By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has begun the week connected a antagonistic note, with bitcoin (BTC) little aft a play spent wrestling with the $100,000 people amid reports that Amazon shareholders are pushing for an allocation to the cryptocurrency. The persistent indecisiveness since Dec. 5 amid <a href="https://x.com/cryptoquant_com/status/1864346040633008510" target="_blank">increased retail participation</a> has immoderate indicators pointing to a mid-bull rhythm top.

For example, BTC's worth days destroyed (VDD) indicator, a velocity gauge, has jumped to 2.0 from 0.5, signaling that older coins are being sold. As the laminitis of <a href="https://10xresearch.co/" target="_blank">10x Research</a>, Markus Thielen, points out, "This often reflects profit-taking by semipermanent holders, a behaviour emblematic successful the aboriginal stages of a bull market." Luckily for the bulls, VDD is inactive beneath the captious 3.8 level, marking the extremity of erstwhile bull markets. The fashionable MVRV ratio supports this idea, rising to 2.7x successful a determination Thielen calls a hint of a mid-cycle highest wherever galore investors contemplate taking profits.

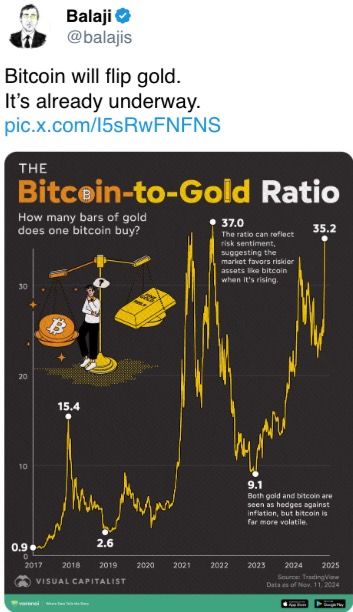

Meanwhile, MicroStrategy's CEO Michael Saylor <a href="https://x.com/PauloMacro/status/1865767710816075910" target="_blank">faced a backlash</a> connected societal media for urging the U.S. to regenerate golden with BTC successful its reserves, leaving America's enemies with a worthless asset. At slightest that's an betterment compared with the maxi communicative of precocious 2020 <a href="https://www.coindesk.com/markets/2020/10/06/bitcoin-unlikely-to-replace-us-dollar-as-global-reserve-marc-chandler" target="_blank">that suggested</a> BTC would regenerate the USD, oregon is it? The cheesy instrumentality has immoderate wondering whether the bullish rhythm is astir to peak.

Ether is besides feeling the pressure, posting adjacent larger losses than bitcoin and dampening hopes for a betterment successful the ether-bitcoin ratio. Despite this, retail involvement remains robust, with unfastened involvement successful ETH perpetuals rising to $843 cardinal connected starring decentralized speech <a href="https://stats.hyperliquid.xyz/" target="_blank">Hyperliquid</a>, exceeding BTC's $616 million. This follows <a href="https://www.chaincatcher.com/en/article/2155819#:~:text=Last%20week%2C%20the%20U.S.%20Ethereum,million%20and%20%24296%20million%2C%20respectively." target="_blank">record inflows</a> of $836 cardinal into ether ETFs past week.

"This indicates important retail involvement successful ETF flows," said Toe Bautista, a probe expert astatine GSR. "Most transportation trades are connected CME versus Hyperliquid, truthful this involvement seems to bespeak sticky retail superior that could substance the adjacent limb up."

