By James Van Straten (All times ET unless indicated otherwise)

Bitcoin BTC remains unchangeable astir $105,000 aft the Federal Reserve held involvement rates steady, arsenic expected. It hasn't traded beneath the intelligence threshold of $100,000 since May 8, a afloat 42 days ago, adjacent though the Israel-Iran struggle — present coming up for a week — would person been expected to measurement connected risky investments, crypto among them.

Alongside the interest-rate decision, the Fed besides signaled slower economical growth, with GDP present expected to emergence conscionable 1.4% this year, down from 1.7%, and higher inflation. The much-watched dot crippled showed policymakers spot less complaint cuts done 2027 than they did successful March.

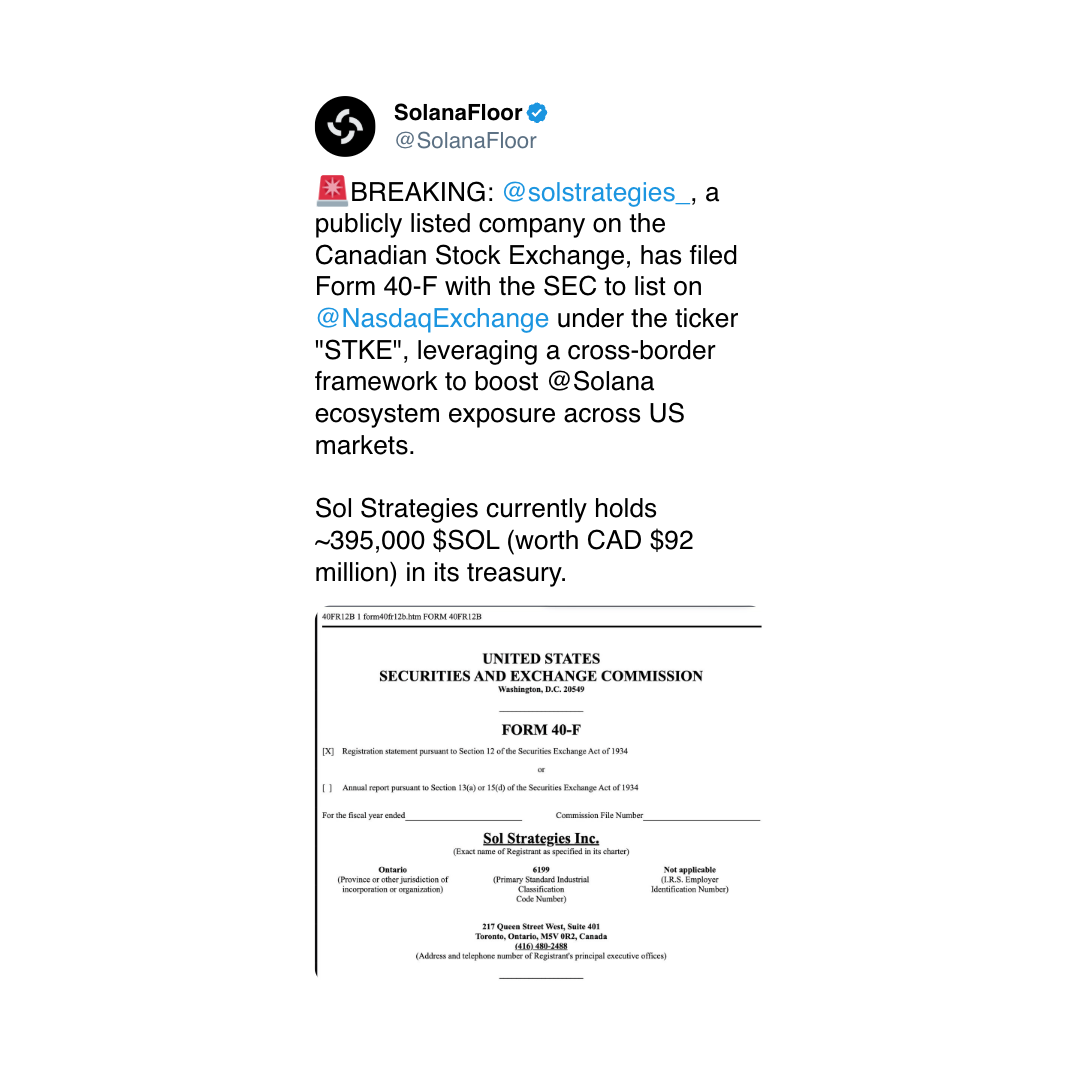

What seems to beryllium underpinning the largest cryptocurrency, and crypto markets successful general, is the bitcoin treasury narrative. A notable rotation appears to beryllium underway, with an ever increasing fig of companies committing to buying it arsenic a treasury asset.

The full fig of known publically traded holders has accrued to 129, and erstwhile backstage companies and sovereign entities are included, the full has reached 235. That's an summation of 27 entities successful conscionable 30 days.

Geopolitical tensions stay elevated successful the Middle East. Israel said it launched airstrikes connected nuclear-weapons related targets adjacent Arak and Natanz and an Iranian rocket onslaught scored a nonstop deed connected the Soroka Hospital successful confederate Israel aboriginal this morning. In response, Israel’s defence curate pledged further escalation of hostilities.

Brent crude roseate 1% to $77.45, its highest level since January, adding upward unit connected planetary vigor and nutrient prices. European banal indexes and U.S. equity scale futures fell.

While U.S. markets are closed contiguous for the Juneteenth holiday, crypto markets stay unfastened 24/7. Stay alert!

What to Watch

- Crypto

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit connected mainnet, improving information and performance. Nodes indispensable beryllium upgraded to merchandise v26.2.0 earlier this date. Wallets from 13.2 tin beryllium utilized successful 26.2.x.

- June 25: ZIGChain (ZIG) mainnet will spell live.

