By James Van Straten (All times ET unless indicated otherwise)

"There are decades wherever thing happens; and determination are weeks wherever decades happen." Vladimir Ilyich LeninFew quotes amended seizure the existent turbulence successful planetary markets. For decades, the classical portfolio of 60% equities and 40% bonds was considered the cornerstone of balanced investing. This allocation typically offered extortion successful downturns done bonds, portion equities drove returns successful times of economical growth.

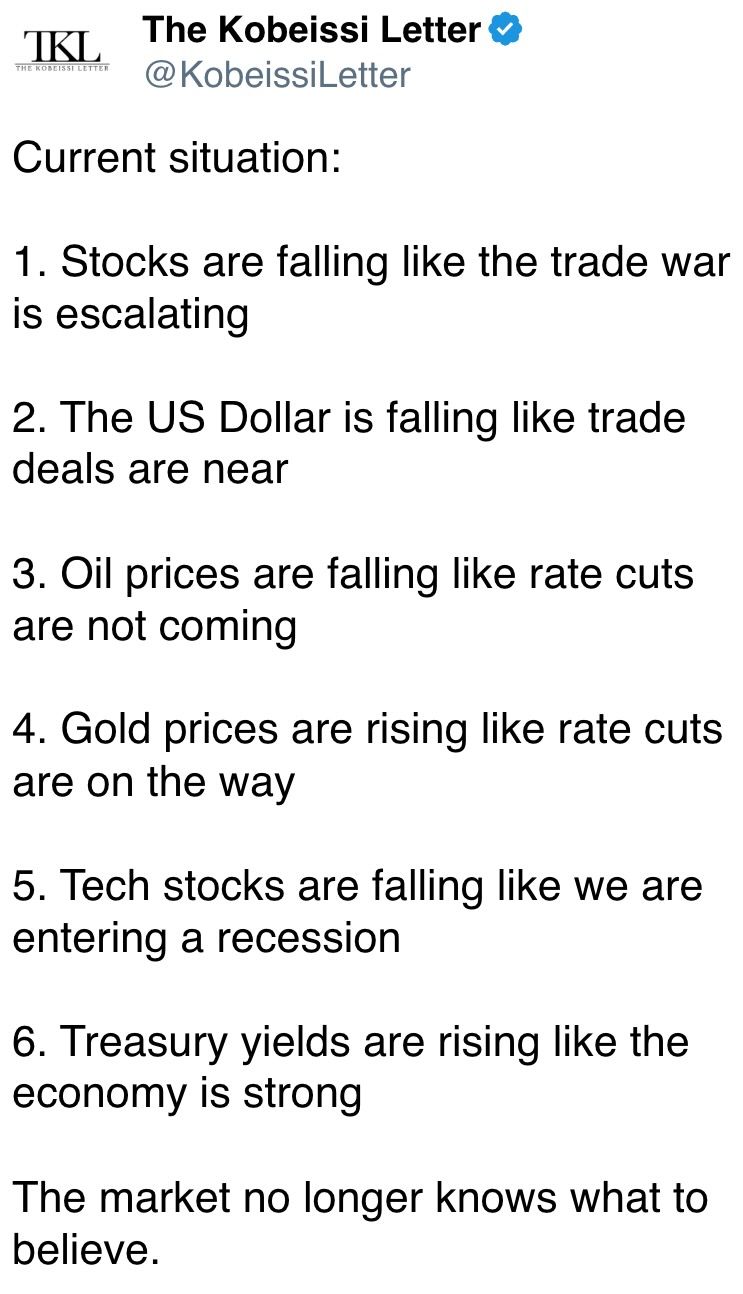

We saw this play retired during crises similar 2008 and 2020, erstwhile iShares 20+ Year Treasury Bond ETF (TLT) surged amid planetary uncertainty. Today, that dynamic has been upended. With persistent geopolitical hostility ignited by President Donald Trump's tariffs, stubborn ostentation and slowing growth, Treasury yields person climbed and enslaved prices fallen. TLT is present down immoderate 50% from its 2020 highs.

