By Francisco Rodrigues (All times ET unless indicated otherwise)

One of the biggest bitcoin BTC options expiries of the twelvemonth has travel and gone, and the largest cryptocurrency has declined conscionable 0.6% successful the past 24 hours to a small nether $107,000.

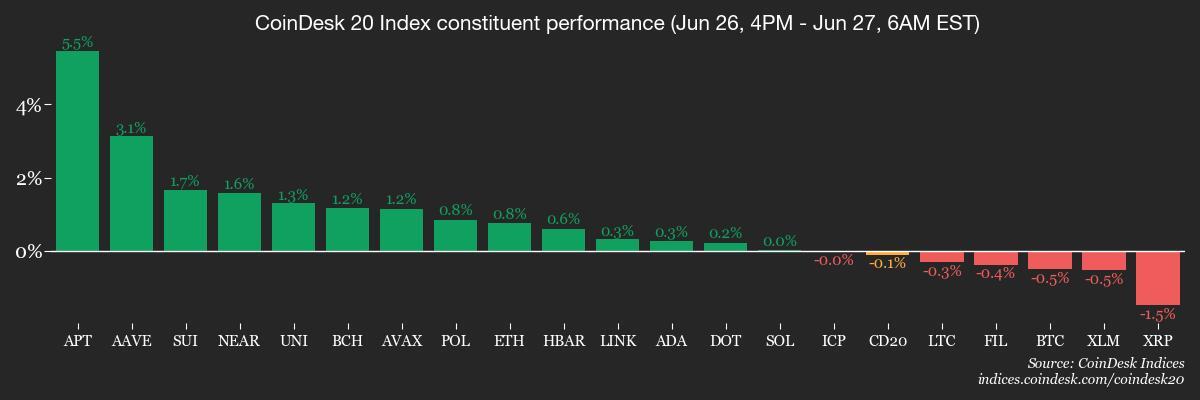

In bitcoin terms, that's beauteous overmuch stone steady. For a look astatine however unperturbed traders are astatine the moment, see Deribit’s BTC Volatility Index (DVOL), a measurement of implied volatility. That's present dropped to 37, its lowest level since precocious 2023. The broader crypto marketplace is little sanguine, with the CoinDesk 20 (CD20) scale down 1.2%.

Bitcoin's reduced volatility is "perhaps a motion that the marketplace is progressively assured successful its macro-hedge role," Deribit's Chief Commercial Officer Jean-David Péquignot told CoinDesk. “Bitcoin’s $105K level is pivotal, with technicals suggesting caution if enactment fails."

