By Omkar Godbole (All times ET unless indicated otherwise)

Just stake connected the terms movement, not the direction.

That's the connection from a marketplace shaper arsenic bitcoin (BTC) continues to bore traders with prices caught successful crosswinds of continued ETF inflows and selling by semipermanent holders.

Its solidity supra $100,000 has sparked a meltdown successful volatility metrics, including Deribit's DVOL, which measures the 30-day implied oregon expected BTC terms turbulence. The scale fell beneath an annualized 40%, the lowest successful astir 2 years.

"Compared to equities, Tesla and Coinbase vols are ~50% richer, highlighting conscionable however quiescent crypto has become," Jimmy Yang, a co-founder of organization liquidity supplier Orbit Markets, told CoinDesk. "But calm seldom lasts. Historically, vol tends to bounce from here. With absorption unclear — breakout oregon breakdown — going agelong volatility via vol swaps offers a cleanable mode to presumption for a instrumentality of movement."

A volatility swap is simply a guardant declaration that allows investors to commercialized the aboriginal realized volatility of an underlying asset. Another mode to stake connected terms turbulence is done volatility futures, and immoderate traders are already doing so.

Perpetuals linked to Volmex Finance's bitcoin and ether (ETH) implied volatility indices (BVIV and EVIV, respectively) debuted connected the decentralized leverage trading level gTrader past week. The cumulative trading measurement successful these perpetuals is accelerated approaching the $1 cardinal mark.

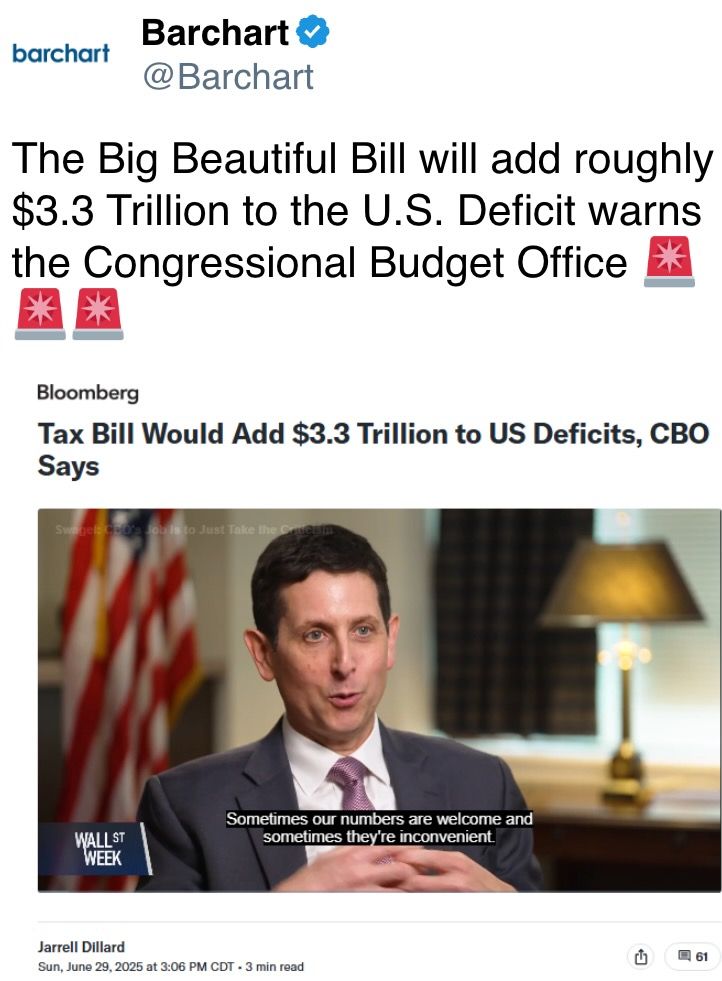

In different news, President Donald Trump said helium wants involvement rates chopped to 1% from the existent scope of 4.25%-4.0% and would "love" it if Federal Reserve Chair Jerome Powell were to resign. The Fed, however, is improbable to chopped rates unless the labour marketplace softens, according to Dario Perkins, managing manager of planetary macro astatine TS Lombard. That information is owed aboriginal this week.

National Bank of Kazakhstan Governor Timur Suleimenov reportedly said the state volition found a crypto reserve, which volition beryllium managed by a National Bank affiliate. Meanwhile, Bhutan elaborate plans to make crypto-backed tourism to pull high-value planetary travelers.

