By James Van Straten (All times ET unless indicated otherwise)

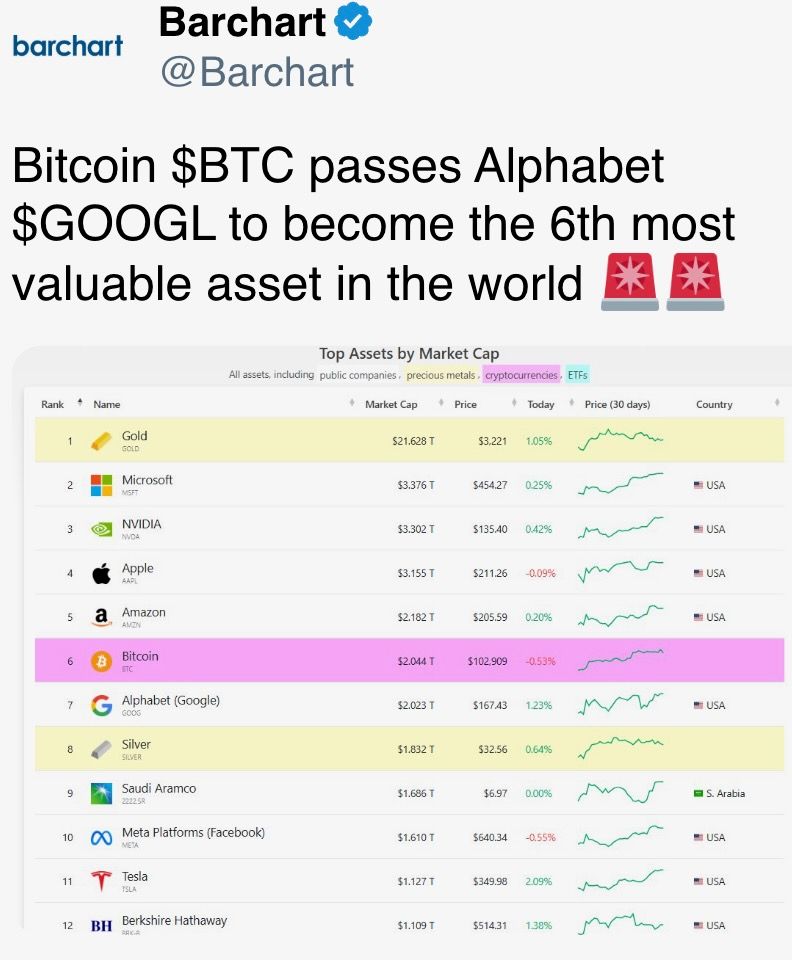

Bitcoin BTC started the week on a affirmative note, rising supra $107,000 — the highest since Jan. 24, according to CoinDesk information —before pulling backmost to $102,000 during the Asian morning.

Despite the retracement, the largest cryptocurrency continues to inclination upward, forming higher highs and higher lows wrong an ascending consolidation channel, portion its marketplace dominance roseate supra 64%.

There's a bullish bias successful the options market, too. Deribit data shows a dense attraction of telephone unfastened involvement supra $100,000, peculiarly astatine the $110,000, $115,000 and $120,000 onslaught prices for May 30, erstwhile $8 cardinal successful notional worth expires. Call options, which springiness holders the close to bargain BTC astatine a circumstantial price, are typically utilized to stake that the terms volition emergence to oregon supra that level.

Another motion of beardown request comes from Glassnode information showing wide accumulation crossed each wallet cohorts from holders of little than 1 BTC to implicit 10,000 BTC. The accumulation inclination people roseate to 0.87; the maximum worth is 1.

