By Omkar Godbole (All times ET unless indicated otherwise)

Imagine you person a uncommon collectible. It's aged similar good wine, but lone shows the archetypal terms tag. That's however U.S. companies person been told to worth their bitcoin ... stuck successful the past alternatively of reflecting its existent worth. As of today, that changes.

Yes, contiguous is erstwhile the FASB just worth accounting rule, which passed successful 2023, takes effect, allowing companies to study their bitcoin holdings astatine just marketplace worth alternatively of the acquisition price. The alteration gives firms much power implicit however they classify these assets and whitethorn accelerate firm adoption. Note, though, the caller modular doesn’t use to NFTs, wrapped tokens oregon internally generated integer assets.

Alex Kuptsikevich, an expert astatine The FXPro, said, quoting a JPMorgan report, that publically traded companies person already begun implementing a MicroStrategy-like strategy to adhd BTC to their equilibrium sheets.

The regularisation alteration mightiness besides explicate wherefore BTC spiked supra $106,000 successful Asia, boosted further by President-elect Donald Trump's assurance to make a strategical BTC reserve and a abbreviated compression connected Deribit.

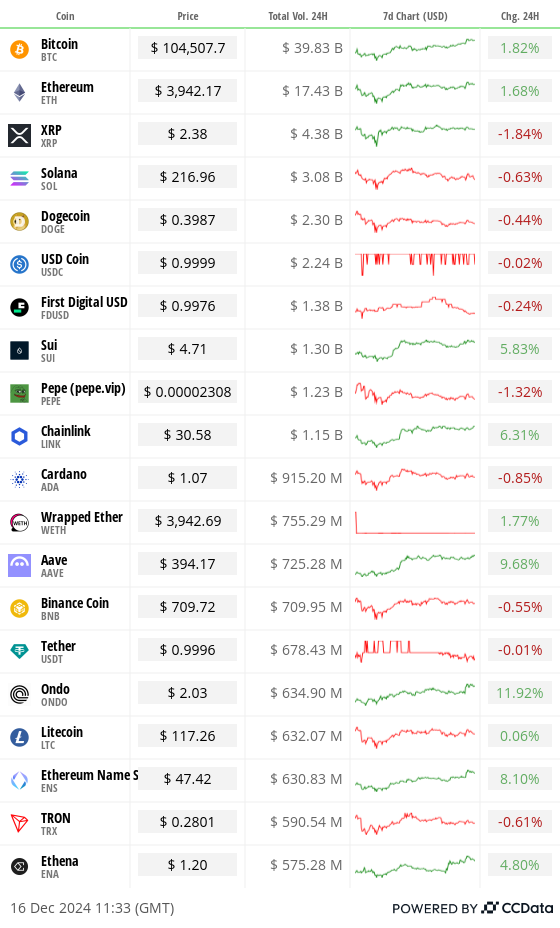

The terms has present pulled backmost to astir $104,500, astir apt owed to interest the Fed's overmuch anticipated complaint chopped this Wednesday volition travel with projections for less reductions adjacent year. BTC is trading astatine a discount connected Coinbase compared with Binance, a motion of weaker request successful the U.S., a CryptoQuant tracker shows.

Looking much broadly, ETH failed to found a foothold supra $4,000 amid reports of ample withdrawals of staked ether from Lido Finance. Payments-focused XRP traded much than 2% lower, weakening a bullish method pattern. Ripple CTO David Schwartz raised concerns astir FOMO-driven volatility earlier the debut of the company’s RLUSD stablecoin, which it plans to usage for cross-border payments alongside XRP. Early terms fluctuations and precocious pre-launch bids don’t rather bespeak the existent marketplace value, Schwartz said.

