By Francisco Rodrigues (All times ET unless indicated otherwise)

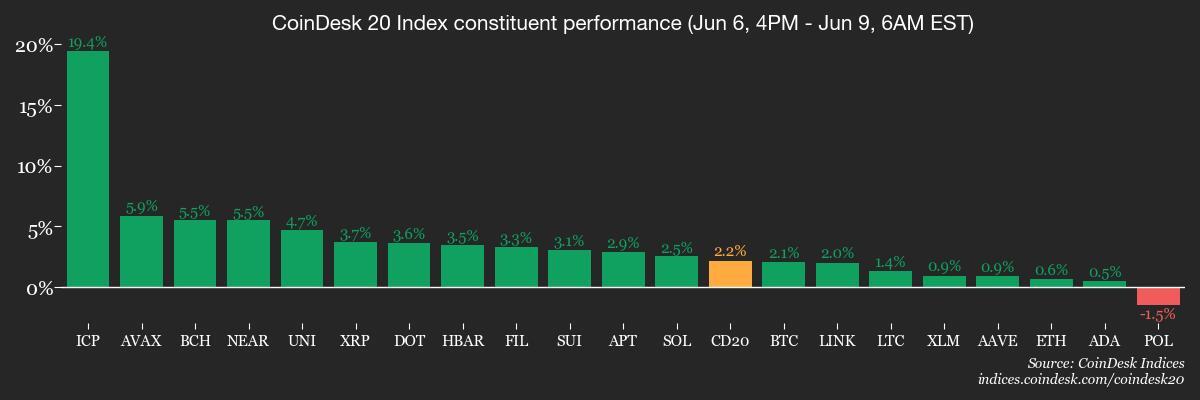

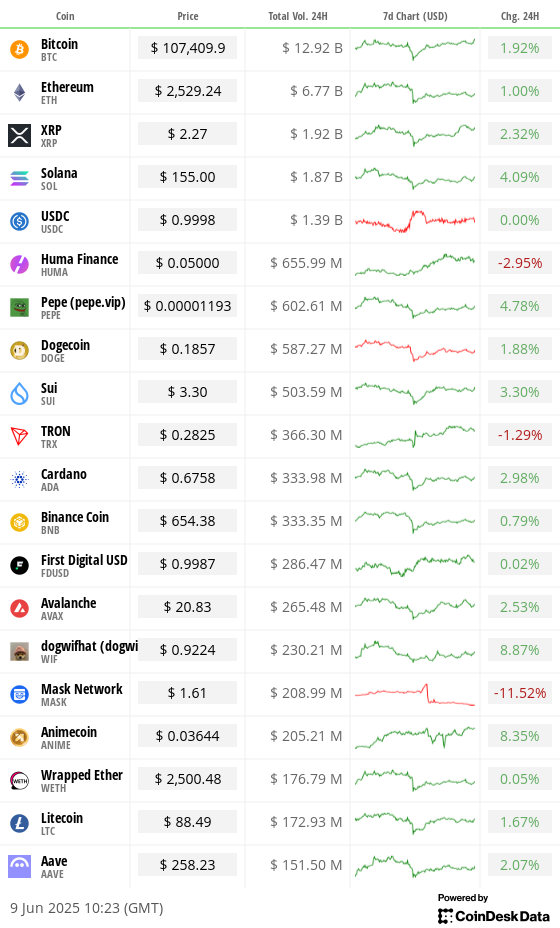

Bitcoin BTC roseate implicit the weekend, offering a reprieve aft a week of marketplace jitters. It is present trading astir $106,600 aft gaining 1.2% successful the past 24 hours, portion the broader CoinDesk 20 (CD20) scale added astir 1.7%.

The betterment appeared driven little by headlines and much their absence, marking a displacement from the nationalist feud betwixt U.S. President Donald Trump and Tesla CEO Elon Musk that rattled investors. As tensions cooled, markets recovered.

Even developments that mightiness beryllium seen arsenic antagonistic did not look to sway markets. These see Taiwan-based crypto speech BitoPro confirming being hacked, and information from Blockchain.com showing a slowdown successful BTC’s web enactment to the lowest level successful a year.

Meanwhile, the Hang Seng scale jumped 1.6% arsenic traders reacted to U.S. President Donald Trump expressing optimism for talks with China successful London that commencement today, saying the meeting “should spell precise well.”

