By Omkar Godbole (All times ET unless indicated otherwise)

The crypto marketplace has had a bullish 24 hours, acknowledgment to Wednesday's brushed U.S. halfway ostentation people that alleviated hawkish Fed concerns. The momentum, however, has slowed.

With the ostentation information retired of the way, crypto traders are refocusing connected President-elect Donald Trump's swearing-in connected Jan. 20 and imaginable pro-crypto enactment connected the archetypal day. Some expect bitcoin to acceptable caller highs by then, portion others are penciling successful astatine slightest 10% terms swings successful XRP, SOL, ETH and BTC.

On Polymarket, the probability of the U.S. holding BTC arsenic a portion of a strategical reserve has accrued to 50% for the archetypal time.

Bitwise, a San Francisco-based crypto plus absorption company, said connected X that it provided accusation astir bitcoin ETFs to a nation-state, adding value to the sovereign BTC adoption narrative.

Speculation is rife that SEC commissioners Hester Peirce and Mark Uyeda could rekindle crypto argumentation arsenic aboriginal arsenic adjacent week.

That said, don't place the value and market-moving quality of Treasury nominee Scott Bessent's confirmation proceeding successful beforehand of the Senate Finance Committee that kicks disconnected astatine 10:30 a.m. successful Washington. Bessent volition apt look scrutiny connected assorted topics, including dollar policy, tariffs and fiscal sustainability.

In released remarks, Bessent said helium wants the 2017 taxation cuts to go imperishable and guarantee the dollar remains a ascendant planetary reserve currency. He besides said tariffs are a invaluable negotiating tool.

According to ING, the dollar could rally if Bessent highlights the supposedly inflationary tariffs arsenic a cardinal tool. A renewed uptick successful the currency and Treasury yields whitethorn dilatory BTC's gains, perchance injecting volatility successful hazard assets successful general. Stay alert!

What to Watch

Crypto

Jan. 17: Oral arguments astatine the Court of Appeals for the District of Columbia successful KalshiEX LLC v. CFTC, wherever the CFTC is appealing the territory court's Sep. 12, 2024 ruling favoring Kalshi's Congressional Control Contracts.

Jan. 23: First deadline for a determination by the SEC connected NYSE Arca's Dec. 3 proposal to database and commercialized shares of Grayscale Solana Trust (GSOL), a closed-end trust, arsenic an ETF.

Jan. 25: First deadline for SEC decisions connected proposals for 4 caller spot solana ETFs: Bitwise Solana ETF, Canary Solana ETF, 21Shares Core Solana ETF and VanEck Solana Trust, which are each sponsored by Cboe BZX Exchange.

Macro

Jan. 16, 8:30 a.m.: The U.S. Department of Labor releases the Unemployment Insurance Weekly Claims Report for the week ended Jan. 11. Initial Jobless Claims Est. 210K vs. Prev. 201K.

Jan. 16, 10:30 a.m.: President-elect Donald Trump’s Treasury Secretary nominee, Scott Bessent, volition attest earlier aSenate Committee during his confirmation hearing. Livestream link.

Jan. 17, 5:00 a.m.: Eurostat releases December 2024's Eurozone ostentation data.

Inflation Rate MoM Final Est. 0.4% vs Prev. -0.3%.

Core Inflation Rate YoY Final Est. 2.7% vs. Prev. 2.7%.

Inflation Rate YoY Final Est. 2.4% vs. Prev. 2.2%.

Token Events

Governance votes & calls

The Aave assemblage is discussing a strategy to standard its GHO stablecoin by deploying a caller gross watercourse via bitcoin mining. It would usage superior from the GHO treasury to acquisition hardware.

Balancer DAO will vote connected whether to deploy Balancer v3 connected the Arbitrum blockchain. Voting starts Jan. 16 and ends Jan. 20.

Unlocks

Jan. 16: Arbitrum (ARB) to unlock 2.2% of its circulating supply, worthy $68 million.

Jan. 18: Ondo (ONDO) to unlock 134% of its circulating supply, worthy $2.19 billion.

Jan. 21: Fasttoken (FTN) to unlock 4.6% of circulating proviso worthy $76 million.

Token Launches

Jan. 16: Solayer (LAYER) to big token merchantability followed by 5 months of points farming.

Jan. 17: Solv Protocol (SOLV) to beryllium listed connected Binance.

Conferences:

Day 11 of 14: Starknet, an Ethereum furniture 2, is holding its Winter Hackathon (online).

