By Omkar Godbole (All times ET unless indicated otherwise)

As bitcoin (BTC) and the wider crypto marketplace await the Fed's complaint decision connected Wednesday, an anomaly has emerged that could measurement heavy connected marketplace mood: renewed uncertainty implicit the passing of U.S. crypto regulation.

Early Tuesday, CoinDesk reported that Senate Democrats are hesitant to propulsion guardant landmark stablecoin legislation, citing concerns implicit President Donald Trump's increasing idiosyncratic gains from his crypto ventures.

When Trump took office, galore observers felt crypto regularisation would proceed smoothly. Looking back, that optimism was astir apt misplaced. With the president actively progressive successful integer assets done family-linked projects similar WLFI and memecoins, absorption has mounted, perchance slowing the regulatory progress.

That mightiness pb investors to reprice regulatory uncertainty conscionable arsenic charts for BTC and XRP are signaling pullback risks. Additionally, according to CryptoQuant, determination are signs of renewed weakness successful bitcoin request from U.S.-based investors.

"Over the past month, the premium recovered importantly but is present dropping again — aligning with the caller BTC terms correction," CryptoQuant contributor AbramChart said.

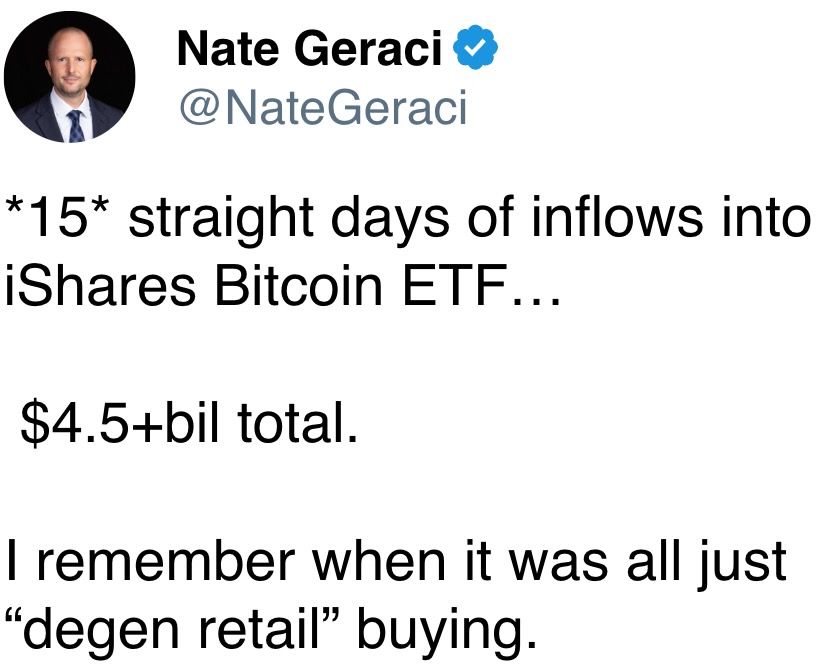

On the affirmative side, U.S.-listed spot bitcoin exchange-traded funds (ETFs) marked 3 consecutive days of nett inflows.

Acting CFTC Chairman Caroline Pham told crypto writer Eleanor Terret that the derivatives marketplace regulator plans to observe a fistful of tokenization aviator programs to measure the exertion and spot however good tokenized assets relation successful the existent satellite .

Speaking of accepted markets and macro, Taiwan dollar guardant contracts signal utmost pressure connected the U.S. dollar, meaning the greenback could proceed to weaken against the Asian currency and astir apt large currencies similar the euro. The broad-based USD weakness whitethorn enactment arsenic a tailwind for crypto. FX marketplace volatility could thrust investors to golden and possibly bitcoin, too, unless it leads to a broad-based risk-off, successful which lawsuit BTC whitethorn consciousness the heat.

The different bullish improvement is the U.S. Treasury Secretary Scott Bessent's comments that U.S. rates present transportation sovereign recognition hazard and not conscionable semipermanent maturation and ostentation expectations. In different words, rates are artificially precocious due to the fact that the U.S. authorities itself is present the hazard premium, arsenic pseudonymous perceiver EndGame Macro said. So, a displacement distant from U.S. assets and into alternate investments could continue. Stay alert!