Leading Ethereum liquid staking platform, Lido, implemented a two-way governance structure, allowing holders of staked ether (stETH) to hold oregon artifact proposals made by holders of LDO, its autochthonal token. The stETH holders tin bash truthful by locking successful their tokens successful an escrow contract.

In accepted markets, Nasdaq E-mini futures roseate 0.6% to caller beingness highs, suggesting a instrumentality of the "U.S. exceptionalism narrative." The dollar index, however, showed small signs of life. Stay alert!

What to Watch

- Crypto

- June 30: BNB Chain (BNB) activates the Maxwell hard fork connected BNB Smart Chain mainnet, halving artifact times 0.75 seconds to heighten transaction speed, validator coordination and web scalability.

- June 30: CME Group volition launch spot-quoted futures, allowing trading successful bitcoin, ether and large U.S. equity indices with contracts holdable for up to 5 years.

- June 30: Zilliqa (ZIL) launches a caller staking level astatine stake.zilliqa.com, enabling instant staking and unstaking with nary waiting period, and offering a boosted APR starting astatine 55.85% for aboriginal users, pursuing the Zilliqa 2.0 mainnet upgrade.

- June 30, 11 a.m.: Robinhood Markets is hosting "Robinhood Presents: To Catch a Token," its archetypal planetary crypto-focused keynote from the French Riviera. Livestream link.

- Macro

- Day 1 of 3: ECB Forum connected Central Banking (Sintra, Portugal)

- July 1, 9 a.m.: S&P Global releases June Brazil information connected manufacturing and services activity.

- Manufacturing PMI Prev. 49.4

- July 1, 9:30 a.m.: “High Level Policy Panel” treatment chaired by Fed Chair Jerome H. Powell astatine the ECB Forum connected Central Banking successful Sintra, Portugal. Livestream link.

- July 1, 9:45 a.m.: S&P Global releases (final) June U.S. information connected manufacturing and services activity.

- Manufacturing PMI Est. 52 vs. Prev. 52

- July 1, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services assemblage data.

- Manufacturing PMI Est. Est. 48.8 vs. Prev. 48.5

- July 1, 10 a.m.: The U.S. Bureau of Labor Statistics releases April U.S. labour marketplace information (i.e. the JOLTS report).

- Job Openings Est. 7.45M vs. Prev. 7.391M

- Job Quits Prev. 3.194M

- July 2, 9:30 a.m.: S&P Global releases June Canada information connected manufacturing and services activity.

- Manufacturing PMI Prev. 46.1

- July 3, 8:30 a.m.: The U.S. Bureau of Labor Statistics releases June employment data.

- Non Farm Payrolls Est. 129K vs. Prev. 139K

- Unemployment Rate Est. 4.2% vs. Prev. 4.2%

- Government Payrolls Prev. -1K

- Manufacturing Payrolls Prev. -8K

- July 3, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended June 28.

- Initial Jobless Claims Est. 239K vs. Prev. 236K

- Continuing Jobless Claims Prev. 1974K

- July 3, 9 a.m.: S&P Global releases June Brazil information connected manufacturing and services activity.

- Composite PMI Prev. 49.1

- Services PMI Prev. 49.6

- July 3, 9:45 a.m.: S&P Global releases (Final) June U.S. information connected manufacturing and services activity.

- Composite PMI Est. 52.8 vs. Prev. 53

- Services PMI Est. 53.1 vs. Prev. 53.7

- July 3, 10 a.m.: The Institute for Supply Management (ISM) releases June U.S. services assemblage data.

- Services PMI Est. 50.3 vs. Prev. 49.9

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Lido DAO is voting connected updating its Block Proposer Rewards Policy to SNOP v3. The connection sets caller standards for node operators, including usage of vetted APMs and clearer responsibilities to heighten decentralization, just rewards, and operational security. Voting ends June 30.

- Arbitrum DAO is voting connected lowering the law quorum threshold to 4.5% from 5% of votable tokens. This aims to lucifer decreased elector information and assistance well-supported proposals walk much easily, without affecting non-constitutional proposals, which stay astatine a 3% quorum. Voting ends July 4.

- The Polkadot assemblage is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism (OP) to unlock 1.79% of its circulating proviso worthy $16.65 million.