Day 4 of 12: Swiss WEB3FEST Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Jan. 17: Unchained: Blockchain Business Forum 2025 (Los Angeles)

Jan. 18: BitcoinDay (Naples, Florida)

Jan. 20-24: World Economic Forum Annual Meeting (Davos-Klosters, Switzerland)

Jan. 21: Frankfurt Tokenization Conference 2025

Jan. 25-26: Catstanbul 2025 (Istanbul). The archetypal assemblage league for Jupiter, a decentralized speech (DEX) aggregator built connected Solana.

Jan 30-31: Plan B Forum (San Salvador, El Salvador)

Feb. 3: Digital Assets Forum (London)

Feb. 18-20: Consensus Hong Kong

Token Talk

By Oliver Knight

Cryptocurrency speech Kraken has experienced a spike successful ether (ETH) inflows aft a whale deposited $67 cardinal worthy of the token connected Thursday.

The wallet successful question withdrew a full of 217,513 ETH ($350 million) from Kraken and Coinbase implicit a 10-day play successful 2022 astatine an mean terms of $1,611. With ether presently trading astatine $3,330, the trader has made a full nett of $354 million, Lookonchain reports.

Coinbase's (COIN) derivatives speech has listed perpetual swap contracts for AERO, BEAM, DRIFT and S. All tokens are up betwixt 4% and 7% respectively.

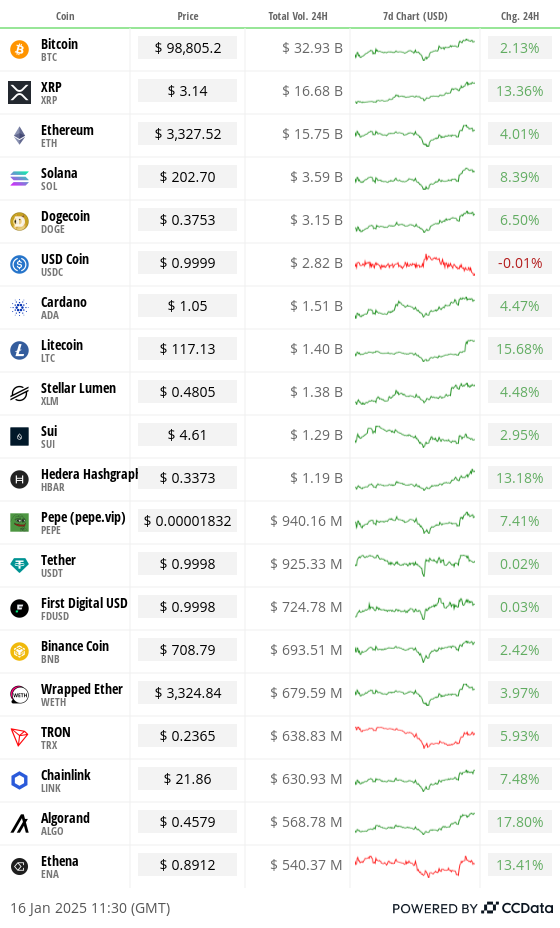

Artificial quality (AI) cause tokens shrugged disconnected past week's driblet with a important determination to the upside. Virtuals protocol (VIRTUAL) is up 31% successful the past 24 hours portion AI16Z is up 13%, some outperforming the CoinDesk20 (CD20) index which has risen by 5.7% successful 24-hours.

Litecoin is besides 1 of the day's apical performers aft exchange-traded money (ETF) expert Eric Balchunas said that the Litecoin S-1 ETF exertion had received comments backmost from the SEC, perchance paving the mode for a spot LTC ETF.

Derivatives Positioning

LTC has emerged arsenic the best-performing large coin successful the past 24 hours, with prices rising by 16%. The surge is accompanied by a 21% summation successful futures unfastened involvement and a affirmative Cumulative Volume Delta (CVD) indicator, suggesting beardown nett buying pressure.

HBAR and XRP person seen 10% jumps successful unfastened involvement with affirmative CVDs.

Front-end BTC and ETH options nary longer amusement a bias for puts, realigning with bullish semipermanent sentiment.

Key flows connected Deribit and Paradigm featured a BTC bull telephone dispersed involving $102K and $110K strikes and a carnivore telephone dispersed successful ETH, involving the March 28 expiry options astatine $3.5K and $4.5K strikes.