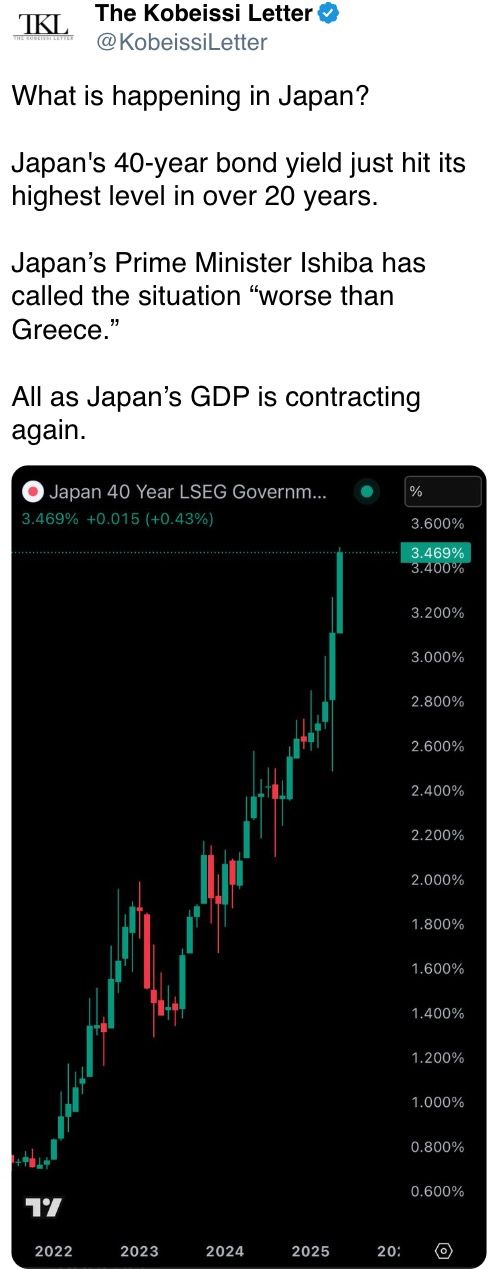

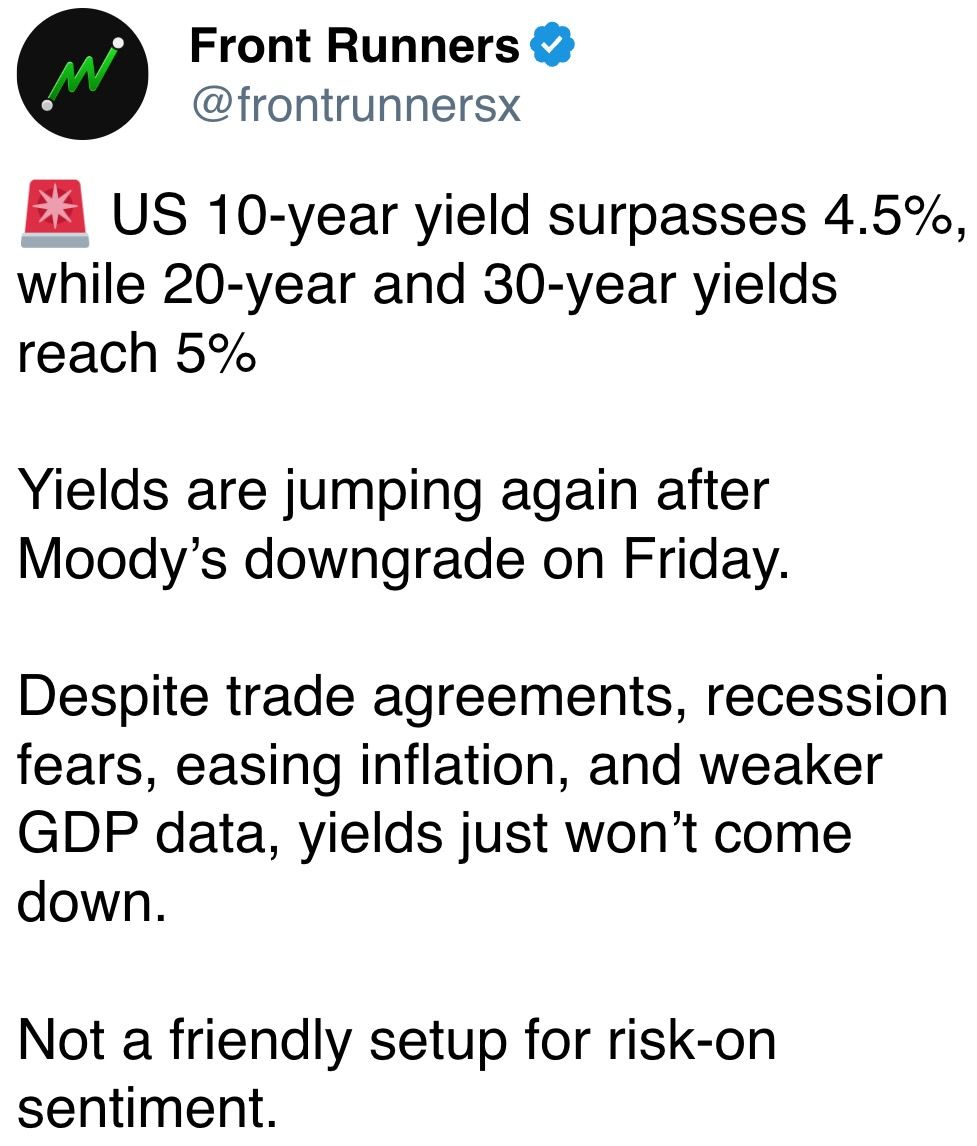

For a enactment of caution, instrumentality a look astatine the U.S. 30-year Treasury yield, which topped 5% arsenic Moody’s Ratings downgraded the indebtedness to Aa1 from Aaa, citing fiscal concerns successful the U.S. The past clip the output roseate that high, April 9, bitcoin dropped to a monthly debased of $75,000.

Meanwhile, the U.K. overtook China arsenic the second-largest holder of U.S. debt, and Tether’s U.S. Treasury holdings are poised to surpass Germany’s, perchance placing it among the apical 20 overseas holders. At a clip erstwhile the U.S. is actively seeking buyers for its bonds, nary whitethorn beryllium much captious than the issuer of the largest stablecoin. Stay alert!

What to Watch

- Crypto

- May 19: CME Group volition launch its cash-settled XRP futures.

- May 19: Coinbase Global (COIN) volition replace Discover Financial Services (DFS) successful the S&P 500, effectual earlier the opening of trading.

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders volition be a gala dinner hosted by President Trump astatine the Trump National Golf Club successful Washington.

- May 30: The second circular of FTX repayments starts.

- Macro

- May 19: U.K. Prime Minister Keir Starmer meets European Council President António Costa and European Commission President Ursula von der Leyen successful London for the archetypal post-Brexit U.K.-EU summit, which should effect successful the signing of a landmark defence and information pact and a associated connection pledging deeper economical cooperation.

- May 19, 10 a.m.: President Donald Trump is scheduled to call Russian President Vladimir Putin to sermon a imaginable ceasefire successful the Russia-Ukraine war. He volition past telephone Ukrainian President Volodymyr Zelenskyy and assorted members of NATO.

- May 20-22: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem volition co-host the three-day gathering of G7 concern ministers and cardinal slope governors successful Banff, Alberta.

- May 20, 8:30 a.m.: Statistics Canada releases April user terms ostentation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Est. 0.5% vs. Prev. 0.3%

- Inflation Rate YoY Est. 1.6% vs. Prev. 2.3%