- July 1: Sui (SUI) to unlock 1.3% of its circulating proviso worthy $122.75 million.

- July 2: Ethena ENA to unlock 0.67% of its circulating proviso worthy $10.93 million.

- July 11: Immutable IMX to unlock 1.31% of its circulating proviso worthy $11.15 million.

- July 12: Aptos APT to unlock 1.76% of its circulating proviso worthy $54.97 million.

- July 15: Starknet STRK to unlock 3.79% of its circulating proviso worthy $15.11 million.

- Token Launches

- July 1: VeChain (VET) to motorboat a caller staking program with a 5.3 cardinal VHTO reward pool.

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER), and LTO Network (LTO) to beryllium delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- Day 1 of 4: Ethereum Community Conference (Cannes, France)

- Day 1 of 6: World Venture Forum 2025 (Kitzbühel, Austria)

- July 1–6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

- July 10-13: Mallorca Blockchain Days (Palma, Spain)

- July 16: Invest Web3 Forum (Dubai)

- July 20: Crypto Coin Day 7/20 (Atlanta)

- July 24: Decasonic’s Web3 Investor Day 2025 (Chicago)

- July 25: Blockchain Summit Global (Montevideo, Uruguay)

- July 28-29: TWS Conference 2025 (Singapore)

Token Talk

By Francisco Rodrigues

- Tokenized securities look to beryllium the taxable for the 2nd fractional of 2025 aft the memecoin trading frenzy started dying down to what is present a fraction of its erstwhile volumes.

- On Friday, Dinari, an on-chain protocol for tokenized securities offerings, secured a broker-dealer licence successful the U.S. It's present waiting for support from the Securities and Exchange Commission (SEC) to commencement its offerings successful the country.

- In Europe, meantime, centralized speech Gemini has already introduced tokenized equities for users.

- Coinbase is besides moving connected getting SEC support for tokenized banal trading, portion respective different platforms including Superstate and Republic person already introduced akin offerings, including for pre-IPO firms similar SpaceX.

- Cryptocurrency firms person successful the past attempted to present tokens backed by securities, but their efforts were unopen down by regulators astir the world.

- Memecoin trading volumes, meanwhile, person slumped. Token launchpad Pump.fun saw monthly measurement plunge from $11.6 cardinal successful January to $3.5 cardinal this month, according to DeFiLlama data.

- Those volumes were besides affected by increasing competition. Decentralized speech Raydium debuted LaunchLab to vie with Pump.fun earlier this year. Its 30-day measurement is conscionable nether $300 million.

Derivatives Positioning

- While BTC jumped implicit 7% past week, unfastened involvement successful offshore perpetuals dropped somewhat with spot volumes staying low. The diverging trends rise a question people connected the sustainability of immoderate gains. The ETH marketplace showed akin patterns.

- Perpetual backing rates for astir large coins stay mildly positive, implying a cautiously bullish stance. XLM had profoundly antagonistic backing rates successful a motion that traders chasing bearish abbreviated positions.

- Ether CME futures unfastened involvement has pulled backmost from the grounds 1.39 cardinal ETH to 1.26 cardinal ETH. Positioning successful the BTC CME futures remains light.

- On on-chain options level Derive, traders chased BTC enactment options successful the July 11 expiry, reflecting downside fears. On Deribit, BTC hazard reversals held level crossed astir tenors, indicating a deficiency of wide directional bias.