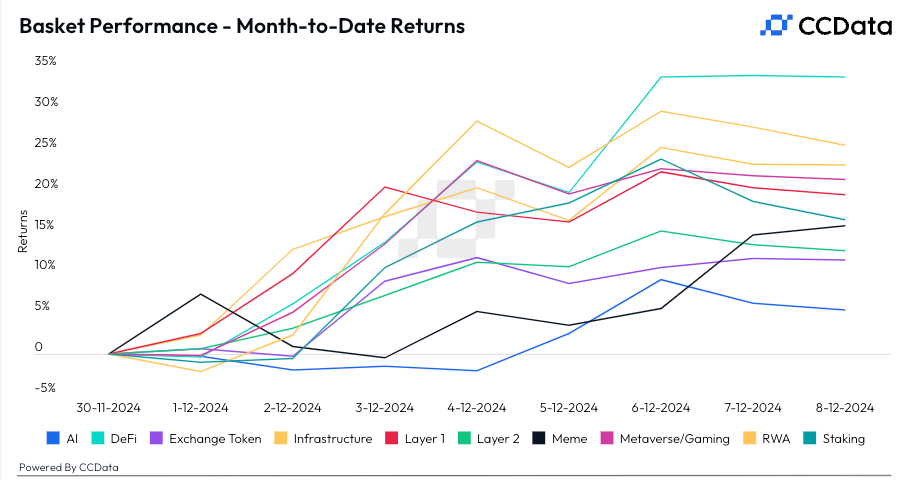

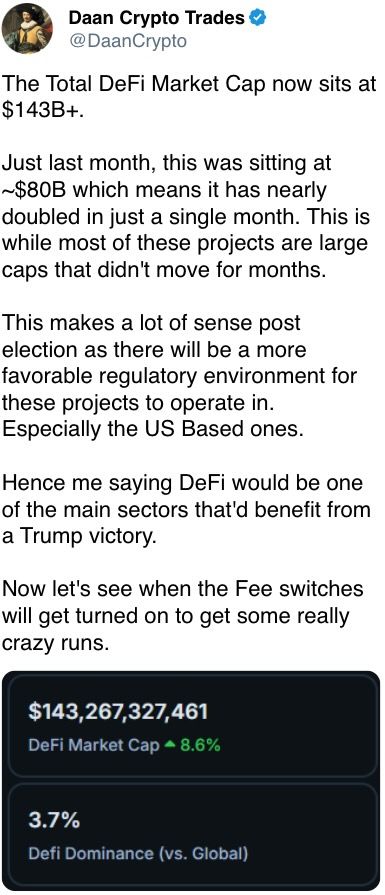

On a affirmative enactment for ETH, the DeFi sector, which chiefly operates connected Ethereum, is booming. Last week, TradingView's DeFi marketplace headdress scale surged implicit 28% to $151.9 billion, its highest since aboriginal 2022. This summation has reduced ether's ostentation complaint to 0.3% and was accompanied by a 71% emergence successful DEX trading volumes, a 39% summation successful web gross and a 20x surge successful full blob fees.