Market Movements:

BTC is down 0.47% from 4 p.m. ET Wednesday astatine $99,217.43 (24hrs: +0.64%)

ETH is down 2.46% astatine $3,334.68 (24hrs: +3.22%)

CoinDesk 20 is up 0.2% astatine 3,752.68 (24hrs: +5.68%)

Ether staking output is down 2 bps astatine 3.1%

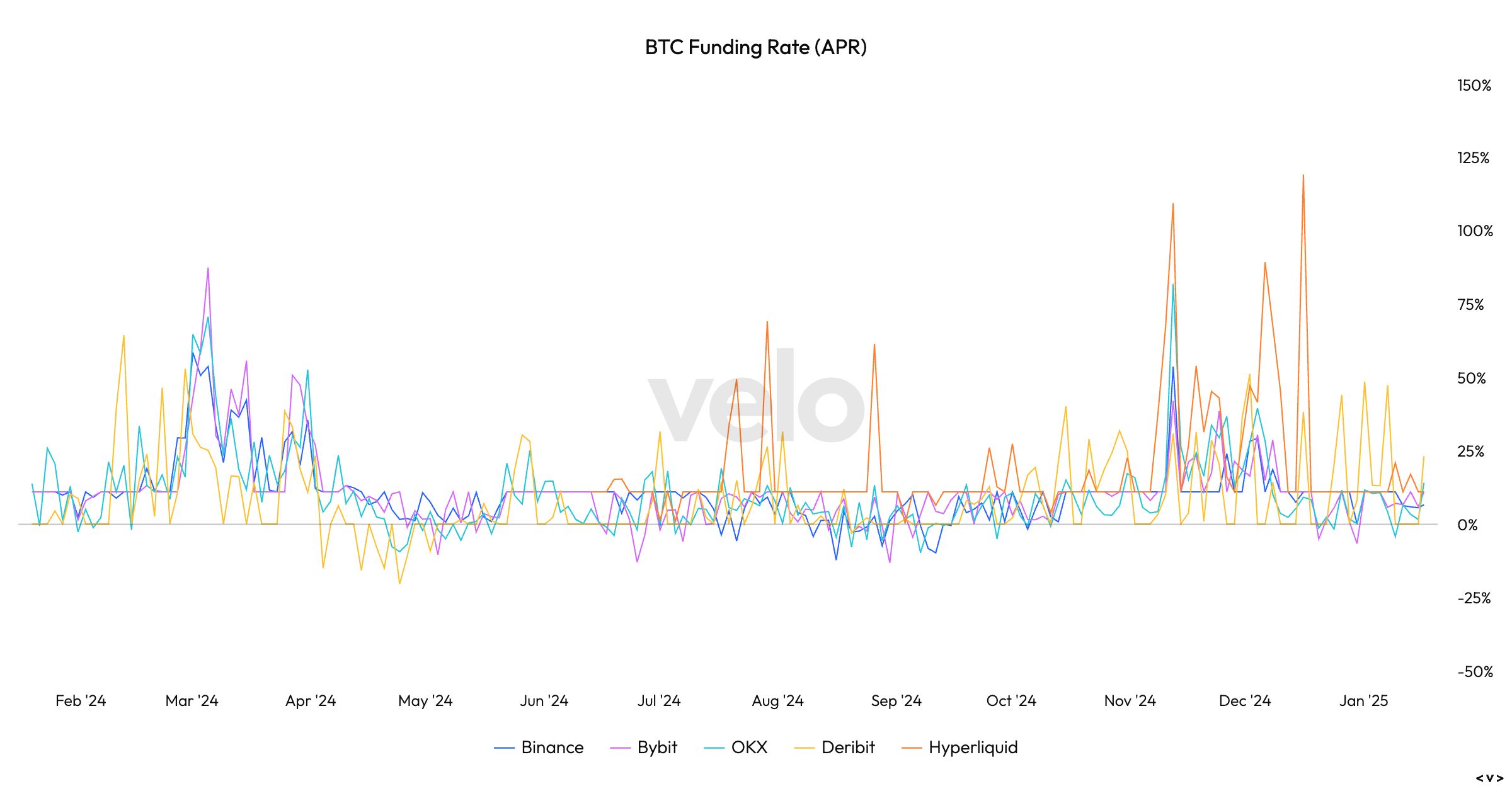

BTC backing complaint is astatine 0.006% (6.52% annualized) connected Binance

DXY is unchanged astatine at 109.13

Gold is up 0.94% astatine $2,737.90/oz

Silver is up 1.85% astatine $31.90/oz

Nikkei 225 closed +0.33% to 38,572.60

Hang Seng closed +1.23% astatine 19,522.89

FTSE is up 0.82% astatine 8,369.48

Euro Stoxx 50 is up 1.24% astatine 5,094.68

DJIA closed connected Wednesday +1.65% to 43,221.55

S&P 500 closed +1.84% astatine 5,949.91

Nasdaq closed +2.45% astatine 19,511.23

S&P/TSX Composite Index closed +0.82% astatine 24,789.3

S&P 40 Latin America closed +2.49% astatine 2,262.81

U.S. 10-year Treasury is up 1 bp astatine 4.67%

E-mini S&P 500 futures are up 0.33% astatine 6,009.00

E-mini Nasdaq-100 futures are up 0.48% astatine 21,504.00

E-mini Dow Jones Industrial Average Index futures are unchanged astatine 43,501.00

