By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin (BTC) is hovering a smidgen nether $105,000 having dropped conscionable 1.4% successful the past 24 hours arsenic crypto markets balanced the Israel-Iran warfare with regulatory advancement successful the U.S.

Tensions successful the Middle East are heightening aft President Donald Trump called for Iran’s “unconditional surrender” aft saying the country’s person was an “easy target.” Corporate bitcoin buying, however, is underpinning demand, and Senate support of U.S. stablecoin authorities is seen arsenic a win for the industry.

Trump's words helped rise the perceived likelihood of the U.S. entering the struggle to 62% connected prediction marketplace Polymarket , up from astir 50% a time ago. The perceived likelihood of U.S. subject enactment against Iran earlier August are astatine 73%.

“Despite escalating tensions successful the Middle East, BTC is yet to amusement signs of full-blown panic,” analysts astatine crypto hedge money QCP Capital wrote. “BTC’s resilient terms enactment appears underpinned by continued organization accumulation.”

That accumulation is partially driven by firm bitcoin treasuries. Strategy, for one, has added implicit 10,000 BTC with funds from the STRD preferred banal offering, and The Blockchain Group said it added 182 BTC this week. Bitcoin rewards steadfast Fold has secured a $250 cardinal facility to walk connected bitcoin, portion Mercury Fintech is readying on raising $800 cardinal for a bitcoin treasury.

“The marketplace seems to person rediscovered its footing, peculiarly aft BTC held supra the cardinal intelligence threshold of $100k contempt the archetypal shock,” QCP’s analysts said. “Crucially, Friday’s humble 3% pullback paled successful examination to April past year, erstwhile BTC fell much than 8% amid akin Iran-Israel turmoil.”

Deribit’s BTC Volatility Index (DVOL) is presently astir 40.86, down from implicit 62 successful aboriginal April.

