By Omkar Godbole (All times ET unless indicated otherwise)

Crypto bulls are taking a breather, leaving bitcoin BTC successful stasis adjacent $103,000 up of the U.S. April ostentation data, owed astatine 8:30 a.m.

With U.S.-China commercialized tensions easing, markets are, for now, optimistic astir a softer-than-expected ostentation print, perchance stirring up calls for Fed interest-rate cuts.

This resulting risk-on sentiment could propulsion bitcoin to caller highs and accelerate the ongoing rotation of funds into alternate cryptocurrencies. The bitcoin dominance rate, oregon the largest cryptocurrency's stock of full crypto marketplace cap, has slipped 63% from 65%, indicating increasing involvement beyond bitcoin.

An important constituent to see amid each this is that bitcoin has led swings successful U.S. assets this year.

Notably, bitcoin peaked supra $109,000 successful January, weeks earlier the Nasdaq and dollar scale reached their tops and entered carnivore markets, pricing the economical interaction of rising commercialized tensions.

Similarly, BTC's aboriginal April bottommost astatine astir $75,000 happened weeks earlier the selling successful the dollar scale climaxed adjacent 92 successful precocious April. Since then, the scale has rebounded to 102, challenging its bearish trendline (see Technical Analysis).

This terms enactment raises a compelling question: Is bitcoin evolving to beryllium a starring indicator for U.S. assets, portion being portion of the U.S. exceptionalism story, arsenic CoinDesk noted successful March? If yes, past days of tracking Nasdaq for cues connected the adjacent imaginable determination successful BTC are past. Stay alert!

What to Watch

- Crypto:

- May 14: Neo (NEO) mainnet volition acquisition a hard fork web upgrade (version 3.8.0) astatine artifact tallness 7,300,000.

- May 14: Expected motorboat date for VanEck Onchain Economy ETF (ticker: NODE).

- May 16, 9:30 a.m.: Galaxy Digital Inc.’s Class A shares are set to statesman trading connected the Nasdaq nether the ticker awesome GLXY.

- May 19: CME Group is expected to launch its cash-settled XRP futures.