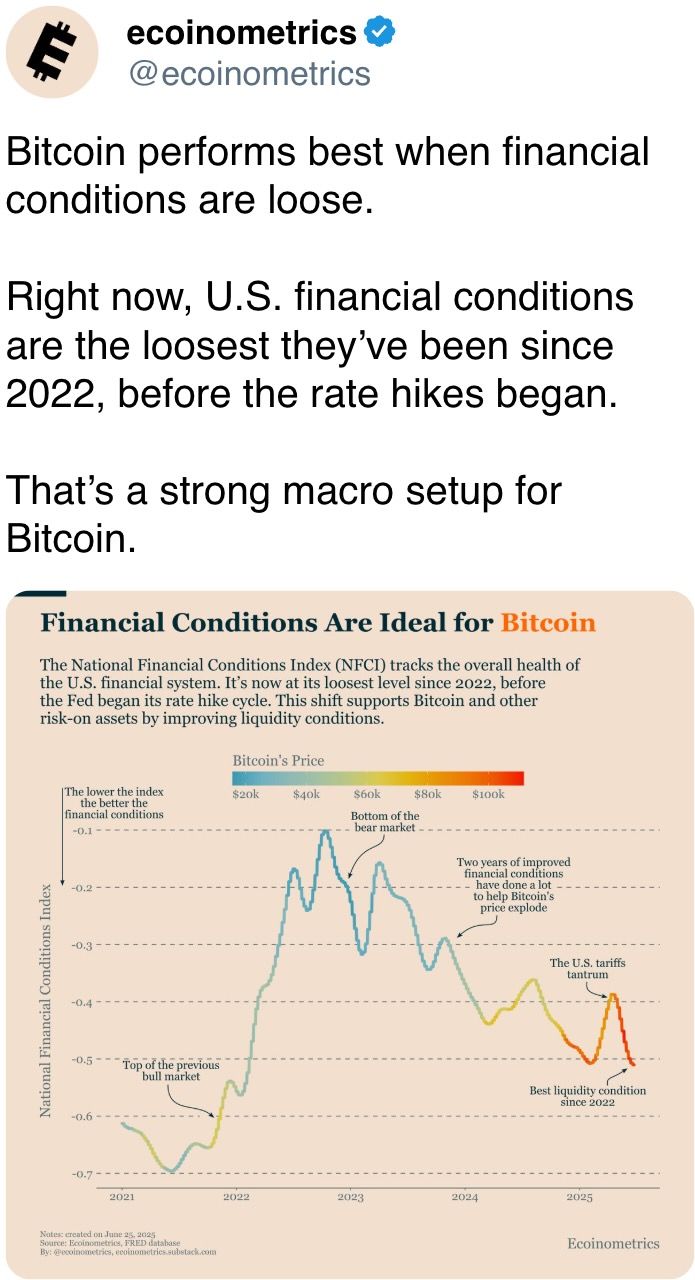

The ceasefire successful the Israel-Iran warfare has, nary doubt, calmed geopolitical tensions for the clip being, though that's acold from the lone struggle successful the world. Investors whitethorn besides beryllium waiting for directional signs from the economy, with U.S. idiosyncratic depletion expenditures (PCE) owed aboriginal today. That's a study the Federal Reserve keeps a adjacent oculus on.

“Emergence of an outer catalyst specified arsenic an escalation of the NATO-Russia tensions volition trial the market’s resilience, though the wide mid-term upward terms trajectory seems to stay successful play," Péquignot said.

