By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace remains directionless, with bitcoin (BTC) languishing beneath $100,000 earlier the U.S. jobs report. It's astonishing prices person not yet crossed that threshold, particularly aft President Donald Trump's son, Eric, encouraged the family-linked WLFI to put successful BTC successful a station connected X connected Thursday.

Typically, specified endorsements during a bull tally pb to important gains. That that hasn't materialized is simply a motion markets are nary longer buoyed by speech unsocial and Trump needs to locomotion the walk. Early this week, the medication said it's evaluating the feasibility of a strategical BTC reserve.

Another anticipation is that caution up of nonfarm payrolls is capping the upside. If that's the case, a breakout whitethorn hap erstwhile the information is out, particularly if the fig prints weaker than estimated, perchance driving Treasury yields and the dollar scale lower.

Crypto newsletter work LondonCryptoClub recommends keeping an oculus connected revisions successful the erstwhile figures. "Bloomberg Intelligence expecting immoderate ample downside revisions suggesting the Labour marketplace not arsenic beardown successful 2024 arsenic archetypal appeared We inactive deliberation the marketplace (and the Fed themselves) are massively nether pricing the complaint cuts that volition request to come," the newsletter service's founders said connected X.

At property time, Volmex's one-day bitcoin implied volatility scale stood astatine an annualized 51%, suggesting a regular terms plaything of 2.6%, oregon astir $2,600. In different words, the fig could determination the spot terms by $2,600 successful either direction. Notably, immoderate traders are buying enactment options, bracing for imaginable downside volatility should the information travel successful strong.

In different news, the "Strategic Bitcoin Reserve" measure passed the House successful the authorities of Utah and volition present determination to the Senate. Bloomberg ETF expert James Seyffart reported that the U.S. SEC has acknowledged Grayscale's Solana 19b-4 filing. And VanEck predicted a $500 terms for SOL, much than treble its existent worth of astir $180.

Additionally, FOX newsman Eleanor Terrett shared that U.S. House Financial Services Committee Chairman French Hill and Digital Assets Subcommittee Chairman Bryan Steil person released a stablecoin regularisation treatment draft, which proposes a two-year prohibition connected stablecoins backed solely by self-issued integer assets and mandates a Treasury survey connected their risks.