Bitcoin Stats:

BTC Dominance: 57.66

Ethereum to bitcoin ratio: 0.033

Hashrate (seven-day moving average): 801 EH/s

Hashprice (spot): $56.8

Total Fees: $739,760/ 7.5 BTC

CME Futures Open Interest: 178,810 BTC

BTC priced successful gold: 36.5 oz

BTC vs golden marketplace cap: 10.40%

Technical Analysis

BTC is probing dual absorption astatine astir $100K, marked by the descending trendline from grounds highs and the Ichimoku cloud.

A breakout whitethorn motivate momentum traders to articulation the market, accelerating terms gains.

Crossovers supra the unreality are said to correspond a bullish displacement successful momentum.

Crypto Equities

MicroStrategy (MSTR): closed connected Wednesday astatine $360.62 (+5.39%), down 1% astatine $357 successful pre-market.

Coinbase Global (COIN): closed astatine $274.93 (+7.66%), down 0.53% astatine $273.48 successful pre-market.

Galaxy Digital Holdings (GLXY): closed astatine C$27.93 (+5%)

MARA Holdings (MARA): closed astatine $18.15 (+4.55%), down 0.55% astatine $18.05 successful pre-market.

Riot Platforms (RIOT): closed astatine $13.46 (+%), down 0.52% astatine $13.39 successful pre-market.

Core Scientific (CORZ): closed astatine $14.53 (+4.46%), down 0.21% astatine $14.50 successful pre-market.

CleanSpark (CLSK): closed astatine $11.2 (+8.21%), down 0.89% astatine $11.10 successful pre-market.

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $24.57 (+6.5%), down 1.14% astatine $24.29 successful pre-market.

Semler Scientific (SMLR): closed astatine $56.11 (+2.15%), unchanged successful pre-market.

Exodus Movement (EXOD): closed astatine $35.36 (+6.92%), unchanged successful pre-market.

ETF Flows

Spot BTC ETFs:

Daily nett flow: $755.1 million

Cumulative nett flows: $36.48 billion

Total BTC holdings ~ 1.133 million.

Spot ETH ETFs

Daily nett flow: $59.7 million

Cumulative nett flows: $2.477 billion

Total ETH holdings ~ 3.550 million.

Source: Farside Investors arsenic of Jan. 15.

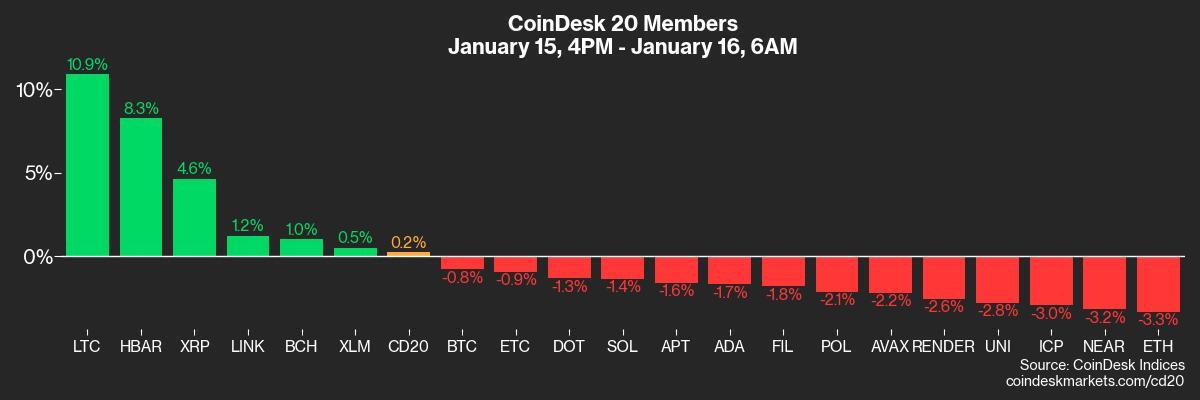

Overnight Flows

Chart of the Day

Bitcoin backing rates connected large exchanges, excluding Hyperliquid, stay good beneath aboriginal 2024 levels and the highs seen successful December, erstwhile the BTC terms broke supra $100,000 for the archetypal time.