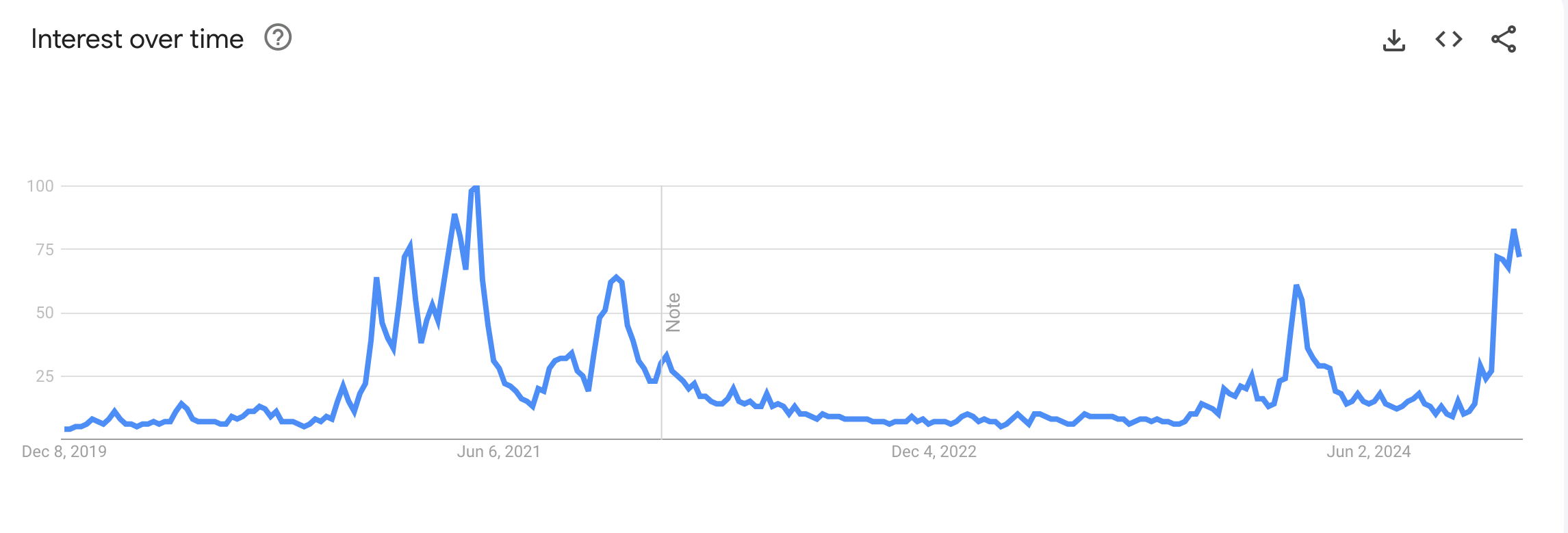

Frax Finance’s FXS token fell contempt an expected large upgrade announcement, portion Aptos’ APT token dropped 7% up of a $165 cardinal token unlock connected Dec. 11. Altcoins are gaining accrued hunt involvement connected Google, arsenic shown successful today’s chart.

In accepted markets, U.S. equity futures held steady, with China’s Politburo <a href="https://www.forexlive.com/news/chinas-politburo-says-will-implement-more-proactive-fiscal-policy-20241209/" target="_blank">announcing</a> much proactive fiscal and escaped monetary policies, prompting the 10-year Chinese authorities enslaved output to driblet beneath 2%. (Are bonds pricing successful a imaginable Chinese QE?) Stay alert!

What to Watch

Crypto:

Dec. 10, 11:30 a.m.: Microsoft's 2024 Annual Shareholders Meeting. The gathering volition see MicroStrategy Executive Chairman <a href="https://www.michael.com/microsoft-bitcoin-strategy" target="_blank">Michael Saylor's 44-slide Bitcoin presentation</a> (“Microsoft Bitcoin Strategy”). Microsoft volition past disclose the voting results. <a href="https://www.microsoft.com/en-us/investor/annual-meeting" target="_blank">Livestream link</a>.

Dec. 13: The yearly Nasdaq-100 reconstitution. Changes to the index, if any, are announced connected this day. Nasdaq-listed MicroStrategy (MSTR), the world’s largest firm holder of bitcoin, is wide expected to beryllium added to the index.

Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

Macro

Dec. 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases November’s <a href="https://www.bls.gov/cpi/" target="_blank">Consumer Price Index (CPI)</a> data.

Inflation Rate YoY Est. 2.7% vs Prev. 2.6%.

Core Inflation Rate YoY Est. 3.3% vs Prev. 3.3%.

Dec. 11, 9:45 a.m.: The Bank of Canada announces its <a href="https://www.bankofcanada.ca/core-functions/monetary-policy/key-interest-rate/" target="_blank">policy involvement rate</a> (also known arsenic overnight people complaint and overnight lending rate). Est. 3.25% vs Prev. 3.75%. A property league starts astatine 10:30 a.m. <a href="https://youtu.be/x-motc1cW8s" target="_blank">Livestream link</a>

Dec. 12, 8:15 a.m.: The European Central Bank (ECB) announces its latest <a href="https://www.ecb.europa.eu/press/pr/activities/mopo/html/index.en.html" target="_blank">monetary argumentation decision</a> (three cardinal involvement rates).