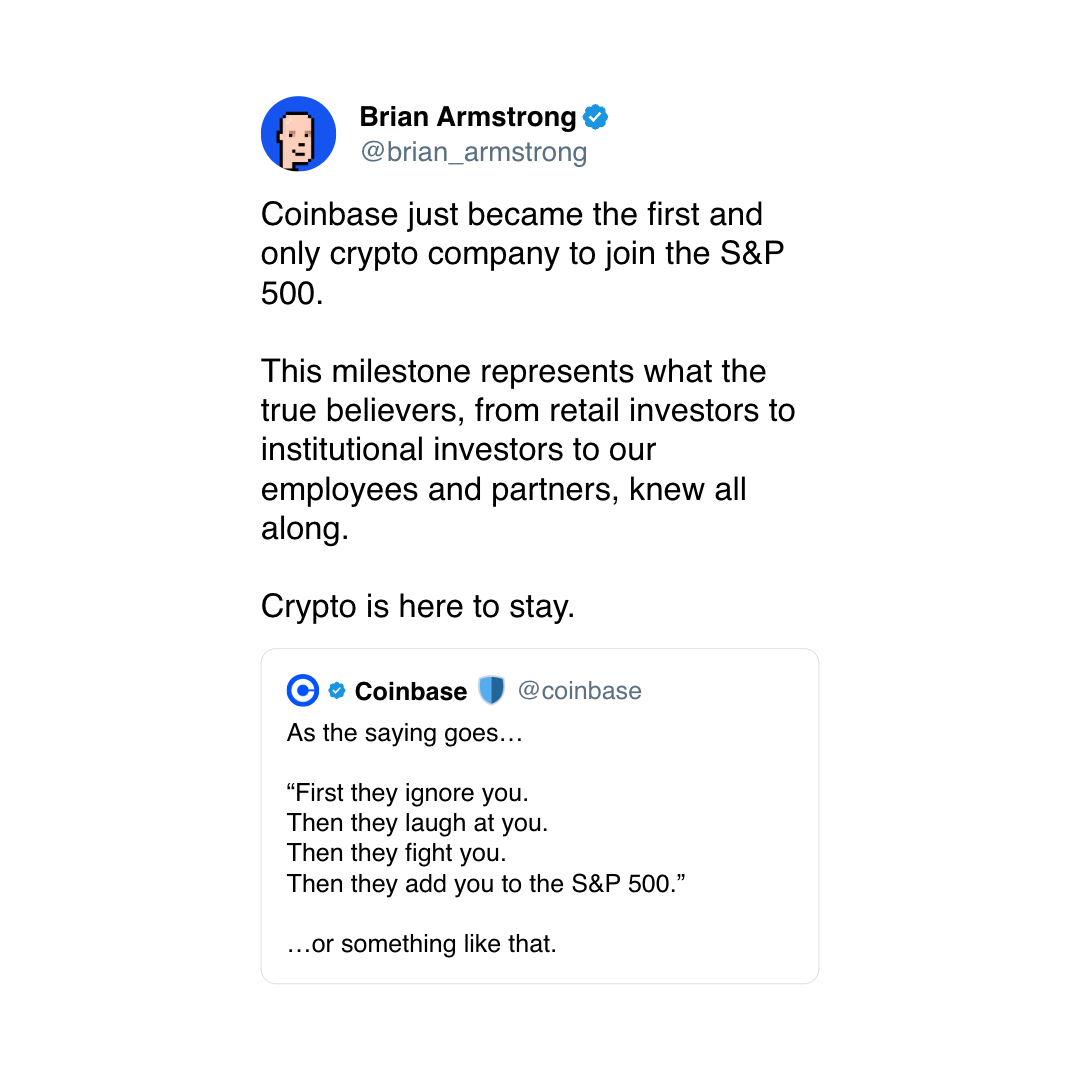

- May 19: Coinbase Global (COIN) volition replace Discover Financial Services (DFS) successful the S&P 500, effectual earlier the opening of trading.

- Macro

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.1%

- Core Inflation Rate YoY Est. 2.8% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.3% vs. Prev. -0.1%

- Inflation Rate YoY Est. 2.4% vs. Prev. 2.4%

- May 14, 3 p.m.: Argentina’s National Institute of Statistics and Census releases April ostentation data.

- Inflation Rate MoM Prev. 3.7%

- Inflation Rate YoY Prev. 55.9%

- May 15, 8 a.m.: The Brazilian Institute of Geography and Statistics releases March retail income data.

- Retail Sales MoM Prev. 0.5%

- Retail Sales YoY Prev. 1.5%

- May 15, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases April shaper terms ostentation data.

- Core PPI MoM Est. 0.3% vs. Prev. -0.1%

- Core PPI YoY Est. 3.1% vs. Prev. 3.3%

- PPI MoM Est. 0.2% vs. Prev. -0.4%

- PPI YoY Est. 2.5% vs. Prev. 2.7%

- May 15, 8:30 a.m.: The U.S. Census Bureau releases April retail income data.

- Retail Sales MoM Est. 0% vs. Prev. 1.5%

- Retail Sales YoY Prev. 4.9%

- May 15, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended May 10.

- Initial Jobless Claims Est. 230K vs. Prev. 228K

- May 15, 8:40 a.m.: Fed Chair Jerome H. Powell volition present a code ("Framework Review") successful Washington. Livestream link.

- May 13, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases April user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- May 13: Semler Scientific (SMLR), post-market

- May 14: Bitfarms (BITF), pre-market

- May 14: IREN (IREN), post-market

- May 15: Bit Digital (BTBT), post-market

- May 15: Bitdeer Technologies Group (BTDR), pre-market

- May 15: Fold Holdings (FLD), post-market

- May 15: KULR Technology Group (KULR), post-market

- May 28: NVIDIA (NVDA), post-market

Token Events

- Governance votes & calls

- May 15, 10 a.m.: Moca Network to big a Discord townhall league discussing web updates.

- Unlocks

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.2 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $23.87 million.

- May 15: Sei (SEI) to unlock 1.09% of its circulating proviso worthy $14.91 million.

- May 16: Arbitrum (ARB) to unlock 1.95% of its circulating proviso worthy $39.06 million.

- Token Launches

- May 13: LOFI (LOFI) to database connected Kraken.

- May 13: Cosmos Hub (ATOM) to database connected Bitbank.

- May 13: Redacted (RDAC) to database connected Binance Alpha.