- Earnings (Estimates based connected FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected launching “The Watchdog,” a 400,000-ARB bounty programme to reward assemblage sleuths for uncovering misuse of the hundreds of millions successful grants, incentives and work budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting connected a law AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto”, bringing them successful enactment with Ethereum’s May 7 Pectra upgrade. The connection schedules activation for June 17. Voting ends connected May 29.

- May 20, 12 p.m.: Lido to hist its 28th node relation assemblage call.

- May 21: Maple Finance teased an announcement connected the aboriginal of plus management.

- May 21, 6 p.m.: Theta Network to big an Ask Me Anything league in a livestream

- May 22: Official Trump to announce its “next Era” at the time of the meal for its largest holders.

- Unlocks

- May 19: Pyth Network (PYTH) to unlock 58.62% of its circulating proviso worthy $306.28 million.

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $21.6 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $161.9 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $14.31 million.

- Token Launches

- No large upcoming token listings.

Conferences

- Day 1 of 7: Dutch Blockchain Week (Amsterdam)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa

- Elon Musk revived his “Kekius Maximus” persona connected X implicit the weekend, sending an associated memecoin up much than 100% aft months of inactivity.

- Musk updated his illustration representation to a gladiator-style depiction of himself and changed his show name.

- The Ethereum-based KEKIUS surged arsenic followers noticed the change. Trading volumes for the token jumped to implicit $45 million, up from an mean of $5 cardinal successful the past week, CoinGecko information shows.

- The 'Kekius' sanction is linked to existing frog-themed coins similar pepe, featuring a frog dressed up arsenic a Roman gladiator.

- It stems from the "Cult of Kek," a tongue-in-cheek net improvement linking the word to an past Egyptian frog-headed deity of chaos and darkness.

- Ethereum-based PEPE, different frog-themed memecoin, surged 5%, with trading measurement astir tripling to $2.19 billion, making it the second-most traded memecoin aft dogecoin (DOGE).

