By Francisco Rodrigues (All times ET unless indicated otherwise)

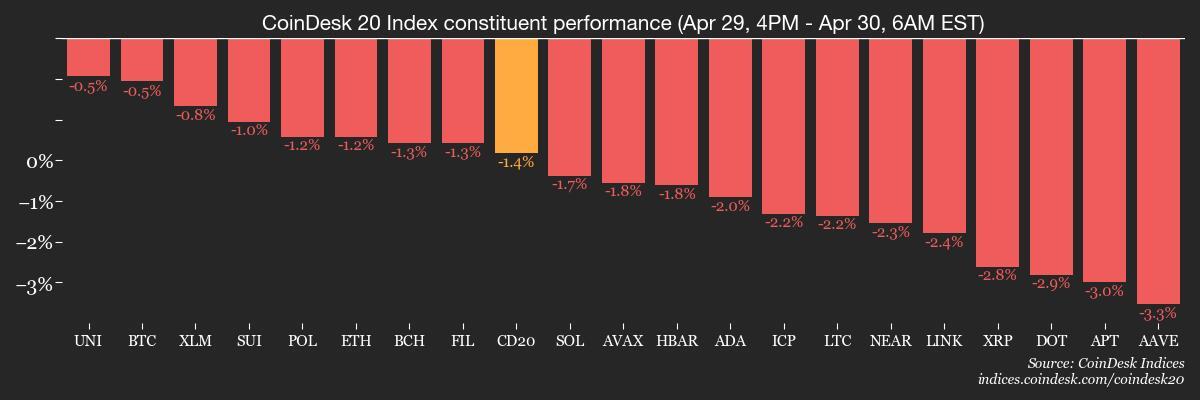

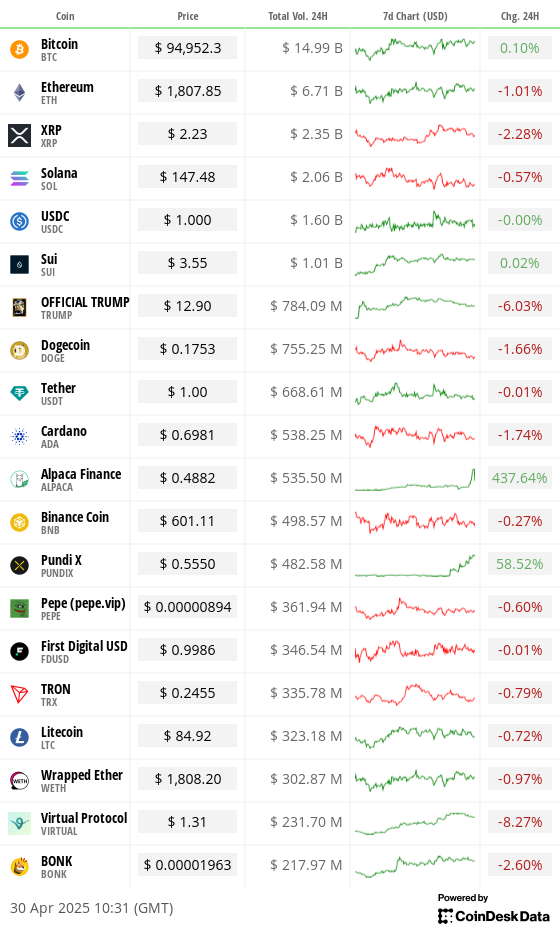

Cryptocurrencies fell somewhat successful the past 24 hours, with the wide marketplace CoinDesk 20 (CD20) scale dropping 1.4%. Bitcoin (BTC) is small changed astir $95,000. These figures are good wrong precocious volatility ranges and travel connected the backmost of a beardown monthly show — BTC is connected way to emergence 15% successful April, the astir since November.

The marketplace has been grappling with increasing pessimism surrounding the imaginable interaction of President Donald Trump's reciprocal tariffs connected astir each state and optimism that the Federal Reserve volition chopped involvement rates earlier than expected.

Stock prices person rallied implicit the past week connected expectations Trump would little the tariffs and the continuation of interest-rate cuts, according to Spanish slope Bankinter.