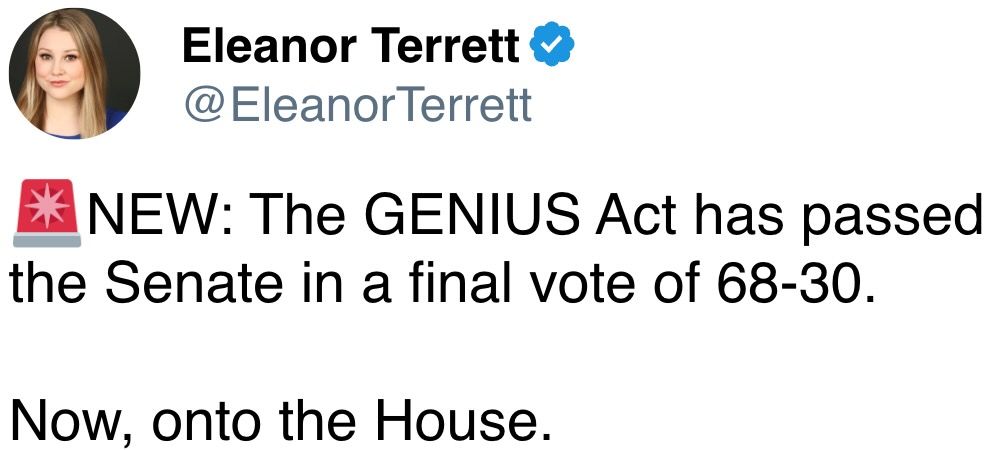

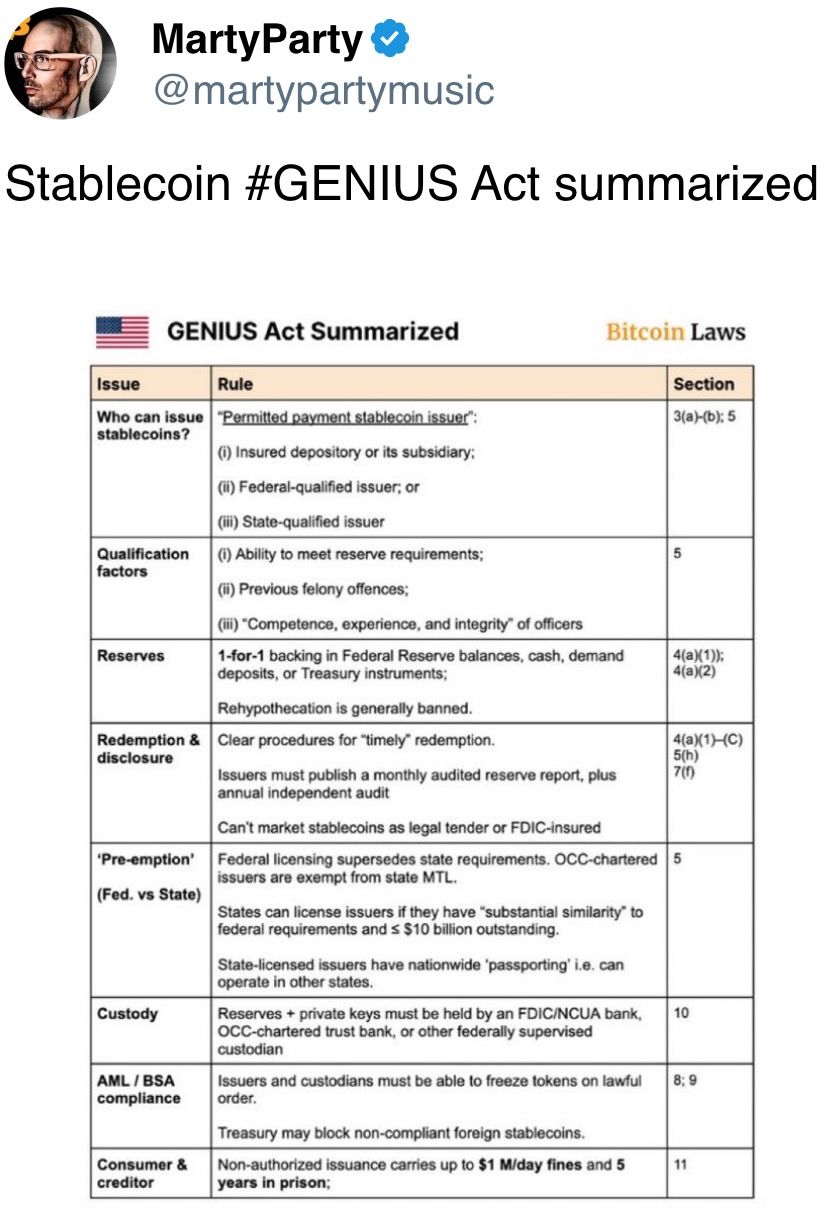

The Senate's support of the Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act, the archetypal large portion of crypto authorities to wide the chamber, sends a wide message: U.S. lawmakers are progressively unfastened to formalizing rules for the industry. Markets interpreted the determination arsenic a structural win.

Traders volition beryllium watching today’s interest-rate determination from the Federal Reserve for immoderate surprises. According to the CME’s FedWatch tool, markets are astir definite rates are going to stay unchanged.

That amplifies immoderate fallout from the Iran-Israel conflict, which has present entered the crypto space. The Iranian crypto speech Nobitex was hacked by a radical thought to beryllium linked to Israel conscionable a time aft the aforesaid radical targeted the state-owned Bank Sepah. And successful the wider sphere, Iran closing the Strait of Hormuz, a important shipping lane, oregon the U.S. intervening would apt pb to a hazard plus sell-off.

“It’s omniscient to reserve judgement until the U.S. open, wherever astir terms find has been occurring,” said Jake O., an OTC trader astatine Wintermute. Stay alert!

What to Watch

- Crypto

- June 18: At astir 9:28 p.m. IoTeX L1 v2.2.0 hard fork volition activate astatine artifact 36,893,881. The fork volition halve artifact clip to 2.5s and motorboat System Staking v3.