In different words, it's cheaper to beryllium agelong close present than past period and a twelvemonth ago.

While You Were Sleeping

XRP’s Bullish Momentum Strongest Since January 2018 arsenic Futures Open Interest Hits Record High (CoinDesk): XRP has soared 50% this period to implicit $3, experiencing its strongest rally since 2018.

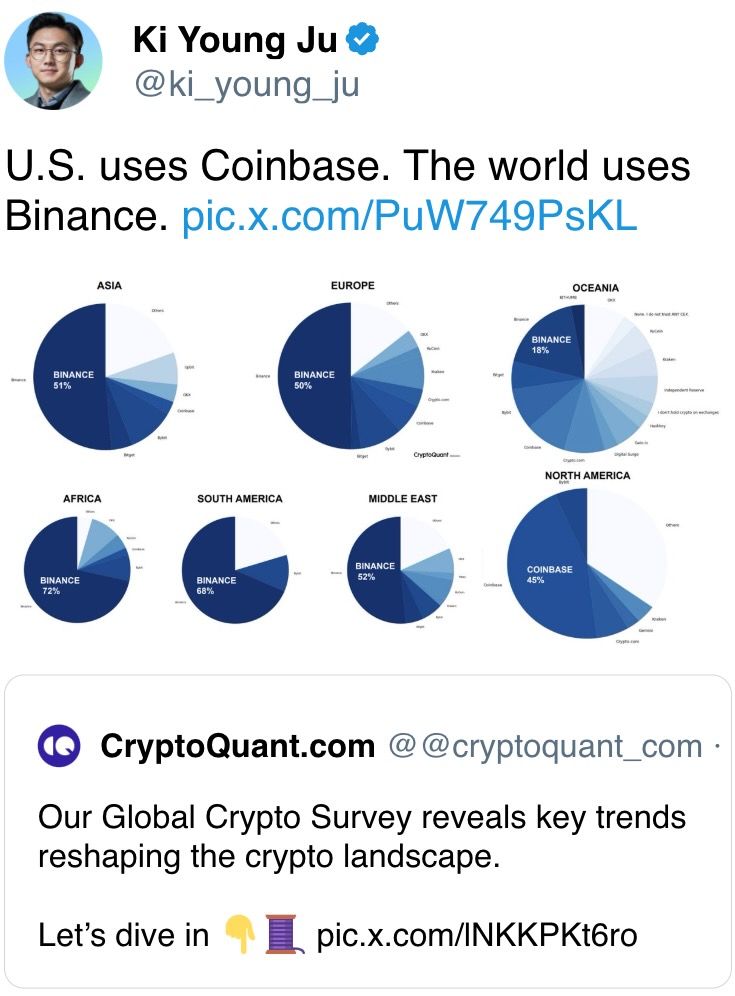

Monthly Crypto Trading connected CEXs Hits All-Time High successful December: CCData (Cointelegraph): December acceptable a caller grounds for crypto trading, with $11.3 trillion successful spot and derivatives measurement connected centralized exchanges.

Nomura-Backed Crypto Firm Komainu Raises $75 Million successful Bitcoin (Bloomberg): Komainu, a crypto custodian backed by Nomura, secured $75 cardinal successful bitcoin from Blockstream to grow globally, follow tokenization tools, and make a bitcoin treasury.

UK Economy Returns to Growth, Faces Uncertain Outlook (The Wall Street Journal): The U.K. system inched up 0.1% successful November, missing forecasts, arsenic ostentation and precocious borrowing costs strained growth.

Chinese Citizens’ Doubts Grow Over Official Growth Claims (Financial Times): China is acceptable to study 5% maturation for 2024, but skepticism abounds arsenic anemic user demand, layoffs and a existent property slump measurement heavy connected investment, depletion and regular life.

Bank of Korea Leaves Rates Unchanged successful a Surprise Move, Warns GDP Growth ‘Highly Likely’ to Miss Forecasts (CNBC): South Korea’s cardinal slope held its benchmark complaint astatine 3%, astonishing analysts expecting a cut, citing economical uncertainty. It warned of weaker maturation successful 2024 and 2025. Stocks and the won roseate pursuing the decision.

In the Ether

9 months ago

9 months ago

English (US)

English (US)