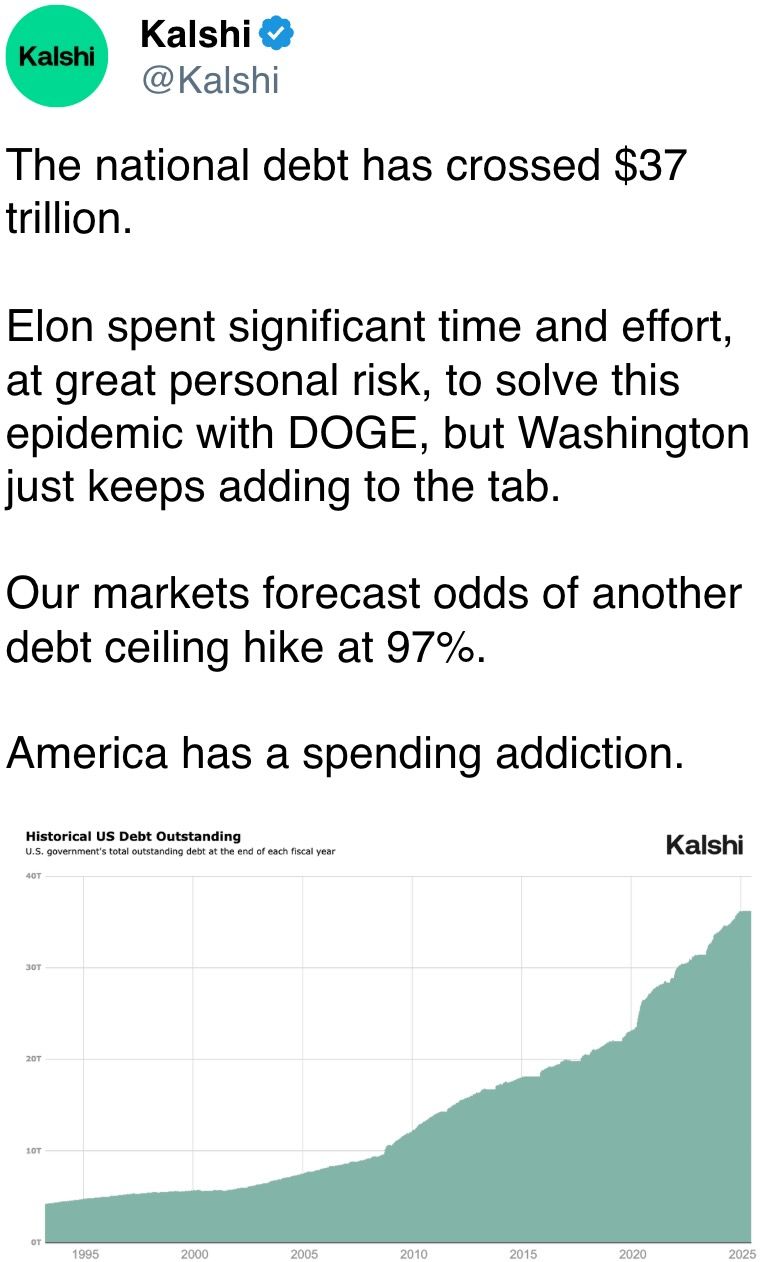

Reports that the White House whitethorn announce a successor to Fed Chair Jerome Powell successful coming months raised caller questions astir the U.S. cardinal bank’s independence, bringing down the greenback: The U.S. dollar scale stumbled to a 3-year low.

Equity markets, meantime, person roared backmost to life. In Asia, shares deed a three-year precocious connected optimism the U.S. and China person reached an agreement implicit the rare-earth trade, feeding a broader risk-on trend.

Still, the impending U.S. PCE study is dominating today's agenda. A fig supra economists' estimates could wounded the chances of a July complaint chopped and undermine the existent trend.

"The crypto marketplace is presently successful a wait-and-see phase, and the upcoming information volition apt find the short-term direction,” Bitfinix analysts told CoinDesk. “If PCE results travel successful arsenic expected oregon thin dovish, crypto assets whitethorn spot a catch-up rally.” Stay alert!

What to Watch

- Crypto

- June 30: CME Group volition introduce spot-quoted futures, pending regulatory approval, allowing trading successful bitcoin, ether and large U.S. equity indices with contracts holdable for up to 5 years.

- July 21: Coinbase Derivatives volition launch perpetual-style crypto futures successful the U.S., starting with bitcoin and ether (ETH). The futures person nary quarterly expiration, are disposable 24/7, way spot prices, and are afloat CFTC compliant.

- Macro

- June 27, 9:15 a.m.: Fed Governor Lisa D. Cook volition present a code astatine a Fed Listens lawsuit hosted by the Federal Reserve Bank of Cleveland. Livestream link.

- June 27, 8 a.m.: The Brazilian Institute of Geography and Statistics (IBGE) releases May unemployment complaint data.

- Unemployment Rate Est. 6.4% vs. Prev. 6.6%

- June 27, 8 a.m.: Mexico's National Institute of Statistics and Geography releases May unemployment complaint data.

- Unemployment Rate Est. 2.5% vs. Prev. 2.5%

- June 27, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases May user income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.5%

- PCE Price Index MoM Est. 0.1% vs. Prev. 0.1%

- PCE Price Index YoY Est. 2.3% vs. Prev. 2.1%

- Personal Income MoM Est. 0.3% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.1% vs. Prev. 0.2%

- June 27, 10 a.m.: The University of Michigan releases (final) June U.S. user sentiment data.

- Michigan Consumer Sentiment Est. 60.5 vs. Prev. 52.2

- July 1, 9:30 a.m.: Policy sheet treatment chaired by Fed Chair Jerome H. Powell astatine the ECB Forum connected Central Banking successful Sintra, Portugal. Livestream link.

- Earnings (Estimates based connected FactSet data)

- None successful the adjacent future.

Token Events

- Governance votes & calls

- Lido DAO is voting connected updating its Block Proposer Rewards Policy to SNOP v3. The connection sets caller standards for node operators, including usage of vetted APMs and clearer responsibilities to heighten decentralization, just rewards, and operational security. Voting ends June 30.

- Arbitrum DAO is voting connected lowering the law quorum threshold to 4.5% from 5% of votable tokens. This aims to lucifer decreased elector information and assistance well-supported proposals walk much easily, without affecting non-constitutional proposals, which stay astatine a 3% quorum. Voting ends July 4.

- The Polkadot assemblage is voting on launching a non-custodial Polkadot branded outgo card to “to span the spread betwixt integer assets successful the Polkadot ecosystem and mundane spending.” Voting ends July 9.

