By James Van Straten (All times ET unless indicated otherwise)

Since May 22, bitcoin (BTC) has been trading wrong a constrictive 5% scope betwixt $106,600 and $111,700, contempt a flurry of bullish developments, including the announcement that Trump Media volition rise $2.5 cardinal done equity and enslaved income to money a bitcoin treasury strategy.

This intermission successful momentum comes adjacent arsenic the U.S. equity marketplace rallies, with the S&P 500 up 22% from its April lows. Notably, bitcoin appears to person front-run accepted markets, with crypto markets present entering a consolidation signifier portion the S&P 500 inactive trades 4% beneath its all-time highs from February.

Meanwhile, the divergence betwixt bitcoin and the broader crypto marketplace continues to widen. Bitcoin marketplace headdress dominance present consolidates supra 64%, highlighting its increasing influence. At existent prices adjacent $108,000, bitcoin trades astir $14,000 supra its 200-day moving average, which sits conscionable nether $94,500, underscoring the spot of its caller performance.

In contrast, ether (ETH) and solana (SOL) stay subdued. Ether has been rejected 3 times astatine its 200-DMA ($2,697) and presently trades astatine $2,633. Similarly, SOL is priced astatine $173, beneath its 200-DMA of $181, having besides faced repeated rejections.

“Ether and solana person been battling absorption successful the signifier of their 200-day moving averages for much than 2 weeks now. We look to beryllium dealing with an indecisive marketplace choosing betwixt a further mighty rally and fading aft a rebound. Bitcoin's rally has the imaginable to animate large alts to interruption out, but for now, we are not determination yet," Alex Kuptsikevich, Chief Market Analyst astatine FxPro, told CoinDesk.

In the derivatives market, bitcoin options expiring astatine the extremity of May amusement the highest attraction of telephone involvement astatine $110,000, with June and July expiries skewing much bullish, peculiarly astatine $115,000 and $120,000 strikes, according to Kaiko. The highest turnover remains astir $110,000, indicating expectations of continued consolidation astir existent levels.

On the corporate front, Circle, issuer of the USDC stablecoin, has updated its IPO filing with the New York Stock Exchange. The institution aims to rise $600 cardinal astatine a valuation of $5.4 billion, becoming the latest crypto steadfast to propulsion toward nationalist markets amid renewed involvement successful organization crypto adoption. Stay Alert!

What to Watch

- Crypto

- May 30: The second circular of FTX repayments starts.

- May 31 (TBC): Mezo mainnet launch.

- June 6, 1-5 p.m.: U.S. SEC Crypto Task Force Roundtable connected "DeFi and the American Spirit"

- Macro

- May 28, 2 p.m.: The Fed releases FOMC gathering minutes for May 6-7.

- May 29, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases April unemployment complaint data.

- Unemployment Rate Est. 6.9% vs. Prev. 7%

- May 29, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases Q1 GDP data.

- GDP Growth Rate QoQ 2nd Estimate Est. -0.3% vs. Prev. 2.4%

- GDP Price Index QoQ 2nd Estimate Est. 3.7% vs. Prev. 2.3%

- GDP Sales QoQ 2nd Estimate Est. -2.5% vs. Prev. 3.3%

- May 29, 2 p.m.: Fed Governor Adriana D. Kugler volition present a code astatine the 5th Annual Federal Reserve Board Macro-Finance Workshop (virtual). Livestream link.

- Earnings (Estimates based connected FactSet data)

- May 28: NVIDIA (NVDA), post-market, $0.88

Token Events

- Governance votes & calls

- Lido DAO is voting on adopting Dual Governance (LIP-28), a protocol upgrade that inserts a dynamic timelock betwixt DAO decisions and execution truthful stETH holders tin escrow tokens to intermission proposals astatine 1% of TVL oregon afloat artifact and “rage-quit” astatine 10%. Voting ends May 28.

- Arbitrum DAO is voting connected a law AIP to upgrade Arbitrum One and Arbitrum Nova to ArbOS 40 “Callisto,” bringing them successful enactment with Ethereum’s May 7 Pectra upgrade. The connection schedules activation for June 17, and voting ends connected May 29.

- May 28, 1 p.m.: Sui to big an X Spaces league on Sui DeFi.