What to Watch

- Crypto:

- May 6, 7:15 a.m.: Casper Network (CSPR) launches its 2.0 mainnet upgrade, introducing faster transactions, enhanced astute contracts, and improved staking features to boost endeavor adoption.

- May 7, 6:05 a.m.: The Pectra hard fork web upgrade volition get activated connected the Ethereum (ETH) mainnet astatine epoch 364032. Pectra combines 2 large components: the Prague execution furniture hard fork and the Electra statement furniture upgrade.

- May 8: Judge John G. Koeltl volition condemnation Alex Mashinsky, the laminitis and erstwhile CEO of the now-defunct crypto lending steadfast Celsius Network, astatine the U.S. District Court for the Southern District of New York.

- Macro

- May 6, 9 a.m.: S&P Global releases Brazil April purchasing managers’ scale (PMI) data.

- Composite PMI Prev. 52.6

- Services PMI Prev. 52.5

- May 6, 10 a.m.: U.S. House Financial Services Committee and Agriculture Committee joint hearing titled “American Innovation and the Future of Digital Assets: A Blueprint for the 21st Century.” Livestream link.

- May 7, 2 p.m.: The Federal Reserve announces its interest-rate decision. The FOMC property league is livestreamed 30 minutes later.

- Federal Funds Rate Target Range Est. 4.25%-4.5% vs. Prev. 4.25%-4.5%

- May 8, 7 a.m.: The Bank of England announces its interest-rate decision. The Monetary Policy Report Press Conference is livestreamed 30 minutes later.

- Bank Rate Est. 4.25% vs. Prev. 4.5%

- May 6, 9 a.m.: S&P Global releases Brazil April purchasing managers’ scale (PMI) data.

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Uniswap DAO is voting on whether to wage Forse, a data‑analytics level from StableLab, $60,000 successful UNI to physique an “analytics hub” that tracks however inducement programs are moving connected 4 much blockchains. Voting ends connected May 6.

- Arbitrum DAO is voting connected whether to enactment the last $10.7 million from its 35 million ARB diversification plan into 3 low‑risk, dollar‑based funds from WisdomTree, Spiko and Franklin Templeton. Voting ends connected May 8.

- May 6, 1:30 p.m.: MetaMask and Aave to big an X Spaces league on USDC supplied to Aave being spendable connected the MetaMask card.

- May 7, 7:30 a.m.: PancakeSwap to big an X Spaces Ask Me Anything (AMA) league on the aboriginal of trading.

- May 7, 9 a.m.: Binance to big an AMA connected its Binance Seeds program.

- May 7, 11 a.m.: Pendle to big a Pendle Yield Talk: Stablecoin Alpha X Spaces session.

- May 8, 10 a.m.: Balancer and Euler to big an Ask Me Anything (AMA) session.

- Unlocks

- May 7: Kaspa (KAS) to unlock 0.55% of its circulating proviso worthy $13.24 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $8.97 million.

- May 11: Solayer (LAYER) to unlock 12.87% of its circulating proviso worthy $55.93 million.

- May 12: Aptos (APT) to unlock 1.82% of its circulating proviso worthy $54.97 million.

- May 13: WhiteBIT Coin (WBT) to unlock 27.41% of its circulating proviso worthy $1.12 billion.

- May 15: Starknet (STRK) to unlock 4.09% of its circulating proviso worthy $16.34 million.

- Token Launches

- May 7: Obol (OBOL) to beryllium listed connected Binance, Bitget, Bybit, Gate.io, MEXC,and others.

- May 16: Galxe (GAL), Litentry (LIT), Mines of Dalarnia (DAR), Orion Protocol (ORN), and PARSIQ (PRQ) to beryllium delisted from Coinbase.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 1 of 2: Financial Times Digital Assets Summit (London)

- Day 1 of 3: Stripe Sessions (San Francisco)

- May 7-9: SALT’s Bermuda Digital Finance Forum 2025 (Hamilton, Bermuda)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

- May 14-16: CoinDesk's Consensus 2025 (Toronto)

Token Talk

By Shaurya Malwa

- Tokens of immoderate DeFi powerhouses are catching a bid arsenic attraction turns to fundamentals successful a level market.