- June 18: Shares of Purpose Investments' "Purpose XRP ETF" are expected to commencement trading connected the Toronto Stock Exchange. The ETF volition connection Canadian dollar–hedged, Canadian dollar unhedged and U.S. dollar units nether the tickers XRPP, XRPP.B and XRPP.U, respectively.

- June 18: Evolve Funds Group launches Evolve XRP ETF connected the Toronto Stock Exchange nether tickers XRP (CAD) and XRP.U (USD), offering nonstop carnal XRP vulnerability without derivatives oregon currency hedging.

- June 18, 2025: 3iQ launches the 3iQ XRP ETF connected the Toronto Stock Exchange nether tickers XRPQ (CAD) and XRPQ.U (USD), debuting with a 0% absorption interest for six months.

- June 20: Proof-of-stake blockchain BlackCoin (BLK) activates SegWit connected mainnet, improving information and performance. Nodes indispensable beryllium upgraded to merchandise v26.2.0 earlier this date. Wallets from 13.2 tin beryllium utilized successful 26.2.x.

- Macro

- June 18, 8:30 a.m.: U.S. Department of Labor releases unemployment security information for the week ended June 14.

- Initial Jobless Claims Est. 245K vs. Prev. 248K

- June 18, 2 p.m.: Federal Reserve announces its interest-rate decision. Rates expected to beryllium held astatine 4.25%-4.50%. Chair Jerome Powell’s property league follows astatine 2:30 p.m.

- June 18, 5:30 p.m.: Brazil’s cardinal bank, Banco Central bash Brasil, announces its interest-rate decision.

- Selic Rate Est. 14.75% vs. Prev. 14.75%

- June 19, 7 a.m.: Bank of England (BoE) announces its interest-rate decision.

- Bank Rate Est. 4.25% vs. Prev. 4.25%

- June 19, 3 p.m.: Argentina’s National Institute of Statistics and Censuses releases Q1 employment data.

- Unemployment Rate Prev. 6.4%

- June 18, 8:30 a.m.: U.S. Department of Labor releases unemployment security information for the week ended June 14.

- Earnings (Estimates based connected FactSet data)

- June 23 (TBC): HIVE Digital Technologies (HIVE), post-market, $-0.12

Token Events

- Governance votes & calls

- Compound DAO is acceptable to ballot connected a connection to create the Compound Foundation, a non-profit to thrust protocol maturation and strategy. It calls for an 18-month program and requests $9 cardinal successful COMP, Voting ends June 20.

- Arbitrum DAO is voting connected a connection to motorboat DRIP, an $80M incentives program targeting circumstantial DeFi activity. Managed by a foundation-led committee, DRIP would reward users straight and let the DAO to unopen it down via vote. Voting ends June 20.

- ApeCoin DAO is voting connected whether to sunset the decentralized autonomous organization and motorboat ApeCo, a caller entity established by Yuga Labs with a ngo to “supercharge the APE ecosystem.” Voting ends June 24.

- Polkadot Community is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- June 17, 12 p.m.: Lido to big its 29th Node Operator Community Call.

- June 18, 10 a.m.: Filecoin to big a league on unlocking Filecoin’s blistery retention era.

- June 19, 9 a.m.: TON to big a Builders Call: Payments Edition.

- Unlocks

- June 18: Fasttoken (FTN) to unlock 4.65% of its circulating proviso worthy $88.80 million.

- June 30: Optimism (OP) to unlock 1.83% of its circulating proviso worthy $17.34 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $120.99 million.

- July 2: Ethena (ENA) to unlock 0.67% of its circulating proviso worthy $11.23 million.

- Token Launches

- June 18: Fartcoin (FART) listed connected Binance.US.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN) and Synapse (SYN).

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight.

- Day 1 of 2: Canadian Blockchain Consortium’s 2nd Annual Policy Summit (Ottawa)

- Day 1 of 2: SuperAI (Singapore)

- June 19-21: BTC Prague 2025

- June 24-26: Blockworks' Permissionless IV (New York)

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26: The Injective Summit (New York)

- June 26-27: Istanbul Blockchain Week

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

Token Talk

By Shaurya Malwa

- The Ink Foundation is introducing INK, a autochthonal token designed to bootstrap on-chain superior markets with a liquidity-first strategy, starting with a DeFi protocol built connected Aave.