- The archetypal Kekius Maximus rally occurred connected New Year’s Eve 2024, erstwhile Musk archetypal adopted the persona, sending the coin up 600% successful a fewer days.

- The coin mislaid each gains aft Musk dropped the avatar, but has since seen episodic spikes tied to his societal media activity, as successful March.

- The latest terms question underscores Musk’s continued outsized power connected speculative crypto markets, particularly meme tokens, and however monitoring his relationship mightiness unfastened up short-lived nett (albeit highly risky) opportunities for micro-cap traders.

Derivatives Positioning

- Total unfastened involvement (OI) crossed each instruments connected centralized exchanges remained comparatively unchangeable implicit the weekend, dipping somewhat to $150 billion.

- Among assets with implicit $100 cardinal successful unfastened interest, the biggest week-on-week gains were seen successful PAXG, PEPE, TON and ALCH.

- The largest declines were observed successful PNUT, POPCAT, BONK and SHIB.

- After sweeping cardinal liquidation clusters astatine $106.5K and $102.8K, bitcoin is present trading astir $103K.

- The adjacent important clump of liquidations connected the BTC-USDT brace connected Binance sits astatine $107.5K, representing immoderate $71.4 cardinal successful imaginable liquidations. On the downside, there's notable liquidation involvement worthy $52.7 cardinal astatine $102.2K — a level that acted arsenic enactment during today’s earlier reversal.

- Short-term hedging has intensified up of the May 23 and May 30 expiries, with puts dominating measurement (~$1.3B notional) and concentrated OTM exposure, signaling traders are bracing for near-term downside, according to information from Deribit.

- May 30 is the cardinal expiry to watch, holding the largest OI (~$8 billion) connected Deribit, skewed toward OTM calls and puts. This positioning suggests imaginable for crisp moves connected spot terms shifts astir cardinal onslaught levels.

Market Movements

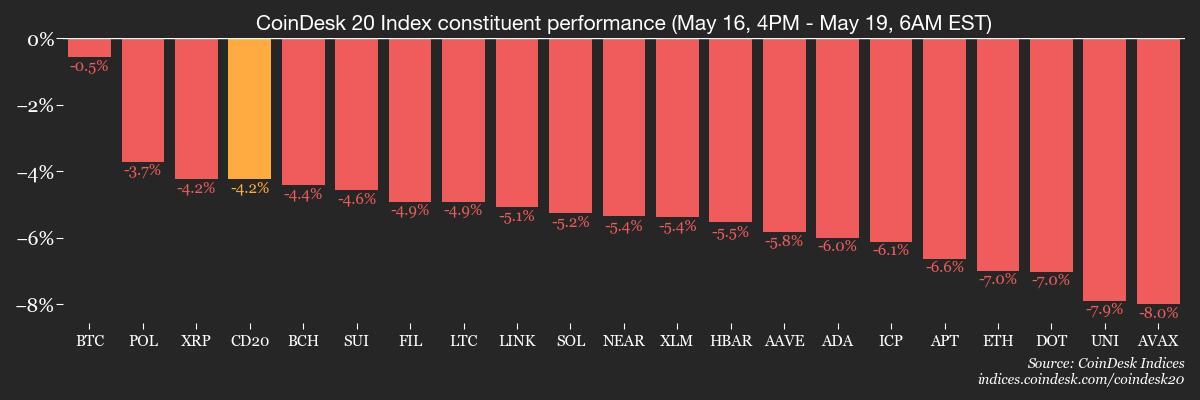

- BTC is down 0.78% from 4 p.m. ET Friday astatine $102,937.12 (24hrs: -0.74%)

- ETH is down 6.36% astatine $2,408.96 (24hrs: -3.89%)

- CoinDesk 20 is down 4.24% astatine 3,072.36 (24hrs: -3.33%)

- Ether CESR Composite Staking Rate is down 15 bps astatine 2.91%

- BTC backing complaint is astatine 0.0054% (5.9261% annualized) connected Binance

