By Omkar Godbole (All times ET unless indicated otherwise)

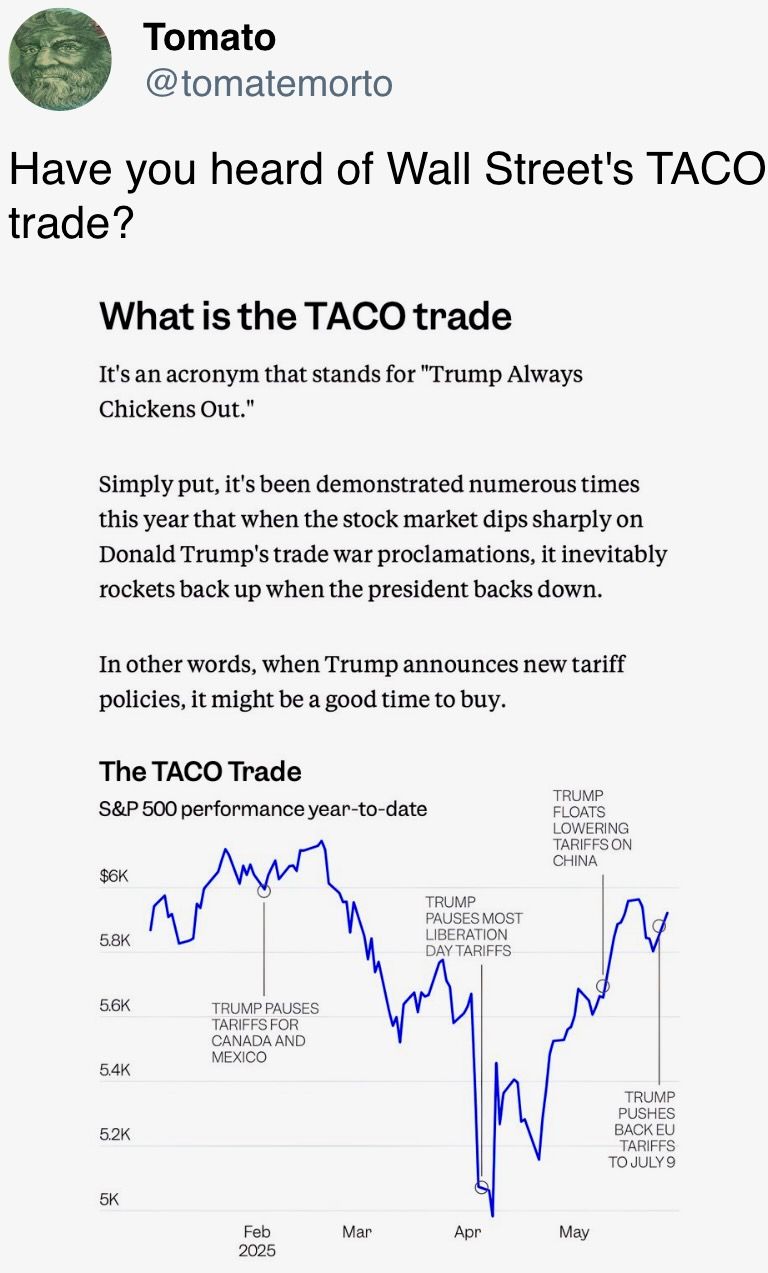

Bitcoin BTC roseate and banal scale futures surged aboriginal Thursday aft a U.S. tribunal declared President Donald Trump’s broad-based tariffs authorities invalid. The affirmative sentiment was buoyed by AI elephantine Nvidia's upbeat earnings.

On-chain information showed ample wallets, those holding implicit 10,000 BTC, have shifted to selling from buying arsenic the largest cryptocurrency holds adjacent to its grounds high, with an summation successful speech deposits besides pointing to selling pressure. Meanwhile, options marketplace information signaled imaginable for volatility up of Friday's monthly settlement.

Ether ETH, the second-largest cryptocurrency by marketplace value, jumped to $2,780, the highest since Feb. 24, consistent with the bullish signals from the derivatives market. The token has been bid this week, supposedly connected SharpLink's $425 cardinal Treasury plan. Notably, U.S.-listed spot ether ETFs saw a nett inflow of $84.89 cardinal connected Wednesday, extending their streak to 8 consecutive days.

Canada-listed concern steadfast Sol Strategies said it filed a preliminary prospectus with section securities regulators to rise up to $1 cardinal to boost its concern successful the Solana ecosystem. Still, SOL was flattish astatine astir $170.