- INK volition beryllium airdropped to aboriginal users, with the instauration pledging measures to bounds airdrop farming and support semipermanent alignment.

- The token has a fixed headdress of 1 cardinal and won’t beryllium taxable to governance changes oregon emanation tweaks — a determination to debar communal dilution concerns.

- Governance of the Ink furniture 2 remains abstracted from the INK token, differentiating it from different Superchain projects that often intertwine protocol and token governance.

- The archetypal inferior volition beryllium a autochthonal liquidity protocol for lending and trading, serving arsenic a foundational DeFi gathering artifact connected the Ink chain.

- INK volition debut amid anemic marketplace conditions, with astir 2024–25 L2 token launches underperforming arsenic the hype subsides. Examples see Celestia, Linea, and Blast.

- Ink’s DeFi enactment remains minimal, with conscionable $7 cardinal successful TVL and nether $100 successful regular gross — raising questions astir product-market acceptable contempt its "product-first" narrative.

Derivatives Positioning

- Perpetual backing rates for large coins are hardly positive, indicating a renewed caution among traders.

- BTC and ETH futures ground connected the CME remains dependable astatine astir 7% and 8%.

- Short-term options connected Deribit amusement a bias for protective puts.

- Top 5 astir traded BTC options connected Deribit are each enactment options astatine strikes ranging from $90K to $100K, indicating heightened request for downside protection.

Market Movements

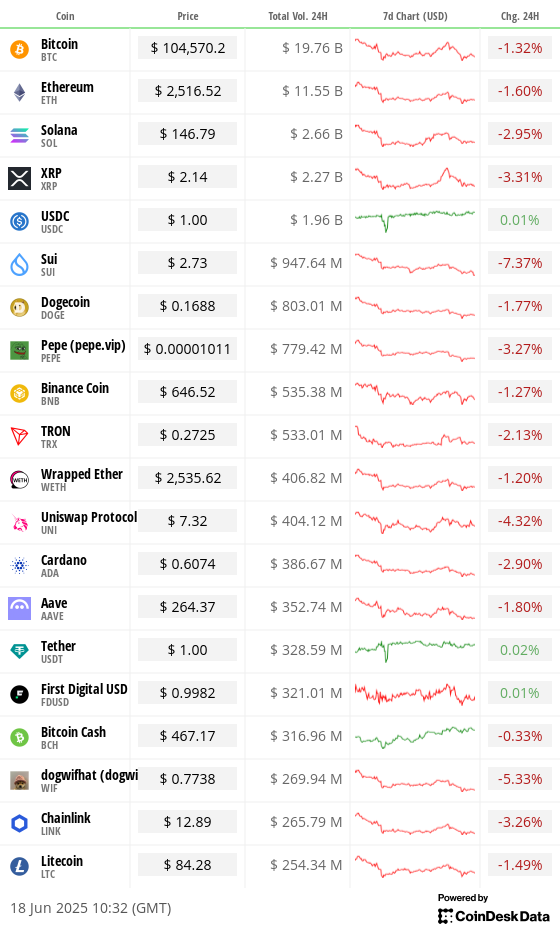

- BTC is up 0.32% from 4 p.m. ET Tuesday astatine $104,736.41 (24hrs: -1.19%)

- ETH is up 0.59% astatine $2,526.50 (24hrs: -1.34%)

