By Francisco Rodrigues (All times ET unless indicated otherwise)

Bitcoin’s (BTC) presumption arsenic a haven successful the discourse of broader fiscal markets whitethorn beryllium up for debate, but wrong crypto it’s hardly questionable. Cryptocurrency prices person fallen crossed the committee implicit the past 24 hours, yet bets connected BTC’s dominance support growing.

The market’s sell-off comes amid profit-taking and conflicting messages from the Trump medication implicit its commercialized warfare with China.

Those comments cooled a rally that started aft President Donald Trump signaled helium would not region Federal Reserve Chair Jerome Powell and suggested a softer stance connected commercialized with China. That helped the terms of bitcoin to attack $95,000 earlier it dropped backmost to $92,200.

The pullback followed comments from Treasury Secretary Scott Bessent, who said there’s nary unilateral program to assistance U.S. tariffs connected Chinese goods, contradicting Trump’s proposition that tariff rates could driblet successful the coming weeks. Investors struggled to construe the argumentation absorption arsenic Trump besides hinted astatine a “fair deal” with the world's second-largest economy.

The uncertainty revealed a displacement toward bitcoin successful the crypto space. The broader CoinDesk 20 (CD20) scale mislaid 3.75% of its worth implicit the past 24 hours, compared with BTC’s 2% drop.

Institutional traders’ penchant for BTC is shown by a Binance futures declaration tracking the cryptocurrency’s dominance. It’s traded astatine a 76% premium for the one-year forward, indicating traders expect BTC to clasp an borderline implicit altcoins successful the coming months, according to an emailed connection from Jake O., an OTC trader astatine Wintermute.

Options trading further illustrates this positioning. Large bets were placed connected bitcoin hitting $110,000 by June, according to Jake O., with traders simultaneously selling calls astatine $140,000 and $170,000 for September and December — a calendar dispersed that signals short-term optimism and semipermanent caution.

Similar enactment emerged successful May $110,000 calls, wherever increasing gamma vulnerability points to expanding sensitivity successful the marketplace to terms swings. Still, semipermanent crypto holders stay unfazed arsenic data shows they support accumulating.

For now, the markets stay reactive to the signals coming retired of Washington, which fixed their softer stance besides led to a golden dropping to $3,350 per ounce from much than $3,500. Stay alert!

What to Watch

- Crypto:

- April 25, 1 p.m.: U.S. Securities and Exchange Commission (SEC) Crypto Task Force Roundtable connected "Key Considerations for Crypto Custody".

- April 28: Enjin Relaychain increases progressive validator slots to 25 from 15 to heighten decentralization.

- April 29, 1:05 a.m.: BNB Chain (BNB) — BSC mainnet hardfork.

- April 30, 9:30 a.m.: ProShares expects its XRP ETF, offering vulnerability done futures and swap agreements, to statesman trading connected NYSE Arca.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- Macro

- Day 4 of 6: World Bank (WB) and the International Monetary Fund (IMF) spring meetings successful Washington.

- April 24, 8:30 a.m.: The U.S. Census Bureau releases March manufactured durable goods orders data.

- Durable Goods Orders MoM Est. 2% vs. Prev. 0.9%

- Durable Goods Orders Ex Defense MoM Est. 0.2% vs. Prev. 0.8%

- Durable Goods Orders Ex Transp MoM Est. 0.2% vs. Prev. 0.7%

- April 24, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended April 19.

- Initial Jobless Claims Est. 221K vs. Prev. 215K

- April 25, 10:00 a.m.: The University of Michigan releases (Final) April U.S. user sentiment data.

- Michigan Consumer Sentiment Est. 50.8 vs. Prev. 57

- Earnings (Estimates based connected FactSet data)

Token Events

- Governance votes & calls

- Lido DAO is voting to extend its delegate incentivization programme (DIP) done Q4 with a $225,000 LDO budget. Voting ends April 28.