- May 15: RIZE (RIZE) to database connected Kraken.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 2 of 2: Dubai Fintech Summit

- Day 2 of 2: Filecoin (FIL) Developer Summit (Toronto)

- Day 2 of 2: Latest successful DeFi Research (TLDR) Conference (New York)

- Day 2 of 2: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

- May 19-25: Dutch Blockchain Week (Amsterdam, Netherlands)

- May 20-22: Avalanche Summit London

- May 20-22: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw, Poland)

Token Talk

By Shaurya Malwa

- Over 11,700 tokens were launched connected LetsBONK.fun successful the past 24 hours, astir fractional the fig created connected Pump.fun during the aforesaid play — a motion of large idiosyncratic migration to the comparatively caller token-issuance level connected Solana.

- The level generated 5,884 SOL successful fees ($1.02 million) connected Monday, pushing full interest gross past 16,000 SOL ($2.78 million) since its precocious April launch, wide followed trader @theunipcs told CoinDesk successful a Telegram message.

- LetsBONK.fun present controls 31% of the Solana memecoin launchpad marketplace by volume, rapidly closing successful connected ascendant players contempt its comparative youth.

- The full fig of tokens created connected LetsBONK.fun present exceeds 38,000, with the bulk launched successful the past fewer days.

- Many of the platform’s competitory features and catalysts person yet to spell live, suggesting upside imaginable arsenic planned tools and gamification rotation out, @theunipcs pointed retired successful the X post.

- BONK prices are up much than 25% successful the past week arsenic LetsBONK's metrics contributed to the momentum.

Derivatives Positioning

- Open involvement successful bitcoin perpetual futures listed connected offshore exchanges dropped by $1 cardinal to $19 cardinal during the overnight BTC terms pullback, which indicates that the weakness was led by nett taking. Ether information shows the same.

- Funding rates successful BTC and ETH stay positive, indicating an wide bullish mood.

- BTC and ETH CME futures unfastened involvement successful coin presumption has jumped to the highest since aboriginal April, but the wide positioning remains airy and good beneath the highs seen successful December.

- On Deribit, BTC and ETH calls proceed to commercialized astatine premiums to puts crossed aggregate clip frames, reflecting a bullish bias.

- On over-the-counter level Paradigm, enactment flows person been mixed with telephone spreads lifted successful ETH alongside enactment spreads successful bitcoin.

Market Movements

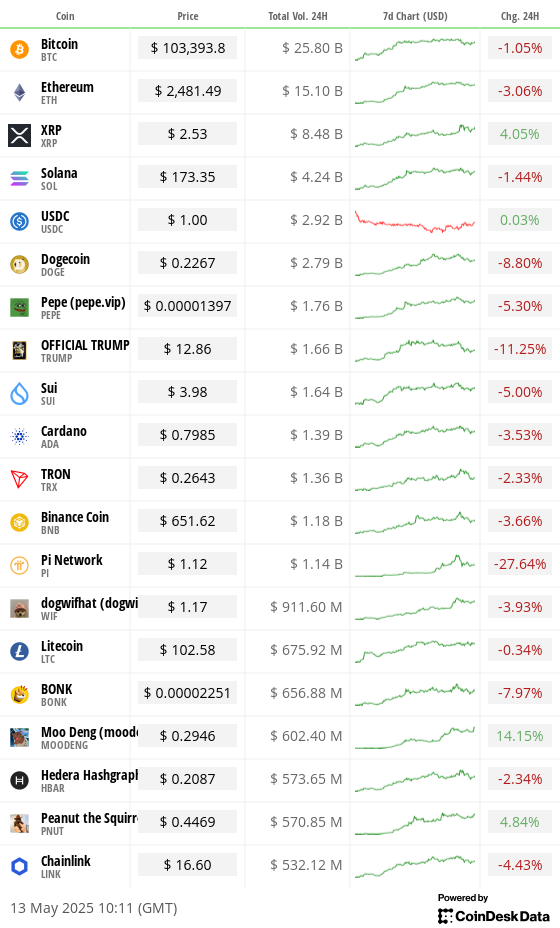

- BTC is up 1.58% from 4 p.m. ET Monday astatine $103,469.13 (24hrs: -0.97%)

- ETH is up 1.22% astatine $2,485.45 (24hrs: -2.9%)

