By Omkar Godbole (All times ET unless indicated otherwise)

The large communicative successful fiscal markets is not conscionable global bond-market jitters, it's besides bitcoin's (BTC) stableness supra $100,000.

BTC has held supra that level for 11 consecutive days aft jumping sharply from astir $75,000 successful aboriginal April. Some mightiness construe that arsenic a motion of uptrend exhaustion, but it could besides beryllium the marketplace normalizing the six-figure mark.

Think of it similar this: When BTC archetypal deed $100,000, galore radical apt thought, "This is crazy. It's excessively expensive" and possibly refrained from buying oregon adjacent took profits connected their holdings. But the longer it stays there, the much the terms feels mean and becomes anchored successful people's minds. In different words, don't beryllium amazed if buying enactment picks up crossed the spectrum of products tied to BTC.

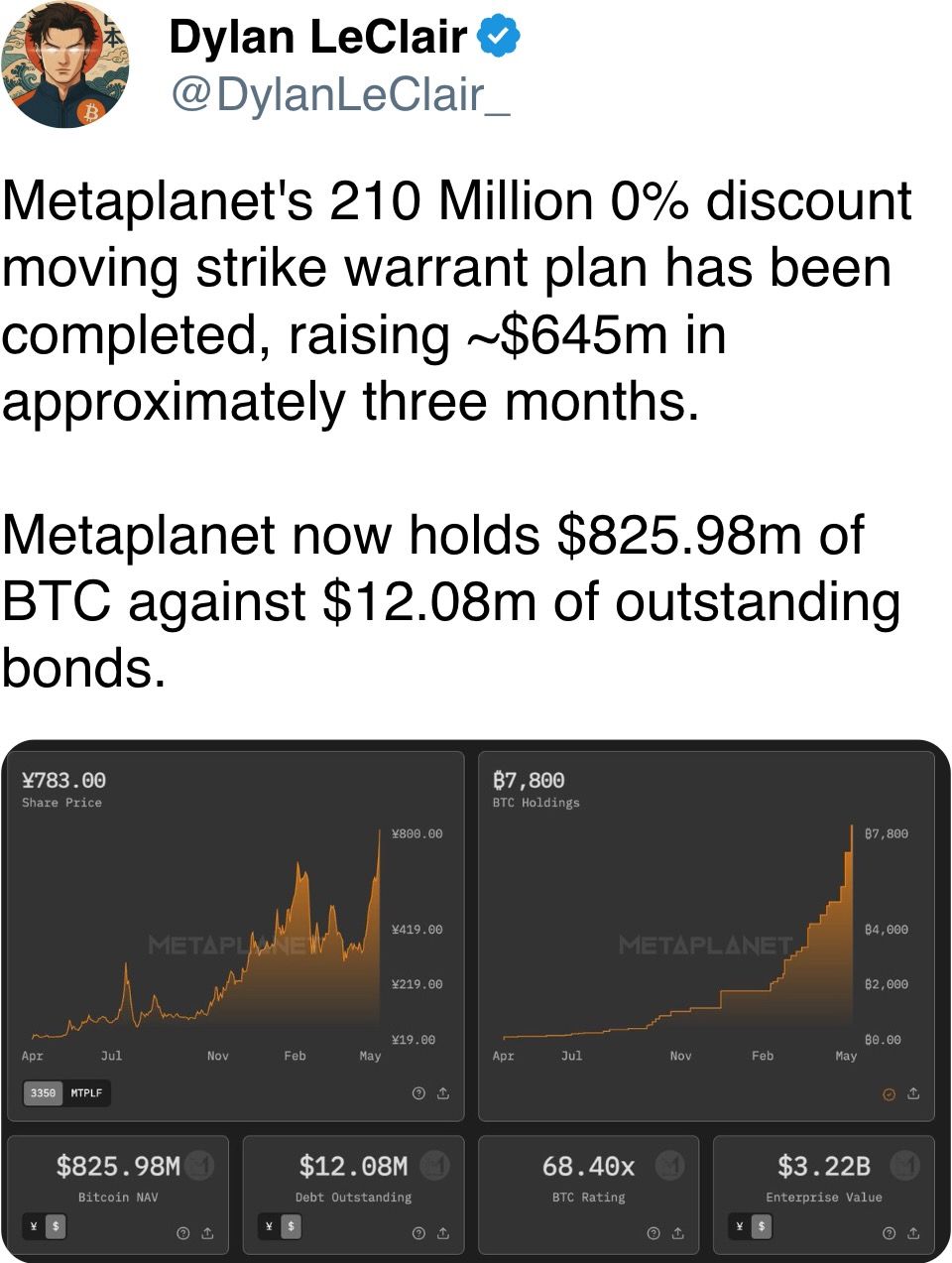

Confidence got a boost connected Monday aft Strategy, the largest publically traded BTC holding firm, disclosed that it has precocious bought 7,630 BTC astatine an mean terms of implicit $103,000.

"This assertive buying run is aimed astatine solidifying $100K+ levels arsenic the caller level for Bitcoin. ETF inflows echoed that strength," Valentin Fournier, pb probe expert astatine BRN, told CoinDesk successful an email.

According to Fournier, a terms emergence successful ether (ETH) "seems driven much by integrated request than organization flows — a imaginable motion of rising retail enactment and decoupling show betwixt bitcoin and altcoins."

In different cardinal developments, the marketplace headdress for Ethena Labs' synthetic stablecoin, USDe, has surged 35% to $5 cardinal successful conscionable implicit 7 days, CoinDesk information show. The token maintains a brushed peg with the U.S. dollar done an automated delta-hedging strategy that shorts bitcoin and ether perpetual futures to offset changes successful the prices.