- June 10: Ether.fi to host an expert call followed by a Q&A session.

- Unlocks

- May 31: Optimism (OP) to unlock 1.89% of its circulating proviso worthy $23.76 million.

- June 1: Sui (SUI) to unlock 1.32% of its circulating proviso worthy $163.22 million.

- June 1: ZetaChain (ZETA) to unlock 5.34% of its circulating proviso worthy $11.19 million.

- June 12: Ethena (ENA) to unlock 0.7% of its circulating proviso worthy $16.07 million.

- June 12: Aptos (APT) to unlock 1.79% of its circulating proviso worthy $60.51 million.

- Token Launches

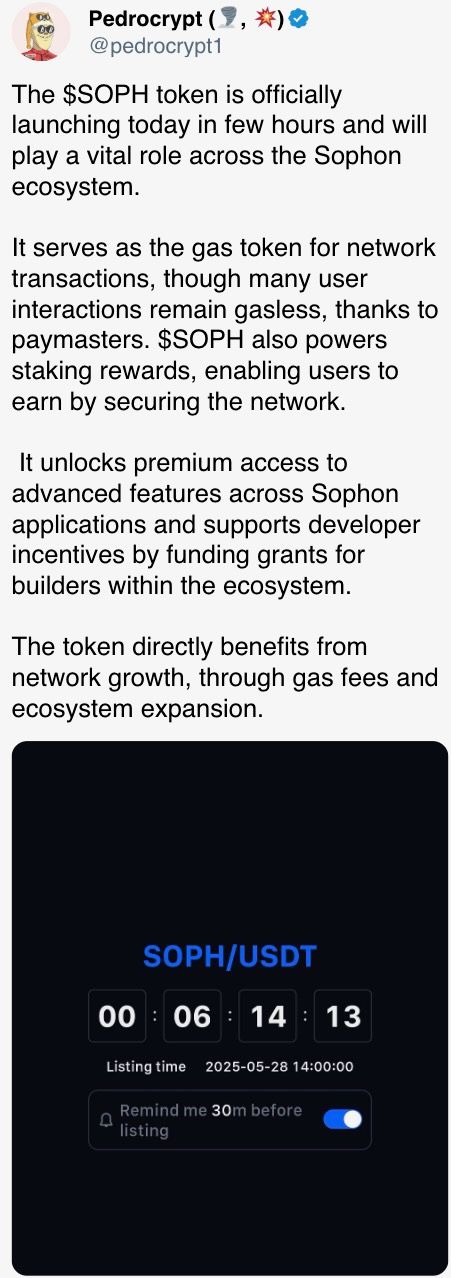

- May 28: Sophon (SOPH) to beryllium listed connected Binance, BingX, KuCoin MEXC, OKX, and others.

- June 1: Staking rewards for staking ERC-20 OM connected MANTRA Finance end.

- June 16: Advised deadline to unstake stMATIC arsenic portion of Lido connected Polygon’s sunsetting process ends.

- June 26: Coinbase to delist Helium Mobile (MOBILE), Render (RNDR), Ribbon Finance (RBN), & Synapse (SYN)

Conferences

- Day 2 of 3: Bitcoin 2025 (Las Vegas)

- Day 2 of 4: Web Summit Vancouver (Vancouver, British Columbia)

- May 29: Stablecon (New York)

- May 29-30: Litecoin Summit 2025 (Las Vegas)

- May 29-June 1: Balkans Crypto 2025 (Tirana, Albania)

- June 2-7: SXSW London

- June 19-21: BTC Prague 2025

- June 25-26: Bitcoin Policy Institute’s Bitcoin Policy Summit 2025 (Washington)

- June 26-27: Istanbul Blockchain Week

Token Talk

By Shaurya Malwa

- Sui's SUI jumps 6.5%, Cetus Protocol's token soars 26% arsenic teams pledge to backstop exploit losses.

- Cetus Protocol, the apical DEX connected the Sui blockchain, secured a indebtedness from the Sui Foundation to afloat reimburse users affected by a $223 cardinal exploit.

- The attacker utilized spoof tokens similar BULLA to manipulate terms curves and drain SUI, USDC, and different assets from liquidity pools.

- About $162 cardinal of the stolen tokens were frozen on-chain; the remainder were bridged retired and whitethorn person been laundered done aggregate routes.