- Hyperliquid's HYPE token surged 72% implicit the past week, outpacing astir of the apical 100 tokens. The platform's gas-free, bid book-based, decentralized exchange exemplary is attracting traders seeking businesslike and transparent trading environments.

- AAVE has seen accrued enactment with the integration of Ripple's RLUSD stablecoin into its V3 Ethereum Core Market. The determination aims to span accepted concern with DeFi, enhancing AAVE's entreaty to organization investors.

- Despite a caller information breach connected Curve Finance's X account, CRV managed to station a 40% summation successful the past week, demonstrating capitalist assurance successful the underlying protocol.

- Kay Lu, CEO of HashKey Eco Labs, said successful a enactment to CoinDesk that traders are turning to projects with stronger fundamentals and token economics arsenic memecoins autumn retired of favor.

Derivatives Positioning

- XMR, TAO, ADA pb majors successful 24-hour maturation of perpetual futures unfastened interest. XRP, meanwhile, has the astir antagonistic 24-hour cumulative measurement delta, hinting astatine an influx of selling pressure.

- BTC's backing complaint is hardly positive, portion ETH has flipped marginally negative, some pointing to weakening of bull momentum.

- CME futures ground climbed to betwixt 5% and 10%, reviving involvement successful cash-and-carry arbitrage trades, according to Binance Research.

- Flows successful the Deribit-listed options marketplace person been mixed with May BTC calls and puts lifted.

