By Omkar Godbole (All times ET unless indicated otherwise)

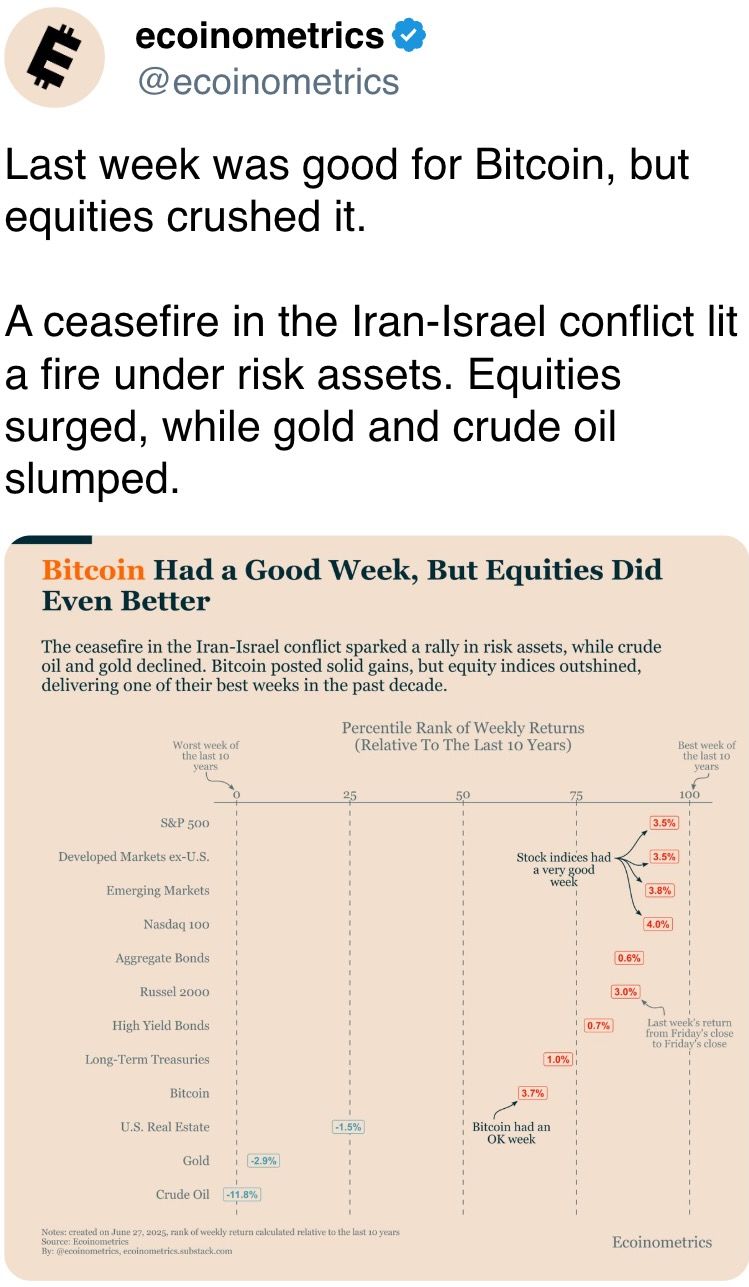

Bitcoin (BTC) ended June supra $107,000 astatine a grounds monthly close. Still, the largest crypto's 2.5% monthly summation failed to lucifer the euro's beforehand against the dollar, the astir liquid FX brace successful the world.

The eurozone currency roseate astir 4% against the greenback past month, hitting its highest since September 2021. That prompted immoderate traders to power to euro-pegged stablecoins, resulting successful a notable increase successful their marketplace values.

The euro's momentum highlights the continued broad-based diminution successful the U.S. currency, which means fiscal conditions volition apt stay easy, adjacent though the weakness hasn't done overmuch to assistance a directionless BTC.

The prolonged scope play has been wide attributed to selling by wallets with a past of holdings coins for implicit a year. The profit-taking continued connected Monday, with on-chain realized gains hitting the $2.4 cardinal mark.