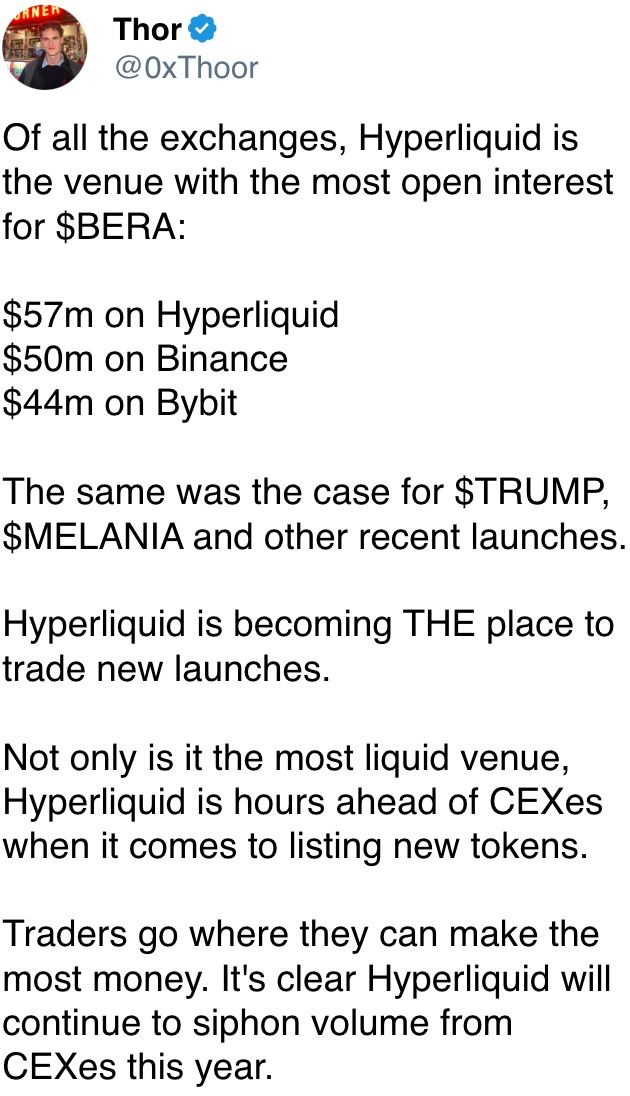

And finally, Berachain's BERA token, which debuted yesterday, has already recorded a staggering perpetual trading measurement of $4.8 billion, with its terms presently sitting astatine $7.60, a important driblet from yesterday's highest of $14. Stay alert!

What to Watch

Crypto:

Feb. 13: Start of Kraken's gradual delisting of the USDT, PYUSD, EURT, TUSD, UST stablecoins for EEA clients. The process ends March. 31.

Feb. 18, 10:00 a.m.: FTX Digital Markets, the Bahamas-based subsidiary of FTX, will commencement reimbursing creditors.

Macro

Feb. 7, 8:30 a.m.: U.S. Bureau of Labor Statistics (BLS) releases January’s Employment Situation report.

Non Farm Payrolls Est. 170K vs. Prev. 256K

Unemployment Rate Est. 4.1% vs. Prev. 4.1%

Feb. 8, 8:30 p.m.: China’s National Bureau of Statistics (NBS) releases January’s Consumer Price Index (CPI) report.

Inflation Rate MoM Prev. 0%

Inflation Rate YoY Prev. 0.1%

PPI YoY Prev. -2.3%

Earnings

Feb. 10: Canaan (CAN), pre-market, $-0.08

Feb. 11: HIVE Digital Technologies (HIVE), post-market, $-0.11

Feb. 11: Exodus Movement (EXOD), post-market, $0.14 (2 ests.)

Feb. 12: Hut 8 (HUT), pre-market, $0.04

Feb. 12: IREN (IREN), post-market, $-0.01

Feb. 12 (TBA): Metaplanet (TYO:3350)

Feb. 12: Reddit (RDDT), post-market, $0.25

Feb. 12: Robinhood Markets (HOOD), post-market, $0.41

Feb. 13: Coinbase Global (COIN), post-market, $1.61

Token Events

Governance votes & calls

OsmosisDAO is discussing a alteration to the usage of taker fees collected successful OSMO to pain 50% of collected fees.

Threshold DAO is discussing the instauration of a enslaved programme to code its stablecoin’s liquidity challenges.

Sky DAO is voting connected an an enforcement connection to little savings rates, expanse implicit 400K DAI successful PauseProxy into the Surplus Buffer and allocate 3 cardinal DAI for integration boost funding, among different things.

Yearn DAO is discussing the elimination of the Protocol Guardian Role implicit concerns surrounding its usage to override erstwhile antiauthoritarian decisions and imaginable ineligible risks.

Feb. 7, 1 p.m.: Sweat Economy (SWEAT) to hold a token holders briefing discussing tokenomics, merchandise roadmap and partnerships.

Feb. 8, 1:08 p.m.: A dYdX Foundation vote connected granting the dYdX Operations subDAO signer marketplace authorization implicit the marketplace representation and destruct gross sharing for that relation is connected way to pass.

Feb. 10, 10:30 a.m.: OKX to hold a listings AMA with Chief Marketing Officer Haider Rafique and Head of Product Marketing Matthew Osofisan.

Unlocks

Feb. 9: Movement (MOVE) to unlock 2.17% of circulating proviso worthy $31.41 million.

Feb. 10: Aptos (APT) to unlock 1.97% of circulating proviso worthy $68.99 million.

Feb. 12: Aethir (ATH) to unlock 10.21% of circulating proviso worthy $22.72 million.