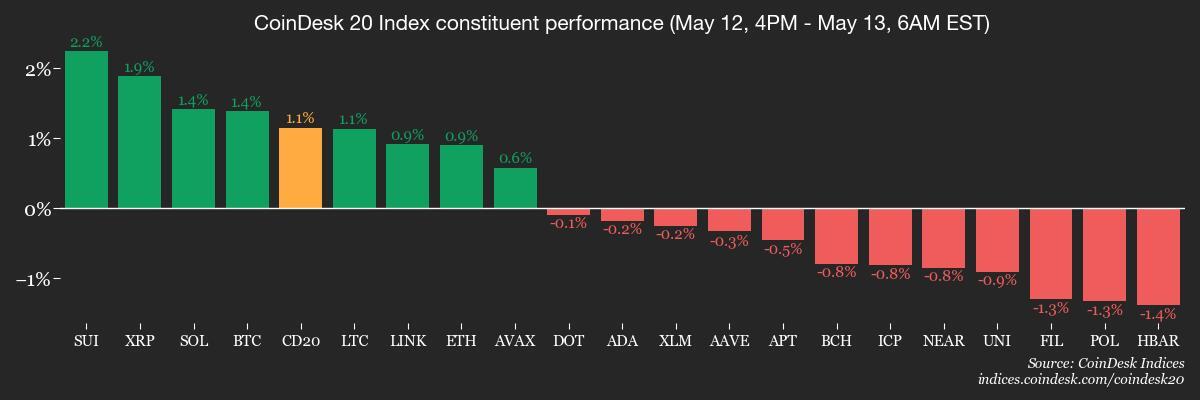

- CoinDesk 20 is up 1% astatine 3,244.61 (24hrs: -0.95%)

