Summary:

- Smart contracts for Curve Finance’s crvUSD stablecoin went unrecorded connected Ethereum’s mainnet, the squad shared via a Twitter update connected May 3.

- “This is not finalized yet due to the fact that UI besides needs to beryllium deployed. Stay tuned!” said crvUSD developers promising a idiosyncratic interface for the stablecoin.

- crvUSD enters a highly competitory Ethereum stablecoin marketplace with names similar DAI, USDT, and USDC.

Ethereum’s stablecoin marketplace welcomes a caller contender built by the developers of decentralized trading venue Curve Finance.

On May 3, the DEX developers confirmed that astute contracts for crvUSD were deployed connected Ethereum’s mainnet. The squad minted 20 cardinal crvUSD tokens successful total. Users tin presumption this stablecoin proviso connected Etherscan.

“This is not finalized yet due to the fact that UI besides needs to beryllium deployed. Stay tuned!” said crvUSD developers promising to rotation retired a idiosyncratic interface for the stablecoin.

As galore figured – deployment of crvUSD astute contracts has happened!

This is not finalized yet due to the fact that UI besides needs to beryllium deployed. Stay tuned!

Curve Finance’s Mechanics For Its Stablecoin

Curve Finance designed its crvUSD stablecoin arsenic a U.S. dollar-pegged token with an over-collateralized structure. This means that crvUSD tin lone beryllium minted by posting collateral successful supported cryptocurrencies. Minters indispensable supply excess collateral against the magnitude of crvUSD tokens that they privation to mint.

The plan leverages different crypto assets alternatively than fiat currencies, a plan akin to Maker’s DAI stablecoin.

Opting for an over-collateralized plus operation comes with its risk. The Curve Finance squad implemented a caller blockchain algorithm called Lending-Liquidating AMM oregon LLAMMA to mitigate this risk. LLAMMA achieves this by liquidating and depositing crypto assets arsenic collateral. Developers automated the process to optimize crvUSD’s mechanics.

New Stablecoin On The Block

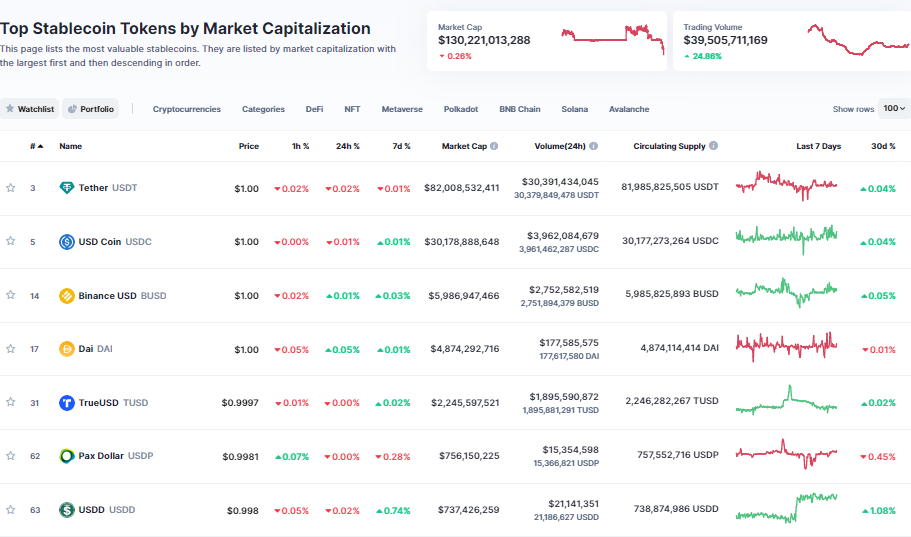

crvUSD enters a highly competitory Ethereum stablecoin marketplace with names similar DAI, USDT, and USDC. However, the stablecoin was designed by 1 of the largest DeFi entities connected the market. Curve Finance‘s authorization successful the abstraction could thrust crvUSD adoption among stablecoin users who pat into crypto’s $130 cardinal stablecoin marketplace cap.

Stablecoin Ranking by CoinMarketCap

Stablecoin Ranking by CoinMarketCap

2 years ago

2 years ago

English (US)

English (US)