The leap had immoderate marketplace observers drawing parallels with the crisp emergence successful the marketplace headdress weeks earlier BTC and the wider marketplace went bonkers successful November. Back then, Ethena's ENA token chalked retired a five-fold rally to $1.25. Let's spot if past repeats itself.

The U.S. Senate connected Monday voted successful favor of the GENUIS Act, advancing the stablecoin measure to the last stage. "The measure … could importantly boost marketplace assurance and supply long-awaited clarity for issuers and investors alike, but doesn't afloat code offshore stablecoin issuers similar Tether, which proceed to play an outsized relation successful planetary liquidity," Vugar Usi Zade, COO astatine Bitget, said successful an email. "For U.S.-based issuers, compliance volition present travel with steeper costs, apt accelerating consolidation crossed the marketplace and favoring well-resourced players who tin conscionable the caller thresholds."

In accepted markets, yields connected longer-duration bonds continued to emergence crossed the precocious world, signaling increasing concerns astir the fiscal indebtedness sustainability. The 30-year Japanese authorities enslaved output deed a grounds precocious supra 3%. Stay alert!

What to Watch

- Crypto

- May 22: Bitcoin Pizza Day.

- May 22: Top 220 TRUMP token holders volition be a gala dinner hosted by President Trump astatine the Trump National Golf Club successful Washington.

- May 30: The second circular of FTX repayments starts.

- Macro

- Day 1 of 3: Canadian Finance Minister François-Philippe Champagne and Bank of Canada Governor Tiff Macklem volition co-host the three-day gathering of G7 concern ministers and cardinal slope governors successful Banff, Alberta.

- May 20, 8:30 a.m.: Statistics Canada releases April user terms ostentation data.

- Core Inflation Rate MoM Est. 0.2% vs. Prev. 0.1%

- Core Inflation Rate YoY Prev. 2.2%

- Inflation Rate MoM Est. -0.2% vs. Prev. 0.3%

- Inflation Rate YoY Est. 1.6% vs. Prev. 2.3%

- May 21, 2 a.m.: The U.K.'s Office for National Statistics releases April user terms ostentation data.

