving mean and 100-day EMA connected the regular clip frame.

- The terms is presently capped by the 50-day measurement connected the play clip frame. A decisive interruption and clasp supra this level could unfastened the doorway for a determination backmost toward the anterior scope highs betwixt $170 and $180.

- In the lawsuit of a pullback, bulls volition privation to spot a higher debased form, with the play bid artifact continuing to clasp arsenic a beardown enactment zone.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $392.12 (+4.71%), +0.64% astatine $394.61 successful pre-market

- Coinbase Global (COIN): closed astatine $256.63 (+2.13%), +0.34% astatine $257.49

- Circle (CRCL): closed astatine $115.25 (+7.01%), +3.44% astatine $119.27

- Galaxy Digital Holdings (GLXY): closed astatine C$28.58 (+4.31%)

- MARA Holdings (MARA): closed astatine $16.27 (+3.11%), unchanged successful pre-market

- Riot Platforms (RIOT): closed astatine $10.12 (+2.74%), +0.3% astatine $10.15

- Core Scientific (CORZ): closed astatine $12.71 (+4.27%), +1.57% astatine $12.91

- CleanSpark (CLSK): closed astatine $10.12 (+3.37%), +0.2% astatine $10.14

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $20.16 (+3.01%)

- Semler Scientific (SMLR): closed astatine $33.99 (+3.06%)

- Exodus Movement (EXOD): closed astatine $29.01 (+0.52%), +0.24% astatine $29.08