Deposit installation involvement complaint Est. 3.0% vs Prev. 3.25%.

Main refinancing operations involvement complaint Est. 3.15% vs Prev. 3.4%.

Marginal lending installation involvement complaint Prev. 3.65%.

Dec. 18, 2:00 p.m.: The Fed is acceptable to merchandise December's <a href="https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm" target="_blank">Federal Open Market Committee (FOMC) Statement</a> and interest-rate decision, with the erstwhile complaint astatine 4.75%. The <a href="https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html" target="_blank">CME Group's FedWatch instrumentality </a>currently indicates that traders successful national funds futures delegate a 90.5% probability of a 25 basis-point complaint chopped being announced, compared to a 9.5% probability of nary change.

Dec. 18, 2:30 p.m.: Fed Chair Jerome Powell hosts a property league connected the FOMC decision. <a href="https://www.federalreserve.gov/live-broadcast.htm" target="_blank">Livestream link</a>.

Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its involvement complaint decision.

Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases <a href="https://www.bea.gov/data/gdp/gross-domestic-product" target="_blank">third-quarter GDP (final)</a>.

GDP Growth Rate QoQ Est. 2.8% vs Prev. 3.0%.

GDP Price Index QoQ Est. 1.9% vs Prev. 2.5%.

Dec. 24, 1:00 p.m. The Fed releases November’s <a href="https://www.federalreserve.gov/releases/h6/default.htm" target="_blank">H.6 (Money Stock Measures) report</a>.

Token Events

Unlocks

Bitget to unlock 5.38 BGB, 0.38%of circulating supply, worthy $6.81 cardinal astatine existent prices connected Dec. 9 astatine 7 p.m.

EigenLayer to unlock 1.29 cardinal EIGEN, worthy $5.92 million, connected Dec. 10 astatine 2 pm.

Conferences:

Dec. 9 - 10: <a href="https://b.tc/conference/mena" target="_blank">Bitcoin MENA 2024</a> (Abu Dhabi, UAE)

Dec. 9 - 12: <a href="https://adfw.com/" target="_blank">Abu Dhabi Finance Week 2024</a> (Abu Dhabi, UAE)

Dec. 9 - 13: <a href="https://www.blockchainweek.lu/" target="_blank">Luxembourg Blockchain Week 2024</a>

Dec. 12 - 13: <a href="https://www.globalblockchainshow.com/" target="_blank">Global Blockchain Show</a> (Dubai, UAE)

Dec. 12 - 14: <a href="https://www.taipeiblockchainweek.com/" target="_blank">Taipei Blockchain Week 2024</a> (Taipei, Taiwan)

Dec. 13: <a href="https://www.limitlesscrypto.com/" target="_blank">Limitless Crypto 2024</a> (San Juan, Puerto Rico)

Dec. 16 - 17: <a href="https://theblockchainassociation.org/policy-summit-2024/" target="_blank">Blockchain Association’s Policy Summit</a> (Washington)

Jan. 13 - 24: <a href="https://web3fest.ch/swiss-web3fest/" target="_blank">Swiss WEB3FEST Winter Edition 2025</a> (Zug, Zurich, St. Moritz, Davos)

Jan. 17: <a href="https://www.anderson.ucla.edu/about/clubs-and-associations/institutions/entrepreneur-association-ea/unchained" target="_blank">Unchained: Blockchain Business Forum 2025</a> (Los Angeles)

Jan. 18: <a href="https://bitcoinday.io/" target="_blank">BitcoinDay</a> (Napes, Florida)

Jan. 21: <a href="https://www.tokenizationsummit.de/eng" target="_blank">Frankfurt Tokenization Conference 2025</a>

Token Talk

By Shaurya Malwa Over the weekend, Ethereum-based Pepe (PEPE) zoomed to a grounds $11 cardinal marketplace capitalization, continuing its correlation arsenic a beta stake connected the web arsenic ether (ETH) leapt to an eight-month high.