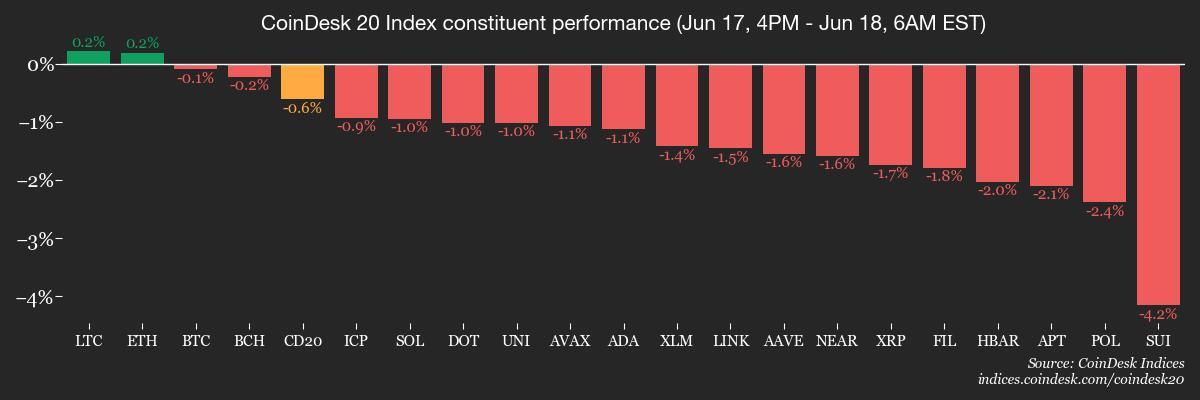

- CoinDesk 20 is down 0.17% astatine 3,005.42 (24hrs: -2.01%)

- Ether CESR Composite Staking Rate is up 6 bps astatine 3.02%

- BTC backing complaint is astatine 0.0048% (5.2834% annualized) connected Binance