- DXY is down 0.97% astatine 100.11

- Gold is up 1.04% astatine $3,237.26/oz

- Silver is up 0.71%% astatine $32.50/oz

- Nikkei 225 closed -0.68% astatine 37,498.63

- Hang Seng closed unchanged astatine 23,332.72

- FTSE is down 0.78%% astatine 8,616.91

- Euro Stoxx 50 is down 0.77% astatine 5,385.80

- DJIA closed connected Friday +0.78% astatine 42,654.74

- S&P 500 closed +0.7% astatine 5,958.38

- Nasdaq closed +0.52% astatine 19,211.10

- S&P/TSX Composite Index closed +0.29% astatine 25,971.93

- S&P 40 Latin America closed -0.28% astatine 2,623.99

- U.S. 10-year Treasury complaint is up 7 bps astatine 4.55%

- E-mini S&P 500 futures are down 1.33% astatine 5,896.25

- E-mini Nasdaq-100 futures are down 1.72% astatine 21,135.25

- E-mini Dow Jones Industrial Average Index futures are down 0.84% astatine 42,375.00

Bitcoin Stats

- BTC Dominance: 64.01 (0.26%)

- Ethereum to bitcoin ratio: 0.02327 (-0.85%)

- Hashrate (seven-day moving average): 855 EH/s

- Hashprice (spot): $54.44

- Total Fees: 5.92 BTC / $617,813

- CME Futures Open Interest: 149,515 BTC

- BTC priced successful gold: 31.9 oz

- BTC vs golden marketplace cap: 9.03%

Technical Analysis

- After signaling the highest ever play close, bitcoin has retraced to the little extremity of its existent scope astatine $102,800.

- Last week, each dip beneath this level was met with beardown buying interest, highlighting continued demand.

- While the play adjacent signals bullish momentum, it's worthy noting that bitcoin has rallied from its April lows without a meaningful pullback, printing six consecutive greenish play candles.

- Should the scope lows break, a deeper determination toward the play bid artifact betwixt $94,000 and $99,000 becomes likely. This portion besides aligns with cardinal method confluences, including the 50-day exponential moving mean and the erstwhile monthly high.

- Today’s terms enactment is shaping a emblematic Monday scope setup, and a reclaim of Monday’s debased successful the coming days could service arsenic a catalyst for further upside.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $399.80 (+0.7%), down 1.32% astatine $394.52 successful pre-market

- Coinbase Global (COIN): closed astatine $266.46 (+9.01%), down 2.8% astatine $259

- Galaxy Digital Holdings (GLXY): closed astatine C$31.49 (+3.01%)

- MARA Holdings (MARA): closed astatine $16.21 (+3.38%), down 1.97% astatine $15.89

- Riot Platforms (RIOT): closed astatine $9.15(+5.17%), down 1.97% astatine $8.97

- Core Scientific (CORZ): closed astatine $10.78 (+2.57%), down 3.15% astatine $10.44

- CleanSpark (CLSK): closed astatine $9.78 (+4.49%), down 2.56% astatine $9.53

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18 (+8.63%)

- Semler Scientific (SMLR): closed astatine $40.88 (+28.59%), down 4.35% astatine $39.10

- Exodus Movement (EXOD): closed astatine $35.40 (-1.01%), down 1.13% astatine $35

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $260.2 million

- Cumulative nett flows: $41.74 billion

- Total BTC holdings ~ 1.18 million

Spot ETH ETFs

- Daily nett flow: $22.2 million

- Cumulative nett flows: $2.53 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

