By Francisco Rodrigues (All times ET unless indicated otherwise)

Crypto prices roseate connected Wednesday, riding the aforesaid alleviation question that lifted planetary equities aft Iran and Israel accepted a U.S.-brokered ceasefire.

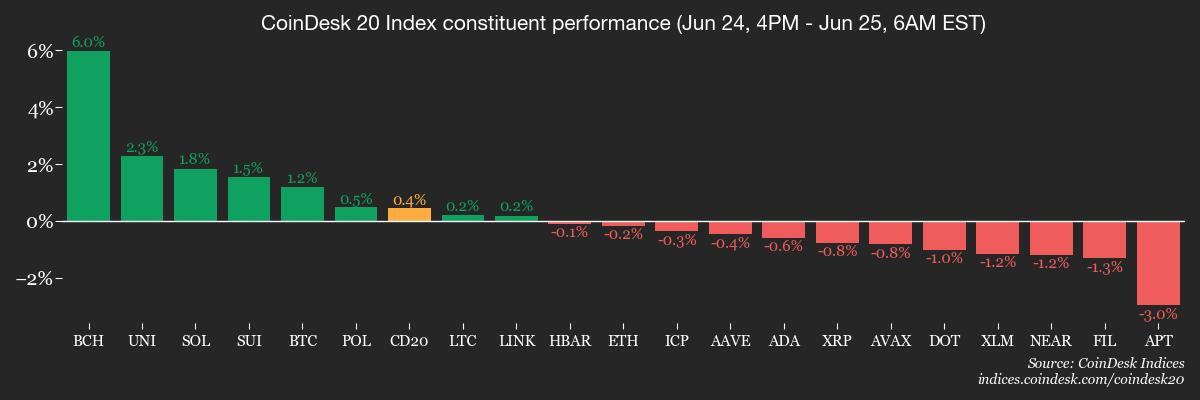

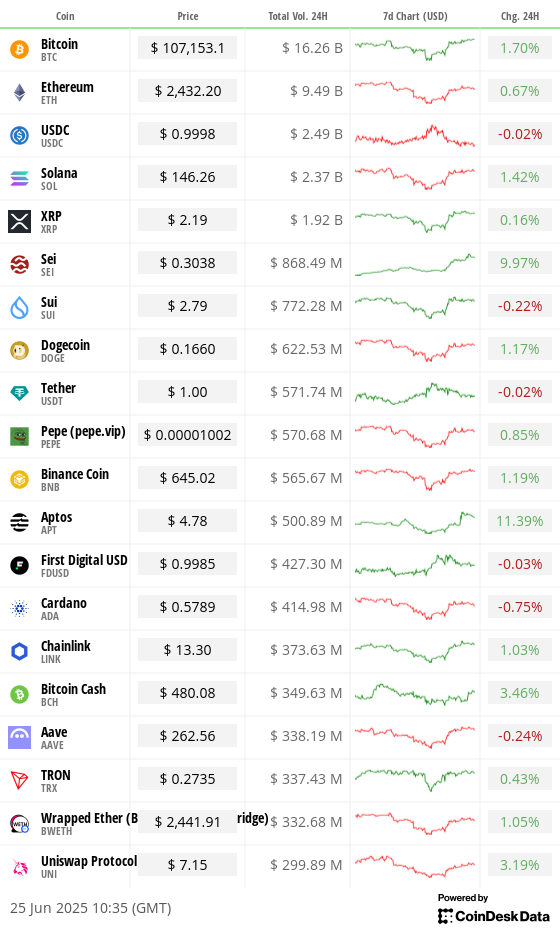

With the menace of an contiguous lipid proviso crunch fading, traders moved backmost into hazard assets. The terms of bitcoin BTC roseate to adjacent $107,000, adding 1.7% successful the past 24 hours. The broader CoinDesk 20 (CD20) scale gained 1%.

That beforehand whitethorn beryllium short-lived.