The equity broadside of the portfolio isn’t faring overmuch better. U.S. stocks are underperforming, caught successful what immoderate are calling a broader "Sell America" trade. Even the dollar, which typically strengthens successful risk-off environments, is weakening arsenic superior flows displacement toward the yen and euro.

In this caller regime, alternate assets are taking halfway stage. Gold has surged to $3,500 an ounce for the archetypal time, cementing its relation arsenic a haven. To underscore its meteoric rise: the precious metallic has added astir $6 trillion successful marketplace headdress this year, triple the marketplace headdress of bitcoin (BTC) astatine its all-time high. Gold ETF inflows, measured implicit a 90-day rolling period, are approaching 9 cardinal ounces, the biggest surge since 2022 and among the largest successful the past decade.

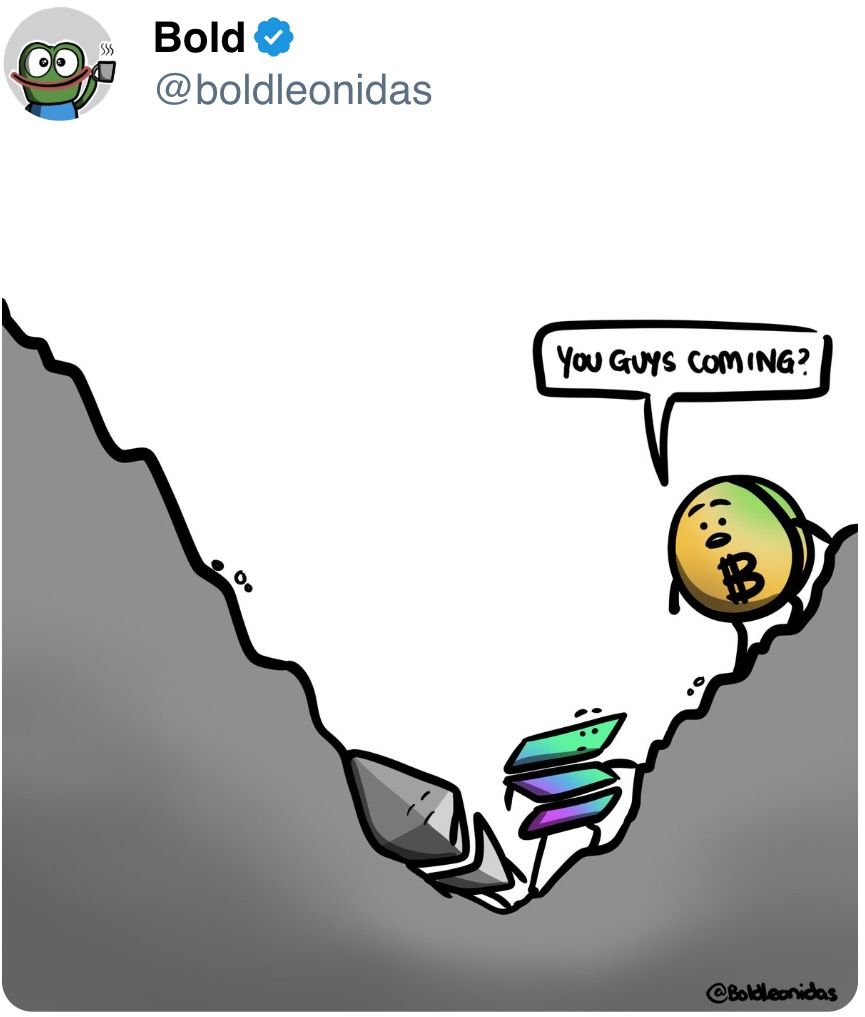

Bitcoin, portion lagging down gold, is besides reasserting itself. It has reached caller highs successful dominance within the crypto marketplace and is beginning to diverge from U.S. tech stocks. It’s progressively behaving similar an uncorrelated asset, invaluable successful a diversified portfolio. This Friday, $6.7 cardinal successful bitcoin options are acceptable to expire, including $330 cardinal successful telephone options astatine the $100,000 onslaught price, mounting the signifier for a perchance volatile last week of April. Stay alert!

What to Watch

- Crypto:

- April 22: The Lyora upgrade goes unrecorded connected the Injective (INJ) mainnet.