- DXY is down 0.17% astatine 98.65

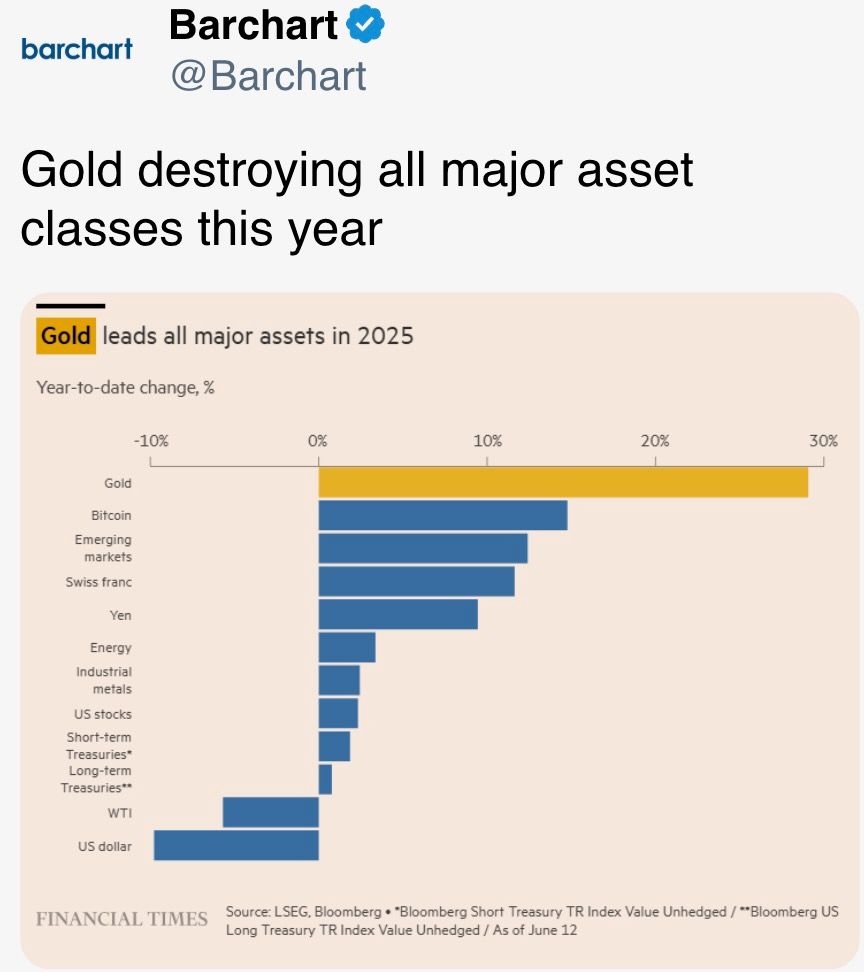

- Gold futures are down 0.19% astatine $3,400.40

- Silver futures are up 0.47% astatine $37.33

- Nikkei 225 closed up 0.90% astatine 38,885.15

- Hang Seng closed down 1.12% astatine 23,710.69

- FTSE is up 0.18% astatine 8,850.37

- Euro Stoxx 50 is up 0.11% astatine 5,294.25

- DJIA closed connected Tuesday down 0.70% astatine 42,215.80

- S&P 500 closed down 0.84% astatine 5,982.72

- Nasdaq Composite closed down 0.91% astatine 19,521.09

- S&P/TSX Composite closed down 0.10% astatine 26,541.39

- S&P 40 Latin America closed down 0.92% astatine 2,618.36

- U.S. 10-Year Treasury complaint is unchanged astatine 4.38%

- E-mini S&P 500 futures are up 0.32% astatine 6,004.00

- E-mini Nasdaq-100 futures are up 0.43% astatine 21,824.75

- E-mini Dow Jones Industrial Average Index are up 0.23% astatine 42,325.00

Bitcoin Stats

- BTC Dominance: 64.90% (0.13%)

- Ethereum to bitcoin ratio: 0.02403 (0.12%)

- Hashrate (seven-day moving average): 886 EH/s

- Hashprice (spot): $53.1

- Total Fees: 6.26 BTC / $662,109

- CME Futures Open Interest: 153,825 BTC

- BTC priced successful gold: 30.6 oz

- BTC vs golden marketplace cap: 8.68%

Technical Analysis

- Chainlink's LINK token has dropped beneath the Ichimoku cloud, confirming renewed bearish momentum.

- The contiguous enactment is astatine astir $12.6, the aboriginal June low.

- If it drops beneath that, the terms could descent to $10.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $375.18 (-1.85%), -0.32% astatine $373.99

- Coinbase Global (COIN): closed astatine $253.85 (-2.95%), +0.65% astatine $255.50

- Circle (CRCL): closed astatine $149.15 (-1.26%), +3.43% astatine $154.27

- Galaxy Digital Holdings (GLXY): closed astatine C$25.22 (-4.22%)

- MARA Holdings (MARA): closed astatine $14.67 (-4.24%), +0.48% astatine $14.74

- Riot Platforms (RIOT): closed astatine $9.66 (-5.01%), +0.31% astatine $9.69

- Core Scientific (CORZ): closed astatine $11.89 (-1.57%), -0.34% astatine $11.85

- CleanSpark (CLSK): closed astatine $8.90 (-7.48%), +0.79% astatine $8.97

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.68 (-5.18%)

- Semler Scientific (SMLR): closed astatine $28.53 (-6.52%), +4.66% astatine $29.86

- Exodus Movement (EXOD): closed astatine $30.01 (-8.39%)