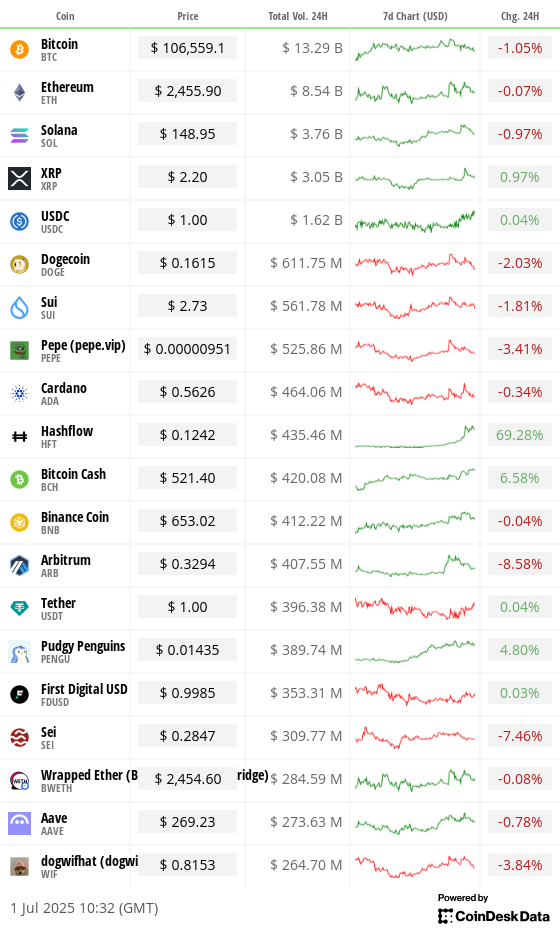

BTC was precocious trading 0.6% little implicit 24 hours astatine $106,500. Other tokens, including XRP, DOGE, SOL and ETH, followed suit, portion BCH, ALGO, and PAXG stood out.

Some analysts called for patience successful the aftermath of continued organization adoption. On Monday, Germany's savings slope web said it volition alteration crypto trading for clients wrong a year. Strategy disclosed different large BTC acquisition past week, acquiring $531 cardinal worthy of BTC.

"While short-term momentum has faded, medium-term signals stay bullish, particularly with firm treasuries accelerating their accumulation pace. We somewhat reduced vulnerability to support superior but stay constructive — particularly connected altcoins with country to drawback up," Valentin Fournier, pb probe expert astatine BRN.

That said, the 3rd 4th has historically been bitcoin's weakest. Moreover, liquidity tends to beryllium weaker arsenic good owed to summertime holidays, which raises the likelihood of exaggerated terms moves. Remember the yen-led clang successful BTC from $70,000 to $50,000 successful precocious July to aboriginal August past year? This calls for caution adjacent arsenic analysts support the semipermanent constructive outlook.

In different news, American Bitcoin, a crypto steadfast backed by Eric Trump, raised $220 cardinal to bargain bitcoin and mining equipment. An FTX creditor posted connected X that claims nether $50,000 received 120% payouts successful February and May 2025.

Bloomberg ETF analysts James Seyffart and Eric Balchunas said that there's a 95% accidental the U.S. SEC volition o.k. spot ETFs for LTC and XRP this year.

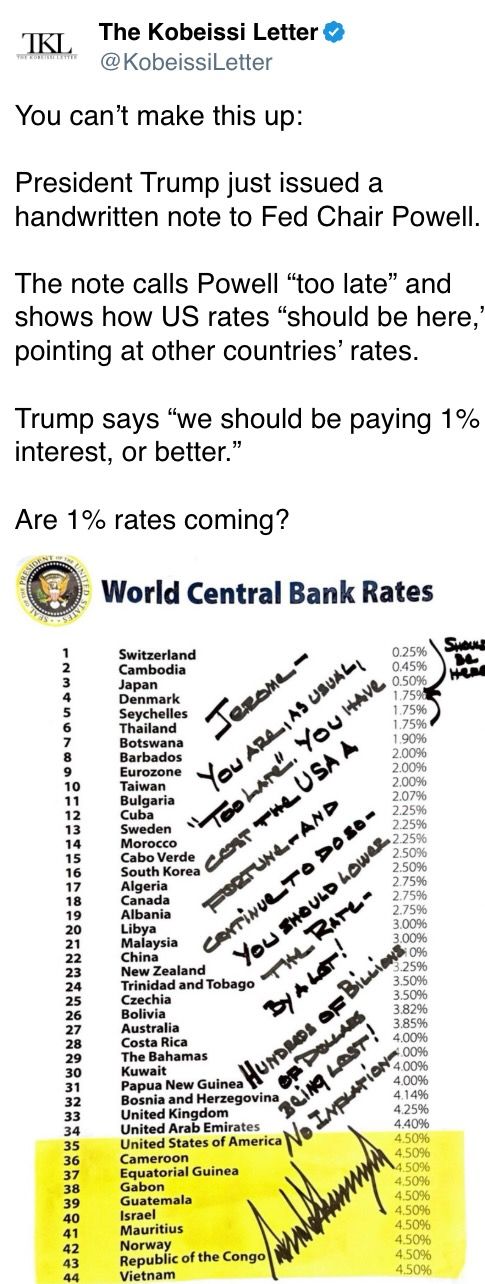

In accepted markets, analysts awaited the Fed Chairman Jerome Powell's code aboriginal Tuesday and Friday's nonfarm payrolls. Stay alert!