Token Launches

Feb. 7: Avalon Labs (AVL) to beryllium listed connected Bybit.

Feb. 13: EthereumPoW (ETHW) and Polygon (MATIC) to nary longer beryllium supported astatine Deribit.

Conferences

CoinDesk's Consensus to instrumentality spot in Hong Kong connected Feb. 18-20 and in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

Feb. 7: Solana APEX (Mexico City)

Feb. 13-14: The 4th Edition of NFT Paris.

Feb. 18-20: Consensus Hong Kong

Feb. 19: Sui Connect: Hong Kong

Feb. 23 to March 2: ETHDenver 2025 (Denver, Colorado)

Feb. 25: HederaCon 2025 (Denver)

Token Talk

By Shaurya Malwa

BNB Chain speculators are gambling with a random TST token aft an acquisition video showed its creation.

TST, oregon Test Token, was issued connected the BNB Chain utilizing the BEP-20 standard. It was not officially launched by Binance, but alternatively utilized successful a token instauration tutorial video by the BNB Chain team.

The terms surged aft the video was shared by Binance laminitis Changpeng Zhao connected X due to the fact that users took it to beryllium an authoritative Binance token adjacent though Zhao nary longer has a ceremonial relation astatine the company.

Zhao deleted his repost of the video later.

TST skyrocketed to a marketplace headdress of astir $40 cardinal soon aft Zhao's post, reaching trading volumes of implicit $90 cardinal astatine peak.