- Core Inflation Rate MoM Est. 1.2% vs. Prev. 0.5%

- Core Inflation Rate YoY Est. 3.6% vs. Prev. 3.4%

- Inflation Rate MoM Est. 1.1% vs. Prev. 0.3%

- Inflation Rate YoY Est. 3.3% vs. Prev. 2.6%

- May 21, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail income data.

- Retail Sales MoM Est. 0.1% vs. Prev. 0.2%

- Retail Sales YoY Est. 2.2% vs. Prev. -1.1%

- Earnings (Estimates based connected FactSet data)

- May 20: Canaan (CAN), pre-market

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected launching “The Watchdog,” a 400,000-ARB bounty programme that would reward assemblage sleuths for uncovering misuse of the hundreds of millions successful grants, incentives and work budgets the DAO has deployed. Voting ends May 23.

- Arbitrum DAO is voting connected a law AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto”, bringing them successful enactment with Ethereum’s May 7 Pectra upgrade. The connection schedules activation for June 17. Voting ends connected May 29.

- May 20, 12 p.m.: Lido to hist its 28th node relation assemblage call.

- May 21: Maple Finance has teased astatine an upcoming announcement connected the aboriginal of plus management.

- May 21, 6 p.m.: Theta Network to big an Ask Me Anything league in a livestream

- May 22: Official Trump to announce its “next Era” at the time of the meal for its largest holders.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $22.28 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $169.82 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating proviso worthy $11.24 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $15.16 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $58.02 million.

- Token Launches

- May 20: Deadline for users to assertion their Xterio (XTER) airdrop connected Binance Alpha.

- June 1: Staking rewards for staking ERC-20 OM connected MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

Conferences

- Day 2 of 7: Dutch Blockchain Week (Amsterdam)

- Day 1 of 3: Avalanche Summit London

- Day 1 of 3: Seamless Middle East Fintech 2025 (Dubai)

- May 21-22: Crypto Expo Dubai

- May 21-22: Cryptoverse Conference (Warsaw)

- May 27-29: Bitcoin 2025 (Las Vegas)

- May 27-30: Web Summit Vancouver

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

Token Talk

By Shaurya Malwa

- TokenFi is facilitating what it calls the first-ever tokenization of a user AI robot, the Floki Minibot M1, giving the level a unsocial real-world usage and a beardown communicative successful the progressively crowded marketplace for RWA applications.

- The Floki Minibot M1 presale and tokenization spell unrecorded May 23, the aforesaid time TokenFi debuts its RWA tokenization module, aligning a high-profile merchandise driblet with halfway level functionality — a almighty operator for level visibility and inferior for TokenFi's TOKEN.

- TokenFi’s relation with Rice Robotics, which works with companies similar Nvidia, Softbank and 7-Eleven Japan, lends legitimacy to the project’s RWA ambitions and strengthens semipermanent capitalist assurance successful TOKEN, which sits astatine a $60 cardinal marketplace capitalization arsenic of Tuesday.

- TokenFi volition payment from an upcoming RICE token airdrop to Floki and TokenFi holders, offering nonstop worth accrual and perchance incentivizing caller buyers and stakers of TOKEN successful anticipation of eligibility.

- The TokenFi squad said Monday it would beryllium the rubric sponsor of the West Indies cricket team's circuit of Ireland 2025, bringing its marque to viewers globally done broadcast partners similar TNT Sports, Supersport and Fancode, giving the token a visibility boost among retail audiences.

Derivatives Positioning

- Bitcoin CME futures unfastened involvement has risen to the highest successful 3 months successful a motion of renewed uptick successful organization activity. ETH's unfastened involvement has jumped to its highest since March.

- Still, positioning successful some markets remains airy compared with December.

- On offshore exchanges, perpetual backing rates for large coins stay beneath an annualized 10%. It's a motion that portion traders are utilizing leverage to instrumentality bullish bets, the marketplace is acold from being frothy.