- Ether CESR Composite Staking Rate is down 7 bps astatine 3.17%

- BTC backing complaint is astatine 0.0057% (6.219% annualized) connected OKX

- DXY is down 0.22% astatine 101.56

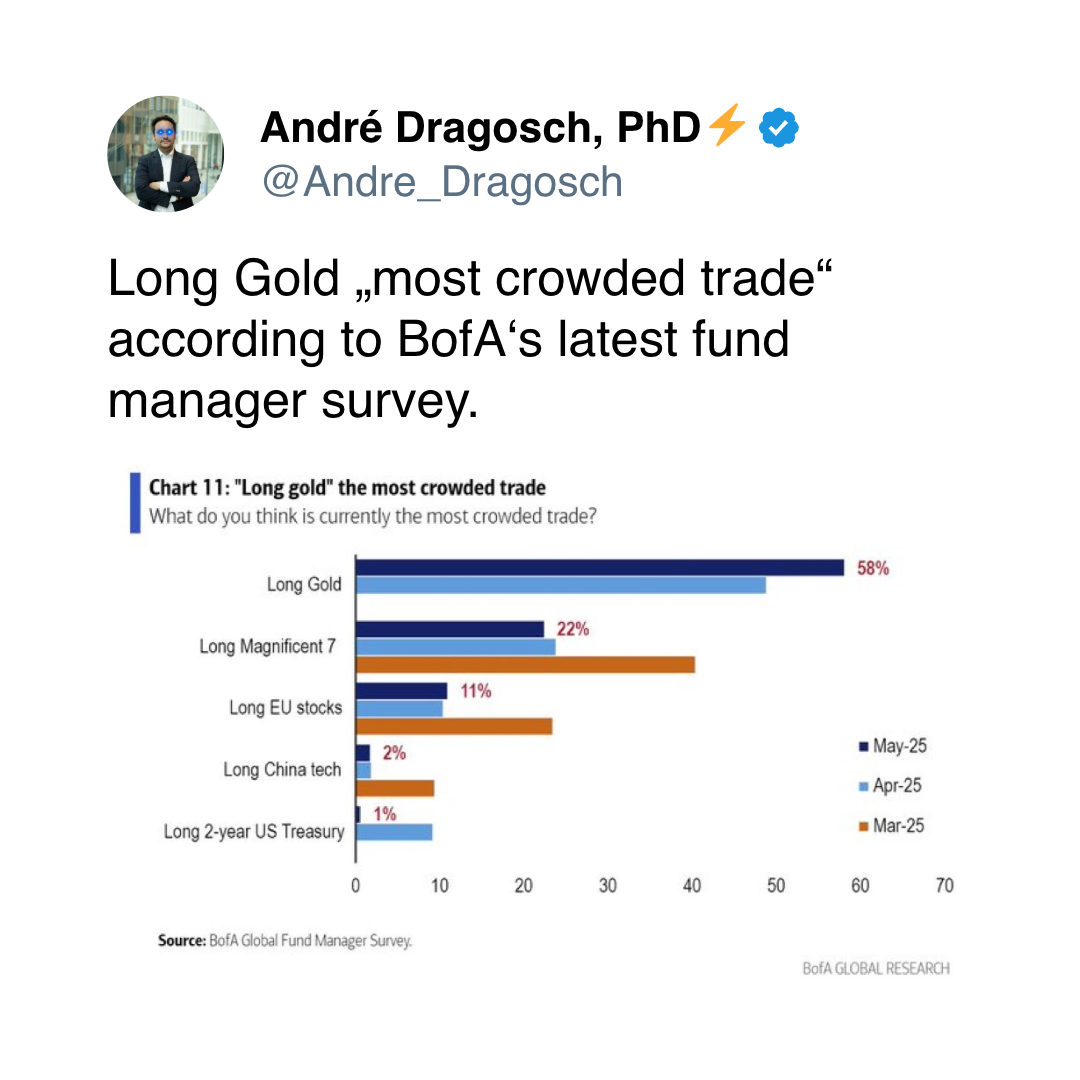

- Gold is up 3.22% astatine $3,251.80/oz

- Silver is up 1.85% astatine $33.03/oz

- Nikkei 225 closed +1.43% astatine 38,183.26

- Hang Seng closed -1.87% astatine 23,108.27

- FTSE is unchanged astatine 8,605.82

- Euro Stoxx 50 is unchanged astatine 5,394.23

- DJIA closed connected Monday +2.81% astatine 42,410.10

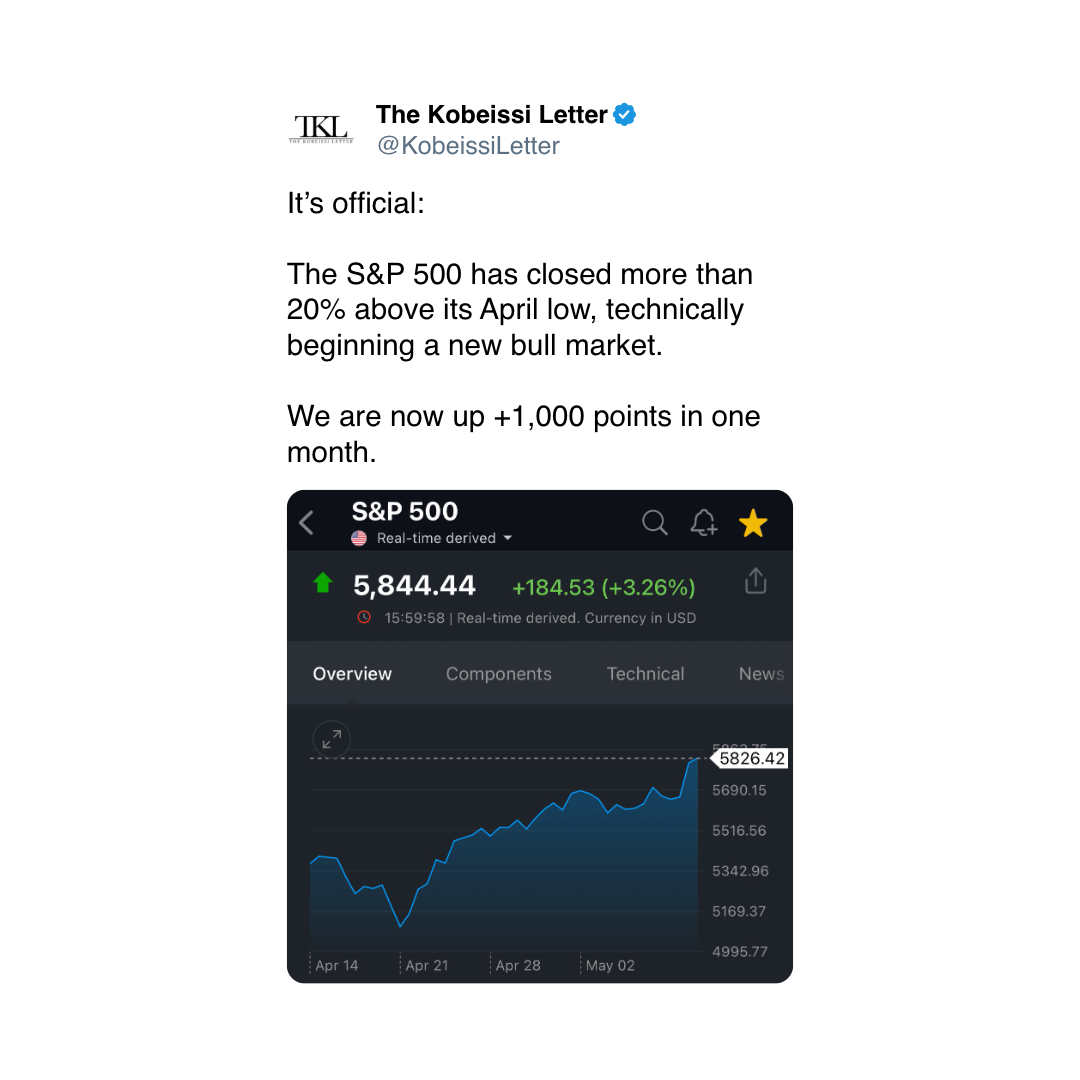

- S&P 500 closed +3.26% astatine 5,844.19

- Nasdaq closed +4.35% astatine 18,708.34

- S&P/TSX Composite Index closed +0.69% astatine 25,532.18

- S&P 40 Latin America closed unchanged astatine 2,578.53

- U.S. 10-year Treasury complaint is down 2 bps astatine 4.46%

- E-mini S&P 500 futures are down 0.31% astatine 5846.75

- E-mini Nasdaq-100 futures are down 0.41% astatine 20,862.75

- E-mini Dow Jones Industrial Average Index futures are down 0.11% astatine 42,445.00

Bitcoin Stats

- BTC Dominance: 62.95 (+0.51%)

- Ethereum to bitcoin ratio: 0.02394 (-1.36%)

- Hashrate (seven-day moving average): 875 EH/s

- Hashprice (spot): $56.15

- Total Fees: 12.946 BTC / $1.33 million

- CME Futures Open Interest: 146,020 BTC