“’Optimism astir the fragile ceasefire holding betwixt Iran and Israel has bubbled done markets, lifting equities, but much doubts are present creeping successful astir the truce holding,” said Susannah Streeter, the caput of wealth markets astatine Hargreaves Lansdown.

“A leaked study from U.S. Intelligence casting uncertainty connected the effectiveness of the U.S. strikes successful crippling Tehran’s atomic capabilities, has led to immoderate worries that subject enactment could resume,” she said.

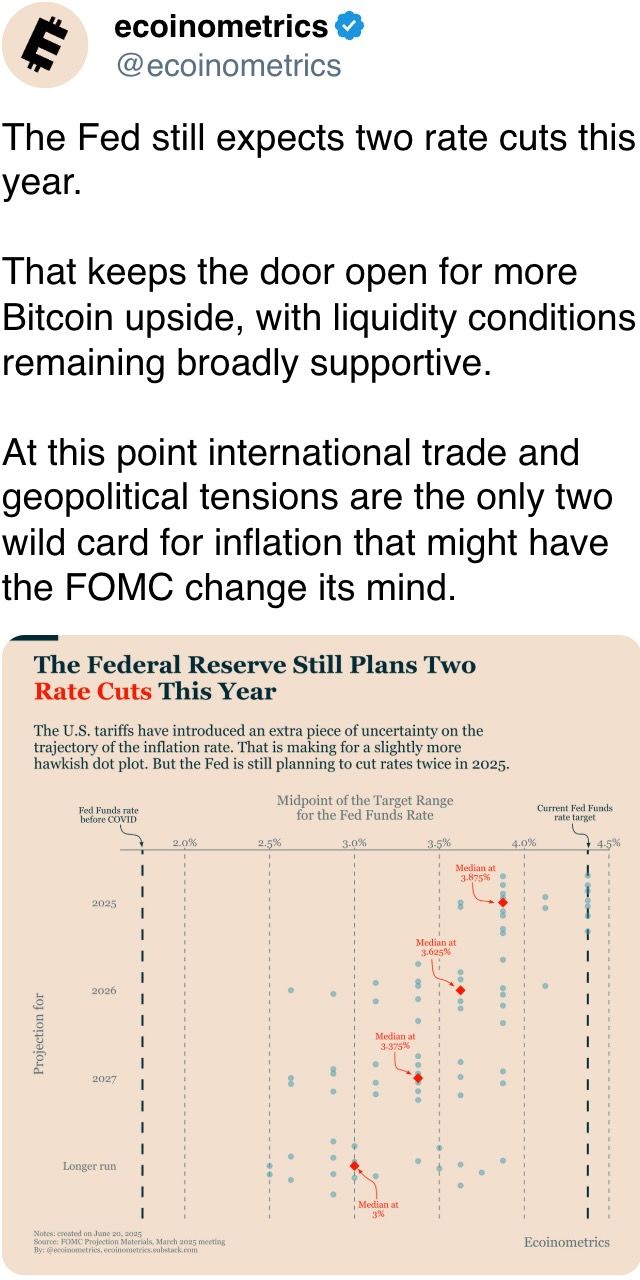

Still, the ceasefire wasn’t the lone crushed for the rally. On Tuesday, Federal Reserve Chair Jerome Powell told House lawmakers that the cardinal slope is being diligent earlier moving guardant with interest-rate cuts. Powell pointed retired that ostentation is inactive elevated and could look further unit from tariffs successful coming months.

“Powell’s accent connected a wait-and-see” attack underscores short-term uncertainty successful complaint policy,” Bitunix analysts wrote successful an emailed statement. “The remarks supply markets with flexibility and are wide supportive of hazard assets, but investors should intimately show upcoming tariff developments and ostentation data.”

U.S. consumer-confidence data softened, pulling two-year Treasury yields to a six-week debased of 3.78% and raising the perceived chances of a complaint chopped successful July to astir 20%, according to the CME’s FedWatch tool. That's up from astir 13% a week ago. On Polymarket, traders are weighing an 18% accidental of a cut.