- On Deribit, BTC and ETH calls proceed to commercialized pricier than puts crossed timeframes, indicating a bullish bias.

- Block flows connected Paradigm person been mixed, with calendar spreads some bought and sold.

Market Movements

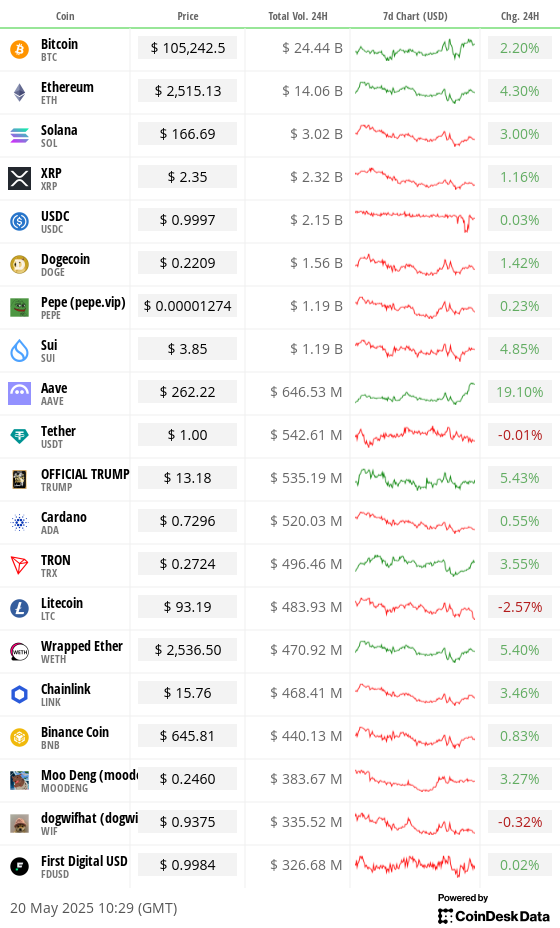

- BTC is down 0.51% from 4 p.m. ET Monday astatine $105,181.50 (24hrs: +2.12%)

- ETH is unchanged astatine $2,519.42 (24hrs: +4.46%)

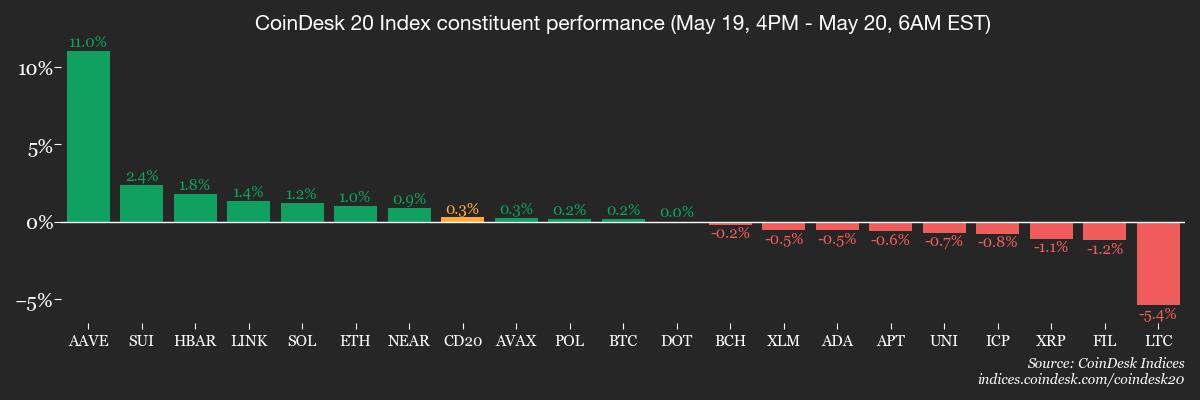

- CoinDesk 20 is down 0.42% astatine 3,171.22 (24hrs: +2.84%)