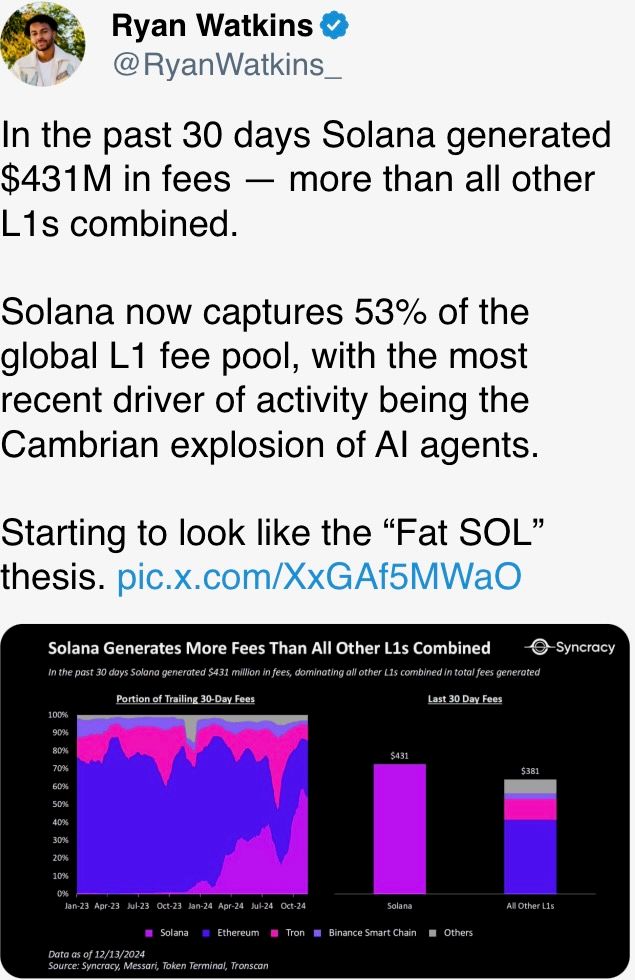

On a brighter note, Solana's industry-beating gross procreation has been grabbing eyeballs. Ryan Watkins, co-founder of Syncracy Capital, said: "Solana generated a staggering $431 cardinal successful fees implicit the past 30 days – much than each different Layer 1s combined!" Solana present captures 53% of the planetary furniture 1 interest pool, mostly driven by the surge successful AI activity. Still, the token dipped 3%, threatening to interruption beneath the 50-day SMA, a cardinal indicator for near-term marketplace trends.

Chainlink’s LINK defied the weakness successful large tokens, rising 4% acknowledgment to whale buying. Data from LookOnChain revealed that a whale withdrew 429,999 LINK, worthy implicit $12 million, implicit the weekend.