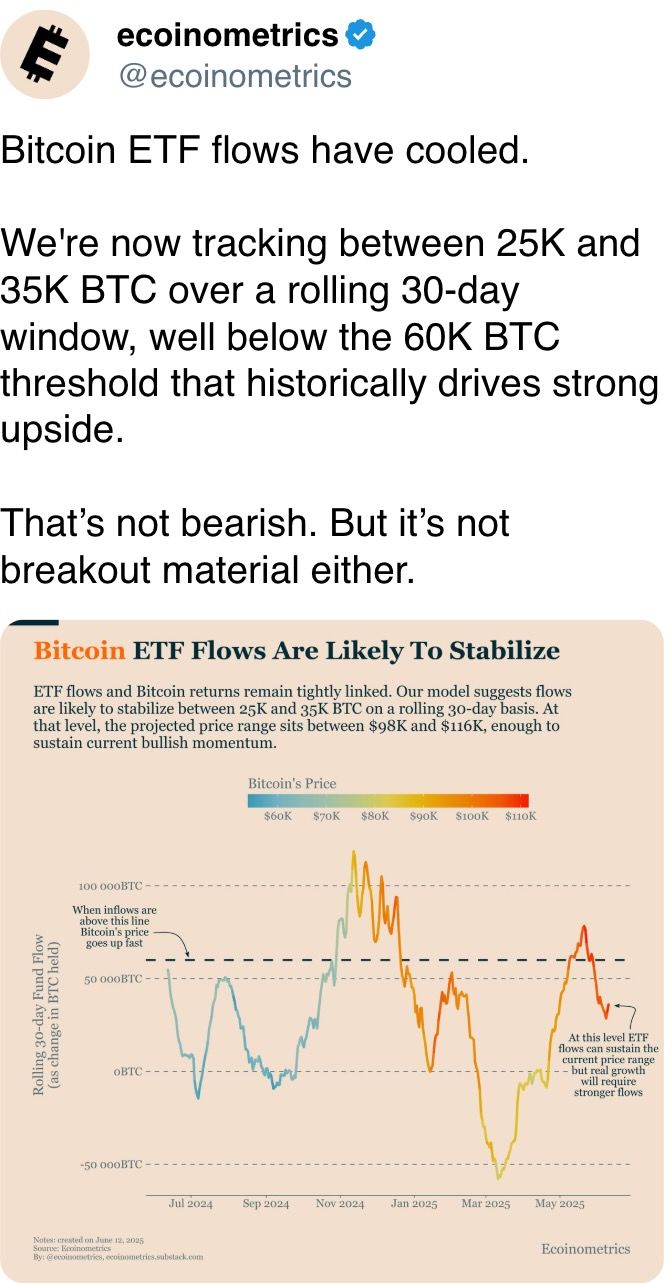

ETF Flows

Spot BTC ETFs

- Daily nett flows: $216.5 million

- Cumulative nett flows: $46.24 billion

- Total BTC holdings ~1.22 million

Spot ETH ETFs

- Daily nett flows: $11.1 million

- Cumulative nett flows: $3.91 billion

- Total ETH holdings ~3.97 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The Dollar Index, which tracks the U.S. currency's worth against large peers, looks acceptable to transverse supra its downtrend line.

- A breakout could measurement connected hazard assets, including bitcoin.

While You Were Sleeping

- Bitcoin Traders Are Looking astatine a Key Data Point successful Fed Meeting and It's Not the Interest Rate Decision (CoinDesk): Traders are watching the Fed’s complaint projections. A hawkish stance could measurement connected bitcoin and strain U.S. finances by raising involvement payments connected authorities debt.

- Dominant Chinese Makers of Bitcoin Mining Machines Set Up U.S. Production to Beat Tariffs (Reuters): Bitmain began U.S. accumulation successful December and Canaan started proceedings runs, arsenic John Deaton warns China’s dominance successful mining hardware could fto it disrupt bitcoin’s stableness and harm U.S. investors.

- ‘Tariff Engineering’ Is Making a Comeback arsenic Businesses Employ Creative Ways to Skirt Higher Duties (CNBC): Firms person agelong altered merchandise materials, size oregon plan to reclassify goods for little tariffs, a strategy dating backmost to 19th-century sweetener imports.

- Iranian Crypto Exchange Nobitex Hacked for Over $48M by Suspected Israel-Linked Group (CoinDesk): Israel-linked hacktivist radical Gonjeshke Darande claimed the Nobitex breach and threatened to leak interior data.

- The Blockchain Group Adds 182 Bitcoin, Lifts BTC Holdings to Over $170M (CoinDesk): Convertible enslaved deals and warrant conversions funded a 17 million-euro ($19.6 million) bitcoin purchase, lifting holdings to 1,653 BTC. The steadfast reported a 1,173% BTC output year-to-date.

- Ark Invest Dumps Nearly $45M Worth of Circle Shares arsenic U.S. Senate Passes GENIUS Act (CoinDesk): Cathie Wood's steadfast sold 300,108 Circle Internet Group shares for $44.7 million, marking a 2nd time of profit-taking arsenic CRCL maintained momentum pursuing its spectacular marketplace debut earlier this month.

In the Ether

4 months ago

4 months ago

English (US)

English (US)