Market Movements

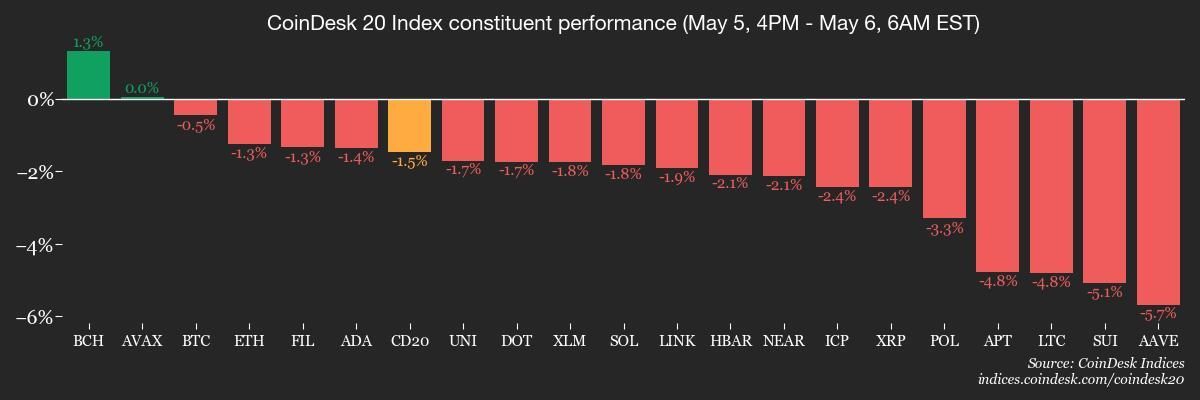

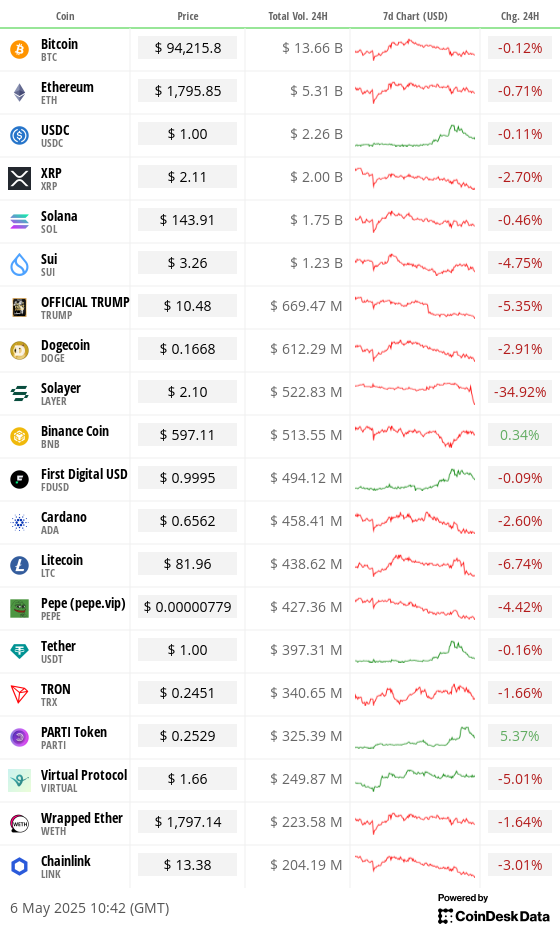

- BTC is down 0.19% from 4 p.m. ET Monday astatine $94,160 (24hrs: -0.18%)

- ETH is down 1.09% astatine $1,795.10 (24hrs: -0.66%)

- CoinDesk 20 is down 1.05% astatine 2,675.34 (24hrs: -0.96%)

- Ether CESR Composite Staking Rate is up 7 bps astatine 2.964%

- BTC backing complaint is astatine 0.0046% (5.1147% annualized) connected Binance

- DXY is down 0.14% astatine 99.69

- Gold is up 1.99% astatine $3,379.76/oz

- Silver is up 2.13% astatine $32.99/oz

- Nikkei 225 closed +1.04% astatine 36,830.69

- Hang Seng closed +0.7% astatine 22,662.71

- FTSE is down 0.18% astatine 8,580.67

- Euro Stoxx 50 is down 1.14% astatine 4,719.66

- DJIA closed connected Monday -0.24% astatine 41,218.83

- S&P 500 closed -0.64% astatine 5,650.38

- Nasdaq closed -0.74% astatine 17,844.24

- S&P/TSX Composite Index closed -0.31% astatine 24,953.52

- S&P 40 Latin America closed -1.15% astatine 2,493.86

- U.S. 10-year Treasury complaint is up 1 bp astatine 4.36%

- E-mini S&P 500 futures are down 0.74% astatine 5,629.75

- E-mini Nasdaq-100 futures are down 1.05% astatine 19,845.50

- E-mini Dow Jones Industrial Average Index futures are down 0.61% astatine 41,067.00

Bitcoin Stats

- BTC Dominance: 64.91 (0.13%)

- Ethereum to bitcoin ratio: 0.01910 (-0.52%)

- Hashrate (seven-day moving average): 908 EH/s

- Hashprice (spot): $50.13

- Total Fees: 5.10 BTC / $480,379.20

- CME Futures Open Interest: 143,680 BTC

- BTC priced successful gold: 28.1 oz

- BTC vs golden marketplace cap: 7.97%

Technical Analysis

- VIRTUAL, the autochthonal token of the Base-native Virtuals Protocol for creating and owning AI agents, has established a basal supra the 23.6% Fibonacci retracement of the January-April sell-off.

- The breakout means imaginable for a rally to the 38.2% Fibonacci level of $2.22.

- VIRTUAL is the best-performing coin of the past 30 days.