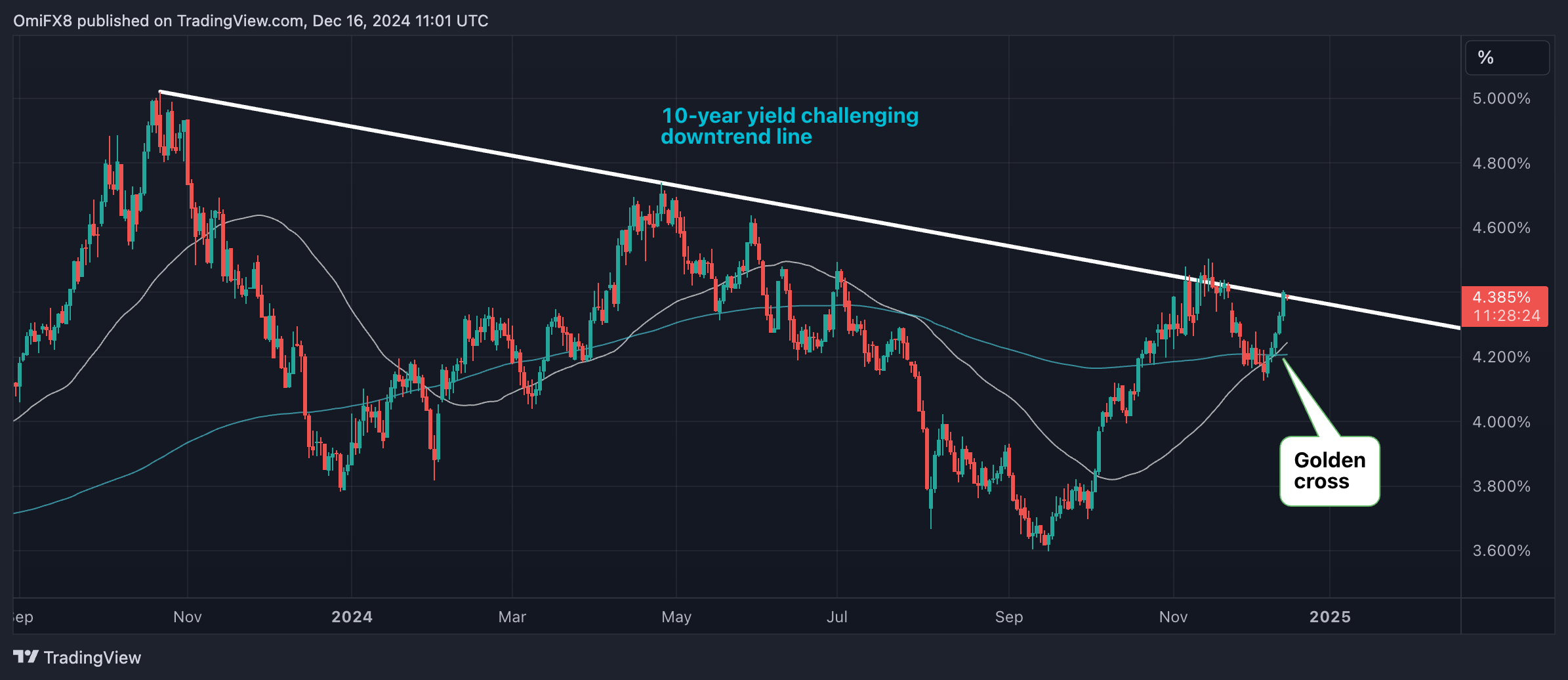

Lastly, successful accepted markets, the output connected the 10-year Treasury enactment looks to interruption retired of a prolonged downtrend arsenic observers expect a hawkish Fed complaint cut this week. This hardening of yields could inject volatility into hazard assets, including cryptocurrencies. So, enactment alert!

What to Watch

Crypto:

Dec. 18: CleanSpark (CLSK) Q4 FY 2024 earnings. EPS Est. $-0.18 vs Prev. $-1.02.

Macro

Dec. 16, 9:45 a.m.: December's S&P Global Flash US PMI information is released. Composite PMI Prev. 54.9.

Dec. 17, 8:30 a.m.: Statistics Canada releases November's Consumer Price Index (CPI) report.

Inflation Rate YoY Prev. 2%.

Core Inflation Rate Prev. 1.7%.

Dec. 18, 2:00 p.m.: The Federal Open Market Committee (FOMC) releases its fed funds people rate, presently 4.50%-4.75%. The CME's FedWatch instrumentality indicates that interest-rate traders delegate a 97.1% probability of a 25 basis-point cut. Press league starts astatine 2:30 p.m. Livestream link.

Dec. 18, 10:00 p.m.: The Bank of Japan (BoJ) announces its interest complaint decision. Short-term involvement complaint Est. 0.25% vs. Prev. 0.25%.

Dec. 19, 7:00 a.m.: The Monetary Policy Committee (MPC) of the Bank of England (BoE) announces its interest complaint decision. Bank Rate Est. 4.75% vs Prev. 4.75%.

Dec. 19, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases third-quarter GDP (final).

GDP Growth Rate QoQ Est. 2.8% vs Prev. 3.0%.

GDP Price Index QoQ Est. 1.9% vs Prev. 2.5%.

Dec. 20, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases November's Personal Income and Outlays report.

Personal Consumption Expenditure (PCE) Price Index YoY Prev. 2.3%.

Core PCE Price Index YoY 2.8%.

Dec. 24, 1:00 p.m. The Fed releases November’s H.6 (Money Stock Measures) report. Money Supply M2 Prev. $23.31T.

Token Events

Governance votes & calls

Avalanche’s (AVAX) Etna upgrade is scheduled to spell unrecorded connected Dec. 16 astatine 12 p.m. The upgrade aims to marque it cheaper to transact and tally validators connected the network

Arbitrum DAO is voting connected allocating 22 cardinal ARB ($22.8 million) to screen operating costs for OpCo, an entity it tin usage to make a much structured attack to governance. The ballot closes Dec. 19.