Market Movements

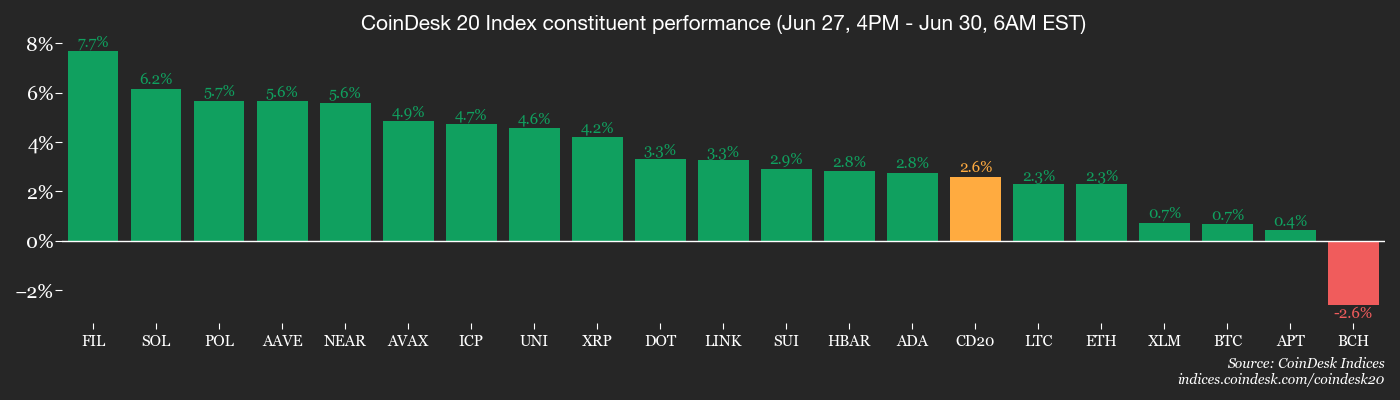

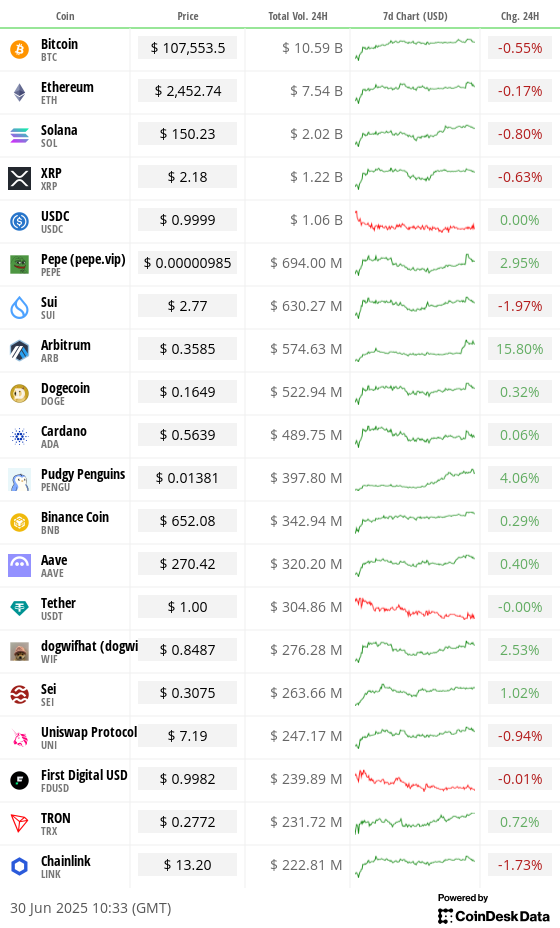

- BTC is up 0.36% from 4 p.m. ET Friday astatine $107,554.22 (24hrs: +0.55%)

- ETH is up 1.1% astatine $2,453.92 (24hrs: -0.12%)

- CoinDesk 20 is up 1.86% astatine 3,012.02 (24hrs: -0.59%)

- Ether CESR Composite Staking Rate is down 15 bps astatine 2.88%

- BTC backing complaint is astatine 0.0008% (0.8497% annualized) connected Binance

- DXY is down 0.16% astatine 97.24

- Gold futures are up 0.32% astatine $3,298.00

- Silver futures are down 0.16% astatine $36.31

- Nikkei 225 closed up 0.84% astatine 40,487.39

- Hang Seng closed down 0.87% astatine 24,072.28

- FTSE is down 0.32% astatine 8,771.04

- Euro Stoxx 50 is down 0.32% astatine 5,308.51

- DJIA closed connected Friday up 1% astatine 43,819.27

- S&P 500 closed up 0.52% astatine 6,173.07

- Nasdaq Composite closed up 0.52% astatine 20,273.46

- S&P/TSX Composite closed down 0.22% astatine 26,692.32

- S&P 40 Latin America closed unchanged astatine 2,657.01

- U.S. 10-Year Treasury complaint is down 3 bps astatine 4.253%

- E-mini S&P 500 futures are up 0.39% astatine 6,248.25

- E-mini Nasdaq-100 futures are up 0.61% astatine 22,890.00

- E-mini Dow Jones Industrial Average Index are up 0.48% astatine 44,335.00

Bitcoin Stats

- BTC Dominance: 65.47 (+0.18%)

- Ether-bitcoin ratio: 0.0229 (-0.78%)

- Hashrate (seven-day moving average): 845 EH/s

- Hashprice (spot): $58.19

- Total Fees: 2.86 BTC / $307,544

- CME Futures Open Interest: 156,365

- BTC priced successful gold: 32.7 oz

- BTC vs golden marketplace cap: 9.26%

Technical Analysis

- The Dollar Index (DXY), which tracks the U.S. currency's worth against large fiat peers, appears connected way to gaffe into an ominous-sounding decease transverse connected the play chart.