PEPE has gained <a href="https://www.coingecko.com/en/coins/pepe" target="_blank">more than 23% successful the past </a>seven days, with trading volumes expanding from an mean of $2 cardinal to implicit $8 cardinal successful that period.

That determination made the token the archetypal among the comparatively caller memes from 2023 — a cohort that includes bonk, dogwifhat, and mog, among others — the archetypal to eclipse a landmark $10 cardinal marketplace cap

Gains successful pepe apt tracked those of ether, which has outperformed bitcoin (BTC) and different large tokens with an 8% emergence successful the past 7 days.

Since precocious 2023, meme tokens person been progressively seen arsenic a beta — oregon a leveraged mode to stake connected the maturation of their underlying blockchain.

Some PEPE whales accrued their holdings by astir 1.1 cardinal tokens implicit the weekend, suggesting beardown organization oregon ample capitalist involvement successful expectations of a higher move, according to <a href="https://x.com/lookonchain/status/1865605723859939690" target="_blank">Lookonchain data</a>.

Derivatives Positioning

Funding rates successful perpetual futures tied to large tokens, including BTC, person dropped to little than 30% from astir 100% past week. It's a motion that speculative excesses person been crowded out.

While perpetual futures unfastened involvement for astir large coins has accrued implicit the past 7 days, cumulative measurement deltas (CVDs) person declined, indicating a nett selling pressure.

BTC's options marketplace has seen a beardown uptake for the Dec. 13 expiry telephone astatine $105,000 and calls astatine $130,000 and $150,000 expiring successful January and March. Calls proceed to commercialized astatine a premium to puts.

In ETH, an entity financed a ample acquisition of the $3,200 enactment expiring connected Dec. 27 with a abbreviated presumption successful the $4,200 call. The positioning shows expectations for a terms drop.

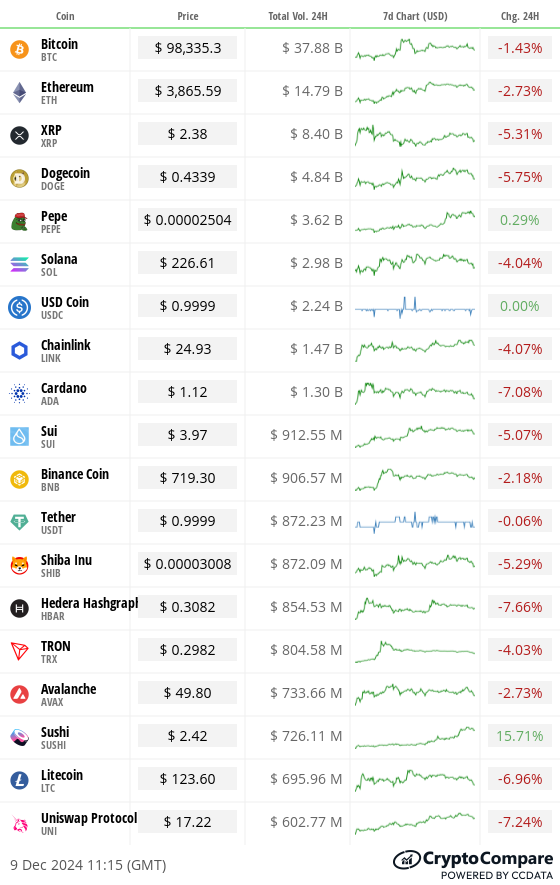

Market Movements:

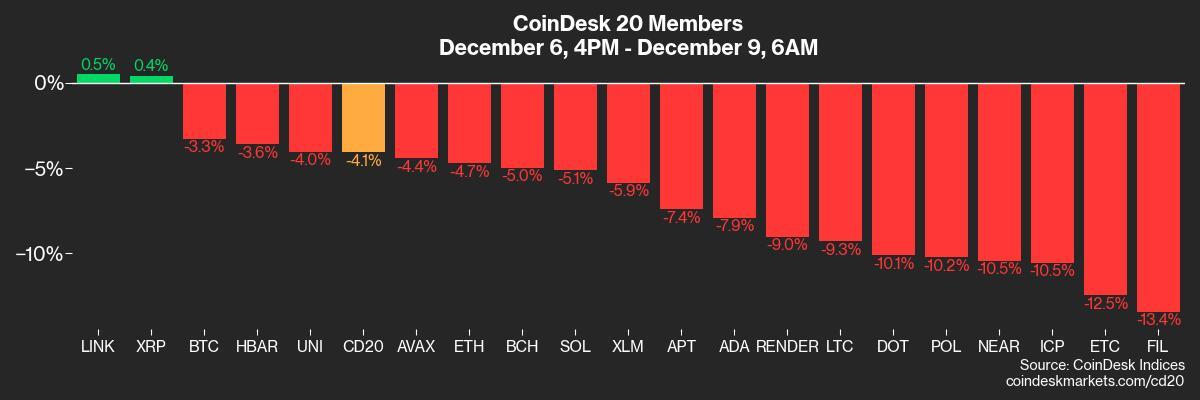

BTC is down 3.3% from 4 p.m. ET Friday to $98,632.41 (24hrs: -1.46%)

ETH is down 4.7% astatine $3,881.34 (24hrs: -2.81%)

CoinDesk 20 is down 4.1% to 3,838.53 (24hrs: -3.37%)

Ether staking output is down 24 bps to 3.05%

BTC backing complaint is astatine 0.0164% (18% annualized) connected Binance

DXY is down 0.18% astatine 105.87

Gold is up 1.49% astatine $2,677.9/oz

Silver is up 2.69% to $32.03/oz

Nikkei 225 closed +0.18% astatine 39,160.5

Hang Seng closed +2.76% astatine 20,414.09

FTSE is up 0.21% astatine 8,326.02

Euro Stoxx 50 is unchanged astatine 4,974.6

DJIA closed Friday -0.28% astatine 44,642.52

S&P 500 closed +0.25% astatine 6,090.27

Nasdaq closed +0.81% astatine 19,859.77

S&P/TSX Composite Index closed unchanged astatine 25,691.8

S&P 40 Latin America closed -1.62% astatine 2,329.74

U.S. 10-year Treasury was unchanged astatine 4.17%

E-mini S&P 500 futures are down 0.1% to 6,092.75

E-mini Nasdaq-100 futures are down 0.19% to 21,615.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 44,692

Bitcoin Stats:

BTC Dominance: 55.86% (0.90%)

Ethereum to bitcoin ratio: 0.03932 (-0.73%)

Hashrate (seven-day moving average): 745 EH/s

Hashprice (spot): $62.26

Total Fees: 15.28 BTC / $2.76M

CME Futures Open Interest: 195K BTC

BTC priced successful gold: 37.4 oz

BTC vs golden marketplace cap: 10.66%

Bitcoin sitting successful over-the-counter table balances: 428.79K

Basket Performance

Technical Analysis

BTC's hourly illustration shows the cryptocurrency has dived beneath the little Bollinger band, hinting astatine deeper losses ahead.

Bollinger bands are volatility bands placed 2 modular deviations supra and beneath the 20-period elemental moving mean of the price.

TradFi Assets

MicroStrategy (MSTR): closed connected Friday astatine $395.01 (+2.23%), down 2.39% astatine $385.50 successful pre-market.

Coinbase Global (COIN): closed astatine $343.62 (+7.19%), down 2.4% astatine $335.4 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$29.90 (+8.14%)

MARA Holdings (MARA): closed astatine $26.43 (+6.62%), down 2.88% astatine $25.67 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.95 (+5.11%), down 1.62% astatine $12.74 successful pre-market.

Core Scientific (CORZ): closed astatine $16.99 (+0.30%), down 1% astatine $16.82 successful pre-market.