Still, concerns are mounting implicit deflation successful China. Consumer prices fell 0.1% year-over-year successful May and mill gross prices dropped 3.3%, the steepest diminution since October 2022.

The People's Bank of China has already responded by trimming involvement rates, reducing reserve requirements, and injecting liquidity into the market. That whitethorn yet payment cryptocurrencies, which often commercialized successful tandem with liquidity conditions successful accepted markets.

All that whitethorn recede successful value connected Wednesday, erstwhile the U.S. announces the latest ostentation figures. May’s user terms scale study is expected to amusement a emergence successful halfway ostentation to 2.9%, up from 2.8% successful April.

A stronger-than-expected speechmaking could hold the Federal Reserve’s adjacent complaint chopped and inject volatility crossed fiscal markets.

In a enactment published Monday, Spanish slope Bankinter warned that rising ostentation and U.S. enslaved yields could unit equity valuations and weaken the "fear of missing out" momentum that’s been propping up planetary stocks and different hazard assets.

The output connected the 10-year Treasury has already climbed to 4.5%, a level that could statesman to measurement connected marketplace sentiment if ostentation surprises to the upside. Crypto markets, for now, are caught successful the crossfire. Stay alert!

What to Watch

- Crypto

- June 9, 1-5 p.m.: U.S. SEC Crypto Task Force roundtable connected "DeFi and the American Spirit"

- June 10, 10 a.m.: U.S. House Final Services Committee hearing for Markup of Various Measures, including the crypto marketplace operation bill, i.e. the Digital Asset Market Clarity (CLARITY) Act.

- June 11, 7 a.m.: Stratis (STRAX) activates mainnet hard fork astatine artifact 2,587,200 to alteration the Masternode Staking protocol.

- June 16: 21Shares executes a 3-for-1 stock split for ARK 21Shares Bitcoin ETF (ARKB); ticker and NAV stay unchanged.

- June 16: Brazil’s B3 speech launches USD-settled ether (0.25 ETH) and solana (5 SOL) futures contracts, approved by Brazil’s securities regulator, the Comissão de Valores Mobiliários (CVM) and benchmarked to Nasdaq indices.

- Macro

- June 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases May user terms ostentation data.

- Core Inflation Rate MoM Prev. 0.49%

- Core Inflation Rate YoY Prev. 3.93%

- Inflation Rate MoM Prev. 0.33%

- Inflation Rate YoY Prev. 3.93%

- June 10, 2 a.m.: The U.K.'s Office for National Statistics releases April employment data.

- Unemployment Rate Est. 4.6% vs. Prev. 4.5%

- Employment Change Prev. 112K

- June 10, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May user terms ostentation data.

- Inflation Rate MoM Prev. 0.43%

- Inflation Rate YoY Prev. 5.53%

- June 11, 8:30 a.m.: The U.S. Bureau of Labor Statistics (BLS) releases May user terms ostentation data.

- Core Inflation Rate MoM Est. 0.3% vs. Prev. 0.2%

- Core Inflation Rate YoY Est. 2.9% vs. Prev. 2.8%

- Inflation Rate MoM Est. 0.2% vs. Prev. 0.2%

- Inflation Rate YoY Est. 2.5% vs. Prev. 2.3%

- June 9, 8 a.m.: Mexico’s National Institute of Statistics and Geography (INEGI) releases May user terms ostentation data.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- ApeCoin DAO is weighing scrapping the decentralized autonomous organization and launching ApeCo to “supercharge the APE ecosystem.”

- Optimism DAO is voting to o.k. eligibility criteria for the Milestones and Metrics (M&M) Council successful Seasons 8 and 9, introducing a exemplary where members are selected “based connected competencies alternatively than elections.” Voting ends June 11.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- June 11, 7 a.m.: Cronos Labs pb Mirko Zhao to enactment successful a assemblage Ask Me Anything (AMA) session.

- Unlocks

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $53.61 million.

- June 13: Immutable (IMX) to unlock 1.33% of its circulating proviso worthy $12.82 million.

- June 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $16.90 million.

- June 15: Sei (SEI) to unlock 1.04% of its circulating proviso worthy $10.59 million.

- June 16: Arbitrum (ARB) to unlock 1.91% of its circulating proviso worthy $32.21 million.

- June 17: ZKsync (ZK) to unlock 20.91% of its circulating proviso worthy $41.25 million.

- June 17: ApeCoin (APE) to unlock 1.95% of its circulating proviso worthy $10.88 million.