In the broader market, TON, PEPE and FLOKI led different coins higher portion FARTCOIN, PI and JUP nursed astir losses. Open involvement successful TON perpetual futures surged 33% to $190 million, clocking the highest since Feb. 18.

Stablecoin issuer Circle froze wallets connected to the Libra token containing millions of dollars worthy of USDC. Metaplanet issued $21M successful bonds to concern much bitcoin purchases.

In accepted markets, immoderate concern banks said Trump has different tools to sidestep the tribunal ruling connected tariffs. Yields connected the longer duration Treasury notes ticked higher, suggesting dollar strength. Stay alert!

What to Watch

- Crypto

- May 30: The second circular of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable connected "DeFi and the American Spirit"

- Macro

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment complaint data.

- Unemployment Rate Est. 6.9% vs. Prev. 7%

- May 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q1 GDP data.

- GDP Growth Rate QoQ (2nd estimate) Est. -0.3% vs. Prev. 2.4%

- GDP Price Index QoQ (2nd estimate) Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ (2nd estimate) Est. -2.5% vs. Prev. 3.3%

- May 29, 2 p.m.: Fed Governor Adriana D. Kugler volition present a code astatine the 5th Annual Federal Reserve Board Macro-Finance Workshop (virtual). Livestream link.

- May 30, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases Q1 GDP data.

- GDP Growth Rate QoQ Est. 1.4% vs. Prev. 0.2%

- GDP Growth Rate YoY Est. 3.2% vs. Prev. 3.6%

- May 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases April unemployment complaint data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.2%

- May 30, 8:30 a.m.: Statistics Canada releases Q1 GDP data.

- GDP Growth Rate Annualized Est. 1.7% vs. Prev. 2.6%

- GDP Growth Rate QoQ Prev. 0.6%

- May 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases April user income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- Core PCE Price Index YoY Est. 2.5% vs. Prev. 2.6%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.3%

- Personal Income MoM Est. 0.3% vs. Prev. 0.5%

- Personal Spending MoM Est. 0.2% vs. Prev. 0.7%

- May 30, 10 a.m.: The University of Michigan releases (final) May U.S. user sentiment data.

- Michigan Consumer Sentiment Est. 51 vs. Prev. 52.2

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment complaint data.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Arbitrum DAO is voting connected a law AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them successful enactment with Ethereum’s May 7 Pectra upgrade. The connection schedules activation for June 17, and voting ends connected May 29.

- Sui DAO is voting connected moving to recover astir $220 million successful funds stolen from the Cetus Protocol hack via a protocol upgrade. Voting ends June 3.

- May 29, 8 a.m.: NEAR Protocol to big a House of Stake Ask Me Anything (AMA) session.

- May 29, 2 p.m.: Wormhole to big an ecosystem call.

- June 4, 6:30 p.m.: Synthetic to host a assemblage call.

- June 10, 10 a.m.: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $24.43 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $160.58 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating proviso worthy $11.18 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $15.83 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $60.96 million.

- Token Launches

- June 1: Staking rewards for staking ERC-20 OM connected MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 3 of 3: Bitcoin 2025 (Las Vegas)

- Day 3 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- Day 1 of 2: Litecoin Summit 2025 (Las Vegas)

- Day 1 of 4: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Oliver Knight

- Markets connected the Ethereum-based Cork Protocol stay paused aft Wednesday's $12 cardinal smart-contract exploit.

- The attacker manipulated the astute contact's exchange-rate relation by issuing fake tokens, stealing 3,761.8 wrapped staked ether (wstETH) successful the process.

- The exploit marked different onslaught connected the decentralized finance (DeFi) manufacture conscionable days aft Sui-based Cetus Protocol mislaid $223 cardinal to an exploit.

- TRM Labs estimates that $2.2 cardinal was stolen successful crypto exploits and hacks successful 2024.

- Ether remains unperturbed by the exploit, starring the marketplace contiguous connected the backmost of renewed organization interest and spot ETF flows. It is up 3.8% successful the past 24 hours portion bitcoin is down by 0.17%.

Derivatives Positioning

- TRX, XMR, ETH, LTC and BNB led large cryptocurrencies' maturation successful perpetual futures unfastened interest.

- Funding rates for majors, but TON, awesome bullish sentiment, but thing extraordinary.

- On the CME, ETH annualized one-month futures ground topped 10%, portion BTC lagged astatine 8.7%.

- Signs of caution emerged connected Deribit, with front-end BTC skew flipping to puts and ETH's telephone skew softening. Block flows connected Paradigm featured request for short-dated BTC puts.