- Unlocks

- June 30: Optimism OP to unlock 1.79% of its circulating proviso worthy $16.65 million.

- July 1: Sui SUI to unlock 1.3% of its circulating proviso worthy $116.59 million.

- July 2: Ethena ENA to unlock 0.67% of its circulating proviso worthy $10.22 million.

- July 11: Immutable IMX to unlock 1.31% of its circulating proviso worthy $10 million.

- July 12: Aptos APT to unlock 1.76% of its circulating proviso worthy $57.11 million.

- July 15: Starknet STRK to unlock 3.79% of its circulating proviso worthy $13.72 million.

- Token Launches

- June 27: Moonveil (MORE) to beryllium listed connected Binance, WEEX, KuCoin, Bitget, BingX, MEXC and others.

- June 27: Blum (BLUM) to beryllium listed connected Gate.io, MEXC, WEEX, BingX, CoinW and others.

- June 27: DeFiTuna’s TUNA airdrop checker, allowing users to verify eligibility for adjacent month’s token procreation event, went live.

- July 4: Biswap (BSW), Stella (ALPHA), Komodo (KMD), LeverFi (LEVER) and LTO Network (LTO) to beryllium delisted from Binance.

Conferences

The CoinDesk Policy & Regulation conference (formerly known arsenic State of Crypto) is simply a one-day boutique lawsuit held successful Washington connected Sept. 10 that allows wide counsels, compliance officers and regulatory executives to conscionable with nationalist officials liable for crypto authorities and regulatory oversight. Space is limited. Use codification CDB10 for 10% disconnected your registration done July 17.

- Day 3 of 3: 7th Blockchain and Internet of Things Conference (Tsukuba, Japan)

- Day 3 of 3: 7th International Congress connected Blockchain and Applications (Lille, France)

- Day 3 of 4: Solana Solstice 2025 (New York)

- Day 2 of 2: Istanbul Blockchain Week

- Day 2 of 2: Seoul Meta Week 2025

- June 28: Cyprus Blockchain Summit 2025 (Limmasol)

- June 28-29: The Bitcoin Rodeo (Calgary, Canada)

- June 30: RWA Cannes Summit 2025 (Cannes, France)

- June 30 to July 3: Ethereum Community Conference (Cannes, France)

- June 30 to July 5: World Venture Forum 2025 (Kitzbühel, Austria)

- July 1–6: Bitcoin Alaska (Juneau, Alaska)

- July 4-5: The Bitcoin Paradigm 2025 (Neuchâtel, Switzerland)

- July 4–6: ETHGlobal Cannes (Cannes, France)

Token Talk

By Shaurya Malwa

- SAHARA plunged astir 40% from a highest of 14 cents connected its archetypal time of unrecorded trading, dropping to a debased adjacent 8 cents, CoinGecko information show.

- Trading measurement exploded to $720M–$850M, a surge of arsenic overmuch arsenic 2,700% implicit the anterior day, indicating frenzied enactment surrounding the listing.

- SAHARA launched with 20% of full proviso (2 cardinal tokens) successful circulation, backed by a Binance “HODLer airdrop” and ample organization funding, including Polychain, Pantera and YZI Labs (formerly Binance Labs).

- With listings crossed large platforms including Binance and OKX, SAHARA was adjacent portion of a Binance airdrop run via its Simple Earn program.

- The task aims to physique a “decentralized AI economy,” touting 1.4 cardinal testnet users and ecosystem tools spanning information services, exemplary marketplaces and compute networks .

- The terms concisely deed highs adjacent $0.59 connected secondary futures markets earlier crashing, indicative of however aboriginal signifier AI‑crypto tokens tin detonate — and illness — wrong hours.

Derivatives Positioning

- The annualized three-month ground successful BTC futures connected offshore giants Binance, Deribit and OKX, has jumped supra 5%, snapping the downtrend from precocious May's highs supra 8% successful a motion of renewed bias for longs.

- ETH ground continues to inclination little and is holding beneath 5%.

- On the CME, SOL futures person slipped beneath an annualized 10% basis, but stay elevated comparative to BTC and ETH. SOL measurement has cooled sharply to $72 cardinal from $244 cardinal connected June 23.