- Cetus volition harvester the Foundation’s indebtedness with its treasury reserves to statesman contiguous repayments for affected users.

- Full betterment hinges connected an upcoming assemblage ballot that would unlock the frozen funds for idiosyncratic compensation.

- At the time, the exploit caused CETUS to driblet 40% and led to a crisp liquidity crunch crossed the Sui DeFi ecosystem, but the betterment program has helped spark a beardown marketplace rebound.

Derivatives Positioning

- Bitcoin CME futures measurement roseate to $15.96 billion, the highest since Feb. 25. But the maturation successful unfastened involvement has stalled adjacent $17 cardinal since May 21, suggesting a intermission successful inflows.

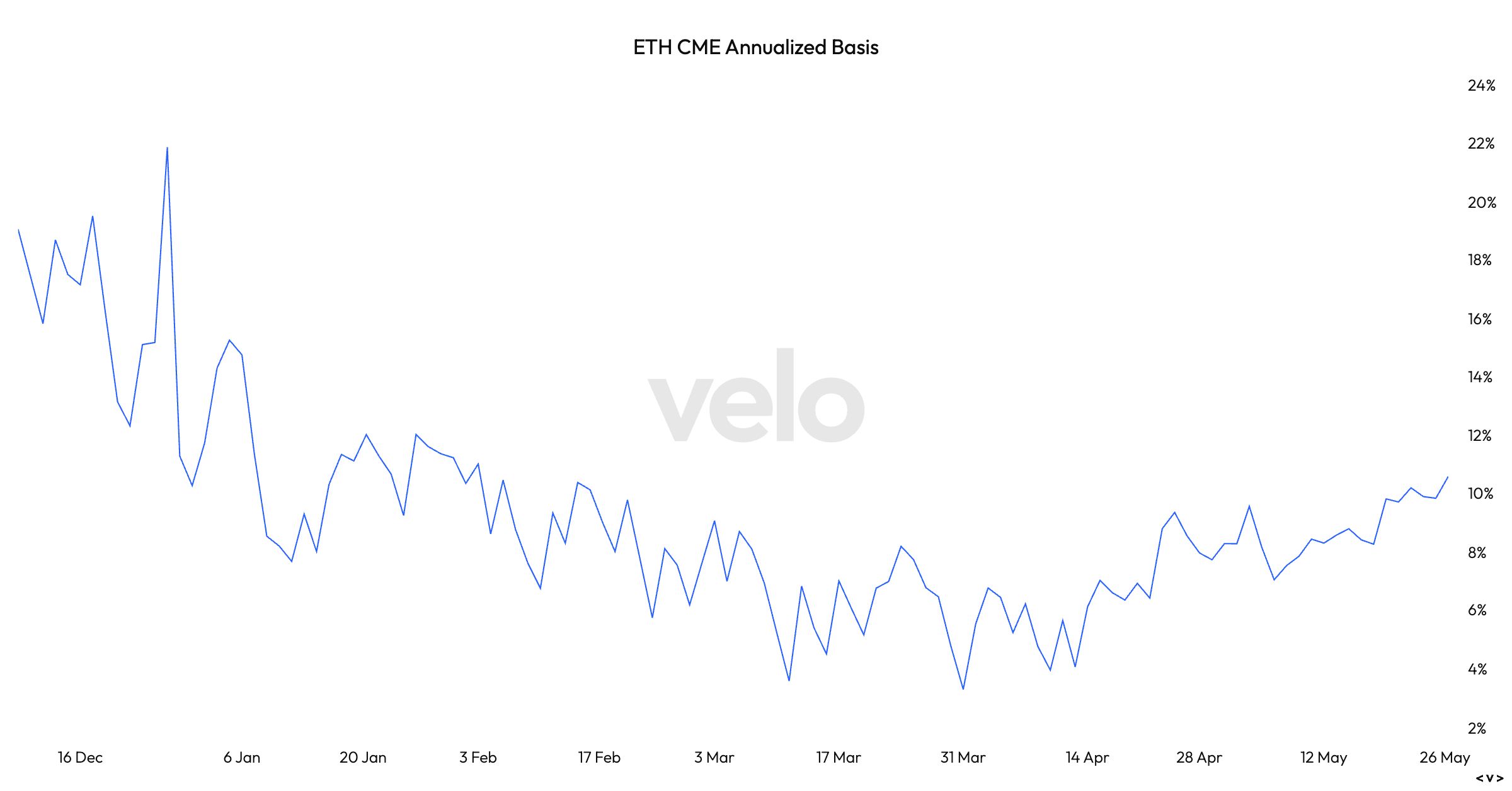

- ETH CME futures measurement roseate to the highest since Feb. 3, with unfastened involvement clocking a three-month precocious of $3.15 billion.