- Token Launches

- June 9: Skate (SKATE) to beryllium listed connected Binance, Bybit, MEXC,KuCoin, Bitget and others.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- June 14: Incrypted Crypto Conference 2025 (Kyiv)

- June 18-19: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Francisco Rodrigues

- Skate, a blockchain infrastructure furniture focused connected unifying liquidity crossed decentralized networks, is introducing its SKATE token today.

- The Token Generation Event (TGE) marks the nationalist debut of the token, with listings connected Binance Alpha, Bybit and MEXC.

- Formerly known arsenic Range Protocol, Skate is gathering a framework that allows decentralized applications (dapps) to tally crossed aggregate virtual machines similar Ethereum, Solana and TON without needing abstracted deployments.

- The token lies astatine the bosom of the system, supporting governance, staking and liquidity proviso done the network’s automated marketplace shaper (AMM).

- Out of a fixed 1 cardinal token supply, 10% is being distributed via airdrops to aboriginal users, ecosystem contributors and NFT run participants. Claiming and staking the tokens instantly whitethorn boost rewards by 30%.

- MEXC’s pre-market trading started connected June 4, with prices initially jumping 33% to $0.20 earlier dropping backmost down to $0.12 astatine the clip of writing.

Derivatives Positioning

- BTC options unfastened involvement connected Deribit is $32.9B, with calls importantly outweighing puts astatine 200,000 contracts versus 110,000.

- The put/call measurement ratio stands astatine 0.54, indicating continued request for upside exposure. The $140K onslaught leads each others with 16,100 calls open, representing $1.79B successful notional value.

- The 27 June expiry is the main focal point, accounting for $13.1B successful notional unfastened involvement oregon 41% of the total. Daily notional travel is highest astatine this expiry with $206M traded, followed by $194M astatine the 13 June expiry.

- Monday travel information from Deribit shows 31% of contracts were calls bought and 17% were puts bought. The remainder of the enactment came from telephone and enactment selling, suggesting traders are combining bullish positioning with output strategies astatine higher strikes.

- Coinglass liquidation heatmaps amusement precocious concentrations of agelong leverage adjacent $104K and $107K. A full of $39M successful liquidation leverage is stacked astir $104.7K, making it a cardinal downside level to ticker for imaginable forced selling.

- Funding rates from Velo are steady, with BTC annualized backing holding adjacent 6.2%. This reflects a moderately bullish stance, with nary signs of excessive leverage successful perpetual markets.

Market Movements

- BTC is up 2% from 4 p.m. ET Friday astatine $106,743.74 (24hrs: +1.19%)

- ETH is up 0.5% astatine $2,514.74 (24hrs: +0.29%)

- CoinDesk 20 is up 2.18% astatine 3,088.96 (24hrs: +1.36%)

- Ether CESR Composite Staking Rate is down 18 bps astatine 2.94%

- BTC backing complaint is astatine 0.006% (6.5667% annualized) connected Binance