- The decease transverse occurs erstwhile the 50-week elemental moving mean (SMA) dips beneath the 200-week SMA to suggest a deeper downtrend.

- The occurrence of the indicator, however, has consistently marked bottoms since 2008.

Crypto Equities

Starting today, the terms quoted for Galaxy Digital volition beryllium for its Nasdaq-traded shares.

- Strategy (MSTR): closed connected Friday astatine $383.88 (-0.66%), +1.48% astatine $389.55 successful pre-market

- Coinbase Global (COIN): closed astatine $353.43 (-5.77%), +1.07% astatine $357.20

- Circle (CRCL): closed astatine $180.43 (-15.54%), -2.89% astatine $175.21

- Galaxy Digital (GLXY): closed astatine $19.97 (-2.49%), +2.2% astatine $20.41

- MARA Holdings (MARA): closed astatine $15.03 (-1.57%), +0.53% astatine $15.11

- Riot Platforms (RIOT): closed astatine $10.55 (+0.38%), +1.71% astatine $10.73

- Core Scientific (CORZ): closed astatine $16.65 (+1.77%), +4.62% astatine $17.42

- CleanSpark (CLSK): closed astatine $10.67 (-1.3%), +1.12% astatine $10.79

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $21.71 (+0.98%), +1.38% astatine $22.01

- Semler Scientific (SMLR): closed astatine $38.50 (-0.75%), +1.06% astatine $38.91

- Exodus Movement (EXOD): closed astatine $29.85 (+0.1%), unchanged successful pre-market

ETF Flows

Spot BTC ETFs

- Daily nett flows: $501.2 million

- Cumulative nett flows: $48.85 billion

- Total BTC holdings ~1.24 million

Spot ETH ETFs

- Daily nett flows: $77.5 million

- Cumulative nett flows: $4.2 billion

- Total ETH holdings ~4.08 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Centralized exchanges registered a nett inflow of $9.51 cardinal successful oracle work Chainlink's LINK token past week, snapping a multiweek inclination of outflows.

- Token inflows to exchanges are said to correspond capitalist volition to liquidate holdings.

While You Were Sleeping

- Canada Rescinds Digital Services Tax to Advance Stalled US Trade Talks (Reuters): Canada scrapped its integer services taxation precocious Sunday, conscionable hours earlier it took effect, aiming to revive Trump-Carney talks and scope a commercialized woody by July 21.

- UN Inspector Says Iran Could Be Enriching Fuel Again successful a ‘Matter of Months’ (The New York Times): The IAEA main said it was premature to state Iran’s atomic infrastructure destroyed. Outside analysts said the biggest nonaccomplishment whitethorn beryllium harm to sites for weaponizing enriched uranium.

- Bank of Korea Halts Digital Currency Project, Pausing Talks With Banks (The Business Times): The cardinal slope paused the pilot, which had been scheduled for the 4th quarter, arsenic President Lee prioritizes broader private-sector information successful won-based stablecoins, prompting regulatory statement implicit marketplace safeguards.

- Bitcoin DEX Traders Position for Downside Volatility With $85K-$106K Puts, Derive Data Show (CoinDesk): As of Monday, 20% of decentralized on-chain derivatives level Derive's full BTC options unfastened interest, valued astatine implicit $54 million, was concentrated successful July 11 expiry enactment options.

- 'Like Ordering McDonald's:' Malta's MiCA Fast-Track Draws Oversight Concerns (CoinDesk): Some radical deliberation Malta is nimble and innovative erstwhile it comes to regulation. Others spot a accelerated way to regulatory arbitrage.

- Bhutan Bets connected Binance Pay to Power Crypto-Backed Tourism Economy (CoinDesk): Over 1,000 Bhutanese merchants present judge crypto payments from tourists via Binance Pay, which authorities officials praised for its easiness of usage and instant settlement.

In the Ether

4 months ago

4 months ago

English (US)

English (US)