Market Movements

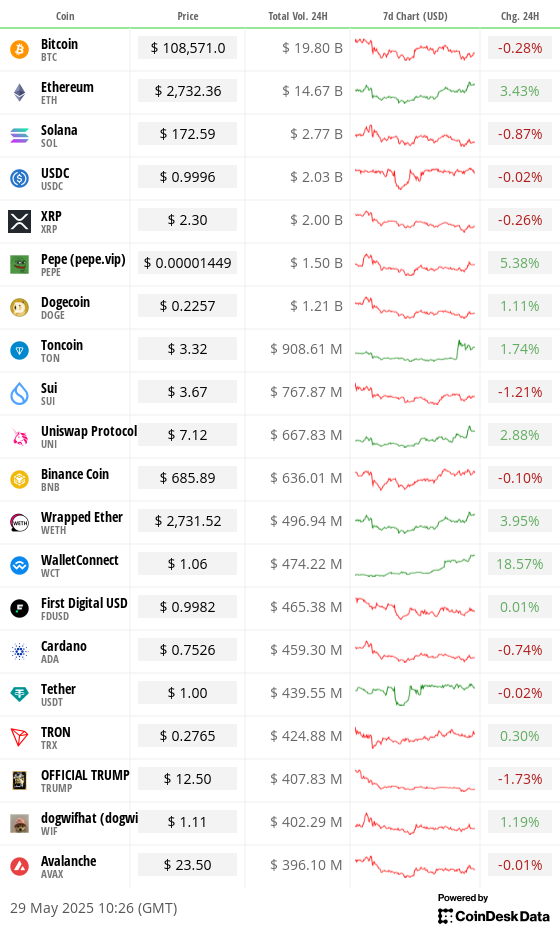

- BTC is up 1.15% from 4 p.m. ET Wednesday astatine $108,594.41 (24hrs: -0.29%)

- ETH is up 3.9% astatine $2,738.04 (24hrs: +3.63%)

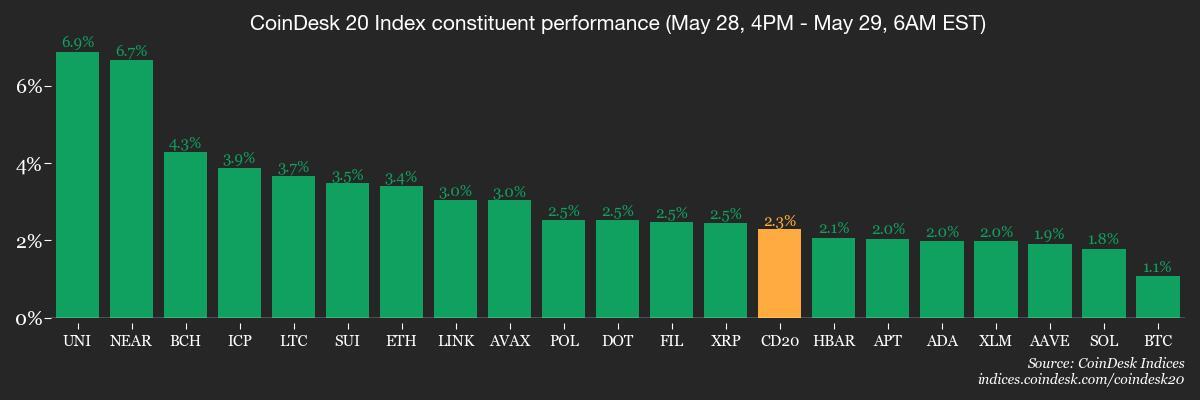

- CoinDesk 20 is up 2.21% astatine 3,278.84 (24hrs: +0.66%)

- Ether CESR Composite Staking Rate is unchanged astatine 3.1%

- BTC backing complaint is astatine 0.0057% (6.3006% annualized) connected Binance

- DXY is up 0.12% astatine 99.99

- Gold is up 0.32% astatine $3,304.20/oz

- Silver is up 1.24% astatine $33.41/oz

- Nikkei 225 closed +1.88% astatine 38,432.98

- Hang Seng closed +1.35% astatine 23,573.38

- FTSE is unchanged astatine 8,724.05

- Euro Stoxx 50 is unchanged astatine 5,378.39

- DJIA closed connected Wednesday -0.58% astatine 42,098.70

- S&P 500 closed -0.56% astatine 5,888.55

- Nasdaq closed -0.51% astatine 19,100.94

- S&P/TSX Composite Index closed unchanged astatine 26,283.50

- S&P 40 Latin America closed -0.76 astatine 2,599.53

- U.S. 10-year Treasury complaint is up 6 bps astatine 4.54%

- E-mini S&P 500 futures are up 1.53% astatine 5,993.25

- E-mini Nasdaq-100 futures are up 2.03% astatine 21,814.25

- E-mini Dow Jones Industrial Average Index futures are up 0.96% astatine 42,576.00