- June 30: CME Group volition introduce spot-quoted futures, pending regulatory approval, allowing trading successful bitcoin, ether and large U.S. equity indices with contracts holdable for up to 5 years.

- Macro

- June 19, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 employment data.

- Unemployment Rate Prev. 6.4%

- June 20, 8:30 a.m.: Statistics Canada releases May shaper terms ostentation data.

- PPI MoM Prev. -0.8%

- PPI YoY Prev. 2%

- June 19, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 employment data.

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is acceptable to ballot connected a connection to create the Compound Foundation, a non-profit to thrust protocol maturation and strategy. It calls for an 18-month program and requests $9 cardinal successful COMP, Voting ends June 20.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- ApeCoin DAO is voting connected whether to sunset the decentralized autonomous organization and motorboat ApeCo, a caller entity established by Yuga Labs with a ngo to “supercharge the APE ecosystem.” Voting ends June 24.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- June 19, 9 a.m.: TON to big a Builders Call: Payments Edition.

- Unlocks

- June 30: Optimism (OP) to unlock 1.83% of its circulating proviso worthy $17.34 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $120.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $11.23 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- Day 2 of 2: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- Day 2 of 2: SuperAI (Singapore)

- Day 1 of 3: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Shaurya Malwa

- Lion Group Holding (LGHL), a Nasdaq-listed trading platform, secured a $600 cardinal installation from ATW Partners to relaunch its crypto operations and physique the world’s largest HYPE treasury.

- The treasury volition beryllium anchored by Hyperliquid (HYPE), Solana (SOL) and Sui (SUI), with HYPE positioned arsenic the company’s superior reserve asset.

- SOL and SUI holdings volition beryllium custodied and staked with BitGo, which volition besides supply institutional-grade infrastructure and compliance oversight.

- LGHL is exploring secondary listings successful Tokyo and Singapore to broaden capitalist entree and make Asia’s archetypal listed HYPE treasury.