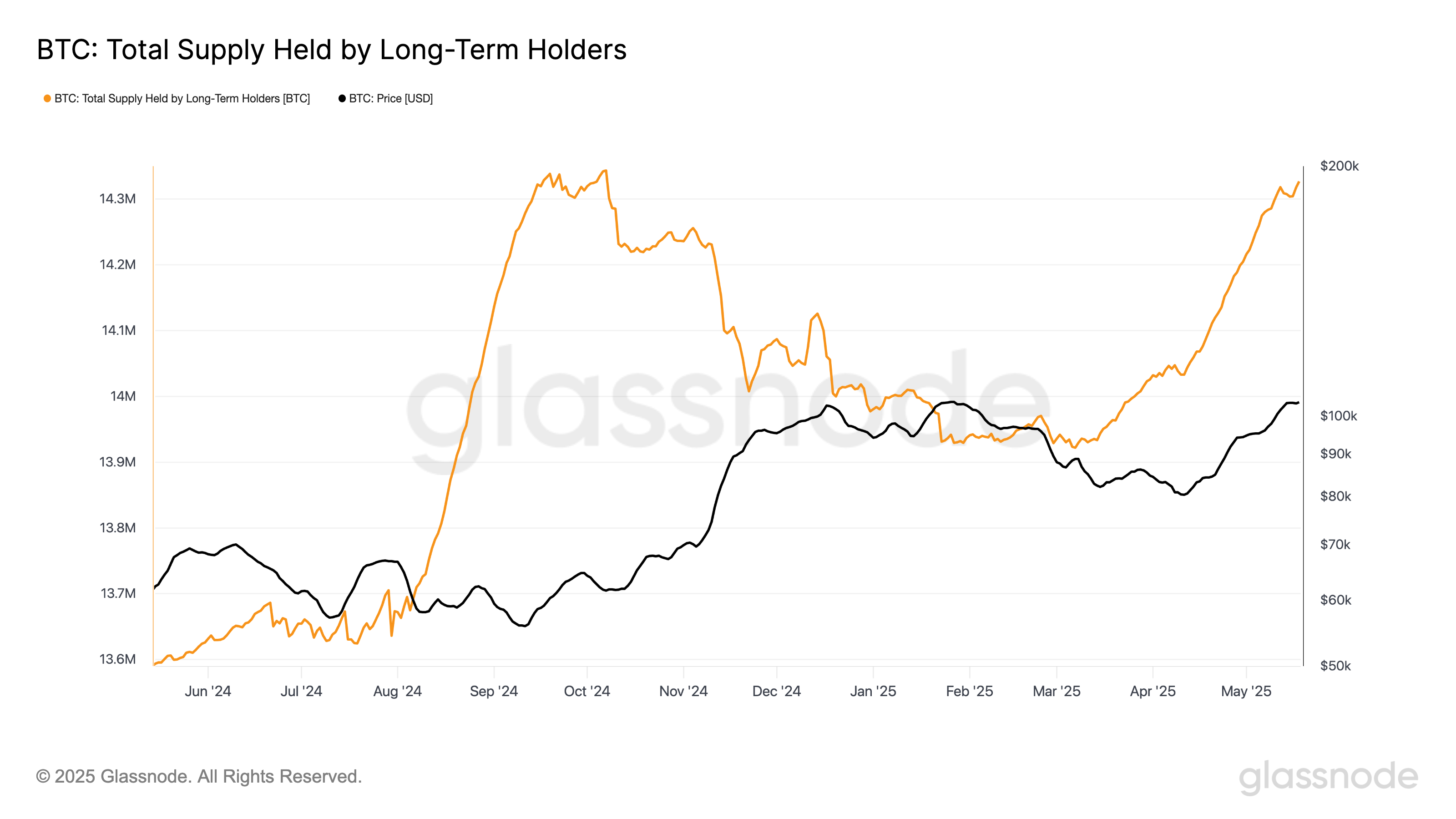

Chart of the Day

- Bitcoin semipermanent holder proviso is approaching a one-year precocious of 14,326,823 BTC.

- That's an summation of 400,000 BTC from this year’s lows arsenic semipermanent holders amusement increasing condemnation successful terms increases.

While You Were Sleeping

- ‘Sell America’ Is Back arsenic Moody’s Pushes 30-Year Yield to 5% (Bloomberg): Moody’s downgrade implicit America’s fund shortage sparked Max Gokhman’s informing that shifting from Treasuries could assistance yields and curb request for the dollar and U.S. stocks.

- China’s Economy Feels the Sting From Trade War (The Wall Street Journal): April information showed weakening concern output, spending and concern arsenic tariff uncertainty weighed connected maturation and analysts urged stronger stimulus to conscionable authoritative targets.

- The Bull Case for Galaxy Digital Is AI Data Centers Not Bitcoin Mining, Research Firm Says (CoinDesk): Rittenhouse analysts accidental AI data-center operations make stable, semipermanent currency flows with minimal superior needs, making them much charismatic than the volatile, capital-intensive concern of bitcoin mining.

- Russia Unleashes One of Its Largest Drone Barrages of the Ukraine War (The New York Times): Ukraine’s aerial defenses battled 273 drones implicit 9 hours, mostly adjacent Kyiv, wherever a pistillate was killed and respective others, including a child, were wounded.

- Metaplanet Buys Another 1,004 Bitcoin, Lifts Holdings to Over $800M Worth of BTC (CoinDesk): The Tokyo-based concern steadfast added to its bitcoin presumption astatine an mean terms of $103,873 per BTC.

- Ripple Signs Two More Payment System Customers successful UAE Expansion (CoinDesk): Ripple signed UAE-based Zand Bank and Mamo to its cross-border payments level aft securing a licence from the Dubai Financial Services Authority successful March.

In the Ether

5 months ago

5 months ago

English (US)

English (US)