“Yet the position could crook for the worse from today, applying the logic of the data, due to the fact that — careless of tariffs and complaint cuts — portion of the harm has already been done, chiefly to confidence, which is the market’s foundation,” the slope wrote successful a note.

Indeed, assorted large companies, including P&G, UPS, PepsiCo, American Airlines and GM, person lowered oregon pulled their net forecasts. Bankinter pointed retired that French first-quarter GDP information released contiguous showed a quarter-on-quarter summation that was wholly inventory-driven, portion consumption, investment, and exports are weakening.

That bodes poorly for the U.S. figure, acceptable to beryllium released astatine 8:30 a.m. Some marketplace observers, including Bankinter, suggest it could declaration sharply. Bitcoin’s emergence truthful acold this year, contrasting with the stock market’s worst 100 days of a statesmanlike administration since 1974, could beryllium further grounds the cryptocurrency is starting to beryllium utilized arsenic a hedge.

As mentioned earlier successful the week, Greg Cipolaro, the planetary caput of probe astatine NYDIG, wrote successful a enactment that BTC has been acting “more similar the non-sovereign issued store of worth that it is.”

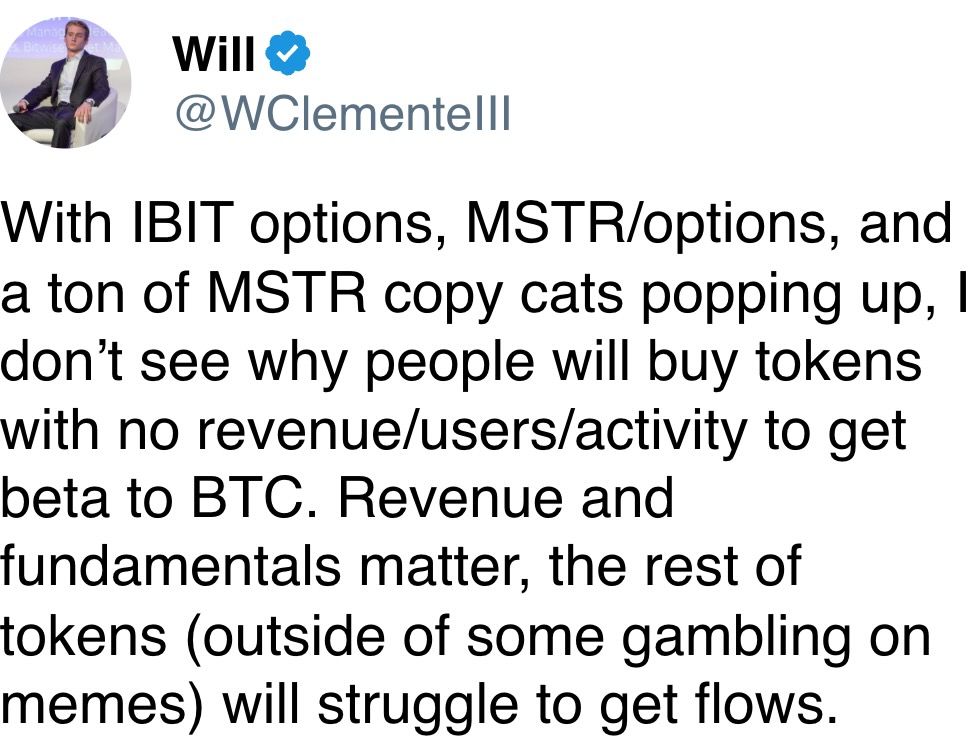

Bitcoin has decoupled from U.S. equities aft the commercialized warfare betwixt the U.S. and China escalated and has been seeing bets connected it rise. This month, spot bitcoin ETFs posted monthly full nett inflows of small implicit $3 cardinal according to SoSoValue data, further pointing to a formation to the cryptocurrency abstraction amid the uncertainty. Stay alert!

What to Watch

- Crypto:

- April 30, 9:30 a.m.: ProShares volition debut 3 ETFs that volition supply leveraged and inverse vulnerability to XRP: the ProShares Ultra XRP ETF, the ProShares Short XRP ETF and the ProShares UltraShort XRP ETF.