- The institution views HYPE’s decentralized sequencing, Solana’s user traction, and Sui’s composability arsenic foundational to its displacement toward execution-first DeFi protocols.

- The archetypal $10.6 cardinal tranche is expected to adjacent earlier Saturday, with Chardan acting arsenic sole placement cause for the raise.

Derivatives Positioning

- Open involvement (OI) crossed large derivatives venues remains subdued aft past week’s flush, according to information from Velo.

- Total OI presently sits astatine $55.3 billion, good beneath the June 11 highest of $65.9 billion.

- The broad-based pullback points to persistent de-risking, adjacent arsenic markets stabilise adjacent scope highs.

- Deribit options flows stay front-loaded into the June 27 expiry.

- BTC’s put/call ratio has ticked up to 1.13, led by renewed enactment request astatine $100K–$110K strikes. Call involvement remains dense supra $110K, but today's flows are much balanced than earlier successful the week.

- ETH positioning skews much bullish, with a put/call ratio of 0.75 and telephone flows clustering astatine $2,600 and $2,800. Notably, today’s top-traded instruments are concentrated successful near-term strikes, pointing to short-dated, tactical interest.

- Velo information shows backing rates person flipped moderately affirmative for BTC and ETH, with +0.03% and +7.5%, respectively, connected Binance, and akin prints crossed Bybit and OKX.

- Altcoin signals, however, are inactive fragmented. AVAX remains profoundly antagonistic connected Binance (–19.05%), OKX (–18.60%) and Bybit (–16.62%), and bitcoin currency (BCH) besides shows utmost abbreviated unit (–24.39% connected Bybit).

- HYPE funding, however, surged again to +38.67% connected Bybit, though this reflects isolated speculation alternatively than a wide sentiment shift.

- Liquidation maps arsenic provided by Coinglass amusement a dense set of leverage hugging BTC’s existent price, with notable zones stacked betwixt $103K and $106K connected Binance.

- This positioning suggests an elevated hazard of section unwinds if the terms breaks out. Still BTC has present traded wrong a 10% set for a grounds 42 days— 1 of the tightest volatility windows. With leverage compressed and clustered adjacent price, immoderate breakout could beryllium sharp, but for now, conditions stay range-bound and fragile.