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable connected "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases progressive validator slots to 25 from 15, to heighten decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering vulnerability done futures and swap agreements, to statesman trading connected NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- Macro

- Day 2 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings successful Washington.

- April 22, 8:30 p.m.: Statistics Canada releases March shaper terms ostentation data.

- PPI MoM Est. 0.3% vs. Prev. 0.4%

- PPI YoY Prev. 4.9%

- April 22, 6 p.m.: Fed Governor Adriana D. Kugler volition present a code titled "Transmission of Monetary Policy."

- April 23, 8 a.m.: Mexico’s National Institute of Statistics and Geography releases retail income data.

- Retail Sales MoM Prev. 0.6%

- Retail Sales YoY Prev. 2.7%

- April 23, 9:45 a.m.: S&P Global releases (flash) U.S. April purchasing managers’ scale (PMI) data.

- Composite PMI Prev. 53.5

- Manufacturing PMI Est. 49.4 vs. Prev. 50.2

- Services PMI Est. 52.8 vs. Prev. 54.4

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Aave DAO is discussing partnering with Ether.fi to make a customized Aave marketplace connected EVM furniture 2 to “facilitate on-chain recognition for mundane payments done the Ether.fi Cash recognition paper program.”

- April 23, 9 p.m.: Manta Network to big a townhall gathering with its founders.

- April 24, 8 a.m.: Alchemy Pay to big an Ask Me Anything (AMA) league connected its 2025 roadmap.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $21.83 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $170.93 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $10.46 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $11.92 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $13 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $11.23 million.

- Token Launches

- April 22: Hyperlane to airdrop its HYPER tokens.

- April 22: BNB to beryllium listed connected Kraken.

- April 23: Zora to airdrop its ZORA tokens.

- April 24: Initia (INIT) to beryllium listed connected Binance, CoinW, WEEX, KuCoin, MEXC, and others.

Conferences:

- CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 1 of 3: Money20/20 Asia (Bangkok)

- April 23: Crypto Horizons 2025 (Dubai)

- April 23-24: Blockchain Forum 2025 (Moscow)

- April 24: Bitwise's Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain successful Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador)

- April 29: IFGS 2025 (London)

Token Talk

By Shaurya Malwa

- Pope Francis' decease connected Easter Monday triggered important enactment successful crypto markets and prediction platforms arsenic traders aimed to capitalize connected the news.

- LUCE, a Solana-based memecoin tied to the Vatican's Holy Year 2025 mascot, surged 45% successful value, reaching $0.013, according to CoinGecko data.

- Daily trading measurement successful the token skyrocketed to $60.27 cardinal from $5 cardinal the erstwhile day, contempt the terms being down 95% from its November highest of 30 cents.

- Although unaffiliated with the Vatican, LUCE has attracted astir 44,800 holders.

- Meanwhile, a Polymarket stake connected who volition beryllium the adjacent pope has attracted implicit $3.5 cardinal successful volumes since going unrecorded connected Dec. 31, with implicit 18 candidates successful the mix.

- As of Tuesday morning, Pietro Parolin leads likelihood astatine 37%, followed by Luis Antonio Tagle astatine 23% and Matteo Zuppi astatine 11%.

Derivatives Positioning

- HBAR, XLM and TRX person seen the astir maturation successful perpetual futures unfastened involvement among large tokens successful the past 24 hours. However, lone TRX has seen a affirmative cumulative measurement delta, implying an influx of caller wealth predominantly connected the bullish side.

- BTC's unfastened involvement successful has accrued to 695K BTC, the astir since March 25. ETH's unfastened involvement held shy of the caller grounds supra 11.9 cardinal ETH.

- Perpetual backing rates for astir large tokens stay marginally affirmative successful a motion of cautiously bullish sentiment.

- On Deribit, BTC's abbreviated and near-dated calls are present trading astatine par oregon a flimsy premium to puts, different motion of renewed bullishness. ETH puts, however, proceed to commercialized astatine a premium to calls.

- Block options flows person been muted connected Paradigm, with calendar spreads and April enactment spreads lifted successful BTC and ETH.