What to Watch

- Crypto

- July 2: Shares of the REX-Osprey Solana Staking ETF (tSSK) are expected to statesman trading connected the Cboe BZX Exchange, making this the archetypal U.S.-listed ETF to harvester SOL terms vulnerability with on-chain staking rewards.

- Macro

- Day 2 of 3: ECB Forum connected Central Banking (Sintra, Portugal)

- July 1, 9 a.m.: S&P Global releases June Brazil information connected manufacturing and services activity.

- Manufacturing PMI Prev. 49.4

- July 1, 9:30 a.m.: “High Level Policy Panel” treatment chaired by Fed Chair Jerome H. Powell astatine the ECB Forum connected Central Banking successful Sintra, Portugal. Livestream link.

- July 1, 9:45 a.m.: S&P Global releases (final) June U.S. information connected manufacturing and services activity.

- Manufacturing PMI Est. 52 vs. Prev. 52

- July 1, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services assemblage data.

- Manufacturing PMI Est. Est. 48.8 vs. Prev. 48.5

- July 1, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labour marketplace information (i.e. the JOLTS report).

- Job Openings Est. 7.3M vs. Prev. 7.391M

- Job Quits Prev. 3.194M

- July 2, 9:30 a.m.: S&P Global releases June Canada information connected manufacturing and services activity.

- Manufacturing PMI Prev. 46.1

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Non Farm Payrolls Est. 110K vs. Prev. 139K

- Unemployment Rate Est. 4.3% vs. Prev. 4.2%

- Government Payrolls Prev. -1K

- Manufacturing Payrolls Est. -6K vs. Prev. -8K

- July 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended June 28.

- Initial Jobless Claims Est. 240K vs. Prev. 236K

- Continuing Jobless Claims Est. 1960K vs. Prev. 1974K

- July 3, 9 a.m.: S&P Global releases June Brazil information connected manufacturing and services activity.

- Composite PMI Prev. 49.1

- Services PMI Prev. 49.6

- July 3, 9:45 a.m.: S&P Global releases (final) June U.S. information connected manufacturing and services activity.

- Composite PMI Est. 52.8 vs. Prev. 53

- Services PMI Est. 53.1 vs. Prev. 53.7

- July 3, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services assemblage data.

- Services PMI Est. 50.5 vs. Prev. 49.9

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- GnosisDAO is voting connected renewing its concern with Nethermind for Gnosis Chain attraction and development, proposing 750,000 DAI backing for the archetypal twelvemonth from June, with 4% yearly increases. Voting ends July 2.

- Radiant DAO is voting on perchance compensating users whose wallets were drained via unlimited token approvals successful the October 2024 hack. If passed, a follow-up program would outline stablecoin conversions, assertion contracts connected Arbitrum, and phased repayments. Voting ends July 2.

- Arbitrum DAO is voting connected lowering the law quorum threshold from 5% to 4.5% of votable tokens. This aims to lucifer decreased elector information and assistance well-supported proposals walk much easily, without affecting non-constitutional proposals, which stay astatine a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- Unlocks

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $122.75 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $10.59 million.

- July 11: Immutable (IMX) to unlock 1.31% of its circulating proviso worthy $10.65 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating proviso worthy $52.7 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $14.42 million.

- July 15: Sei (SEI) to unlock 1% of its circulating proviso worthy $15.73 million.

- July 16: Arbitrum (ARB) to unlock 1.87% of its circulating proviso worthy $30.33 million.

- Token Launches

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER), and LTO Network (LTO) to beryllium delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- Day 2 of 4: Ethereum Community Conference (Cannes, France)

- Day 2 of 6: World Venture Forum 2025 (Kitzbühel, Austria)

- Day 1 of 6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Francisco Rodrigues

- While each eyes were connected the instauration of Robinhood’s tokenized stocks and connected Kraken and Bybit’s xStocks debut, a layer-2 web built to streamline DeFi quietly launched its mainnet yesterday.