- DXY is down 0.31% astatine 98.89

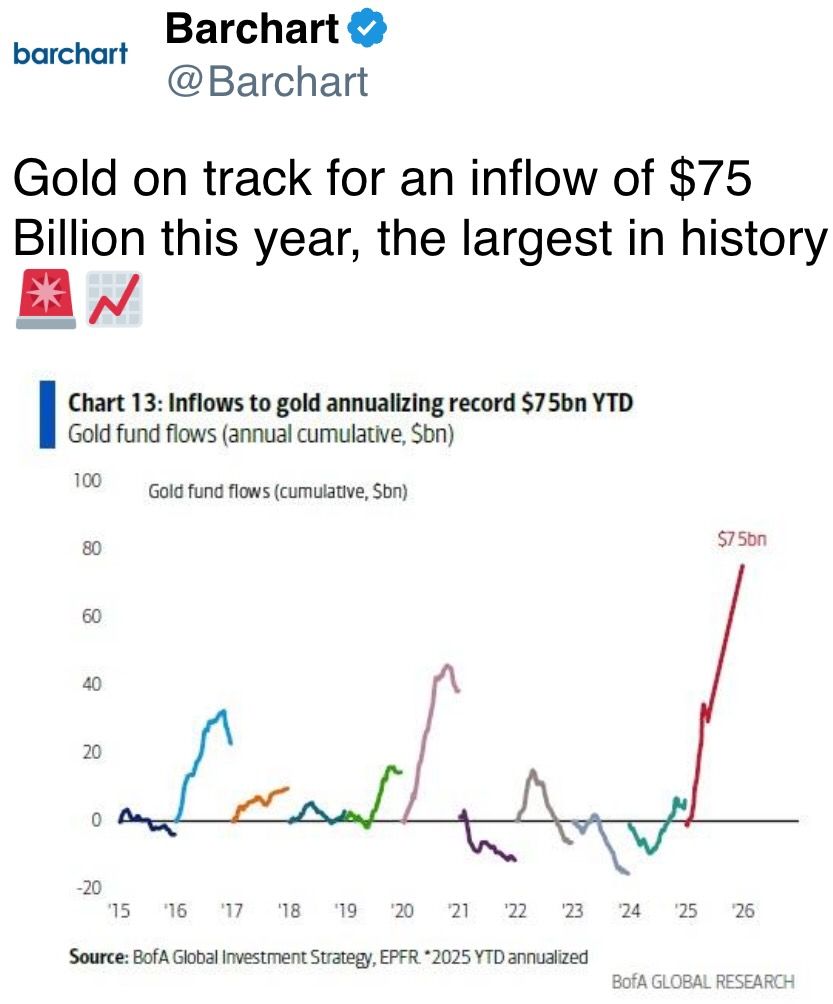

- Gold futures are down 0.16% astatine $3,341.10

- Silver futures are up 0.87% astatine $36.46

- Nikkei 225 closed up 0.92% astatine 38,088.57

- Hang Seng closed up 1.63% astatine 24,181.43

- FTSE is down 0.11% astatine 8,827.95

- Euro Stoxx 50 is up 0.16% astatine 5,418.96

- DJIA closed connected Friday up 1.05% astatine 42,762.87

- S&P 500 closed up 1.03% astatine 6,000.36

- Nasdaq Composite closed up 1.20% astatine 19,529.95

- S&P/TSX Composite closed up 0.33% astatine 26,429.13

- S&P 40 Latin America closed +0.36% astatine 2,584.58

- U.S. 10-Year Treasury complaint is down 2 bps astatine 4.49%

- E-mini S&P 500 futures are unchanged astatine 6,011.50

- E-mini Nasdaq-100 futures are unchanged astatine 21,784.00

- E-mini Dow Jones Industrial Average Index are unchanged astatine 42,840.00

Bitcoin Stats

- BTC Dominance: 64.7 (+0.19%)

- Ethereum to bitcoin ratio: 0.02355 (-0.80%)

- Hashrate (seven-day moving average): 872 EH/s

- Hashprice (spot): $52.77

- Total Fees: 3.17 BTC / $335,041

- CME Futures Open Interest: 148,080

- BTC priced successful gold: 31.8 oz

- BTC vs golden marketplace cap: 9.01%

Technical Analysis

- Bitcoin has reclaimed the 20-day exponential moving mean (EMA) connected the regular timeframe aft retesting the 50-day EMA for the archetypal clip since its breakout from $85,000. Price enactment has breached retired of the downward trendline, signaling a imaginable displacement successful momentum.

- However, it remains wrong a cardinal regular bid block, which whitethorn enactment arsenic resistance.

- For a bullish continuation, it's important for the BTC terms to clasp supra these reclaimed EMAs and unafraid a play adjacent supra $109,400, which would invalidate the existent play plaything nonaccomplishment signifier and corroborate the cryptocurrency's strength.

Crypto Equities

- Strategy (MSTR): closed connected Friday astatine $374.47 (+1.54%), +1.87% astatine $381.49 successful pre-market

- Coinbase Global (COIN): closed astatine $251.27 (+2.9%), +1.52% astatine $255.10

- Circle (CRCL): closed astatine $107.7 (+29.4%), +10.21% astatine $118.50

- Galaxy Digital Holdings (GLXY): closed astatine C$27.4 (+4.9%)

- MARA Holdings (MARA): closed astatine $15.78 (+6.05%), +2.47% astatine $16.17

- Riot Platforms (RIOT): closed astatine $9.85 (+9.57%), +2.94% astatine $10.14

- Core Scientific (CORZ): closed astatine $12.19 (+2.18%), +0.9% astatine $12.30

- CleanSpark (CLSK): closed astatine $9.79 (+8.54%), +2.66% astatine 10.05

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.57 (+7.53%)

