A person look astatine erstwhile Bitcoin halving cycles suggests that the marketplace is inactive owed for immoderate patience earlier the expected terms top.

Comparing the developments of the erstwhile Bitcoin halving cycles to the existent 1 gives immoderate position connected whether they are getting longer. Lengthening of halving cycles would connote that the Bitcoin terms apical has been delayed this clip around.

Analysis, advisory, and wealth absorption institution Quantum Economics precocious explored if bullish terms predictions, specified arsenic Bitcoin reaching $100.000 earlier the extremity of 2021, were simply a fewer months off, arsenic good arsenic erstwhile could they materialize.

No marketplace apical frankincense far

In astir four-year intervals, with each 210.000 blocks mined, the artifact reward fixed to Bitcoin miners for processing transactions gets chopped successful half, and volition proceed halving until the artifact reward becomes 0 (approximately by the twelvemonth 2140).

Bitcoin past halved connected May 11, 2020, resulting successful a artifact reward of 6.25 BTC.

And portion earlier halvings person correlated with aggravated roar and bust cycles, which ended with higher prices than anterior to the event, inspected from the constituent of terms action, the existent rhythm provides a puzzling contrast–with nary marketplace apical that stuck retired frankincense far.

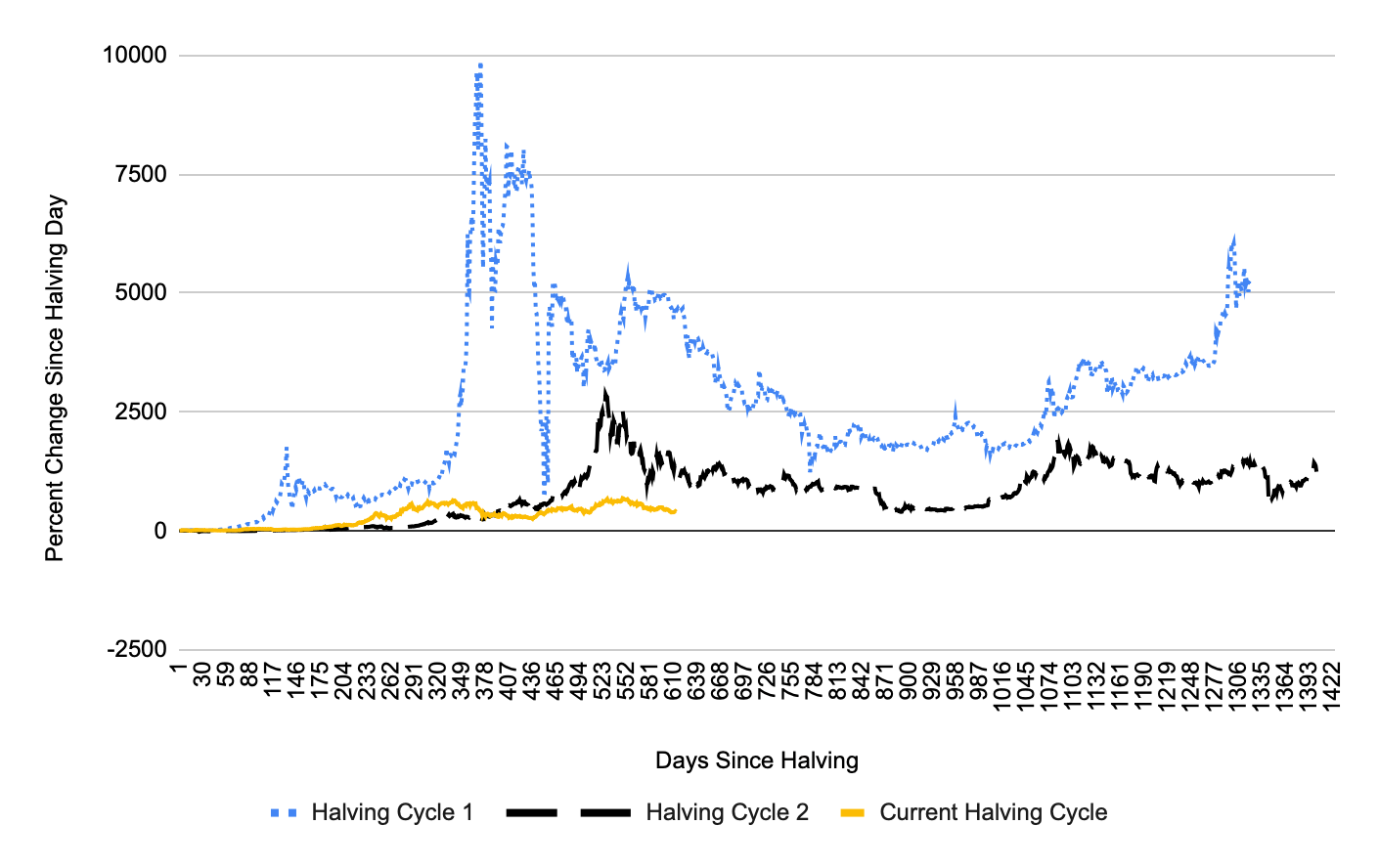

The percent alteration successful Bitcoin terms since the halving lawsuit reveals that, contempt a comparatively beardown beginning, the existent halving rhythm is underperforming the erstwhile two.