Crypto Equities

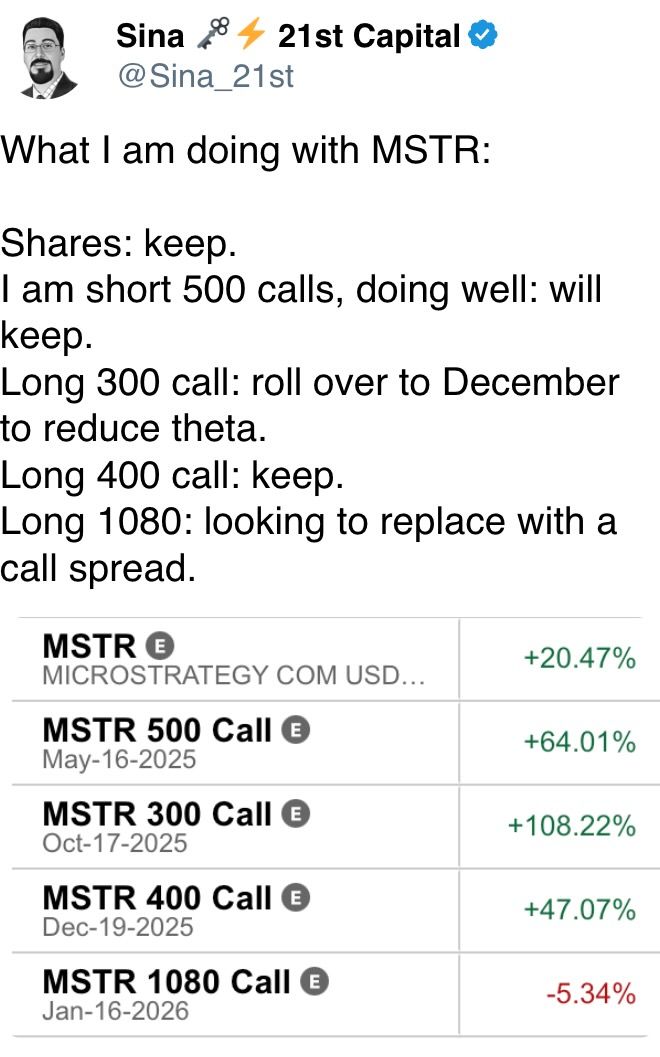

- Strategy (MSTR): closed connected Monday astatine $386.53 (-1.99%), down 1.25% astatine $381.68 successful pre-market

- Coinbase Global (COIN): closed astatine $199.40 (-2.7%), down 0.63% astatine $198.15

- Galaxy Digital Holdings (GLXY): closed astatine C$26.51 (-1.23%)

- MARA Holdings (MARA): closed astatine $13.09 (-9.6%), down 1.22% astatine $12.93

- Riot Platforms (RIOT): closed astatine $7.90 (-5.84%), down 1.27% astatine $7.80

- Core Scientific (CORZ): closed astatine $8.75 (+0.11%)

- CleanSpark (CLSK): closed astatine $8.09 (-8.17%), down 0.62% astatine $8.04

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.26 (-4.74%)

- Semler Scientific (SMLR): closed astatine $33.58 (-7.13%), down 0.24% astatine $33.50

- Exodus Movement (EXOD): closed astatine $41.28 (-7.84%), up 0.51% astatine $41.49

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $425.5 million

- Cumulative nett flows: $40.63 billion

- Total BTC holdings ~ 1.17 million

Spot ETH ETFs

- Daily nett flow: $0 million

- Cumulative nett flows: $2.53 billion

- Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Bitcoin's 30-day implied volatility has dropped to the lowest since July past year.

- In different words, volatility is cheap, which is erstwhile seasoned traders typically similar to bargain options.

While You Were Sleeping

- BlackRock, Citi CEOs to Visit Saudi Arabia Along With Trump (Bloomberg): Several apical U.S. CEOs volition talk May 13 astatine the Saudi-U.S. Investment Forum successful Riyadh, the time President Donald Trump arrives to question different $1 trillion successful Saudi commercialized and investment.

- Bitcoin Developers Plan OP_RETURN Limit Removal successful Next Release (CoinDesk): Bitcoin Core’s program to assistance the headdress has divided developers, with supporters citing cleaner UTXO handling and critics informing of spam risks and a displacement distant from fiscal use.

- Watch Out Bitcoin Bulls, $99.9K Price May Test Your Mettle (CoinDesk): Long-term BTC holders whitethorn instrumentality profits astatine $99,900, aligning with their humanities behaviour of selling astatine 350% insubstantial gains, according to on-chain information from Glassnode.

- VIRTUAL Surges 200% successful a Month arsenic Smart Money Pours Into Virtuals Protocol (CoinDesk): The autochthonal token of the Base-powered decentralized AI cause level has surged 207% successful the past month, helped by $14.2 cardinal successful inflows from astute money, according to Nansen.

- Ukraine Targets Moscow With Drones for Second Straight Night, Officials Say (Reuters): All 4 Moscow airports were unopen for respective hours aft Russian forces intercepted 19 drones days earlier the city’s planned World War II triumph day celebrations.

- Fed Confronts Lose-Lose Scenario Amid Haphazard Tariff Rollout (The Wall Street Journal): Fed officials are expected to hold complaint cuts, fearing premature moves could intensify ostentation driven by Trump’s tariffs and strained planetary proviso chains.

In the Ether

6 months ago

6 months ago

English (US)

English (US)