Market Movements

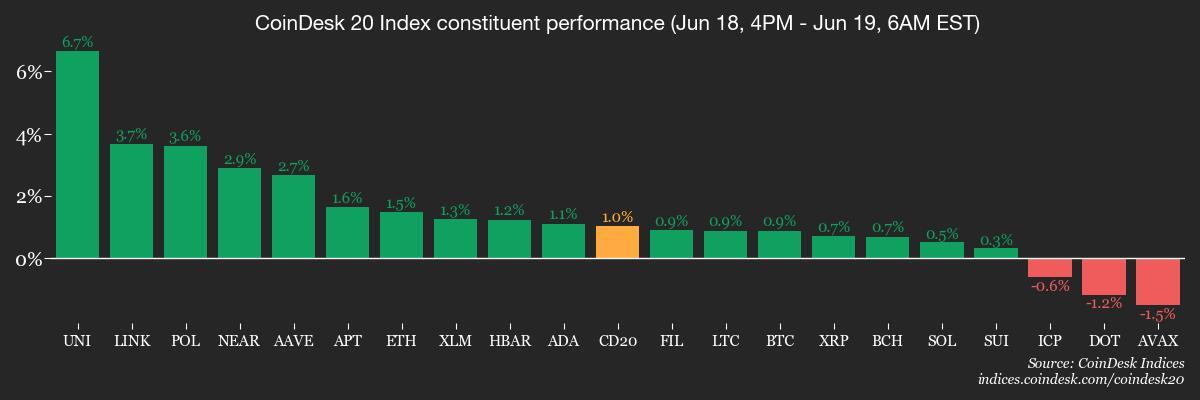

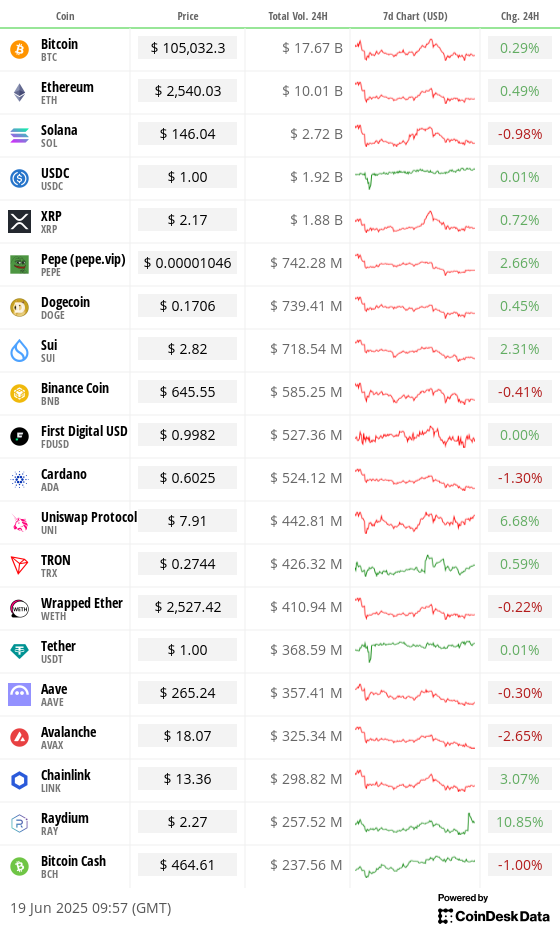

- BTC is up 0.16% from 4 p.m. ET Wednesday astatine $105,032.28 (24hrs: +0.73%)

- ETH is up 0.4% astatine $2,540.03 (24hrs: +1.76%)

- CoinDesk 20 is unchanged astatine 3,014.06 (24hrs: +1.22%)

- Ether CESR Composite Staking Rate is down 4 bps astatine 2.98%

- BTC backing complaint is astatine 0.0052% (5.7179% annualized) connected OKX

- DXY is unchanged astatine 98.95

- Gold futures are down 0.58% astatine $3,388.20

- Silver futures are down 1.43% astatine $36.38

- Nikkei 225 closed down 1.02% astatine 38,488.34

- Hang Seng closed down 1.99% astatine 23,237.74

- FTSE is down 0.27% astatine 8,819.87

- Euro Stoxx 50 is down 0.64% astatine 5,233.39

- DJIA closed connected Wednesday down 0.10% astatine 42,171.66

- S&P 500 closed unchanged astatine 5,980.87

- Nasdaq Composite closed up 0.13% astatine 19,546.27

- S&P/TSX Composite closed unchanged astatine 26,559.85

- S&P 40 Latin America closed up 0.25% astatine 2,622.24

- U.S. 10-Year Treasury complaint is unchanged astatine 4.4%

- E-mini S&P 500 futures are down 0.36% astatine 5,960.00

- E-mini Nasdaq-100 futures are down 0.43% astatine 21,626.25

- E-mini Dow Jones Industrial Average Index are down 0.37% astatine 42,034.00

Bitcoin Stats

- BTC Dominance: 64.9 (+0.06%)

- Ethereum to bitcoin ratio: 0.02408 (0.04%)

- Hashrate (seven-day moving average): 879 EH/s

- Hashprice (spot): $52.87

- Total Fees: 6.95 BTC / $729,711

- CME Futures Open Interest: 154,500

- BTC priced successful gold: 30.9 oz

- BTC vs golden marketplace cap: 8.75%

Technical Analysis

- After dropping beneath Monday’s debased and erstwhile again investigating the 200-day exponential moving mean (EMA), ether has managed to reclaim Monday’s range.