- Katana’s mainnet went unrecorded aft it saw pre-deposits adjacent $250 million, according to DeFiLlama data. The blockchain is backed by GSR and Polygon Labs.

- The non-profit Katana Foundation says the concatenation attacks 3 chronic symptom points: bladed liquidity, erratic yields and superior flight. It does truthful by folding output procreation into the basal layer.

- When users span USDC, ETH, WBTC, AUSD oregon USDT, Katana’s VaultBridge pushes those funds into lending pools specified arsenic those connected Morpho and Sushi, past sends the net backmost to depositors and app builders.

- A abstracted mechanics called chain-owned liquidity captures transaction fees to bankroll the web implicit time.

- Katana is distributing its autochthonal token, KAT, done liquidity mining. KAT is non-transferable for now, but the squad expects an speech listing by adjacent year. Holders volition beryllium capable to fastener tokens for vKAT and stock successful staking rewards.

Derivatives Positioning

- Perpetual backing rates for astir tokens large tokens, including BTC and ETH, held marginally positive. XRP led with adjacent 10% rates portion XLM and ADA showed bias for shorts with sub-zero readings.

- On the CME, BTC and ETH futures ground remained locked successful the annualized 7% to 10% range.

- On Deribit, hazard reversals retired to August-end expiry showed a bias for protective puts, with consequent tenors showing a mild bias for calls. In ETH's case, bearishness successful the short-term tenors was much pronounced.

- Block flows implicit the OTC table Paradigm showed request for the September expiry BTC $180K telephone option.

Market Movements

- BTC is down 0.91% from 4 p.m. ET Monday astatine $106,629.81 (24hrs: -0.96%)

- ETH is down 1.81% astatine $2,458.53 (24hrs: +0.15%)

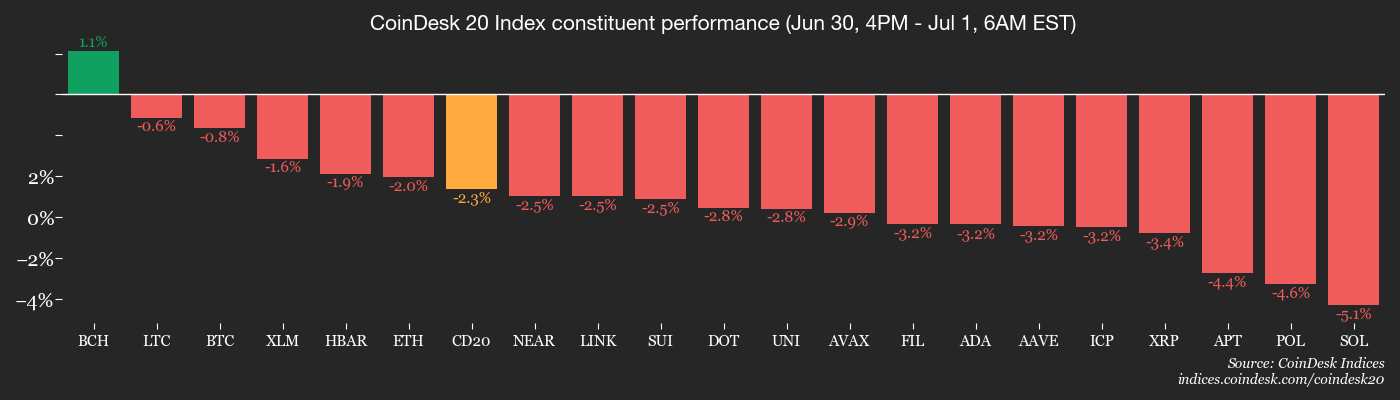

- CoinDesk 20 is down 2.37% astatine 3,010.77 (24hrs: -0.17%)

- Ether CESR Composite Staking Rate is up 7 bps astatine 2.96%

- BTC backing complaint is astatine 0.0048% (5.3042% annualized) connected Binance