Derivatives Positioning

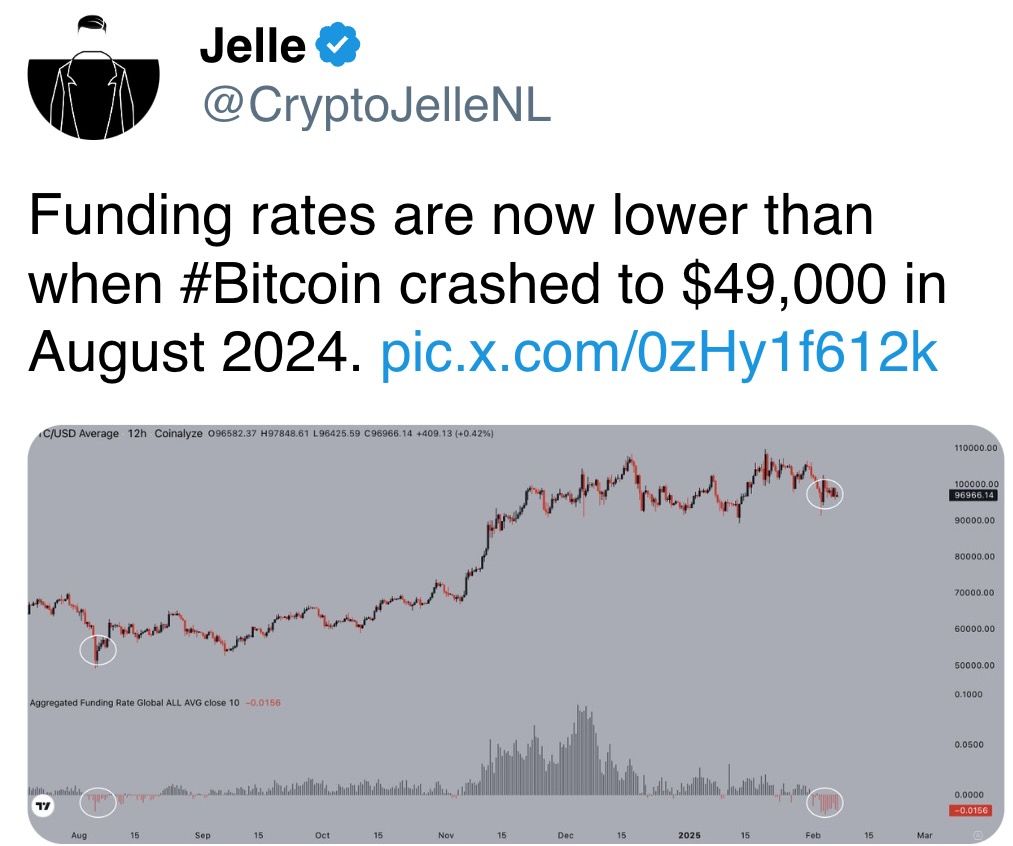

Perpetual backing rates for BERA are profoundly negative, showcasing a beardown bias for abbreviated positions. SOL, BNB, SHIB and BCH besides person antagonistic rates.

QCP Capital noted request for BTC puts astatine $90K and $80K strikes expiring connected Feb. 28 successful a motion of persistent downside worries.

Block flows featured a BTC calendar dispersed betting connected prices staying beneath $120K by the extremity of April, but yet rising past $170K the extremity of December. Plus, an outright agelong successful the $88K Feb expiry enactment crossed the tape.

ETH flows featured an outright agelong successful the Feb. 14 expiry telephone astatine the $2,800 strike.

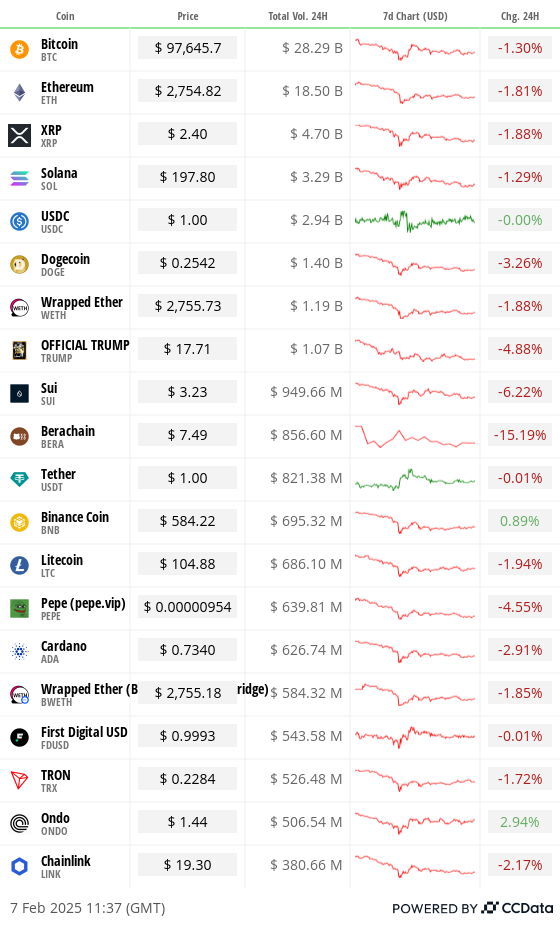

Market Movements:

BTC is up 1.24 % from 4 p.m. ET Thursday to $97,686.16 (24hrs: -1.07%)

ETH is up 1.61% astatine $2,757.18 (24hrs: -1.75%)

CoinDesk 20 is up 1.99% to 3,215.42 (24hrs: -1.83%)

CESR Composite Staking Rate is down 3 bps to 3.06%

BTC backing complaint is astatine 0.0052% (5.72% annualized) connected Binance

DXY is up 0.08% astatine 107.78

Gold is up 0.37% astatine $2,866.78/oz

Silver is up 0.29% to $32.26/oz

Nikkei 225 closed down 0.72% astatine 38,787.02

Hang Seng closed up 1.15% astatine 21,133.54

FTSE is down 0.29% astatine 8,703.92

Euro Stoxx 50 is down 0.15% astatine 5,348.71

DJIA closed -0.28% to 44,747.63

S&P 500 closed +0.36% astatine 6,083.57

Nasdaq closed +0.51% astatine 19,791.99

S&P/TSX Composite Index closed -0.14% astatine 25,534.49

S&P 40 Latin America closed +1.87% astatine 2,437.08

U.S. 10-year Treasury was unchanged astatine 4.44%

E-mini S&P 500 futures are unchanged astatine 6,104.00

E-mini Nasdaq-100 futures are unchanged astatine 21,855.75

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 21,853.00

Bitcoin Stats:

