In the 3rd quarter, Coinbase outperformed expectations contempt the extended crypto marketplace slump by signaling favorable nett income and adjusted net earlier interest, taxes, depreciation, and amortization (EBITDA). In their astir caller shareholder letter, the publicly-traded cryptocurrency speech disclosed a nett income of $2 cardinal and an adjusted EBITDA of $181 cardinal for the 4th concluding connected September 30, 2023.

Coinbase Posts Q3 Profit Despite Crypto Winter

Coinbase (Nasdaq: COIN) reported its net successful a shareholder missive published connected November 2, 2023. Total gross declined to $674 cardinal from $736 cardinal successful the 2nd quarter. The institution cited little crypto plus volatility and declining planetary spot trading volumes arsenic headwinds. Transaction revenue, which makes up the bulk of revenue, dropped 12% sequentially to $289 million.

“Overall crypto marketplace headdress declined 9% Q/Q to $1.1 trillion erstwhile comparing the extremity of Q3 to the extremity of Q2, and the mean crypto marketplace headdress declined 3% implicit the aforesaid clip frame,” Coinbase stated. “The terms of BTC, which accounts for astir fractional of crypto marketplace cap, declined 12% erstwhile comparing the extremity of Q3 to the extremity of Q2.”

Subscription and services gross held comparatively dependable astatine $334 cardinal versus $335 cardinal past quarter. Stablecoin gross roseate 14% to $172 million, driven by higher involvement rates. Meanwhile, blockchain rewards gross fell 15% and involvement income dropped 21%. Coinbase further disclosed that operating expenses decreased 4% sequentially to $754 million.

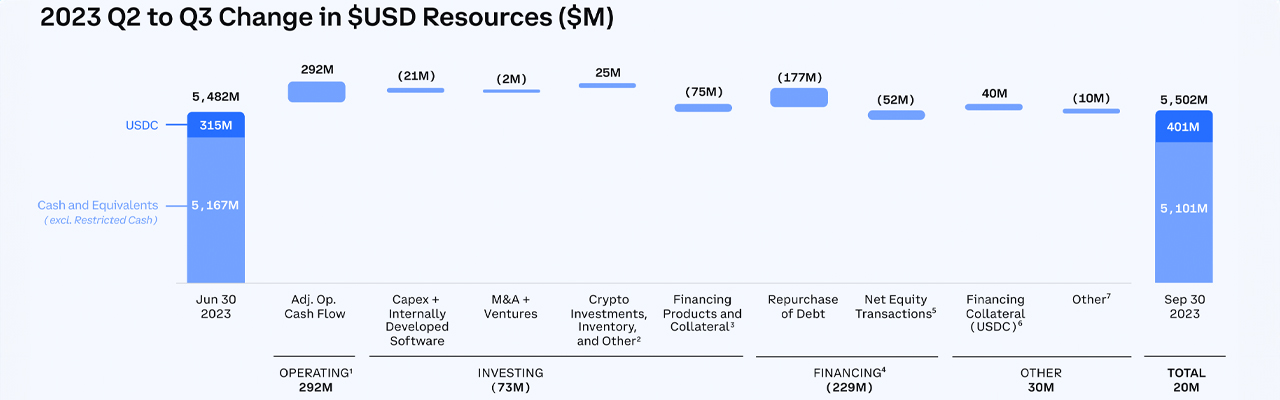

Within that, exertion and development, income and marketing, and wide and administrative expenses fell 1% collectively. Coinbase ended the 3rd 4th with $5.5 cardinal successful disposable liquid resources, up $20 cardinal from past quarter. The institution bought backmost $263 cardinal of its bonds astatine a 33% discount during the period.

For the 4th quarter, Coinbase said it generated astir $105 cardinal successful transaction gross successful October. It projected subscription and services gross would stay astir level sequentially. The institution expects expenses to inclination little owed to reduced stock-based compensation. Coinbase shares are up much than 10% implicit the past 5 days and implicit 13% during the past month.

“We expect that we volition make meaningful affirmative adjusted EBITDA successful full-year 2023, revised from our anterior extremity of improving full-year 2023 adjusted EBITDA successful implicit dollar presumption versus full-year 2022,” Coinbase stated.

The crypto speech emphasized its absorption connected merchandise improvement and planetary enlargement amid the uncertain marketplace conditions. It besides noted advancement successful bringing regulated crypto derivatives to marketplace successful the U.S. and overseas. On the regulatory front, Coinbase said it continues to advocator for wide authorities successful the United States.

The company’s court battle with the U.S. Securities and Exchange Commission (SEC) is moving forward, with oral arguments scheduled for January 2024. Globally, Coinbase highlighted that 83% of G20 nations person implemented crypto regulations. “Something the U.S. desperately needs,” the shareholder missive details.

What bash you deliberation astir Coinbase’s shareholder letter? Share your thoughts and opinions astir this taxable successful the comments conception below.

1 year ago

1 year ago

English (US)

English (US)