- Uniswap DAO volition ballot connected establishing a licensing and deployment model for Uniswap v4 to accelerate its adoption crossed aggregate chains. The connection grants the Uniswap Foundation a broad exemption to deploy v4 connected immoderate DAO-approved concatenation and gives the Uniswap Accountability Committee authorization to update deployment records. Voting occurs April 24-April 30.

- April 24, 8 a.m.: Alchemy Pay to big an Ask Me Anything (AMA) league connected its 2025 roadmap.

- April 24, 9 a.m.: IOTA to big an X spaces session connected staking, validators and the mainnet launch.

- April 24, 8 a.m.: Ronin to big a municipality hallway meeting.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- Unlocks

- April 30: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $23.45 million.

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $221.99 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $11.28 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $13.69 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $13.91 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $11.33 million.

- Token Launches

- April 24: Initia (INIT) to beryllium listed connected Binance, CoinW, WEEX, KuCoin, MEXC and others.

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB) and Wing Finance (WING).

- May 5: Sonic (S) to beryllium listed connected Kraken.

Conferences:

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 3 of 3: Money20/20 Asia (Bangkok)

- Day 2 of 2: Blockchain Forum 2025 (Moscow)

- Day 2 of 3: Semafor’s World Economy Summit 2025 (Washington)

- April 24: Bitwise's Investor Day for Bitcoin Standard Corporations (New York)

- April 26: Crypto Vision Conference 2025 (Manilla)

- April 26-27: Harvard Blockchain successful Action Conference (Cambridge, Mass.)

- April 27: N Crypto Conference 2025 (Kyiv)

- April 27-30: Web Summit Rio 2025

- April 28-29: Blockchain Disrupt 2025 (Dubai)

- April 28-29: Staking Summit Dubai

- April 29: El Salvador Digital Assets Summit 2025 (San Salvador, El Salvador)

- April 29: IFGS 2025 (London)

- April 30-May 1: TOKEN2049 (Dubai)

Token Talk

By Shaurya Malwa

- Infrared, a liquid staking level connected Berachain, precocious Wednesday introduced a points programme to reward users earlier its token debuts successful the 3rd quarter.

- Points person nary fixed proviso and are earned done activities similar staking oregon providing liquidity.

- Users gain points by contributing to Infrared’s liquidity vaults, providing liquidity connected exchanges similar Kodiak and BEX, oregon staking iBGT and iBERA tokens. Longer information increases points.

- Infrared leads Berachain’s ecosystem with $1.5 cardinal successful full worth locked.

- The programme includes retroactive rewards since Infrared’s February launch, and volition tally for astir 3 months. Users tin way points successful existent clip connected a dashboard, with further rewards done partners similar Pendle. Points volition person to Infrared’s autochthonal token astatine a ratio to beryllium announced person to the token launch.

Derivatives Positioning

- Notional unfastened involvement successful bitcoin CME options has climbed to $5 billion, the astir since November.

- Open involvement successful the CME futures has bounced to implicit $12 billion, but remains good beneath the December highest of $22.7 billion, pointing to persistent caution.

- BTC CME futures ground suggests the same, inactive hovering nether an annualized 10%.

- On offshore exchanges, unfastened involvement successful perpetual futures exchanges has dropped with the overnight BTC terms pullback. This suggests the weakness is apt led by profit-taking alternatively than an influx of caller shorts.

- In altcoins, NEAR, UNI and PEPE futures person seen the astir summation successful unfastened involvement successful the past 24 hours.

- On Deribit, BTC, ETH skews proceed to amusement a bias for calls crossed clip frames. Traders are progressively selling cash-secured enactment options tied to BTC, Lin Chen, Deribit's concern improvement caput told CoinDesk.

