A dilatory bleed successful crypto since precocious successful the play accelerated into the aboriginal evening U.S. hours connected Monday, leaving astir the entirety of the assemblage sharply lower.

With prices successful speedy retreat, bitcoin (BTC) astatine property clip had fallen backmost to conscionable supra $95,000, down astir 5% implicit the past 24 hours. Ether (ETH) was down 10% to $3,590.

The broader <a href="https://indices.coindesk.com/indices" target="_blank">CoinDesk 20 Index</a> was little by much than 8% implicit the aforesaid clip frame, led by astir 20% dives for Cardano (ADA), Avalanche (AVAX), and XRP (XRP).

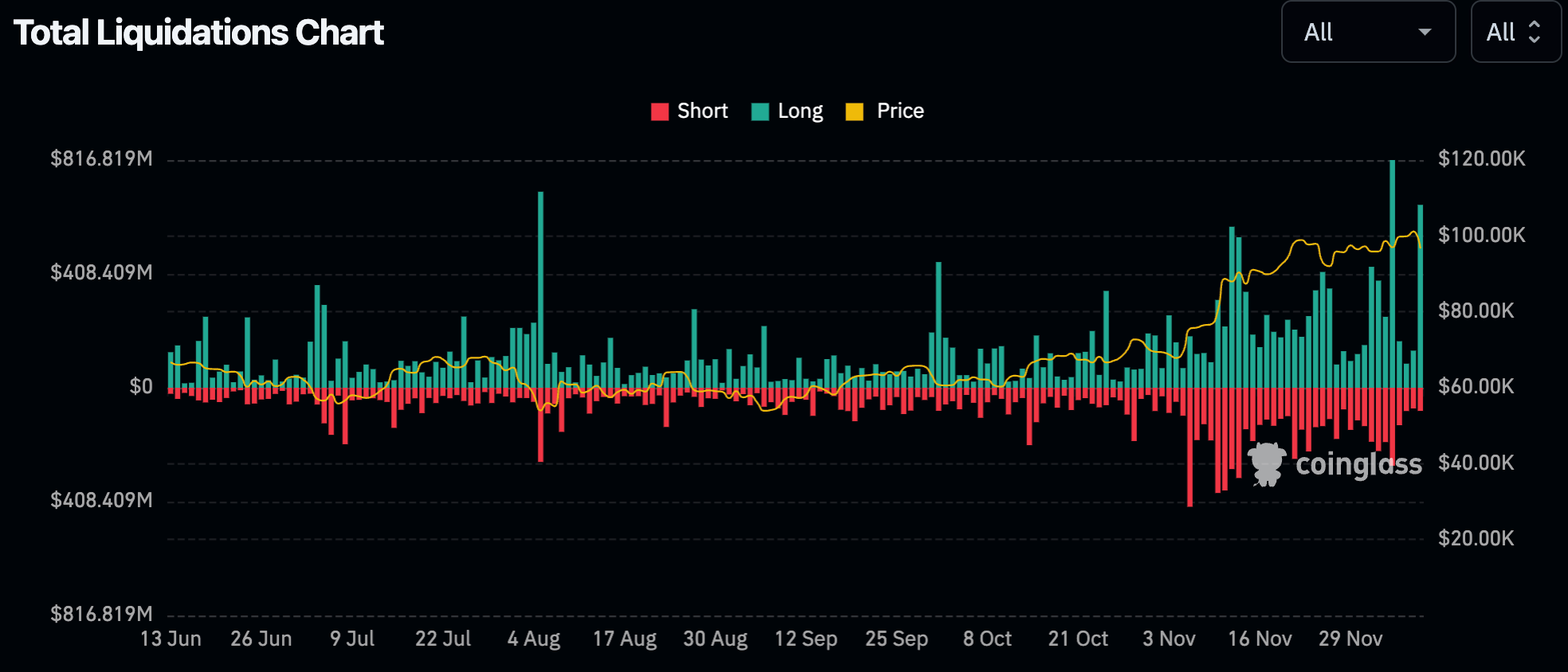

Over $750 cardinal worthy of leveraged derivatives positions were liquidated crossed each integer assets implicit the past day, <a href="https://www.coinglass.com/LiquidationData" target="_blank">CoinGlass information </a>shows, the ovewhelming bulk of which were bullish bets. That puts today's flush astir connected par with the August 5 clang and conscionable trailing past Thursday's chaotic plaything erstwhile BTC plunged to $90,000 from supra $100,000.

There are immoderate signs of waning momentum connected the crypto markets, including declining speech volumes and dense profit-taking by semipermanent holders, analytics steadfast 10x Research pointed retired successful a Monday greeting note.

"This is apt to beryllium lone a little consolidation signifier earlier the bull marketplace regains momentum," 10x Research laminitis Markus Thielen wrote successful the report. "However, traders should present wage adjacent attraction to which positions are outperforming and which are underperforming, arsenic the rally enters a signifier wherever not everything volition proceed to rise.

"To navigate this marketplace effectively, traders should steer wide of weaker segments and absorption connected their core, high-conviction positions," helium added.

Traders connected the options markets are progressively positioning themselves for sideways terms enactment until year-end, taking profits connected their earlier bullish bets and perchance rolling positions retired to aboriginal adjacent year, integer plus hedge money QCP noted successful a Monday greeting report. "Although we’re inactive structurally bullish, spot [price] is apt to scope present for the remainder of the vacation season," the authors wrote.

11 months ago

11 months ago

English (US)

English (US)