- Ether CESR Composite Staking Rate is up 13 bps astatine 3.04%

- BTC backing complaint is astatine 0.0074% (8.1227% annualized) connected Binance

- DXY is down 0.2% astatine 100.22

- Gold is up 0.13% astatine $3,233.79/oz

- Silver is up 0.31% astatine $32.45/oz

- Nikkei 225 closed unchanged astatine 37,529.49

- Hang Seng closed +1.49% astatine 23,681.48

- FTSE is up 0.5% astatine 8,742.80

- Euro Stoxx 50 is up 0.25% astatine 5,440.56

- DJIA closed connected Monday +0.32% astatine 42,792.07

- S&P 500 closed unchanged astatine 5,963.60

- Nasdaq closed unchanged astatine 19,215.46

- S&P/TSX Composite Index closed +0.29% astatine 25,971.93

- S&P 40 Latin America closed +0.56% astatine 2,638.56

- U.S. 10-year Treasury complaint is up 1 bp astatine 4.46%

- E-mini S&P 500 futures are down 0.29% astatine 5,965.25

- E-mini Nasdaq-100 futures are down 0.4% astatine 21,440.25

- E-mini Dow Jones Industrial Average Index futures are unchanged astatine 42,870.00

Bitcoin Stats

- BTC Dominance: 63.86 (-0.04%)

- Ethereum to bitcoin ratio: 0.02401 (0.29%)

- Hashrate (seven-day moving average): 853 EH/s

- Hashprice (spot): $54.3

- Total Fees: 6.87 BTC / $717,919

- CME Futures Open Interest: 157,875 BTC

- BTC priced successful gold: 32.4 oz

- BTC vs golden marketplace cap: 9.17%

Technical Analysis

- The illustration shows the XMR/BTC ratio has breached supra the plaything precocious absorption from September 2024, confirming a bullish inclination reversal higher.

- The signifier points to continued monero (XMR) outperformance comparative to bitcoin.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $413.42 (+3.41%), up 0.4% astatine $415.06 successful pre-market

- Coinbase Global (COIN): closed astatine $263.99 (-0.93%), up 1.11% astatine $266.93

- Galaxy Digital Holdings (GLXY): closed astatine C$31.49 (+3.01%)

- MARA Holdings (MARA): closed astatine $16.32 (+0.68%), up 0.49% astatine $16.40

- Riot Platforms (RIOT): closed astatine $8.97 (-1.97%), up 0.88% astatine $9.04

- Core Scientific (CORZ): closed astatine $10.85 (+0.65%), up 0.55% astatine $10.91

- CleanSpark (CLSK): closed astatine $9.84 (+0.61%), up 0.51% astatine $9.89

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.13 (+0.72%)