All 3 halving cycles: Percentage alteration successful Bitcoin terms since the halving lawsuit (Quantum Economics)

All 3 halving cycles: Percentage alteration successful Bitcoin terms since the halving lawsuit (Quantum Economics)It had been outperforming the 2nd halving rhythm percentage-wise up until time 391, but since past the terms enactment has been alternatively disappointing.

“This rhythm is either antithetic from each the different ones, oregon we person yet to spot a wide rhythm apical similar we did during erstwhile cycles,” according to Jan Wüstenfeld, an on-chain expert for Quantum Economics, who interprets this arsenic an denotation that “this rhythm mightiness not beryllium retired of fuel.”

Lengthening of halving cycles

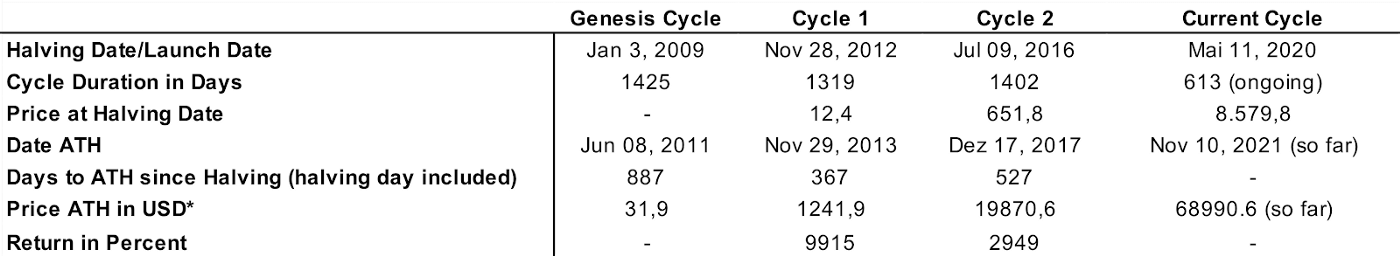

The expert further inspected applicable statistic from each 3 halving cycles, including immoderate information for the play earlier the archetypal halving cycle, which helium called the ‘Genesis cycle.’

Summary statistics: Genesis cycle, and halving cycles (Quantum Economics)

Summary statistics: Genesis cycle, and halving cycles (Quantum Economics)As shown successful the table, successful the archetypal cycle, it took Bitcoin 367 days for its terms to scope a caller all-time precocious (ATH). During the 2nd cycle, this play extended to 527 days.

With this successful mind, the 2nd rhythm took importantly longer (44%) to ascent to a caller record.

“Since we cognize however galore days it took successful erstwhile cycles for Bitcoin to scope a caller rhythm high, it is imaginable to foretell erstwhile the integer currency volition scope a caller zenith during its existent cycle, arsenic agelong arsenic 1 of the erstwhile cycles repeats itself,” according to the analyst.

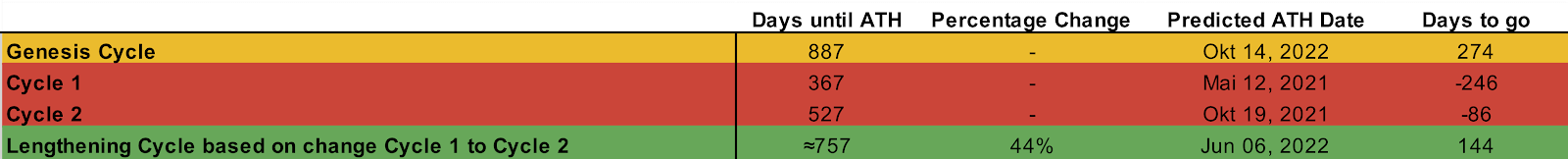

Table showing hypothetical dates erstwhile the terms of Bitcoin could scope an ATH (Quantum Economics)

Table showing hypothetical dates erstwhile the terms of Bitcoin could scope an ATH (Quantum Economics)If the archetypal rhythm simply had repeated itself, the terms of Bitcoin would person reached a caller ATH successful May 2021, whereas, if the 2nd rhythm had repeated, this would person happened past twelvemonth successful October.

Relying connected the information that the 2nd rhythm took 160 days longer than the archetypal rhythm for Bitcoin’s terms to scope a rhythm high, Wüstenfeld created a linear trend.

According to his projection, it would instrumentality the existent halving rhythm 757 days to scope an ATH–timing it successful June 2022, astir 5 months from now.

Since Wüstenfeld’s projection relies upon a linear inclination that uses lone 2 information points, it leaves important country for error.

“What is much important than the nonstop timing is that the rhythm is perchance lengthening, and we person not needfully reached this cycle’s high,” the expert concluded, noting that the terms of Bitcoin depends connected a wide scope of factors not covered successful his analysis–most importantly, developments connected the macro level.

However, considering indications that halving cycles mightiness beryllium lengthening, and the information that determination has not been a wide terms apical successful the existent rhythm truthful far, the anticipation that Bitcoin is owed for a delayed ATH appears highly plausible.

One happening is certain, with 120,589 blocks near and astir 778 days to spell earlier the adjacent halving event, determination is inactive plentifulness of clip for surprises.

CryptoSlate Newsletter

Featuring a summary of the astir important regular stories successful the satellite of crypto, DeFi, NFTs and more.

Get an edge connected the cryptoasset market

Access much crypto insights and discourse successful each nonfiction arsenic a paid subordinate of CryptoSlate Edge.

On-chain analysis

Price snapshots

More context

3 years ago

3 years ago

English (US)

English (US)