- BTC priced successful gold: 31.7 oz

- BTC vs golden marketplace cap: 9.98%

Technical Analysis

- The dollar scale is probing the trendline that characterizes the sell-off from February highs.

- A breakout would corroborate the extremity of the downtrend, perchance drafting momentum traders to market.

Crypto Equities

Strategy (MSTR): closed connected Monday astatine $404.9 (-2.68%), up 1.07% astatine $409.22 successful pre-market

Coinbase Global (COIN): closed astatine $207.22 (+3.96%), up 9.55% astatine $226.88

Galaxy Digital Holdings (GLXY): closed astatine $28.39 (+6.37%)

MARA Holdings (MARA): closed astatine $15.95 (+1.21%), up 0.94% astatine $16.10

Riot Platforms (RIOT): closed astatine $8.7 (+2.59%), up 0.69% astatine $8.76

Core Scientific (CORZ): closed astatine $9.88 (+6.01%), up 1.92% astatine $10.07

CleanSpark (CLSK): closed astatine $9.62 (+4.57%), up 0.83% astatine $9.70

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $16.34 (+5.08%)

Semler Scientific (SMLR): closed astatine $34.84 (+0.14%), down 0.46% astatine $34.68

Exodus Movement (EXOD): closed astatine $54.3 (+8.32%), down 10.22% astatine $48.75

ETF Flows

Spot BTC ETFs:

- Daily nett flows: $5.2 cardinal

- Cumulative nett flows: $41.13 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flows: -$17.6 cardinal