Powell volition aboriginal contiguous attest earlier a Senate committee. Traders volition support a adjacent oculus connected the testimony, which comes arsenic President Donald Trump keeps unit connected the Fed to little involvement rates, posting yesterday they should beryllium “at slightest 2 to 3 points lower.”

Crypto derivatives desks amusement a neutral attack astir the 27 June expiry: Traders sold straddles and abbreviated puts adjacent to $105,000 and $100,000, suggesting an anticipation of choky terms action, Jake O, OTC trader astatine Wintermute, said.

Call enactment buying eyeing $108,000 and $112,000 for July and September points, however, to a humble bullish inclination, Jake added. Stay alert!

What to Watch

- Crypto

- June 25: Core (CORE), an EVM-compatible layer-1 blockchain, volition activate the Theseus hard fork (release V1.0.17) connected its mainnet.

- June 25: ZIGChain (ZIG) mainnet will spell live.

- June 30: CME Group volition introduce spot-quoted futures, pending regulatory approval, allowing trading successful bitcoin, ether and large U.S. equity indices with contracts holdable for up to 5 years.

- Macro

- Day 2 of 2: North Atlantic Treaty Organization (NATO) Summit successful The Hague, the Netherlands, wherever heads of state, overseas and defence ministers of 32 allies and partners volition conscionable to sermon security, defence spending and cooperation. President Trump is expected to explain what committedness to Article 5 of the North Atlantic Treaty means to him.

- June 25, 10 a.m.: Fed Chair Jerome H. Powell testifies earlier the U.S. Senate Committee connected Banking, Housing, and Urban Affairs connected the semiannual monetary argumentation report. Livestream link.

- June 26, 8:30 a.m.: The U.S. Census Bureau releases May manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 8.5% vs. Prev. -6.3%

- Durable Goods Orders Ex Defense MoM Prev. -7.5%

- Durable Goods Orders Ex Transportation MoM Est. 0% vs. Prev. 0.2%

- June 26, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (final) Q1 GDP data.

- GDP Growth Rate QoQ Final Est. -0.2% vs. Prev. 2.4%

- GDP Price Index QoQ Final Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ Final Est. -2.9% vs. Prev. 3.3%

- June 26, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended June 21.

- Initial Jobless Claims Est. 245K vs. Prev. 245K

- Continuing Jobless Claims Est. 1950K vs. Prev. 1945K

- June 26, 3 p.m.: The Bank of Mexico announces its involvement complaint decision.

- Overnight Interbank Target Rate Est. 8% Prev. 8.5%

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected lowering the law quorum threshold from 5% to 4.5% of votable tokens. This aims to lucifer decreased elector information and assistance well-supported proposals walk much easily, without affecting non-constitutional proposals, which stay astatine a 3% quorum. Voting ends July 4.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- June 25, 5:30 p.m.: A BNB Super Meetup is being hosted successful New York.

- Unlocks

- June 30: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $17.13 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $122.31 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $10.81 million.

- July 11: Immutable (IMX) to unlock 1.31% of its circulating proviso worthy $10.31 million.

- July 12: Aptos (APT) to unlock 1.76% of its circulating proviso worthy $53.72 million.

- July 15: Starknet (STRK) to unlock 3.79% of its circulating proviso worthy $14.32 million.

- Token Launches

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

- June 26: Sahara AI (SAHARA) to beryllium listed connected OKX, Bitget, MEXC, CoinW, and others.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- Day 2 of 3: Blockworks' Permissionless IV (New York)

- Day 1 of 2: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- Day 1 of 2: CDAO Government 2025 (Washington)

- Day 1 of 2: FinTech Summit Africa 2025 (Johannesburg)

- Day 1 of 2: Money Expo Colombia 2025 (Bogota)

- Day 1 of 2: NFY.NYC 2025 (New York)

- Day 1 of 3: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- Day 1 of 3: 7th International Congress connected Blockchain and Applications (Lille, France)

- Day 1 of 4: Solana Solstice 2025 (New York)

- June 26: The Injective Summit (New York)

- June 26: Webit 2025 (Sofia, Bulgaria)

- June 26-27: Istanbul Blockchain Week

- June 26-27: Seoul Meta Week 2025 (Seoul)

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

Token Talk

By Shaurya Malwa

- The iconic NFT Wall successful Williamsburg is present complete, with memecoin mascot Joycat (MOG) taking the last spot.