- Semler Scientific (SMLR): closed astatine $43.27 (+5.85%), up 4% astatine $45

- Exodus Movement (EXOD): closed astatine $33.91 (-4.21%), up 3.21% astatine $35

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $667.4 million

- Cumulative nett flows: $42.41 billion

- Total BTC holdings ~ 1.19 million

Spot ETH ETFs

- Daily nett flow: $13.7 million

- Cumulative nett flows: $2.54 billion

- Total ETH holdings ~ 3.47 million

Source: Farside Investors

Overnight Flows

Chart of the Day

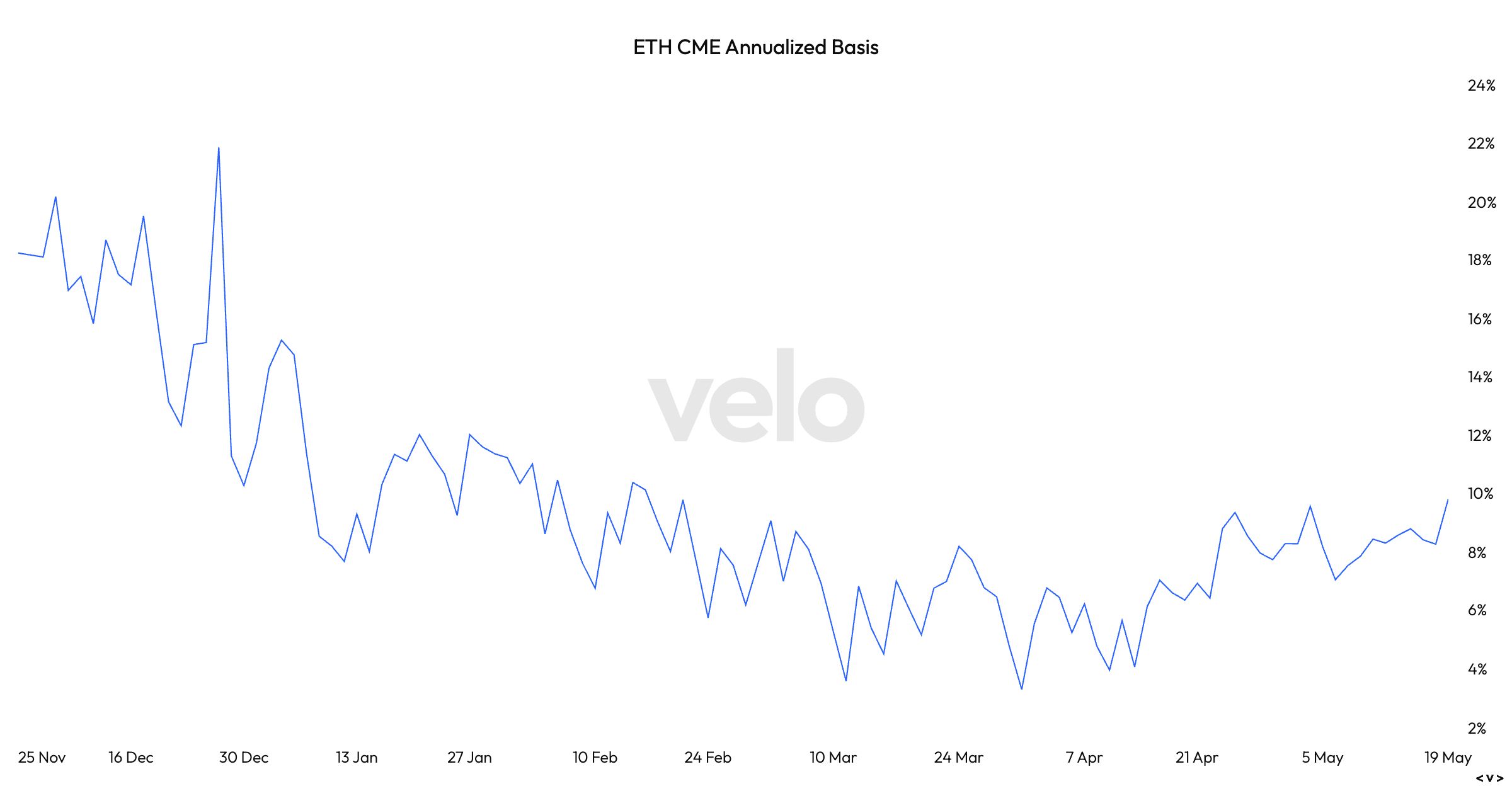

- The annualized premium oregon ground successful ETH futures trading connected the CME is adjacent to topping the 10% people for the archetypal clip since aboriginal February.

- It shows traders are taking leveraged bullish bets connected ETH.

- The widening ground could entice currency and transportation arbitrage traders, starring to accelerated inflows into the U.S.-listed spot ether ETFs.

While You Were Sleeping

- Bitcoin ETF Inflows Surge arsenic Basis Trade Nears 9%, Signaling Renewed Demand (CoinDesk): U.S. spot bitcoin ETFs drew $667.4 cardinal successful nett inflows connected May 19, the astir since May 2, arsenic rising ground commercialized output and bitcoin’s spot supra $100,000 revived organization interest.