- Cumulative nett flows: $2.47 billion

- Total ETH holdings ~ 3.45 million

Source: Farside Investors

Overnight Flows

Chart of the Day

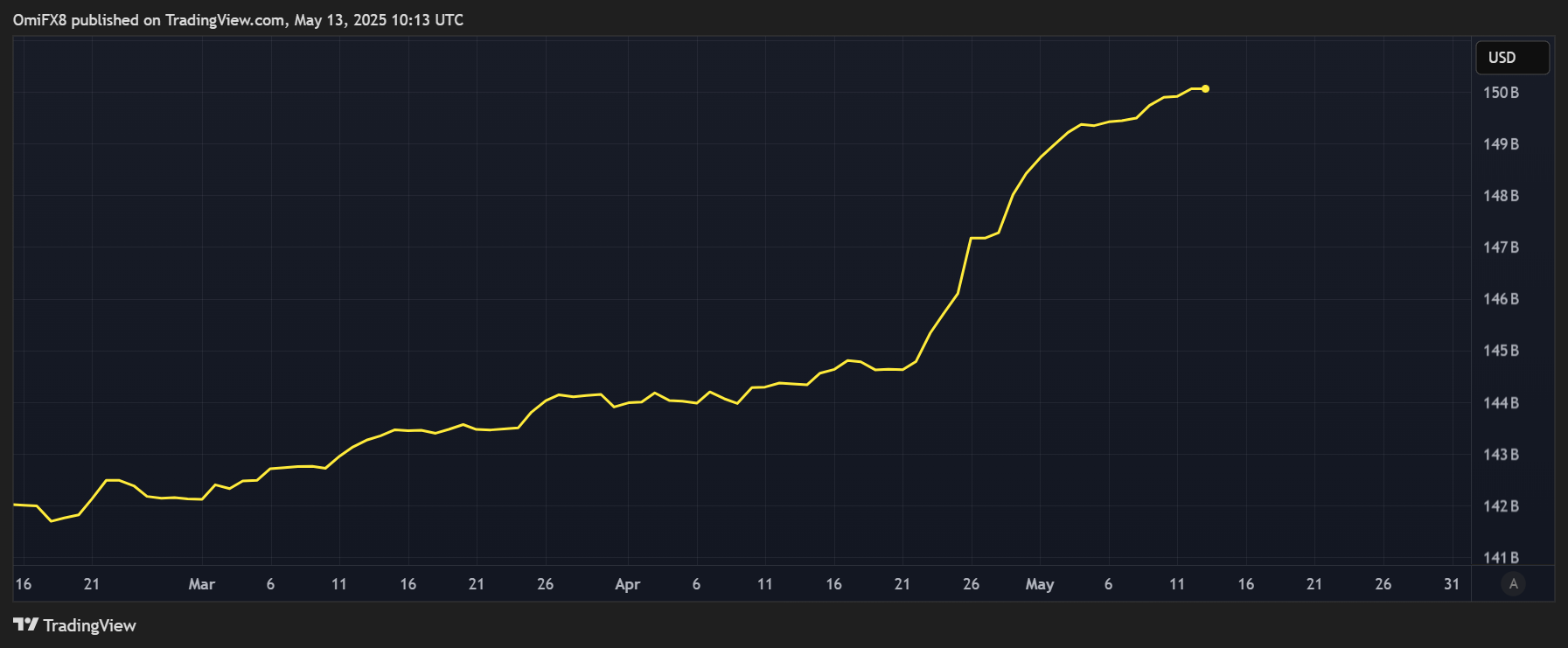

- The marketplace headdress of stablecoin tether (USDT) has deed a grounds precocious of $150 billion, climbing 4% successful little than a month.

- The ever-increasing proviso could support the marketplace good supported connected dips, if any.

While You Were Sleeping

- Bitcoin Crossing $2T successful Market Cap Triggers Wave of New Buyers, but Key Players Tread Cautiously, On-Chain Data Show (CoinDesk): While first-time buyers are showing beardown interest, momentum buyers stay weak, suggesting there's imaginable for terms consolidation.

- Hong Kong Crypto Investor Animoca Plans U.S. Listing arsenic Trump Lures More Groups (Financial Times): Animoca, which has backed OpenSea, Kraken and Consensys, sees the crypto-friendly U.S. regulatory authorities arsenic a accidental to prosecute a listing successful the country.

- Goldman Raises S&P 500 Targets connected Lower Tariff, Recession Risks (Bloomberg): Strategists raised their 12-month people for the S&P 500 scale to 6,500 from 6,200, citing easing recession and tariff risks. Higher duties could inactive erode firm margins, they said.

- Investment Banks Lift China Growth Outlook After Surprise Trade Deal With U.S. (CNBC): UBS raised its 2025 China maturation forecast to arsenic precocious arsenic 4% from 3.4%, portion Nomura upgraded Chinese equities and trimmed Indian vulnerability successful favour of China.

- EU Readies Capital Controls and Tariffs to Safeguard Russia Sanctions (Financial Times): Brussels is weighing alternate ineligible tools to renew sanctions connected Russia beyond July if Hungary follows done connected threats to veto an extension.

- Pump.fun Launches Revenue Sharing for Coin Creators successful Push to Incentivize Long-Term Activity (CoinDesk): Pump.fun launched a revenue-sharing exemplary that pays coin creators 5 ground points of trading volume, aiming to curb pump-and-dumps and reward credible developers with recurring income.

In the Ether

5 months ago

5 months ago

English (US)

English (US)