- April 30, 10:03 a.m.: Gnosis Chain (GNO), an Ethereum sister chain, volition activate the Pectra hard fork connected its mainnet astatine slot 21,405,696, epoch 1,337,856.

- May 1: Coinbase Asset Management volition introduce the Coinbase Bitcoin Yield Fund (CBYF), which is aimed astatine non-U.S. investors.

- May 1: Hippo Protocol starts up its ain layer-1 blockchain mainnet built connected Cosmos SDK and completes a migration from Ethereum’s ERC-20 HPO token to its autochthonal HP token, enabling staking and governance.

- May 1, 9 a.m.: Constellation Network (DAG) activates the Tessellation v3 upgrade connected its mainnet, introducing delegated staking, node collateral, token locking and caller transaction types to heighten web security, scalability and functionality.

- May 1, 11 a.m.: THORChain activates its v3.5 mainnet upgrade, adding the TCY token to person $200 cardinal successful indebtedness into equity. TCY holders gain 10% of web revenue, portion autochthonal RUNE remains the protocol’s information and governance token. TCY activates May 5.

- May 5, 3 a.m.: IOTA’s Rebased web upgrade starts. Rebased moves IOTA to a caller network, boosting capableness to arsenic galore arsenic 50,000 transactions per second, offering staking rewards of 10%-15% a twelvemonth and adding enactment for MoveVM astute contracts.

- May 5, 10 a.m.: The Crescendo web upgrade goes unrecorded connected the Kaspa (KAS) mainnet. This upgrade boosts the network’s show by expanding the artifact accumulation complaint to 10 blocks per 2nd from 1 artifact per second.

- Macro

- April 30, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment complaint data.

- Unemployment Rate Est. 7% vs. Prev. 6.8%

- April 30, 8 a.m.: Mexico's National Institute of Statistics and Geography releases (preliminary) Q1 GDP maturation data.

- GDP Growth Rate QoQ Prev. -0.6%

- GDP Growth Rate YoY Prev. 0.5%

- April 30, 8:30 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases (advance) Q1 GDP maturation data.

- GDP Growth Rate QoQ Est. 0.4% vs. Prev. 2.4%

- April 30, 10 a.m.: The U.S. Bureau of Economic Analysis (BEA) releases March user income and expenditure data.

- Core PCE Price Index MoM Est. 0.1% vs. Prev. 0.4%

- Core PCE Price Index YoY Est. 2.6% vs. Prev. 2.8%

- PCE Price Index MoM Est. 0% vs. Prev. 0.3%

- PCE Price Index YoY Est. 2.2% vs. Prev. 2.5%

- Personal Income MoM Est. 0.4% vs. Prev. 0.8%

- Personal Spending MoM Est. 0.6% vs. Prev. 0.4%

- May 1, 8:30 a.m.: The U.S. Department of Labor releases unemployment security information for the week ended April 26.

- Initial Jobless Claims Est. 224K vs. Prev. 222K

- May 1, 9:30 a.m.: S&P Global releases Canada April purchasing managers’ scale (PMI) data.

- Manufacturing PMI Prev. 46.3

- May 1, 10:00 a.m.: Institute for Supply Management (ISM) releases U.S. April economical enactment data.

- Manufacturing PMI Est. 48 vs. Prev. 49

- April 30, 8 a.m.: Brazil’s Institute of Geography and Statistics (IBGE) releases March unemployment complaint data.

- Earnings (Estimates based connected FactSet data)

- April 30: Robinhood Markets (HOOD), post-market, $0.33

- May 1: Block (XYZ), post-market, $0.97

- May 1: Reddit (RDDT), post-market, $0.02

- May 1: Riot Platforms (RIOT), post-market, $-0.23

- May 1: Strategy (MSTR), post-market, $-0.11

- May 8: Coinbase Global (COIN), post-market, $2.08

- May 8: Hut 8 (HUT), pre-market

- May 8: MARA Holdings (MARA), post-market

Token Events

- Governance votes & calls

- Compound DAO is voting connected moving 35,200 COMP ($1.5 million) into a multisig harmless to trial selling covered calls connected COMP for USDC, lend that USDC successful Compound for other yield, past usage the returns to bargain backmost COMP and repetition — targeting a astir 15 % yearly gain. Voting ends May 2.