Market Movements:

- BTC is down 1.36% from 4 p.m. ET Wednesday astatine $92,411.92 (24hrs: -1.76%)

- ETH is down 2.94% astatine $1,743.77 (24hrs: -2.66%)

- CoinDesk 20 is down 2.21% astatine 2,669.87 (24hrs: -3.02%)

- Ether CESR Composite Staking Rate is up 10 bps astatine 3.125%

- BTC backing complaint is astatine 0.0069% (7.5873% annualized) connected Binance

- DXY is down 0.45% astatine 99.40

- Gold is up 2.19% astatine $3,347.90/oz

- Silver is down 0.57% astatine $33.33/oz

- Nikkei 225 closed +0.49% astatine 35,039.15

- Hang Seng closed -0.74% astatine 21,909.76

- FTSE is down 0.3% astatine 8,378.12

- Euro Stoxx 50 is down 0.74% astatine 5,060.91

- DJIA closed connected Wednesday +1.07% astatine 39,606.57

- S&P 500 closed +1.67% astatine 5,375.86

- Nasdaq closed +2.5% astatine 16,708.05

- S&P/TSX Composite Index closed +0.69% astatine 24,472.70

- S&P 40 Latin America closed +1.28% astatine 2,475.90

- U.S. 10-year Treasury complaint is down 4 bps astatine 4.35%

- E-mini S&P 500 futures are down 0.62% astatine 5,368.00

- E-mini Nasdaq-100 futures are down 0.86% astatine 18,642.25

- E-mini Dow Jones Industrial Average Index futures are down 0.68% astatine 39,503.00

Bitcoin Stats:

- BTC Dominance: 64.56 (0.22%)

- Ethereum to bitcoin ratio: 0.01884 (-1.72%)

- Hashrate (seven-day moving average): 823 EH/s

- Hashprice (spot): $48.61

- Total Fees: 11.29 BTC / $1,042,496

- CME Futures Open Interest: 140,610 BTC

- BTC priced successful gold: 27.8 oz

- BTC vs golden marketplace cap: 7.92%

Technical Analysis

- The illustration shows XRP, presently astatine $2.15, remains stuck successful a downtrend that began successful January.

- The Ichimoku unreality is capping the upside, threatening to derail the betterment rally seen since April 7.

- The contiguous enactment is astatine $2, followed by the month's lows adjacent $1.60.

- On the higher side, the unreality and the descending trendline are levels to bushed for the bulls.