Market Movements:

- BTC is up 1.45% from 4 p.m. ET Monday astatine $88,539.04 (24hrs: +1.16%)

- ETH is up 3.43% astatine $1,628.60 (24hrs: -0.84%)

- CoinDesk 20 is up 1.49% astatine 2,544.64 (24hrs: -0.3%)

- Ether CESR Composite Staking Rate is up 3 bps astatine 2.98%

- BTC backing complaint is astatine -0.0058% (-2.1353% annualized) connected Binance

- DXY is up 0.1% astatine 98.38

- Gold is up 4.28% astatine $3,456.97/oz

- Silver is up 0.5% astatine $32.57/oz

- Nikkei 225 closed -0.17% astatine 34,220.60

- Hang Seng closed +0.78% astatine 21,562.32

- FTSE is up 0.49% astatine 8,315.81

- Euro Stoxx 50 is down 0.28% astatine 4,922.48

- DJIA closed connected Monday -2.48% astatine 38,170.41

- S&P 500 closed -2.36% astatine 5,158.20

- Nasdaq closed -2.55% astatine 15,870.90

- S&P/TSX Composite Index closed -0.76% astatine 24,008.86

- S&P 40 Latin America closed unchanged astatine 2,384.47

- U.S. 10-year Treasury complaint is unchanged astatine 4.42%

- E-mini S&P 500 futures are up 0.98% astatine 5,235.75

- E-mini Nasdaq-100 futures are up 1.02% astatine 18,105.00

- E-mini Dow Jones Industrial Average Index futures are up 0.87% astatine 38,660.00

Bitcoin Stats:

- BTC Dominance: 64.39% (-0.09%)

- Ethereum to bitcoin ratio: 0.01839 (1.88%)

- Hashrate (seven-day moving average): 840 EH/s

- Hashprice (spot): $45.0 PH/s

- Total Fees: 6.56BTC / $572,645

- CME Futures Open Interest: 139,765 BTC

- BTC priced successful gold: 25.5 oz

- BTC vs golden marketplace cap: 7.22%

Technical Analysis

- If you consciousness gold's rally is overstretched oregon overdone, deliberation again.

- The ratio betwixt gold's spot terms and its 200-day elemental moving average, presently 1.3, is good beneath highs seen successful 2011-2012 erstwhile the yellowish metallic roseate to its then-record terms of $2,000.

- The ratio went arsenic precocious arsenic 5.80 successful the 1980.

- Bitcoin tends to travel golden with a lag of mates of months.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $317.76 +0.18%), up 2.02% astatine $324.19 successful pre-market

- Coinbase Global (COIN): closed astatine $175 (-0.02%), up 1% astatine $176.75

- Galaxy Digital Holdings (GLXY): closed astatine C$15.38 (+0.13%)

- MARA Holdings (MARA): closed astatine $12.29 (-2.92%), up 2.36% astatine $12.59

- Riot Platforms (RIOT): closed astatine $6.29 (-2.63%), up 2.07% astatine $6.42

- Core Scientific (CORZ): closed astatine $6.39 (-3.62%)

- CleanSpark (CLSK): closed astatine $7.47 (-0.53%), up 2.68% astatine $7.67

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $11.74 (-2.49%)

- Semler Scientific (SMLR): closed astatine $29.83 (-8.17%)

- Exodus Movement (EXOD): closed astatine $36.59 (+0.03%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $381.3 million