- April 30, 12 p.m.: Helium to big a community telephone meeting.

- May 5, 4 p.m.: Livepeer (LPT) to big a Treasury Talk session connected Discord.

- Unlocks

- May 1: Sui (SUI) to unlock 2.28% of its circulating proviso worthy $261.2 million.

- May 1: ZetaChain (ZETA) to unlock 5.67% of its circulating proviso worthy $12.31 million.

- May 2: Ethena (ENA) to unlock 0.73% of its circulating proviso worthy $12.99 million.

- May 7: Kaspa (KAS) to unlock 0.56% of its circulating proviso worthy $13.08 million.

- May 9: Movement (MOVA) to unlock 2.04% of its circulating proviso worthy $12.31 million.

- Token Launches

- May 2: Binance to delist Alpaca Finance (ALPACA), PlayDapp (PDA), Viberate (VIB), and Wing Finance (WING).

- May 5: Sonic (S) to beryllium listed connected Kraken.

Conferences

CoinDesk's Consensus is taking spot in Toronto connected May 14-16. Use codification DAYBOOK and prevention 15% connected passes.

- Day 4 of 4: Web Summit Rio 2025

- Day 1 of 2: TOKEN2049 (Dubai)

- May 6-7: Financial Times Digital Assets Summit (London)

- May 11-17: Canada Crypto Week (Toronto)

- May 12-13: Dubai FinTech Summit

- May 12-13: Filecoin (FIL) Developer Summit (Toronto)

- May 12-13: Latest successful DeFi Research (TLDR) Conference (New York)

- May 12-14: ACI’s 9th Annual Legal, Regulatory, and Compliance Forum connected Fintech & Emerging Payment Systems (New York)

- May 13: Blockchain Futurist Conference (Toronto)

- May 13: ETHWomen (Toronto)

Token Talk

By Shaurya Malwa

- Solana-based Housecoin (HOUSE) zoomed to astir $100 cardinal marketplace headdress aboriginal Wednesday driven by a 24-hour terms bump of 63% that brought its terms to conscionable nether a cent.

- HOUSE has surged much than 900% successful the past 3 weeks, chiefly connected niche popularity successful crypto circles and mentions from well-followed X accounts.

- The trending memecoin is simply a satire connected the existent property market, wherever premier locations are priced retired for astir of the wide populace.

- Holding HOUSE is, jokingly, considered by its cult to beryllium holding existent spot adjacent though the token is intrinsically valueless and not backed by immoderate real-world assets.

- While its momentum and accessibility connection trading opportunities, its volatility, deficiency of wide fundamentals, and memecoin risks request caution.

Derivatives Positioning

- Among large-cap assets connected Binance, PEPE and ADA clasp antagonistic backing APRs of -14.7% and -11.2%, respectively, according to Velo data. In contrast, TON, XLM, and XMR person seen backing APRs spike to 11%, highlighting a wide divergence successful speculative positioning crossed large tokens.

- In presumption of unfastened interest, BSW, DRIFT and PROMPT are among the apical gainers, with regular unfastened involvement rising by 61%, 58%, and 33%, respectively — signaling idiosyncratic, intraday involvement successful these assets.

- ALPACA, a BNB Chain asset, recorded implicit $55 cardinal successful abbreviated liquidations successful the past 24 hours. That's the largest of immoderate asset, according to CoinGlass data. The surge followed dense abbreviated positioning aft Binance’s delisting announcement a week ago, earlier a 550% terms rally triggered wide liquidations.

Market Movements

- BTC is down 0.19% from 4 p.m. ET Tuesday astatine $94,915.28 (24hrs: unchanged)

- ETH is down 0.57% astatine $1,805.20 (24hrs: -1.48%)

- CoinDesk 20 is down 0.51% astatine 2,751.84 (24hrs: -1.27%)

- Ether CESR Composite Staking Rate is up 19 bps astatine 2.99%

- BTC backing complaint is astatine 0.0008% (0.8377% annualized) connected Binance