CleanSpark (CLSK): closed astatine $14.97 (+7.47%), down 2.54% astatine $14.59 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $30.94 (+7.02%), down 0.94% astatine $30.65 successful pre-market.

Semler Scientific (SMLR): closed astatine $61.75 (+5.47%), down 1.31% astatine $60.94 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $376.6 million

Cumulative nett inflows: $33.4 billion

Total BTC holdings ~ 1.103 million.

Spot ETH ETFs

Daily nett inflow: $83.8 million

Cumulative nett inflows: $1.43 billion

Total ETH holdings ~ 3.280 million.

Source: <a href="https://farside.co.uk/" target="_blank">Farside Investors</a>

Overnight Flows

Chart of the Day

Google Trends, a wide utilized instrumentality to gauge wide oregon retail involvement successful trending topics, is returning a worth of implicit 70 for the worldwide hunt query "altcoins."

That's the highest retail capitalist involvement for much than 4 years.

While You Were Sleeping

<a href="https://www.coindesk.com/markets/2024/12/09/amazon-shareholders-push-for-minimum-5-bitcoin-allocation" target="_blank">Amazon Shareholders Push for Minimum 5% Bitcoin Allocation</a> (CoinDesk): Amazon shareholders are urging the institution to travel MicroStrategy and diversify its reserves into bitcoin to combat ostentation and heighten shareholder value. Proponents reason that adjacent a 5% allocation could output semipermanent benefits, due to the fact that bitcoin has importantly outperformed accepted assets similar golden and the S&P 500 this year.

<a href="https://www.cbsnews.com/news/crypto-spent-big-money-to-reshape-the-political-landscape-60-minutes-transcript/" target="_blank">Big Crypto Spent Big Money to Reshape the Political Landscape</a> (CBS News): In an occurrence of CBS News programme “60 Minutes” that aired connected Sunday, Ripple CEO Brad Garlinghouse said important fiscal contributions from crypto companies, including Ripple, importantly influenced cardinal Senate races successful Ohio, Michigan, and Arizona. Crypto firms contributed a 3rd of each nonstop firm donations to ace PACs, with 85% of the 29 Republicans and 33 Democrats they supported successful legislature races scoring victories.

<a href="https://www.coindesk.com/markets/2024/12/09/gauging-bitcoin-xrp-resistance-levels-after-record-price-rallies" target="_blank">Gauging Bitcoin, XRP Resistance Levels After Record Price Rallies</a> (CoinDesk): Bitcoin's options marketplace highlights $120,000 arsenic a imaginable resistance, with $1.93 cardinal successful unfastened interest, portion $200,000 calls clasp $500 million. XRP, trading adjacent $2.42, shows $2 cardinal successful unfastened involvement astatine the $2.8 onslaught and $1.12 cardinal astatine $5.

<a href="https://www.reuters.com/world/asia-pacific/south-korea-special-forces-officer-involved-martial-law-says-soldiers-were-2024-12-09/" target="_blank">South Korea Says Yoon Still Controls Military arsenic Leadership Crisis Deepens</a> (Reuters): South Korean President Yoon Suk Yeol faces a transgression probe and governmental situation aft a failed effort to enact martial law, sparking dissent among subject officers and his ain party. Despite surviving an impeachment ballot connected Saturday, Yoon's aboriginal remains uncertain arsenic absorption calls for his resignation and prosecution grow.

<a href="https://www.coindesk.com/tech/2024/12/09/radiant-capital-says-north-korean-hackers-behind-50-million-attack-in-october" target="_blank">Radiant Capital Says North Korean Hackers Behind $50 Million Attack successful October</a> (CoinDesk): Radiant Capital linked a $50 cardinal exploit successful October to a North Korean hacking radical called UNC4736. The attackers, posing arsenic a erstwhile contractor, deployed malware to entree backstage keys.

In the Ether

11 months ago

11 months ago

English (US)

English (US)