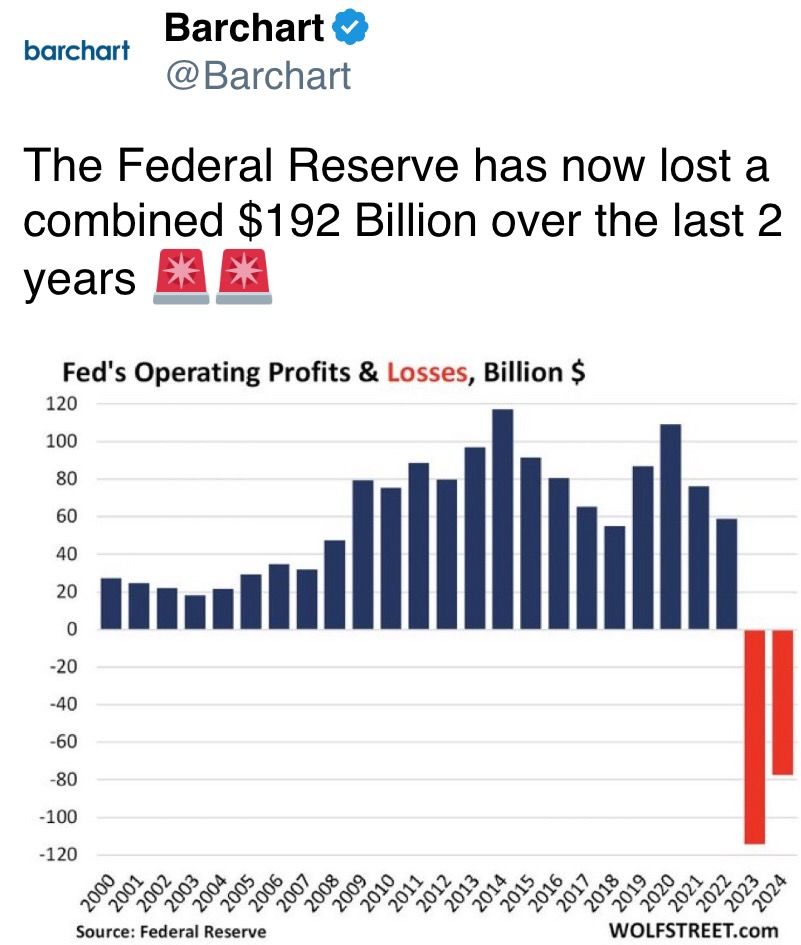

- Bitcoin and Gold successful Sweet Spot arsenic Bond Market 'Smackdown' Exposes the U.S. Fiscal Kayfabe: Godbole (CoinDesk): Bond markets are challenging the illusion of U.S. fiscal stableness and harmless haven status. BTC and golden basal to gain.

- KuCoin Enhances Point-of-Sale Mobile Payments With AEON (CoinDesk): KuCoin introduced a crypto outgo work successful prime Asian markets done a tie-up with AEON.

- Will Trump’s Tariff Climbdown Save the US From Recession? (Financial Times): Trump’s tariff rollback eased recession fears, but lingering uncertainty, elevated commercialized barriers and rising prices proceed to measurement connected confidence, spending and concern business crossed the U.S. economy.

- U.S. Treasury Yields Slip arsenic Fed Signals Just One Rate Cut successful 2025 (CNBC): Yields edged down aboriginal Tuesday aft a Monday spike, arsenic Atlanta Fed President Raphael Bostic flagged tariff-driven ostentation risks and analysts said the U.S. downgrade won’t shingle Treasury markets.

- Divided GOP Closes In connected Tense House Vote (The Wall Street Journal): GOP infighting implicit Medicaid rules, taxation breaks and clime subsidies is stalling Trump’s propulsion to widen 2017 cuts, which would adhd astir $3 trillion to projected deficits implicit the adjacent decade.

In the Ether

3 months ago

3 months ago

English (US)

English (US)