- On offshore exchanges, BTC and ETH perpetual futures signaled a moderately bullish bias with annualized backing rates holding dependable beneath 10%.

- Monero's backing complaint held supra 90%, signaling excessive physique of bullish leverage.

- On Deribit, BTC telephone bias has weakened crossed the board. Block flows featured abbreviated positions successful the BTC May expiry telephone enactment astatine the $113K onslaught alongside request for June and July expiry ETH telephone and telephone spreads.

Market Movements

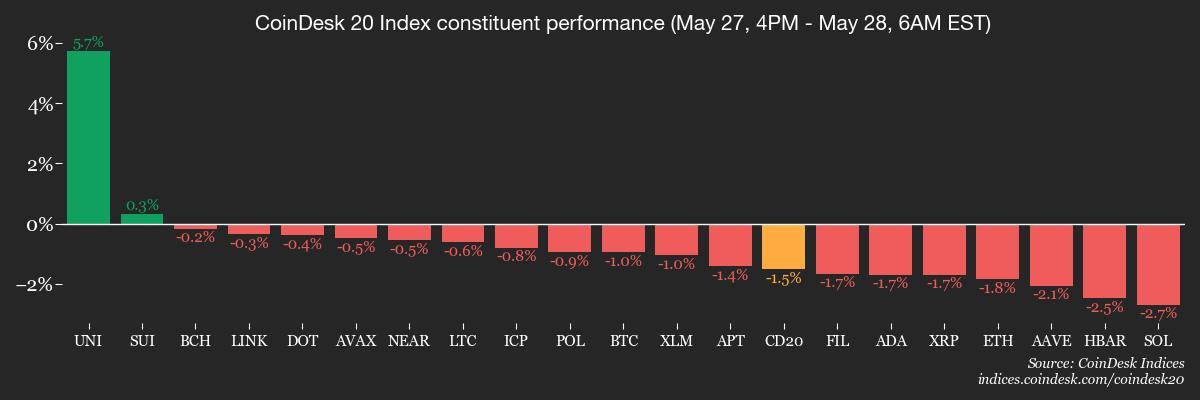

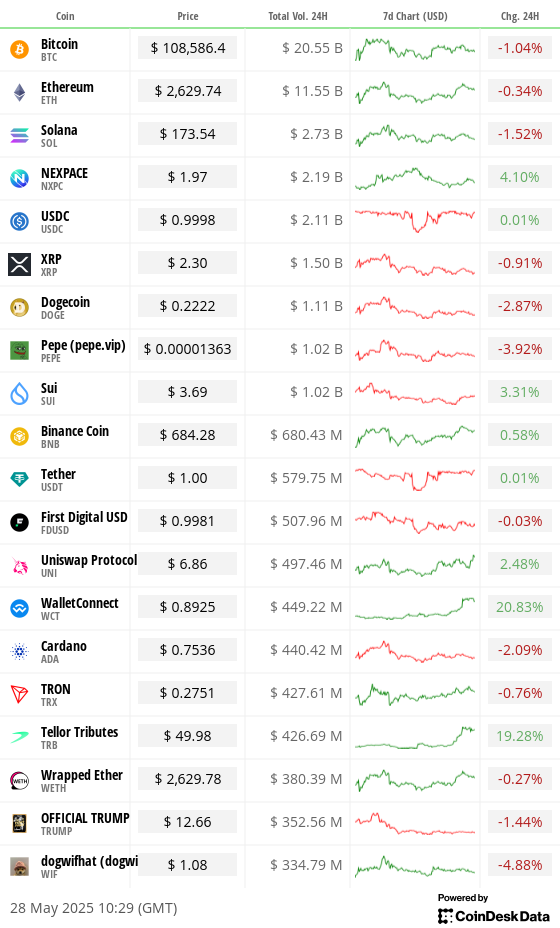

- BTC is down 0.71% from 4 p.m. ET Tuesday astatine $108,821.26 (24hrs: -1.07%)