Livepeer (LPT) volition person an unfastened ecosystem telephone connected Dec. 17. Discussion volition revolve astir updates, products, and treasury

Synapse (SYN) DAO is voting connected allocating 50,000 OP tokens ($127,500) to found and incentivize liquidity connected Velodrome. It is targeting $3 cardinal to $5 cardinal successful TVL implicit a three-month period. The ballot concludes Dec. 16.

Unlocks

Cardano (ADA) volition unlock $19.75 cardinal worthy of tokens connected Dec. 16, representing 0.05% of circulating supply.

Arbitrum (ARB) volition unlock $94.05 cardinal worthy of tokens connected Dec. 16, representing 2.34% of circulating supply.

DYdX (DYDX) volition unlock $11.7 cardinal worthy of tokens connected Dec. 17, representing 0.57% of circulating supply.

Token Launches

Binance announced that information sovereignty level Vana (VANA) volition merchandise a token connected the launchpool. Trading starts Dec. 16.

Conferences:

Day 1 of 2: Blockchain Association’s Policy Summit (Washington D.C.)

Jan. 13-24: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Derivatives Positioning

The futures ground for BTC and ETH has climbed to levels we saw during the archetypal breakthrough of $100,000, making currency and transportation trades progressively attractive. Expect continued beardown inflows into the spot ETFs arsenic a result.

AAVE's perpetual unfastened involvement has accrued 7% successful 24 hours, the astir among large coins. The cumulative measurement delta (CVD), however, has declined, indicating nett selling unit successful the market.

Looking astatine BTC options expiries extending to Jan. 31, we’re seeing calls trading astatine little than a 2.5 volatility premium to puts, a diminution from past week's 4-5 premium. It seems traders aren't jumping connected the latest surge to grounds highs rather arsenic eagerly. It's akin successful ETH options.

Notable traders see a BTC bull telephone dispersed involving $115,000 and $125,000 strikes expiring Jan. 31 and a ample abbreviated presumption successful ETH $4,100 telephone expiring connected Dec. 20.

Market Movements:

BTC is up 3.4% from 4 p.m. ET Friday to $104,645.81 (24hrs: +2.33%)

ETH is up 1.38% astatine $3,951.85 (24hrs: +2.36%)

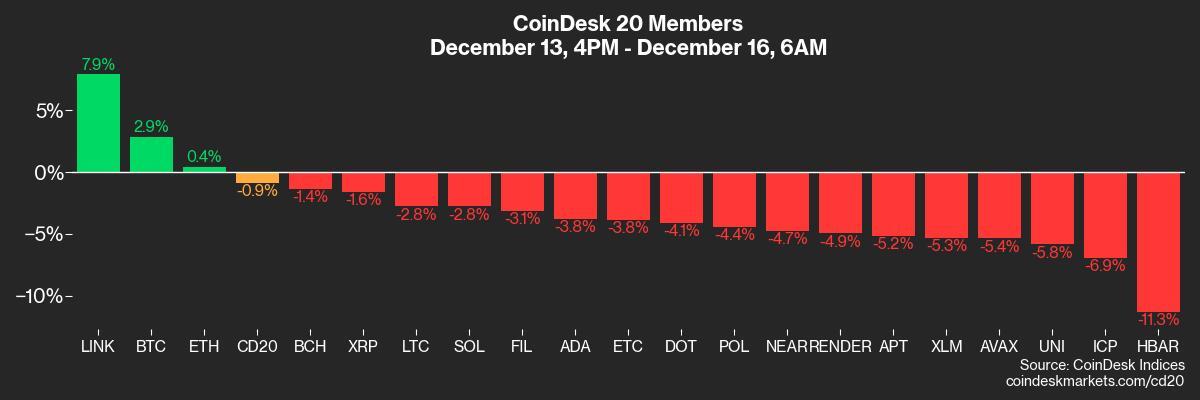

CoinDesk 20 is down 0.94% to 3,954.73 (24hrs: +0.27%)