- In altcoins, XLM, BCH and APT basal retired arsenic coins with profoundly antagonistic perpetual backing rates, suggesting imaginable for a crisp abbreviated compression higher.

- On Deribit, BTC hazard reversals person shifted positively successful favour of calls crossed each tenors. For ether, front-end options proceed to amusement a bias for puts, with bullishness evident lone aft the September expiry.

- Overnight BTC options travel connected the OTC web Paradigm person been mixed alongside a rollover of enactment options successful ETH.

Market Movements

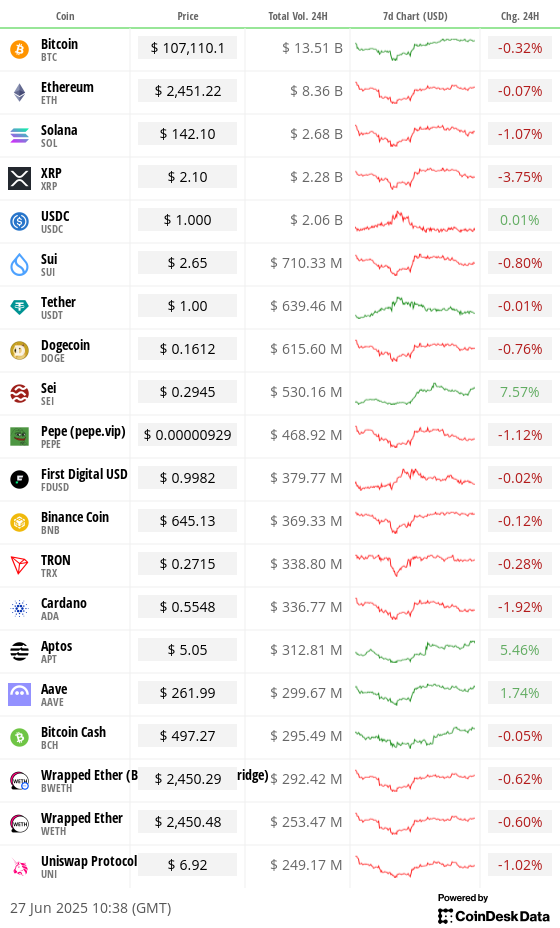

- BTC is down 0.63% from 4 p.m. ET Thursday astatine $107,154.23 (24hrs: -0.3%)

- ETH is up 0.63% astatine $2,462.30 (24hrs: +0.03%)

- CoinDesk 20 is down 0.41% astatine 2,968.88 (24hrs: -0.94%)

- Ether CESR Composite Staking Rate is down 4 bps astatine 3%

- BTC backing complaint is astatine 0.0038% (4.1840% annualized) connected Binance

- DXY is up 0.12% astatine 97.26

- Gold futures are down 1.55% astatine $3,296.10

- Silver futures are down 2.26% astatine $36.09

- Nikkei 225 closed up 1.43% astatine 40,150.79

- Hang Seng closed down 0.17% astatine 24,284.15

- FTSE is up 0.56% astatine 8,784.71

- Euro Stoxx 50 is up 0.98% astatine 5,295.34

- DJIA closed connected Thursday up 0.94% astatine 43,386.84

- S&P 500 closed up 0.80% astatine 6,141.02

- Nasdaq Composite closed up 0.97% astatine 20,167.91

- S&P/TSX Composite closed up 0.70% astatine 26,751.95

- S&P 40 Latin America closed up +1.76% astatine 2,657.77

- U.S. 10-Year Treasury complaint is up 2 bps astatine 4.273%

- E-mini S&P 500 futures are up 0.23% astatine 6,209.00

- E-mini Nasdaq-100 futures are up 0.31% astatine 22,738.50

- E-mini Dow Jones Industrial Average Index are up 0.22% astatine 43,814.00

Bitcoin Stats

- BTC Dominance: 65.78% (-0.18%)

- Ether to bitcoin ratio: 0.0229 (1.33%)

- Hashrate (seven-day moving average): 827 EH/s

- Hashprice (spot): $53.81

- Total Fees: 7.57 BTC / $815,336

- CME Futures Open Interest: 156,305 BTC

- BTC priced successful gold: 32.3 oz

- BTC vs golden marketplace cap: 9.2%

Technical Analysis

- The bullish lawsuit for the bitcoin cash-bitcoin (BCH/BTC) ratio has strengthened with the 14-week comparative spot index, a momentum oscillator, topping the 50 people to suggest upward momentum.

