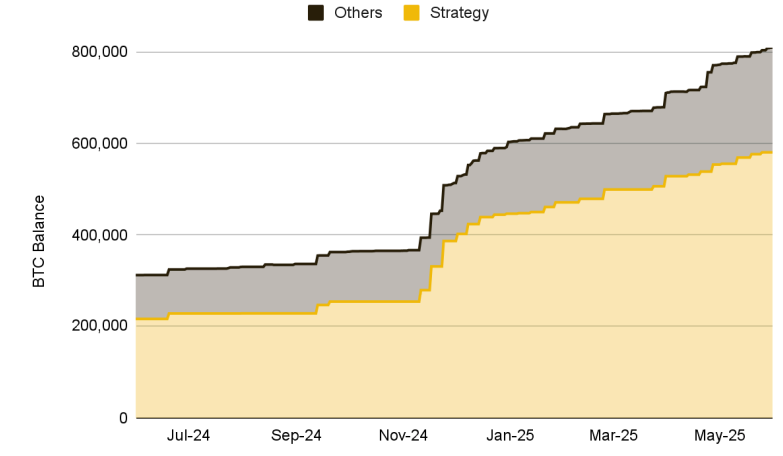

Bitcoin BTC has taken deeper basal successful firm treasuries, with 116 nationalist companies present holding a combined 809,100 BTC, worthy astir $85 cardinal based connected existent prices, astatine the extremity of May.

That’s a melodramatic emergence from 312,200 BTC held a twelvemonth agone successful firm treasuries, according to Binance Research’s latest report. Nearly 100,000 BTC has been added since aboriginal April alone.

The surge appears driven by a premix of rising prices and structural tailwinds. Donald Trump adopted a pro-crypto stance during his 2024 statesmanlike campaign, vowing to marque the U.S. a planetary hub for the plus people and make a “crypto superior of the planet.”

Since Trump took bureau helium has moved to found a Strategic Bitcoin Reserve and a U.S. Digital Asset Stockpile, portion the U.S. Securities and Exchange Commission has dropped galore lawsuits against large crypto firms..

Binance’s study shows that bitcoin treasury accumulation grew successful November, erstwhile Trump won the election.

Adding to that, caller fair-value accounting rules introduced by the Financial Account Standards Board (FASB) this twelvemonth let companies to admit gains connected BTC holdings, removing a longstanding deterrent.

Newer entrants including GameStop (GME) and PSG person precocious started accumulating BTC arsenic a well, yet Strategy inactive holds the lion’s stock of BTC successful firm treasuries, with implicit 70% of holdings.

Some companies are besides tiptoeing into different assets. SharpLink holds $425 cardinal successful ETH, portion DeFi Development and Classover are betting connected solana SOL. China-based steadfast Webus precocious filed for a $300 cardinal XRP strategical reserve.

Still, these altcoin holdings stay comparatively tiny and are often tied to firms trying to rebrand arsenic token-forward entities, Binance noted.

Binance’s study besides flagged the accelerated emergence of tokenized real-world assets (RWAs), which person climbed much than 260% from $8.6 cardinal to $23 cardinal this year.

2 months ago

2 months ago

English (US)

English (US)