Ether staking output is unchanged astatine 3.04%

BTC backing complaint is astatine 0.01% (10.95% annualized) connected Binance

DXY is unchanged astatine 107.00

Gold is up 0.83 astatine $2,678.00/oz

Silver is up 1.44% to $31.16/oz

Nikkei 225 closed unchanged astatine 39,457.49

Hang Seng closed -0.88% astatine 19,795.49

FTSE is down 0.41% astatine 4,947.81

Euro Stoxx 50 is up 0.4% astatine 4,897.96

DJIA closed connected Friday -0.17% to 43,828.06

S&P 500 closed unchanged astatine 6,051.09

Nasdaq closed +0.12% astatine 19,926.72

S&P/TSX Composite Index closed -0.54% astatine 25,274.30

S&P 40 Latin America closed -1.26% astatine 2,320.17

U.S. 10-year Treasury was unchanged astatine 4.38%

E-mini S&P 500 futures are up 0.19% to 6,067.00

E-mini Nasdaq-100 futures are up 0.29% to 21,859.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 43,901.00

Bitcoin Stats:

BTC Dominance: 57.50% (24hrs: +0.57%)

Ethereum to bitcoin ratio: 0.0377 (24hrs: -0.37%)

Hashrate (seven-day moving average): 796 eh/s

Hashprice (spot): $63.2

Total Fees: 9.6 BTC/ $980,000

CME Futures Open Interest: 200,830

BTC priced successful gold: 39.4oz

BTC vs golden marketplace cap: 11.24%

Bitcoin sitting successful over-the-counter table balances: 406,400 BTC

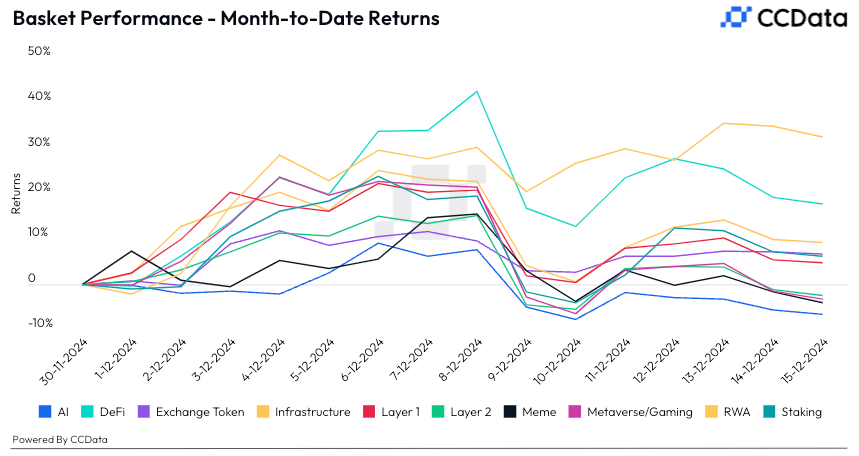

Basket Performance

Technical Analysis

The benchmark enslaved output looks acceptable to interruption done a trendline that represents a downtrend from October 2023 highs.

The aureate transverse of the 50- and 200-day SMAs suggests it mightiness conscionable do, suggesting pugnacious times for hazard assets.

Crypto Equities

MicroStrategy (MSTR): closed connected Friday astatine $408.67 (+4.2%), up 5.51% astatine $431.20 successful pre-market.

Coinbase Global (COIN): closed astatine $310.58 (-0.76%), up 2.2% astatine $317.46 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$28.96 (+5.5%)

MARA Holdings (MARA): closed astatine $22.73 (+0.66%), up 3.61% astatine $23.55 successful pre-market.

Riot Platforms (RIOT): closed astatine $12.99 (+5.35%), up 2.77% astatine $13.35 successful pre-market.

Core Scientific (CORZ): closed astatine $15.55 (+0.06%), up 2.06% astatine $15.87 successful pre-market.

CleanSpark (CLSK): closed astatine $12.02 (-2.51%), up 2.33% astatine $12.30 successful pre-market

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $27.36 (-1.79%), up 3.33% astatine $28.27 successful pre-market.

Semler Scientific (SMLR): closed astatine $67.17 (-6.5%), up 4.26% astatine $70.03 successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett inflow: $428.9 million

Cumulative nett inflows: $35.57 billion

Total BTC holdings ~ 1.131 million.