- The past “White Brick” was placed anonymously, slotted close betwixt 2 CryptoPunks, cementing meme civilization into NFT history.

- The collector called MOG “the earthy heir” to the NFT movement, linking punk provenance to memetic momentum.

- Artist Lorenzo Masnah said the mural’s punchline was intentional: “And I was excited to enactment this laughing feline up determination due to the fact that if you don’t rather recognize memeconomics—the aboriginal of integer currency and art—JOKE’S ON YOU!”

- The Joycat representation marks a symbolic displacement from identity-driven NFTs to axenic taste velocity.

- The NFT Wall present stands arsenic a prophecy and landmark arsenic a snapshot of crypto’s chaotic, originative and ungovernable future.

Derivatives Positioning

- The annualized three-month BTC futures ground connected offshore exchanges has precocious somewhat to 5% arsenic sentiment stabilizes with BTC's speedy rebound supra $100K.

- The level, however, remains beneath May highs supra 7%. A akin signifier is seen successful ETH.

- BTC and ETH ground connected the CME stay beneath 10%, with ETH somewhat pricier than BTC.

- Perpetual backing rates for astir large coins, including BCH and APT, proceed to overgarment a moderately bullish picture.

- On Deribit, the BTC put-call ratio rose, astatine slightest successful portion owed to capitalist involvement successful cash-secured puts, a yield-generation strategy.

- Flows tracked by Wintermute suggest rangeplay betwixt $100K-$105K up of Friday's expiry.

Market Movements

- BTC is up 0.51% from 4 p.m. ET Tuesday astatine $106,693.69 (24hrs: +1.36%)

- ETH is down 1.2% astatine $2,421.55 (24hrs: +0.19%)

- CoinDesk 20 is down 0.5% astatine 2,988.28 (24hrs: +0.56%)

- Ether CESR Composite Staking Rate is up 2 bps astatine 3.14%

- BTC backing complaint is astatine 0.0048% (5.2626% annualized) connected Binance

- DXY is up 0.28% astatine 98.14

- Gold futures are up 0.07% astatine $3,336.20

- Silver futures are down 0.10% astatine $35.69

- Nikkei 225 closed up 0.39% astatine 38,942.07

- Hang Seng closed up 1.23% astatine 24,474.67

- FTSE is up 0.07% astatine 8,765.08

- Euro Stoxx 50 is down 0.06% astatine 5,294.01

- DJIA closed connected Tuesday up 1.19% astatine 43,089.02

- S&P 500 closed up 1.11% astatine 6,092.18

- Nasdaq Composite closed up 1.43% astatine 19,912.53

- S&P/TSX Composite closed up 0.41% astatine 26,718.62

- S&P 40 Latin America closed up 1.78% astatine 2,631.38

- U.S. 10-Year Treasury complaint is unchanged astatine 4.3%

- E-mini S&P 500 futures are unchanged astatine 6,145.50

- E-mini Nasdaq-100 futures are unchanged astatine 22,428.00

- E-mini Dow Jones Industrial Average Index are down 0.11% astatine 43,378.00

Bitcoin Stats

- BTC Dominance: 65.52% (0.38%)

- Ethereum to bitcoin ratio: 0.02269 (-1.78%)

- Hashrate (seven-day moving average): 799 EH/s

- Hashprice (spot): $54

- Total Fees: 6.16 BTC / $650,033

- CME Futures Open Interest: 156,455 BTC

- BTC priced successful gold: 32 oz

- BTC vs golden marketplace cap: 9.05%

Technical Analysis

- The Binance-listed XRP/BTC brace continues to commercialized successful a falling wedge, identified by converging trendlines marking a bid of little highs and little lows.