Bitcoin Stats

- BTC Dominance: 63.71 (-0.06%)

- Ethereum to bitcoin ratio: 0.02517 (1.12%)

- Hashrate (seven-day moving average): 910 EH/s

- Hashprice (spot): $57.0

- Total Fees: 8.03 BTC / $868,310

- CME Futures Open Interest: 152,995 BTC

- BTC priced successful gold: 32.8 oz

- BTC vs golden marketplace cap: 9.30%

Technical Analysis

- The VIRTUAL token has topped the 38.2% Fibonacci retracement of the January-April crash.

- The interruption retired supra the wide tracked absorption could entice much buyers, yielding a bigger rally.

Crypto Equities

- Strategy (MSTR): closed connected Wednesday astatine $364.25 (-2.14%), +2.43% astatine $373.09 successful pre-market

- Coinbase Global (COIN): closed astatine $254.29 (-4.55%), +3.01% astatine $261.95

- Galaxy Digital Holdings (GLXY): closed astatine C$28 (-6.57%)

- MARA Holdings (MARA): closed astatine $14.86 (-9.61%), +4.04% astatine $15.46

- Riot Platforms (RIOT): closed astatine $8.38 (-8.32%), +2.86% astatine $8.62

- Core Scientific (CORZ): closed astatine $10.78 (-4.43%), +2.97% astatine $11.10

- CleanSpark (CLSK): closed astatine $9.11 (-7.61%), +3.62% astatine $9.44

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $17.27 (-5.32%)

- Semler Scientific (SMLR): closed astatine $41.32 (-4.77%), +2.95% astatine $42.54

- Exodus Movement (EXOD): closed astatine $25.94 (-25.35%), +11.6% astatine $28.95

ETF Flows

Spot BTC ETFs

- Daily nett flow: $432.7 million

- Cumulative nett flows: $45.31 billion

- Total BTC holdings ~ 1.21 million

Spot ETH ETFs

- Daily nett flow: $84.9 million

- Cumulative nett flows: $2.9 billion

- Total ETH holdings ~ 3.57 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The MOVE index, which measures the volatility successful U.S. Treasury notes, has dropped to the lowest level since March.

- If it drops further, a continued diminution is apt to easiness fiscal conditions, greasing the bitcoin bull run.

While You Were Sleeping

- U.S. Trade Court Strikes Down Trump’s Global Tariffs (The Wall Street Journal): Judges said economical deficits don’t conscionable the ineligible threshold for a nationalist emergency, and said unchecked enforcement authorization implicit levies violates the law separation of powers.

- Solana Scores Twin Institutional Wins With $1B Raise and First Public Liquid Staking Strategy (CoinDesk): Sol Strategies aims to rise $1 cardinal to grow Solana ecosystem exposure, portion DeFi Development said it is the archetypal nationalist steadfast to clasp Solana-based liquid staking tokens.

- Bitcoin Whales Seem to Be Calling a Top arsenic BTC Price Consolidates (CoinDesk): Large holders are offloading BTC and sending it to exchanges aft a play of accumulation, portion smaller investors proceed buying.

- XRP Army Is Truly Global arsenic CME Data Reveals Nearly Half of XRP Futures Trading Occurs successful Non-U.S. Hours (CoinDesk): These contracts recorded $86.6 cardinal successful measurement implicit six days crossed 4,032 trades, with 46% of enactment logged during overseas sessions.

- Goldman Urges Investors to Buy Gold and Oil arsenic Long-Term Hedges (Bloomberg): Goldman Sachs said surging U.S. indebtedness and concerns implicit monetary and fiscal governance person eroded spot successful semipermanent Treasuries, making golden and lipid indispensable hedges against ostentation and proviso shocks.

- UK Seeks to Speed Up Implementation of U.S. Trade Deal (Financial Times): The U.K. concern caput volition conscionable the U.S. Trade Representative successful Paris adjacent week to sermon implementation timelines for the bilateral commercialized woody announced connected May 8.

In the Ether

5 months ago

5 months ago

English (US)

English (US)