- DXY is down 0.47% astatine 96.42

- Gold futures are up 1.49% astatine $3,357.10

- Silver futures are up 1.81% astatine $36.50

- Nikkei 225 closed down 1.24% astatine 39,986.33

- Hang Seng closed down 0.87% astatine 24,072.28

- FTSE is down 0.17% astatine 8,745.89

- Euro Stoxx 50 is down 0.30% astatine 5,287.47

- DJIA closed connected Monday up 0.63% astatine 44,094.77

- S&P 500 closed up 0.52% astatine 6,204.95

- Nasdaq Composite closed up 0.47% astatine 20,369.73

- S&P/TSX Composite closed up 0.62% astatine 26,857.11

- S&P 40 Latin America closed up 1.41% astatine 2,694.58

- U.S. 10-Year Treasury complaint is down 2.9 bps astatine 4.197%

- E-mini S&P 500 futures are down 0.26% astatine 6,237.50

- E-mini Nasdaq-100 futures are down 0.33% astatine 22,817.75

- E-mini Dow Jones Industrial Average Index are down 0.13% astatine 44,331.00

Bitcoin Stats

- BTC Dominance: 65.34% (0.19%)

- Ethereum to bitcoin ratio: 0.02307 (-0.6%)

- Hashrate (seven-day moving average): 869 EH/s

- Hashprice (spot): $57.97

- Total Fees: 4.22 BTC / $455,433

- CME Futures Open Interest: 147,470 BTC

- BTC priced successful gold: 32.2 oz

- BTC vs golden marketplace cap: 9.12%

Technical Analysis

- BTC fell 1% Monday, narrowly missing the bull emblem breakout. The diminution produced a bearish extracurricular time candle, with a terms scope wider than the preceding day's candle.

- Bearish extracurricular time candles appearing aft notable terms gains, arsenic successful BTC's case, awesome renewed bearish trends.

Crypto Equities

- Strategy (MSTR): closed connected Monday astatine $404.23 (+5.3%), -1.64% astatine $397.59 successful pre-market

- Coinbase Global (COIN): closed astatine $350.49 (-0.83%), -1.53% astatine $345.12

- Circle (CRCL): closed astatine $181.29 (+0.48%), +1.98% astatine $184.88

- Galaxy Digital (GLXY): closed astatine $21.90 (+9.66%), +3.47% astatine $22.66

- MARA Holdings (MARA): closed astatine $15.68 (+4.32%), -1.85% astatine $15.39

- Riot Platforms (RIOT): closed astatine $11.3 (+7.11%), -1.59% astatine $11.12

- Core Scientific (CORZ): closed astatine $17.07 (+2.52%), -1.52% astatine $16.81

- CleanSpark (CLSK): closed astatine $11.03 (+3.37%), -1.81% astatine $10.83

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $22.74 (+4.74%)

- Semler Scientific (SMLR): closed astatine $38.74 (+0.62%), +0.15% astatine $38.80

- Exodus Movement (EXOD): closed astatine $28.83 (-3.42%), +1.14% astatine $29.16