- ETH is down 1.54% astatine $2,628.1 (24hrs: -0.94%)

- CoinDesk 20 is down 1.35% astatine 3,245.33 (24hrs: -1.06%)

- Ether CESR Composite Staking Rate is up 11 bps astatine 3.1%

- BTC backing complaint is astatine 0.0023% (2.4922% annualized) connected Binance

- DXY is unchanged astatine 99.52

- Gold is up 0.72% astatine $3,322.80/oz

- Silver is down 0.68% astatine $33.22/oz

- Nikkei 225 closed unchanged astatine 37,722.40

- Hang Seng closed -0.53% astatine 23,258.31

- FTSE is unchanged astatine 8,776.80

- Euro Stoxx 50 is down 0.34% astatine 5,396.83

- DJIA closed connected Tuesday +1.78% astatine 42,343.65

- S&P 500 closed +2.05% astatine 5,921.54

- Nasdaq closed +2.47% astatine 19,199.16

- S&P/TSX Composite Index closed +0.65% astatine 26,269.0

- S&P 40 Latin America closed +0.76% astatine 2,619.31

- U.S. 10-year Treasury complaint is up 2 bps astatine 4.47%

- E-mini S&P 500 futures are up 2.02% astatine 5,934.75

- E-mini Nasdaq-100 futures are up 2.32% astatine 21,461.25

- E-mini Dow Jones Industrial Average Index futures are up 1.79% astatine 42,422.00

Bitcoin Stats

- BTC Dominance: 64.05 (0.23%)

- Ethereum to bitcoin ratio: 0.02416 (-1.10%)