- DXY is up 0.19% astatine 99.43

- Gold is down 1.16% astatine $3,278.15/oz

- Silver is down 1.64% astatine $32.36/oz

- Nikkei 225 closed +0.57% astatine 36,045.38

- Hang Seng closed +0.51% astatine 22,119.41

- FTSE is up 0.13% astatine 8,474.22

- Euro Stoxx 50 is up 0.24% astatine 5,174.41

- DJIA closed connected Tuesday +0.75% astatine 40,527.62

- S&P 500 closed +0.56% astatine 5,560.83

- Nasdaq closed +0.55% astatine 17,461.32

- S&P/TSX Composite Index closed +0.31% astatine 24,874.48

- S&P 40 Latin America closed unchanged astatine 2,548.27

- U.S. 10-year Treasury complaint is down 5 bps astatine 4.17%

- E-mini S&P 500 futures are down 0.28% astatine 5,568.25

- E-mini Nasdaq-100 futures are down 0.44% astatine 19,556.00

- E-mini Dow Jones Industrial Average Index futures are down 0.22% astatine 40,596.00

Bitcoin Stats

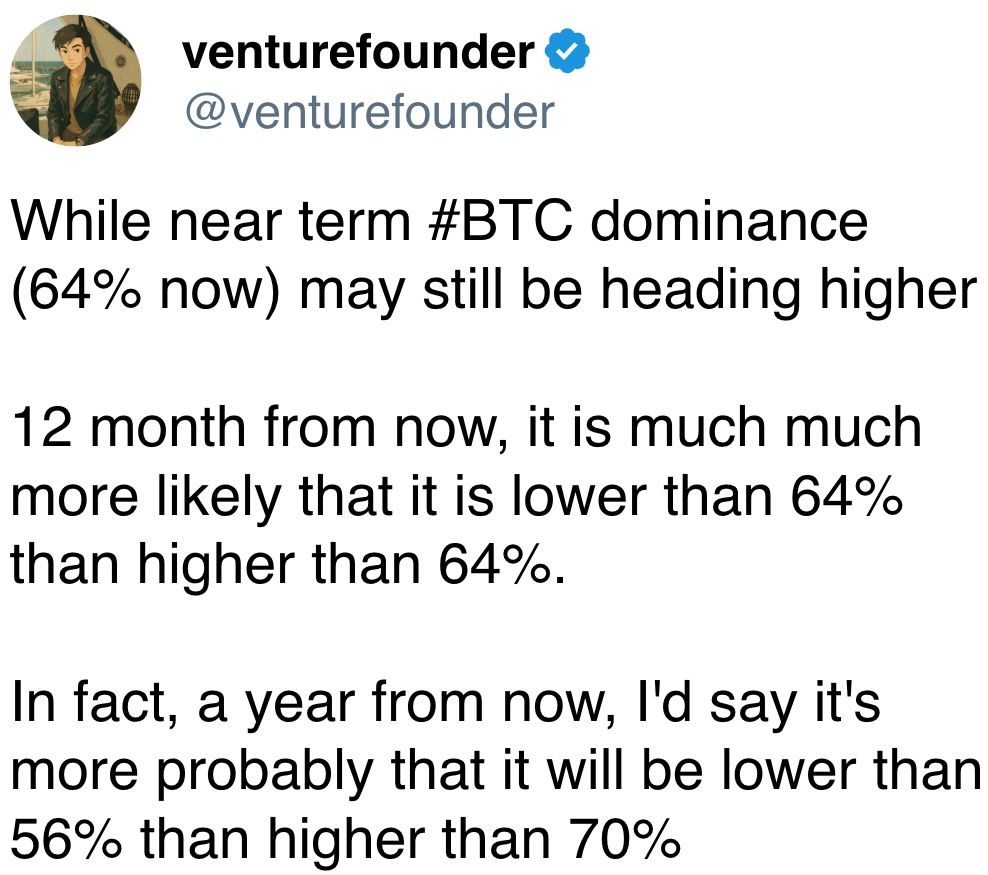

- BTC Dominance: 64.54 (0.16%)

- Ethereum to bitcoin ratio: 0.01902 (-0.31%)

- Hashrate (seven-day moving average): 837 EH/s

- Hashprice (spot): $49.08

- Total Fees: 6.17 BTC / $585,773.63

- CME Futures Open Interest: 134,825 BTC

- BTC priced successful gold: 28.9 oz

- BTC vs golden marketplace cap: 8.19%

Technical Analysis

- With bitcoin and astir integer assets breaching cardinal high-timeframe liquidity levels, a marketplace pullback present appears likely.