Crypto Equities

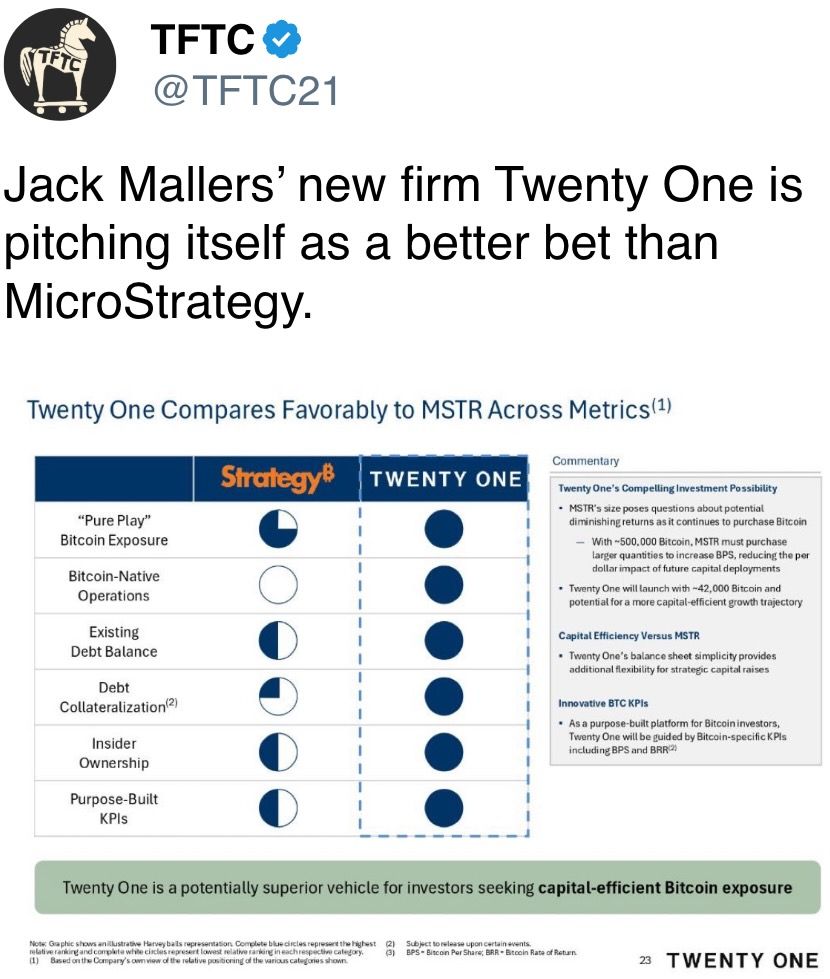

- Strategy (MSTR): closed connected Wednesday astatine $345.73 (+0.79%), down 1.85% astatine $339.33 successful pre-market

- Coinbase Global (COIN): closed astatine $194.80 (+2.53%), down 1.53% astatine $191.82

- Galaxy Digital Holdings (GLXY): closed astatine C$18.73 (+2.86%)

- MARA Holdings (MARA): closed astatine $14.13 (+0.5%), down 2.55% astatine $13.77

- Riot Platforms (RIOT): closed astatine $7.50 (+5.34%), down 2.4% astatine $7.32

- Core Scientific (CORZ): closed astatine $7.12 (+2.89%), down 1.12% astatine $7.04

- CleanSpark (CLSK): closed astatine $8.87 (+1.14%), down 1.92% astatine $8.70

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $13.51 (+3.13%), down 2.59% astatine $13.16

- Semler Scientific (SMLR): closed astatine $34.28 (+3%), down 1.6% astatine $33.73

- Exodus Movement (EXOD): closed astatine $44.09 (+12.5%), up 0.7% astatine $44.40

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $917 million

- Cumulative nett flows: $37.68 billion

- Total BTC holdings ~ 1.13 million

Spot ETH ETFs

- Daily nett flow: -$23.9 million

- Cumulative nett flows: $2.25 billion

- Total ETH holdings ~ 3.33 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The illustration shows the dollar worth of the fig of progressive oregon unfastened ether options contracts connected Deribit.

- The $2,000 onslaught telephone is the astir fashionable bet, with an unfastened involvement of implicit $260 million.

- Strikes with ample unfastened involvement often enactment arsenic magnets, meaning ether could emergence to $2,000 successful the coming days.

While You Were Sleeping

- Russia Reserves Right to Use Nuclear Arms successful Event of Western Aggression — Shoigu (TASS News Agency): Russia’s Security Council caput warned that the country’s defence argumentation permits a atomic effect to accepted attacks, including erstwhile overseas powers connection enactment done territory oregon logistics.

- Why Gold Became the Safe Haven of Choice arsenic U.S. Treasuries and Dollar Sold Off (CNBC): Analysts property gold’s spot to its inflation-hedging appeal, insulation from fiscal and monetary policy, a weaker dollar and beardown buying by emerging marketplace cardinal banks.

- Bitcoin’s April Rally Driven by Institutions, While Retail Flees ETFs: Coinbase Exec (CoinDesk): Bitcoin’s surge to $93,000 has been driven by organization and sovereign wealthiness money accumulation, not retail ETF flows, according to Coinbase Institutional’s John D’Agostino.

- The Dollar Has Further to Fall (Financial Times): Goldman’s main economist says the dollar is overvalued by humanities standards and a cooling U.S. system volition curb overseas appetite for American assets, weakening request for the currency.

- Bitcoin Traders Eye Long Term BTC Accumulation by Selling Put Options

(CoinDesk): Traders are utilizing a cash-secured attack by holding stablecoins, ensuring they tin bargain bitcoin if prices driblet and puts are exercised astatine the higher onslaught price. - Long-Term Bitcoin Holders Show Commitment, Buy More BTC Than Short-Term Holders Sell (CoinDesk): Long-term investors' holdings person accrued by 635,340 BTC since January, absorbing much than what's been distributed by short-term holders astatine a 1.38:1 accumulation ratio.

In the Ether

4 months ago

4 months ago

English (US)

English (US)