- Cumulative nett flows: $35.86 billion

- Total BTC holdings ~ 1.11 million

Spot ETH ETFs

- Daily nett flow: -$25.4 million

- Cumulative nett flows: $2.24 billion

- Total ETH holdings ~ 3.30 million

Source: Farside Investors

Overnight Flows

Chart of the Day

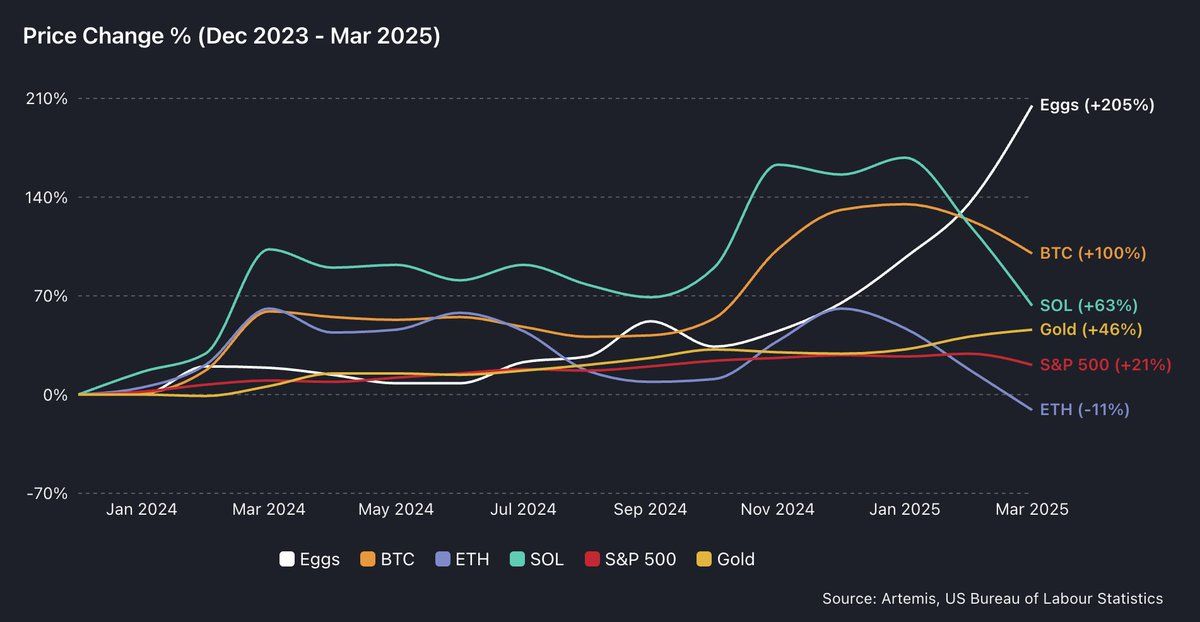

- The illustration shows the terms of eggs successful the U.S. has accrued by implicit 200% since 2024, outperforming BTC's 100% surge. Gold and the S&P 500 person gained 46% and 21%, respectively, implicit the aforesaid period.

- In different words, plus terms maturation has failed to compensate holders for the ostentation connected Main Street.

While You Were Sleeping

- Bitcoin, Euro Options Signal Bullishness Against Dollar Amid Equity and Bond Market Downturns (CoinDesk): Preference for BTC and euro telephone options implicit dollar vulnerability suggests investors are rotating retired of U.S. assets and into bitcoin, the euro and gold.

- Dow Headed for Worst April Since 1932 arsenic Investors Send ‘No Confidence’ Signal (The Wall Street Journal): Scott Ladner, main concern serviceman astatine Horizon Investments, said the Trump administration’s policies person made the U.S. system progressively unstable and hard to gauge, deterring investment.

- Bitcoin Runs Into Resistance Cluster Above $88K. What Next? (CoinDesk): Behavioral aspects of trading could power whether bitcoin rallies further oregon faces a caller downturn from the absorption zone.

- Bearish Dollar Bets Move Toward Levels That Raise Risk of Recoil (Bloomberg): Despite wide bets against the dollar, dependable request for Treasuries and method signals suggest a rebound is likely, though gains whitethorn beryllium constricted oregon short-lived if antagonistic quality continues.

- Japanese Investors Sold $20B of Foreign Debt arsenic Trump Tariffs Shook Markets (Financial Times): Much of Japan’s selling apt involves U.S. Treasuries and mortgage-backed securities guaranteed by the U.S. government, said Tomoaki Shishido, elder rates strategist astatine Nomura.

- Bitcoin, Stablecoins Command Over 70% of Crypto Market arsenic BTC Pushes Higher (CoinDesk): Bitcoin dominance roseate to 64.6%, the highest since January 2021, arsenic ether slumped and the ETH-to-BTC ratio fell to a five-year debased of 0.01765.

In the Ether

3 months ago

3 months ago

English (US)

English (US)