- The converging quality of the lines indicates that the downtrend is steadily losing steam.

- An eventual breakout is considered a motion of bullish inclination reversal.

Cypto Equities

Effective June 30, the terms for Galaxy volition beryllium for its Nasdaq listing denominated successful U.S. dollars alternatively than the Canadian-dollar-denominated listing connected the TSX.

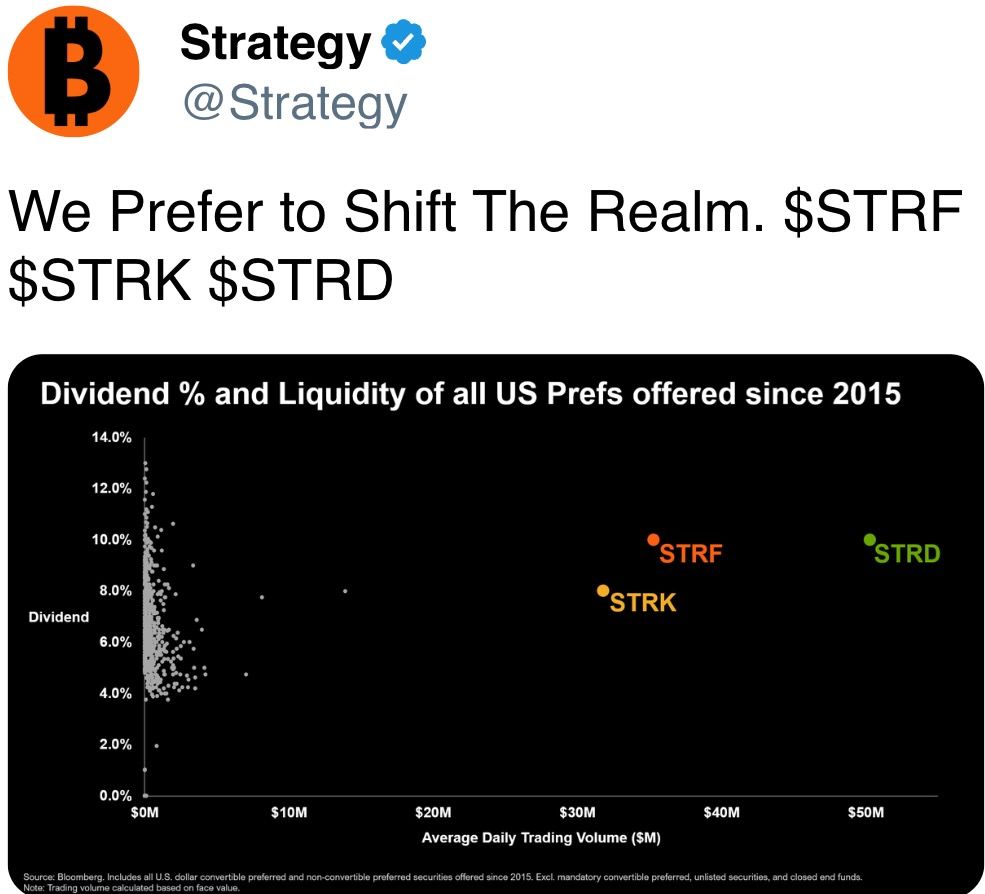

- Strategy (MSTR): closed connected Tuesday astatine $377.02 (+2.68%), +1.45% astatine $382.47 successful pre-market

- Coinbase Global (COIN): closed astatine $344.82 (+12.1%), +1.3% astatine $349.30

- Circle (CRCL): closed astatine $222.65 (-15.49%), +3.93% astatine $231.40

- Galaxy Digital Holdings (GLXY): closed astatine C$27.07 (+6.66%)