- The RSI is present astatine its astir bullish speechmaking since April 2024.

Crypto Equities

Effective June 30, the terms for Galaxy volition beryllium for its Nasdaq listing denominated successful U.S. dollars alternatively than the Canadian-dollar-denominated listing connected the TSX.

- Strategy (MSTR): closed connected Thursday astatine $386.44 (-0.57%), -0.12% astatine $385.97

- Coinbase Global (COIN): closed astatine $375.07 (+5.54%), -0.45% astatine $373.40

- Circle (CRCL): closed astatine $213.63 (+7.56%), +4.18% astatine $222.55

- Galaxy Digital Holdings (GLXY): closed astatine C$27.94 (+5%)

- MARA Holdings (MARA): closed astatine $15.27 (+1.94%), -0.52% astatine $15.19

- Riot Platforms (RIOT): closed astatine $10.51 (+5.1%), unchanged successful pre-market

- Core Scientific (CORZ): closed astatine $16.36 (+33.01%), +6.36% astatine $17.40

- CleanSpark (CLSK): closed astatine $10.81 (+1.98%), -0.37% astatine $10.77

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $21.5 (+10.37%), +2.79% astatine $22.10

- Semler Scientific (SMLR): closed astatine $38.79 (-5.48%), unchanged successful pre-market

- Exodus Movement (EXOD): closed astatine $29.82 (-4.3%), +0.27% astatine $29.90

ETF Flows

Spot BTC ETFs

- Daily nett flows: $226.7 million

- Cumulative nett flows: $48.35 billion

- Total BTC holdings ~1.24 million

Spot ETH ETFs

- Daily nett flows: -$26.4 million

- Cumulative nett flows: $4.12 billion

- Total ETH holdings ~4.08 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- The altcoin dominance index, representing the integer marketplace stock of each cryptocurrencies, excluding the apical 10 tokens, has dropped to the lowest since January 2024, extending a multiyear slide.

- The diminution shows that the latest crypto bull marketplace is chiefly concentrated successful large tokens.

While You Were Sleeping

- Iran’s Foreign Minister Says Nuclear Facilities ‘Seriously Damaged’ (The New York Times): Iran’s overseas minister, Abbas Araghchi, backed a measure to extremity IAEA practice and signaled a displacement distant from inspections, a determination analysts accidental whitethorn beryllium utilized arsenic leverage successful aboriginal negotiations.

- Bitcoin's Double Top Warrants Caution, but a Full-Blown Price Crash Seems Unlikely: Sygnum Bank (CoinDesk): Only a daze lawsuit similar Terra oregon FTX would beryllium apt to trigger a large downturn, with existent conditions alternatively favoring a sustained bull cycle, said Sygnum's caput of concern research.

- Market Cap of Euro Stablecoins Surges to Nearly $500M arsenic EUR/USD Rivals Bitcoin's H1 Gains (CoinDesk): The marketplace headdress of euro-pegged stablecoins roseate 44% to $480 million, driven by a 138% leap successful Circle’s EURC. Still, the combined marketplace headdress remains little than 1% of dollar-pegged stablecoins.

- XRP's Price Volatility Crashes to Lowest Level Since Trump's Victory. What Next? (CoinDesk): XRP's terms has stayed successful a choky set contempt the debut of XRP futures and affirmative regulatory developments, with volatility hovering conscionable supra levels that often precede crisp moves.

- A Remote Himalayan Kingdom Bet Big connected Bitcoin Mining. So Far, It Has Paid Off. (The Wall Street Journal): Bhutan began mining bitcoin successful 2020 utilizing its surplus hydropower and present holds a $1.3 cardinal stash, adjacent to 40% of GDP.

- Brazil Supreme Court Rules Digital Platforms Are Liable for Users’ Posts (Financial Times): The 8-3 ruling allows civilian liability for platforms that neglect to region amerciable contented — adjacent without tribunal orders — drafting disapproval societal level Meta implicit censorship and the summation successful concern risk.

In the Ether

4 months ago

4 months ago

English (US)

English (US)