Spot ETH ETFs

Daily nett inflow: $23.6 million

Cumulative nett inflows: $2.26 billion

Total ETH holdings ~ 3.514 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

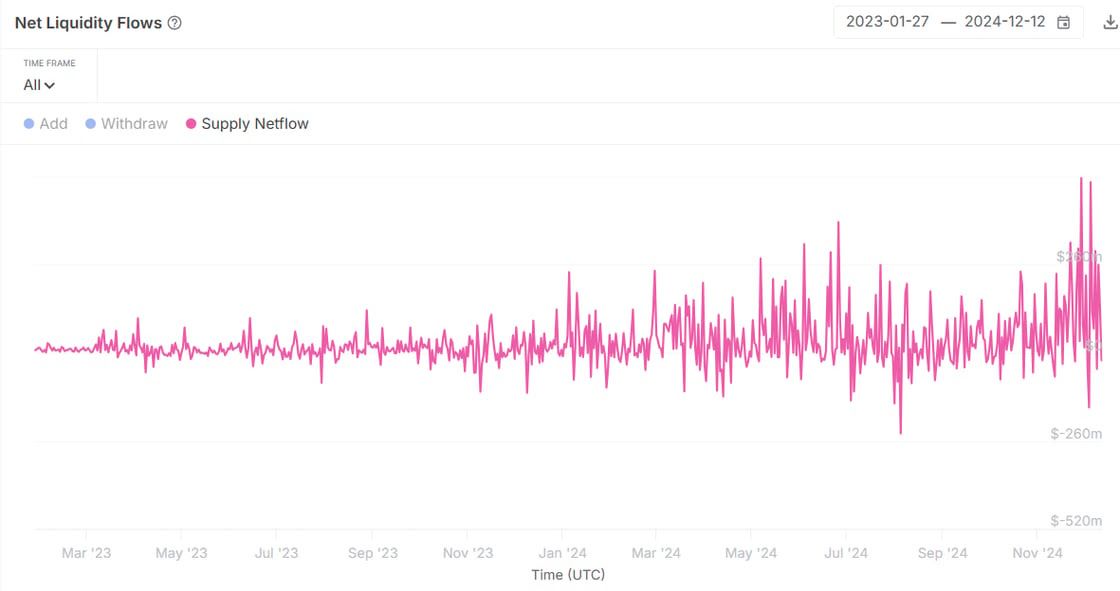

Decentralized lending elephantine AAVE's marketplace is connected occurrence arsenic nett inflows soared to an awesome $500 cardinal successful the past week.

This represents accrued risk-taking successful the crypto market.

While You Were Sleeping

Bitcoin Soars to Record High Above $106K, Then Retreats arsenic Hawkish Fed Rate Cut Looms (CoinDesk): Bitcoin surged to $106,000 arsenic traders anticipated a 25-basis-point Fed complaint chopped connected Wednesday contempt concerns astir a slower gait of easing successful 2025.

Bitcoin Traders Now Target $120K arsenic Bullish 'Santa Claus Rally' Gains Steam (CoinDesk): Traders spot bitcoin extending its upward trajectory toward the $120,000 level, powered by speculation astir a national bitcoin reserve, increasing organization involvement and seasonal patterns.

MicroStrategy to Enter Nasdaq 100, Exposing Bitcoin-Linked Stock to Billions successful Passive Investment Flows (CoinDesk): MicroStrategy (MSTR) volition articulation the Nasdaq 100 scale connected Dec. 23, making it a required holding for each ETFs tracking the index, specified arsenic Invesco’s $300 cardinal QQQ Trust.

China’s Key Bond Yield Hits Fresh Record Low arsenic Data Disappoints (Bloomberg): China’s 10-year sovereign output fell to 1.71% Monday arsenic anemic economical information fueled expectations of further stimulus, with analysts predicting imaginable complaint cuts by the People’s Bank of China to antagonistic deflation.

The Fed’s Game Plan connected Interest-Rate Cuts Keeps Shifting (The Wall Street Journal): Federal Reserve Chair Jerome Powell, needing to equilibrium ostentation concerns, labour marketplace signals and marketplace expectations, faces interior divisions up of a imaginable 3rd interest-rate chopped this week.

Yuan’s Fall Would Be a Gift to Bank of Japan (Reuters): Chinese leaders are considering weakening the yuan to offset imaginable U.S. tariffs, which could unit Asian currencies but assistance the Bank of Japan by supporting yen depreciation up of its Wednesday argumentation meeting.

In the Ether

10 months ago

10 months ago

English (US)

English (US)