BTC Dominance: 61.62 (-0.48%)

Ethereum to bitcoin ratio: 0.02823 (1.40%)

Hashrate (seven-day moving average): 808 EH/s

Hashprice (spot): $57.2

Total Fees: 5.17 BTC / $514,435

CME Futures Open Interest: 163,140 BTC

BTC priced successful gold: 33.7 oz

BTC vs golden marketplace cap: 9.58%

Technical Analysis

Bitcoin seems to beryllium crossing beneath the Ichimoku unreality used by traders to gauge momentum and inclination strength.

Crosses beneath the indicator are taken to correspond a bearish displacement successful trend.

Crypto Equities

MicroStrategy (MSTR): closed connected Thursday astatine $325.46 (-3.34%), up 0.63% astatine $327.50 successful pre-market.

Coinbase Global (COIN): closed astatine $270.37 (-1.73%), up 0.75% astatine $272.39 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.07 (-2.13%)

MARA Holdings (MARA): closed astatine $16.80 (-1.35%), up 0.89% astatine $16.95 successful pre-market.

Riot Platforms (RIOT): closed astatine $11.61 (-1.11%), up 0.69% astatine $11.69 successful pre-market.

Core Scientific (CORZ): closed astatine $12.53 (-1.42%), up 0.32% astatine $12.57 successful pre-market.

CleanSpark (CLSK): closed astatine $10.38 (+0.68%), up 6.84% astatine 11.09 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.76 (+1.34%), down 0.06% astatine $22.70 successful pre-market.

Semler Scientific (SMLR): closed astatine $49.92 (-3.61%), up 2.14% astatine $50.99 successful pre-market.

Exodus Movement (EXOD): closed astatine $48.01 (-6.52%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: -$140.2 million

Cumulative nett flows: $40.53 billion

Total BTC holdings ~ 1.174 million.

Spot ETH ETFs

Daily nett flow: $10.7 million

Cumulative nett flows: $3.18 billion

Total ETH holdings ~ 3.783 million.