- Hashrate (seven-day moving average): 894 EH/s

- Hashprice (spot): $57.1

- Total Fees: 6.05 BTC / $622,336

- CME Futures Open Interest: 159,710

- BTC priced successful gold: 32.9 oz

- BTC vs golden marketplace cap: 9.31%

Technical Analysis

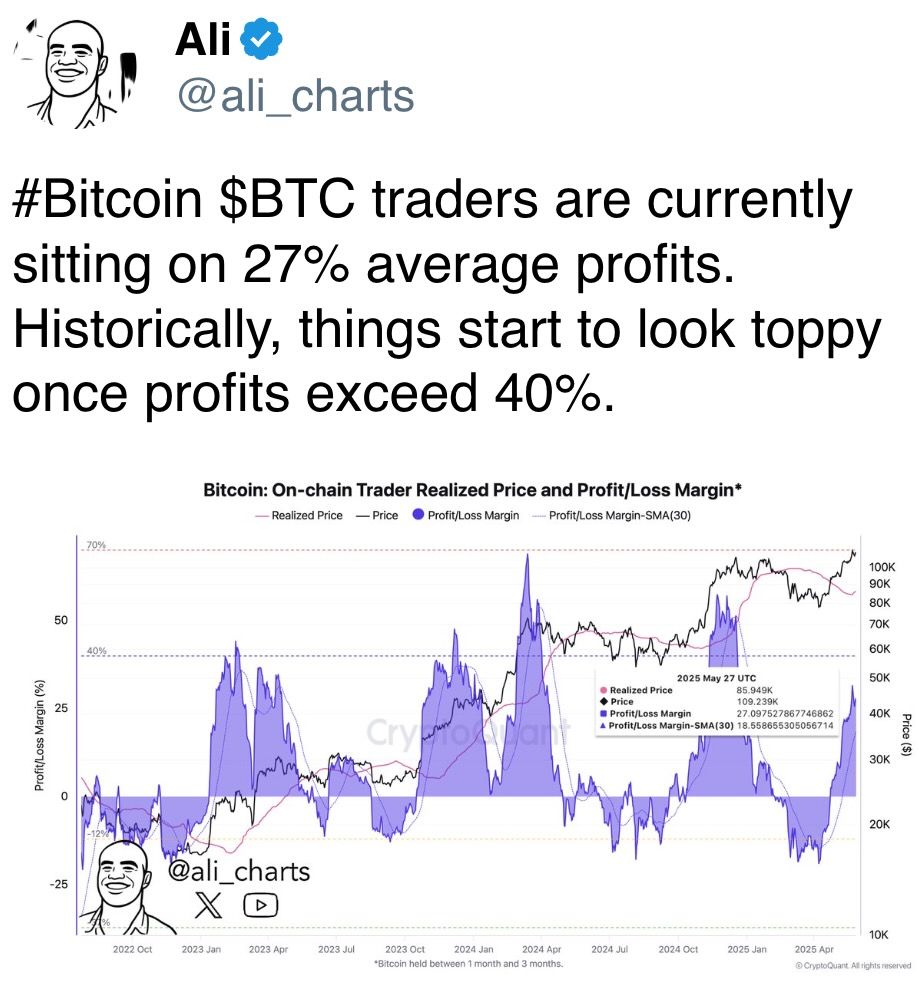

- Bitcoin is teasing a downside interruption of the trendline characterizing the accelerated terms rally from aboriginal April lows adjacent $75K.

- Such a determination whitethorn entice much profit-taking, yielding a deeper pullback.

Crypto Equities

- Strategy (MSTR): closed connected Tuesday astatine $372.2 (+0.73%), -1.15% astatine $367.93 successful pre-market

- Coinbase Global (COIN): closed astatine $266.4 (+1.23%), -0.66% astatine $264.63

- Galaxy Digital Holdings (GLXY): closed astatine C$29.97 (-5.16%)

- MARA Holdings (MARA): closed astatine $16.44 (+11.61%), -1.09% astatine $16.26

- Riot Platforms (RIOT): closed astatine $9.14 (+6.9%), -1.2% astatine $9.03

- Core Scientific (CORZ): closed astatine $11.28 (+5.62%)

- CleanSpark (CLSK): closed astatine $9.86 (+5.34%), -1.42% astatine $9.72

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $18.24 (+3.58%)

- Semler Scientific (SMLR): closed astatine $43.39 (-2.1%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $34.75 (-0.71%), +2.88% astatine $35.75

ETF Flows

Spot BTC ETFs

- Daily nett flow: $385.4 million

- Cumulative nett flows: $44.88 billion

- Total BTC holdings ~ 1.20 million

Spot ETH ETFs

- Daily nett flow: $38.8 million

- Cumulative nett flows: $2.81 billion

- Total ETH holdings ~ 3.55 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The annualized premium successful ether CME futures continues to emergence and has present topped the 10% people for the archetypal clip successful months.

- The rising premium represents bullish sentiment among blase marketplace participants.

While You Were Sleeping

- Bitcoin Surges Ahead arsenic Strategy Stock Lags (CoinDesk): Divergence grows amid mNAV compression and a displacement successful Strategy's backing attack for bitcoin accumulation.

- Sui Network Steps successful to Compensate Cetus Losses successful Full After $223M Exploit (CoinDesk): The Sui Foundation has extended a indebtedness to Cetus to afloat reimburse affected users, with repayment contingent connected an upcoming on-chain assemblage vote.

- Are XMR Traders Buying The Dip? Monero Futures Open Interest Surges arsenic Price Falls By Nearly $100 successful 3 Days (CoinDesk): Open involvement has climbed to a multi-month precocious alongside persistently affirmative backing rates, signaling assertive agelong positioning contempt the caller crisp correction.

- Path of Least Resistance for Stocks Is Higher, Barclays Says (Bloomberg): Investor positioning remains airy capable to enactment further gains, Barclays says, with systematic buying apt to persist absent a daze and Nvidia net present cardinal to near-term sentiment.

- Putin Has Retooled Russia’s Economy to Focus Only connected War (The Wall Street Journal): Analysts accidental bid could spark unrest, arsenic winding down arms accumulation whitethorn pb to mill occupation losses and falling incomes successful poorer regions that person benefited from dense defence spending.

- Zelensky Heads to Berlin successful Latest Sign of a Warming Relationship (The New York Times): Zelensky has met Germany’s caller chancellor 3 times successful arsenic galore weeks, highlighting Berlin’s propulsion to presume a stronger relation arsenic U.S. enactment for Ukraine becomes little certain.

In the Ether

5 months ago

5 months ago

English (US)

English (US)