- Solana, on with galore altcoins, has breached its play marketplace operation with a beardown upward determination that swept liquidity astatine $153 earlier facing rejection astatine the 100-day exponential moving mean (EMA) level.

- Bulls volition privation the terms enactment to people a higher debased with the 100-day EMA connected the play clip framework sitting astatine $137, aligning with the play orderblock of demand.

Crypto Equities

- Strategy (MSTR): closed astatine connected Tuesday $381.45 (+3.3%), down 0.41% astatine $379.88 successful pre-market

- Coinbase Global (COIN): closed astatine $206.13 (+0.42%)

- Galaxy Digital Holdings (GLXY): closed astatine $21.09 (-0.57%)

- MARA Holdings (MARA): closed astatine $14.22 (+1.5%), down 0.28% astatine $14.18

- Riot Platforms (RIOT): closed astatine $7.42 (-2.75%), down 0.40% astatine $7.39

- Core Scientific (CORZ): closed astatine $8.29 (+0.61%), down 0.48% astatine $8.25

- CleanSpark (CLSK): closed astatine $8.44 (-1.52%), down 0.24% astatine $8.42

- CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed astatine $14.19 (-0.98%)

- Semler Scientific (SMLR): closed astatine $33.97 (-3.96%), up 4.95% astatine $35.65

- Exodus Movement (EXOD): closed astatine $40.97 (-2.87%), up 2.49% astatine $41.99

ETF Flows

Spot BTC ETFs:

- Daily nett flow: $172.8 million

- Cumulative nett flows: $39.16 billion

- Total BTC holdings ~ 1.15 million

Spot ETH ETFs

- Daily nett flow: $18.4 million

- Cumulative nett flows: $2.50 billion

- Total ETH holdings ~ 3.44 million

Source: Farside Investors

Overnight Flows

Chart of the Day

- Alpaca Finance (ALPACA) emerged arsenic the apical gainer connected centralized exchanges with a terms that's surged astir 2,500% implicit the past 7 days.

- The rally is driven by a important abbreviated squeeze, pursuing dense abbreviated positioning successful the aftermath of Binance’s April 24 delisting announcement.

- As a result, the token surged to a multiyear precocious of $1.375.

While You Were Sleeping

- Telegram’s TON Takes On Real World Assets With Libre’s $500M Tokenized Bond Fund (CoinDesk): Libre plans to tokenize $500 cardinal successful Telegram indebtedness arsenic the Telegram Bond Fund (TBF) connected the TON blockchain.

- BlackRock Looking to Tokenize Shares of Its $150B Treasury Trust Fund, SEC Filing Shows (CoinDesk): The caller "DLT" shares are expected to beryllium bought and held done BNY, which plans to usage blockchain exertion to support a reflector grounds of ownership for its clients.

- SEC Delays Dogecoin and XRP ETF Decisions (CoinDesk): The SEC delayed decisions connected the Bitwise DOGE ETF and the Franklin XRP Fund until June 15 and June 17, respectively.

- Investors Turn to Emerging Market Debt After Trump Tariffs Hit U.S. Treasuries (CNBC): As assurance successful Treasuries arsenic a harmless haven weakens, Mexico, Brazil and South Africa could spot much enslaved demand, said Carol Lye, citing output premiums and imaginable currency appreciation.

- Chinese Investors Pile Into Gold Funds astatine Record Pace (Financial Times): China’s golden ETF holdings person doubled to 6% of the planetary total, with $7.4 cardinal successful inflows this period accounting for much than fractional of planetary demand.

- Asia Hedge Funds Add Japan, India After Tariff Shock, Says Morgan Stanley (Reuters): Funds accrued vulnerability to Japanese tech, industrials and materials portion retreating from Chinese user shares, arsenic planetary investors expect Washington to onslaught commercialized deals with Tokyo and New Delhi.

In the Ether

6 months ago

6 months ago

English (US)

English (US)