Source: Farside Investors

Overnight Flows

Chart of the Day

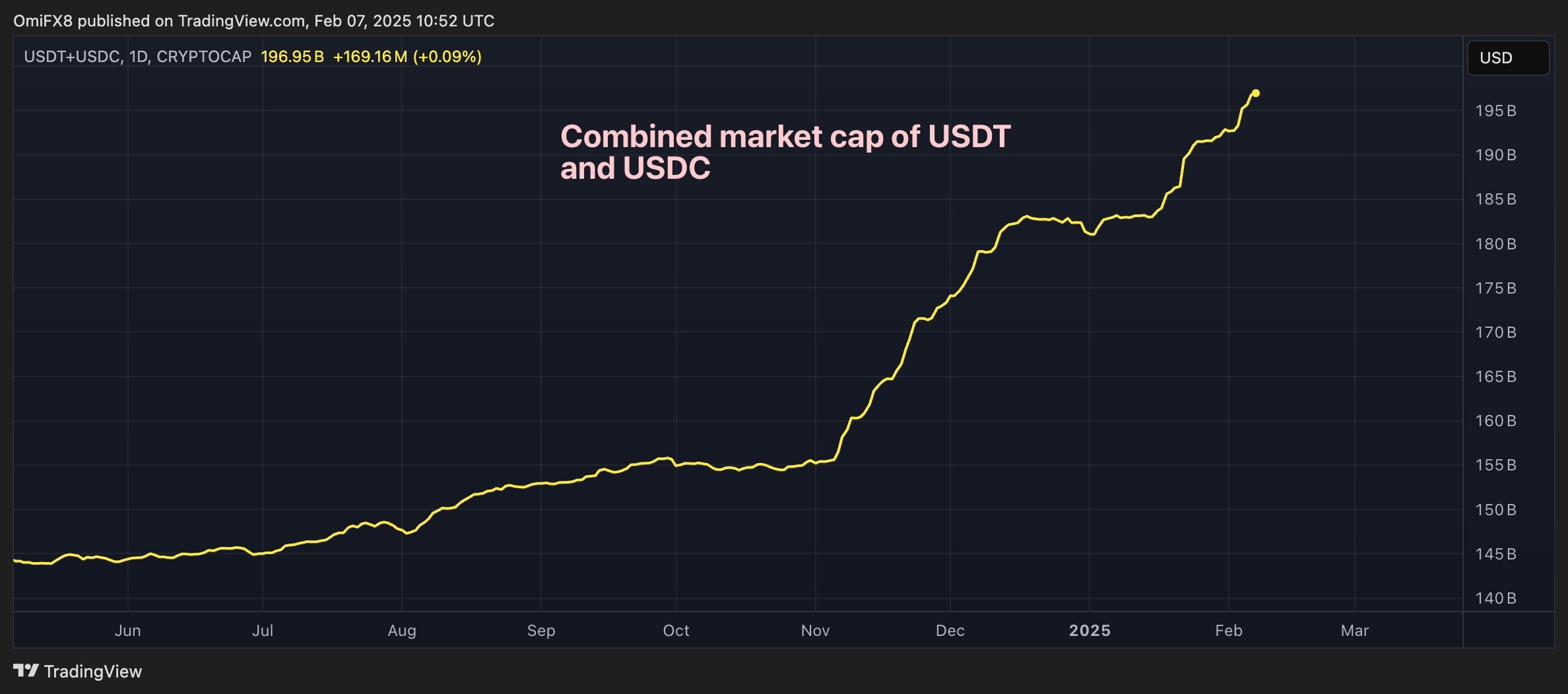

The combined marketplace capitalization of apical 2 stablecoins, USDT and USDC, continues to turn and is accelerated nearing $200 billion.

The relentless emergence represents an influx of wealth into the crypto market, hinting astatine bullish prospects.

While You Were Sleeping

Bitcoin successful a Mire, Gold Eyes 6th Straight Week of Gains arsenic Jobs Data Looms (CoinDesk): With BTC struggling to find its footing amid declining Bitcoin web activity, today's U.S. jobs information volition springiness immoderate clues connected what the Fed whitethorn bash next.

Solana’s SOL Could Hit $520 by 2025-End, VanEck Says (CoinDesk): Investment steadfast VanEck expects the SOL terms to scope $520 by year-end. The forecast is based connected increasing request for smart-contract platforms and an expanding U.S. M2 wealth supply.

Fed’s Waller Says Stablecoins Could Back Dollar’s Reserve Status (Bloomberg): While giving a code successful Washington, Fed Governor Christopher Waller expressed enactment for stablecoins arsenic agelong arsenic due "regulatory rails" are successful spot to "make definite the wealth is there."

Trump’s Memecoin Copycats Spark Fears for Investors (Financial Times): According to an FT analysis, since Donald Trump and his woman launched authoritative memecoins, implicit 700 copycat tokens person flooded his authoritative Solana wallet, prompting capitalist warnings.

India’s Central Bank Cuts Rates for First Time successful Nearly 5 Years; Signals Less Restrictive Approach (Reuters): The Reserve Bank of India (RBI) reduced its repo complaint by 25 ground points portion maintaining a neutral argumentation stance successful an effort to stimulate a sluggish system amid little maturation expectations.

Look to India, Japan for ‘Quality Alpha’ Amid Market Uncertainty, Investor Says (CNBC): According to alternate concern steadfast PAG, it's hard to find alpha successful China close present owed to a lackluster system and uncertainty implicit the interaction of a commercialized warfare with the U.S.

In the Ether

4 months ago

4 months ago

English (US)

English (US)