- MARA Holdings (MARA): closed astatine $14.88 (+4.94%), +1.68% astatine $15.13

- Riot Platforms (RIOT): closed astatine $10.02 (+8.09%), +0.9% astatine $10.11

- Core Scientific (CORZ): closed astatine $12.21 (+7.58%), +0.74% astatine $12.3

- CleanSpark (CLSK): closed astatine $10.04 (+13.45%), +0.6% astatine $10.10

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $19.42 (+7.35%)

- Semler Scientific (SMLR): closed astatine $41.89 (-0.23%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $34.16 (+18.73%)

ETF Flows

Spot BTC ETFs

- Daily nett flows: $588.6 million

- Cumulative nett flows: $47.58 billion

- Total BTC holdings ~1.23 million

Spot ETH ETFs

- Daily nett flows: $71.3 million

- Cumulative nett flows: $4.09 billion

- Total ETH holdings ~4.02 million

Source: Farside Investors

Overnight Flows

Chart of the Day

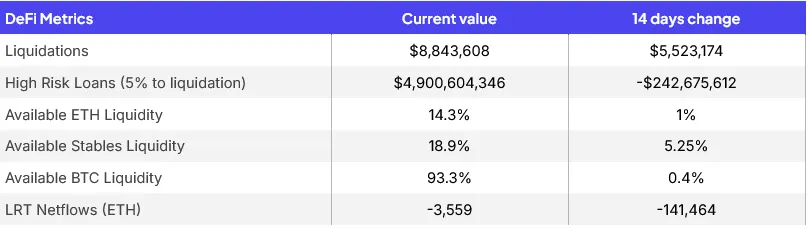

- The cumulative worth of the high-risk DeFi loans, those that commercialized wrong 5% of their liquidation price, has dropped sharply by $242 cardinal successful 2 weeks.

- The diminution indicates healthier marketplace conditions and debased likelihood of monolithic liquidation cascades successful DeFi markets.

While You Were Sleeping

- Bitcoin's Upcoming $14B Options Expiry Marked by Surge successful Put-Call Ratio. What Does It Indicate? (CoinDesk): Traders are loading up connected downside extortion up of a $14 cardinal bitcoin options expiry, but marketplace flows inactive hint astatine mildly bullish expectations adjacent term.

- Metaplanet Raises $515M, Blockchain Group Adds $4.8M successful Bitcoin Treasury Equity Moves (CoinDesk): Metaplanet completed 10% of its 555 Million Plan connected Day 1, issuing 54 cardinal shares, portion The Blockchain Group raised $4.8 cardinal successful an at-the-market-type equity issuance statement with TOBAM.

- Deep Sea Mining Firm Goes Deep connected Bitcoin With $1.2B BTC Treasury Plan (CoinDesk): Oslo-based Green Minerals (GEM) said Wednesday it paid 4.25 cardinal Norwegian kroner ($420,000) to get 4 BTC, its archetypal acquisition since announcing a bitcoin treasury strategy connected Monday.

- China Seizes Moment to Globalize Yuan arsenic Dollar Doubts Mount (Bloomberg): New Chinese directives purpose to unfastened fiscal channels and deepen the yuan’s relation successful planetary markets. By easing controls and attracting overseas capital, Beijing hopes to situation dollar dominance.

- Israel-Iran Conflict Spurs China to Reconsider Russian Gas Pipeline (The Wall Street Journal): Russian President Vladimir Putin is expected to rise the stalled Power of Siberia 2 state nexus erstwhile helium visits his Chinese counterpart successful September, arsenic China weighs alternatives to volatile Middle East vigor routes.

- UK to Purchase Fighter Jets Capable of Carrying Tactical Nuclear Weapons (Reuters): The U.K. volition bargain 12 Lockheed Martin F-35A jets, restoring airborne atomic capableness and strengthening its NATO contributions, according to Prime Minister Keir Starmer’s office.

In the Ether

4 months ago

4 months ago

English (US)

English (US)