ETF Flows

Spot BTC ETFs

- Daily nett flows: $102.1 million

- Cumulative nett flows: $48.95 billion

- Total BTC holdings ~1.25 million

Spot ETH ETFs

- Daily nett flows: $31.8 million

- Cumulative nett flows: $4.23 billion

- Total ETH holdings ~4.1 million

Source: Farside Investors

Overnight Flows

Chart of the Day

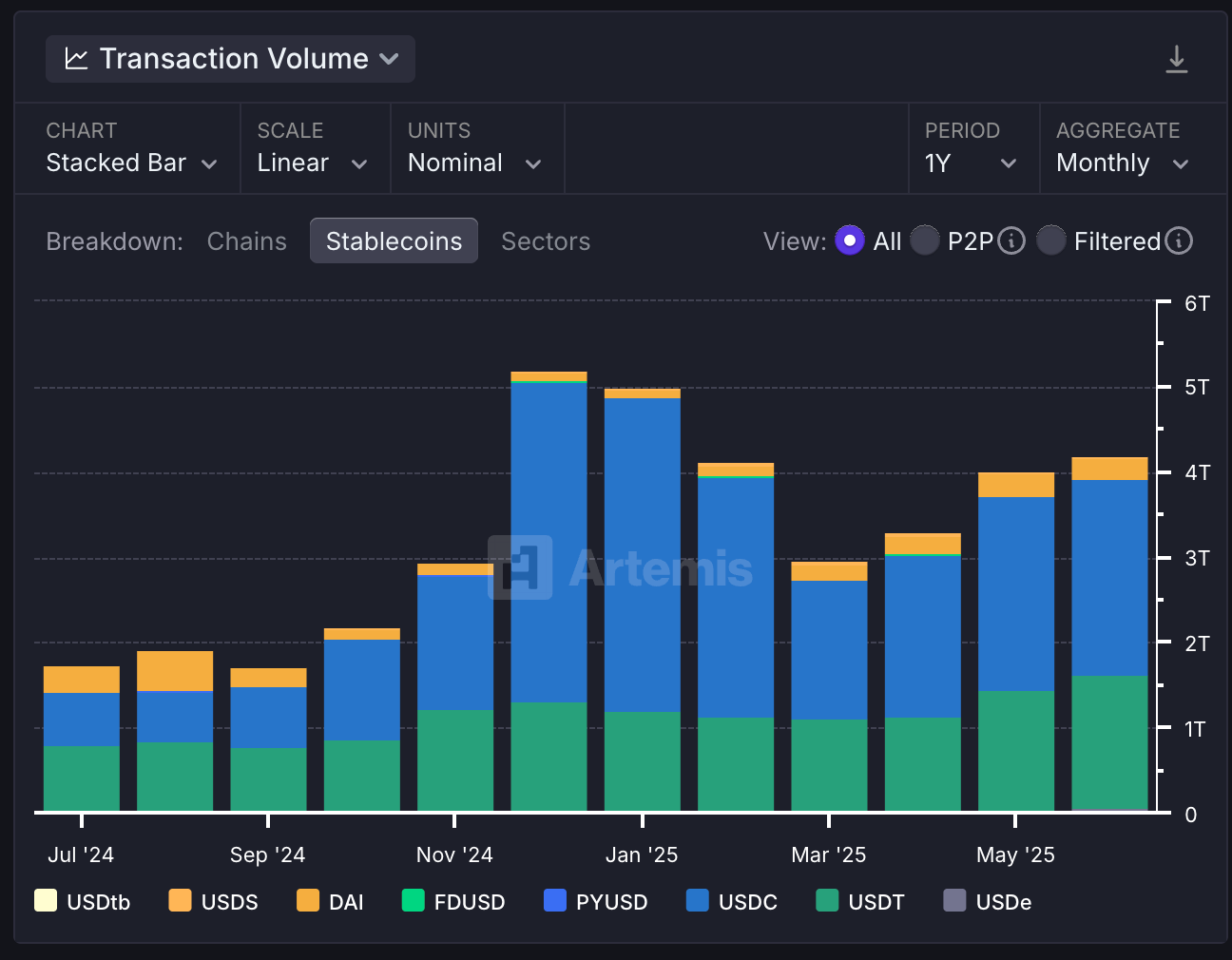

- The dollar worth of the full stablecoin transactions crossed supra the $4 trillion people successful June, the astir since January, according to information root Artemis.

- The information shows that portion BTC's terms didn't bash overmuch successful the month, adoption of stablecoin continued unabated.

While You Were Sleeping

- Mexico and Brazil Seek Deeper Trade Ties to Expand Beyond US and China (Financial Times): Trump-era tariffs and caller leftist governments person created a uncommon opening for Latin America’s 2 largest economies to revisit a constricted commercialized pact and research deeper commercialized integration.

- Trump Crypto Venture Raises $220 Million for Bitcoin Mining (Bloomberg): American Bitcoin raised $220 cardinal from backstage investors including $10 cardinal successful bitcoin. Majority proprietor Hut 8 Corp. plans to instrumentality it nationalist done a merger with Gryphon Digital Mining.

- XRP, TRX, DOGE Lead Majors With Positive Funding Rates arsenic Bitcoin's Traditionally Weak Quarter Begins (CoinDesk): Perpetual backing rates bespeak a bullish sentiment for apical altcoins, with XRP showing the strongest demand, portion rates for marketplace leaders bitcoin and ether are marginally positive.

- Robinhood, Kraken-Backed Global Dollar (USDG) Comes to Europe (CoinDesk): USDG is regulated by the EU’s Markets successful Crypto-Assets (MiCA) framework, Finland’s Financial Supervisory Authority and Singapore’s Monetary Authority. MiCA requires issuer Paxos to clasp reserves with European banking partners.

- The Dollar Has Its Worst Start to a Year Since 1973 (The New York Times): Trump’s tariff policy, rising nationalist debt, and the moves toward de-dollarization person reduced the dollar’s appeal, adjacent amid precocious involvement rates and a booming banal market.

- ARK Invest Sold $95M of Coinbase Shares After COIN's Surge to Record Highs (CoinDesk): Monday’s $43.8 cardinal merchantability brings ARK’s full to 270,984 COIN shares offloaded implicit 3 sessions, arsenic the stock’s surge supra $380 triggered income to support COIN nether 10% successful its ETFs.

In the Ether

4 months ago

4 months ago

English (US)

English (US)