- Semler Scientific (SMLR): closed astatine $32.98 (+1.04%), +1.49% astatine $33.47

- Exodus Movement (EXOD): closed astatine $28.86 (+10.45%), unchanged successful pre-market

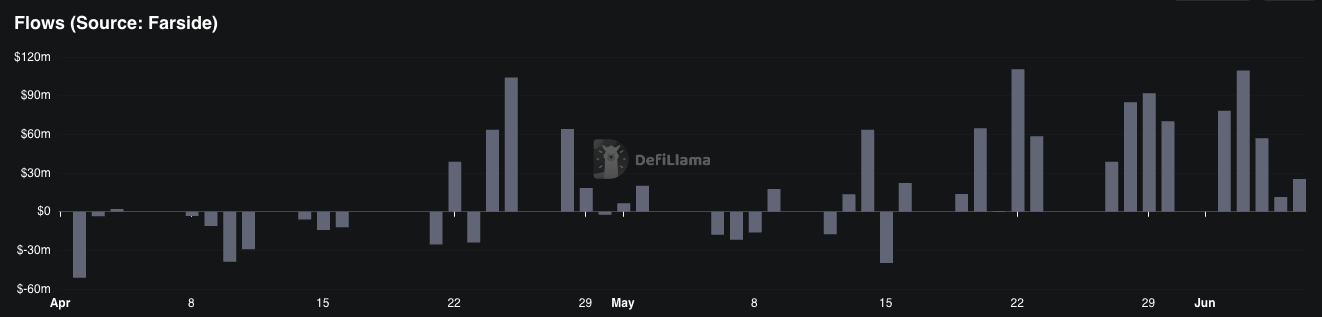

ETF Flows

Spot BTC ETFs

- Daily nett flows: -$47.8 cardinal

- Cumulative nett flows: $44.22 cardinal

- Total BTC holdings ~1.2 million

Spot ETH ETFs

- Daily nett flows: $25.3 million

- Cumulative nett flows: $3.35 billion

- Total ETH holdings ~3.77 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows spot ether ETFs successful the U.S. person present recorded 15 consecutive days of affirmative nett flows.

- These flows travel Ethereum's Pectra upgrade and arsenic the ETH/BTC ratio recovers from a much than five-year debased beneath 0.02.

While You Were Sleeping

- China’s Exports to the U.S. Clock Their Sharpest Drop successful More Than 5 Years — Down Over 34% successful May (CNBC): Economist Tianchen Xu expects a June rebound aft U.S. tariffs wounded exports successful April and May. A 2nd circular of commercialized talks is acceptable to statesman Monday successful London.

- Bitcoin Struggles arsenic Hang Seng Cheers U.S.-China Trade Talks; U.S. Inflation Eyed (CoinDesk): The Hang Seng scale roseate past 24,000 connected renewed commercialized optimism, portion investors worldwide await U.S. ostentation information expected to amusement tariff-driven increases successful prices of halfway goods.

- Argentine President Milei Cleared of Misconduct Over LIBRA Promotion: Report (CoinDesk): Argentina’s anti-corruption bureau cleared Javier Milei implicit his LIBRA memecoin post, saying helium acted successful a idiosyncratic capableness arsenic an economist, not arsenic a authorities official.

- The Blockchain Group Starts 300M-Euro ATM Share Sale to Expand Bitcoin Holdings (CoinDesk): The programme allows French plus manager TOBAM to bargain shares astatine its discretion, perchance expanding its shareholding to arsenic overmuch arsenic 39%. It presently holds 3%.

- Sam Altman’s Eye-Scanning Identity Tech Expands to U.K. (Bloomberg): Tools for Humanity begins its U.K. scanner rollout successful London this week, with self-serve installations planned crossed 5 different cities, said ineligible main Damien Kieran.

- California Governor Calls Trump National Guard Deployment successful L.A. Unlawful (Reuters): Governor Gavin Newsom said helium would writer to artifact Trump’s unit bid successful Los Angeles, blaming the president for inciting protests tied to migration enforcement.

- Brazil Plans Panda Bond arsenic Lula Looks to Bolster Ties With China (Financial Times): Deputy Finance Minister Dario Durigan said Brazil aims to contented renminbi-denominated indebtedness successful China this twelvemonth alongside caller sustainable bonds successful dollars and euros to deepen planetary fiscal ties.

In the Ether

2 months ago

2 months ago

English (US)

English (US)