ETF Flows

Spot BTC ETFs

- Daily nett flows: $386.2 cardinal

- Cumulative nett flows: $44.61 cardinal

- Total BTC holdings ~1.2 million

Spot ETH ETFs

- Daily nett flows: $52.7 million

- Cumulative nett flows: $3.4 billion

- Total ETH holdings ~3.79 million

Source: Farside Investors

Overnight Flows

Chart of the Day

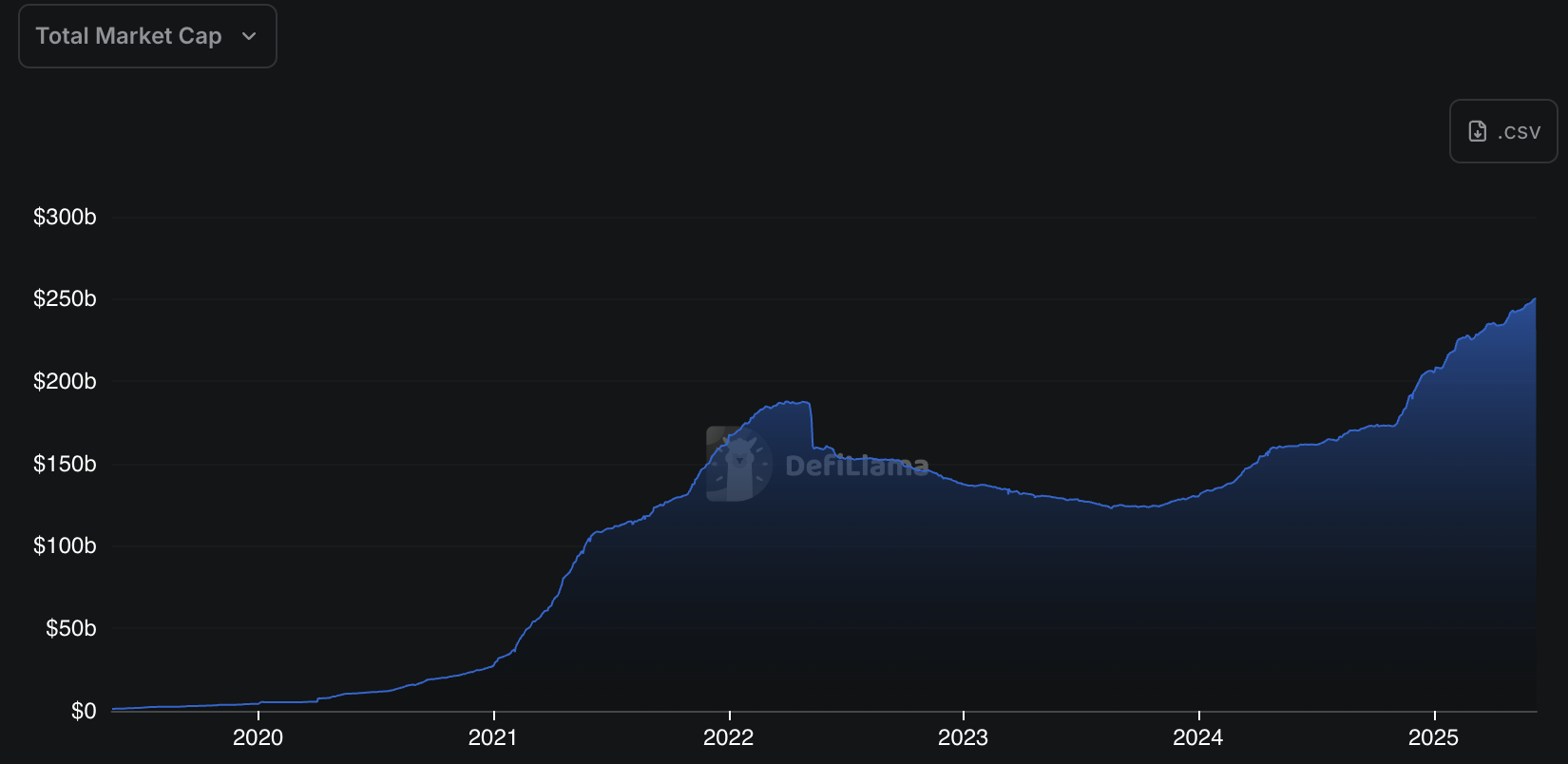

- The full stablecoins marketplace headdress surpasses $250 cardinal for the archetypal time.

While You Were Sleeping

- South Korea’s Ruling Party Unveils Plan to Allow Stablecoins (Bloomberg): The projected Digital Asset Basic Act lets section firms gathering a minimum equity threshold contented reserve-backed stablecoins, reviving cardinal slope concerns that non-bank issuers could undermine monetary policy.

- SocGen’s Crypto Arm Unveils Dollar Stablecoin connected Ethereum and Solana (CoinDesk): SocGen said it became the archetypal planetary slope to contented a nationalist U.S. dollar stablecoin. USD CoinVertible (USDCV) begins trading successful July with BNY Mellon arsenic custodian but excludes “U.S. persons.”

- Riot Sells $1.58M of Bitfarms Shares arsenic Part of Investment Review (CoinDesk): As portion of a continuing reappraisal of its concern successful Bitfarms, Riot sold 1.75 cardinal shares connected June 9 astatine $0.90 each, lowering its involvement to 14.3%.

- Trump Administration More Than Doubles Federal Deployments to Los Angeles (The New York Times): The Pentagon’s deployment of 700 Marines raised unit levels successful Los Angeles to 4,700, arsenic Trump backed a national official’s menace to apprehension California’s politician for mishandling the deportation protests.

- Price Wars Grip China arsenic Deflation Deepens, $30 for a Luxury Coach Bag? (Reuters): Industrial overcapacity, existent property losses and wage cuts are fueling deflation successful China, driving luxury consumers to steep discounts successful a booming second-hand marketplace present gripped by terms wars.

- UK Will Launch Market for Private Share Sales Later This Year (Bloomberg): The Financial Conduct Authority volition aviator a five-year backstage stock marketplace with looser disclosure rules and restricted access, responding to rising request from firms and investors stalled by delayed IPOs.

In the Ether

2 months ago

2 months ago

English (US)

English (US)