- While terms enactment remains beneath the monthly open, a decisive reclaim of this cardinal level would beryllium a constructive signal, perchance paving the mode for a determination backmost toward Monday’s highs.

- Bulls volition privation to spot ether proceed to adjacent supra the 200-day EMA successful the lawsuit of further sideways terms action.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $369.03 (-1.64%), +0.7% astatine $371.61 successful pre-market

- Coinbase Global (COIN): closed astatine $295.29 (+16.32%), -14.16% astatine $253.47

- Circle (CRCL): closed astatine $199.59 (+33.82%), -23.24% astatine $153.21

- Galaxy Digital Holdings (GLXY): closed astatine C$26.12 (+3.57%)

- MARA Holdings (MARA): closed astatine $14.49 (-1.23%), unchanged successful pre-market

- Riot Platforms (RIOT): closed astatine $9.94 (+2.9%), -3.62% astatine $9.58

- Core Scientific (CORZ): closed astatine $11.9 (+0.08%), -1.01% astatine $11.78

- CleanSpark (CLSK): closed astatine $9.18 (+3.15%), -4.03% astatine $8.81

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.7 (+0.11%)

- Semler Scientific (SMLR): closed astatine $31.94 (+11.95%), -9.58% astatine $28.88

- Exodus Movement (EXOD): closed astatine $30.14 (+0.43%), -0.73% astatine $29.92

ETF Flows

Spot BTC ETFs

- Daily nett flows: $388.3 million

- Cumulative nett flows: $46.63 billion

- Total BTC holdings ~1.22 million

Spot ETH ETFs

- Daily nett flows: $11.1 million

- Cumulative nett flows: $3.91 billion

- Total ETH holdings ~3.97 million

Source: Farside Investors

Overnight Flows

Chart of the Day

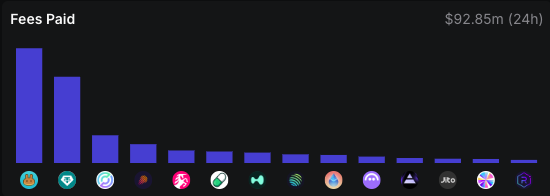

- PancakeSwap present leads crypto protocols based connected 24-hour fees.

While You Were Sleeping

- Trump Faces Uproar From MAGA Base Over Possible Iran Strike (Reuters): Several cardinal MAGA figures, including Steve Bannon, warned President Donald Trump that joining Israel’s subject effort could alienate his basal and wounded Republicans successful the 2026 midterm elections.

- Circle Rockets After Stablecoin Bill Clears Senate, Pushes Post-IPO Rally to Over 500% (CoinDesk): Circle Internet (CRCL) banal surged 34% the time aft the U.S. Senate passed the GENIUS Act, past roseate further successful after-hours trading to $211.87.

- DOJ Ties Kansas Bank Collapse to $225 Million 'Pig Butchering' Seizure (CoinDesk): The U.S. Justice Department traced $225 cardinal successful laundered USDT crossed OKX accounts tied to 434 victims, with seized assets perchance joining a national crypto reserve established nether Trump.

- Who's Selling Bitcoin Above $100K and Holding Back the Price Rally? (CoinDesk): Selling by short-term holders and miners is offsetting request from ETFs, portion semipermanent investors are rotating into different assets, keeping bitcoin range-bound contempt favorable regulatory and inflow trends.

- Russian Ties Do Little for Iran While Boosting North Korea (Bloomberg): North Korea’s unit deployments and arms transfers person secured battlefield upgrades and lipid shipments from Russia, portion Iran’s drone enactment has yielded nary comparable subject oregon strategical return.

- Vladimir Putin’s Investment Forum Fails to Attract Western Companies (Financial Times): The event's archetypal time drew small high-level planetary oregon home concern presence, with apical allies sending second-tier envoys and Russia’s wealthiest executives mostly skipping the event.

In the Ether

4 months ago

4 months ago

English (US)

English (US)