On May 13, Circle’s main fiscal serviceman Jeremy Fox-Geen published a blog station called “How to Be Stable,” pursuing the aftermath of Terra’s stablecoin implosion. Circle’s CFO explained that since usd coin’s inception, the stablecoin aims to beryllium “the astir transparent and trusted dollar integer currency.”

Terra’s Stablecoin De-Pegging Incident Has Cast a Spotlight connected the Entire Stablecoin Economy

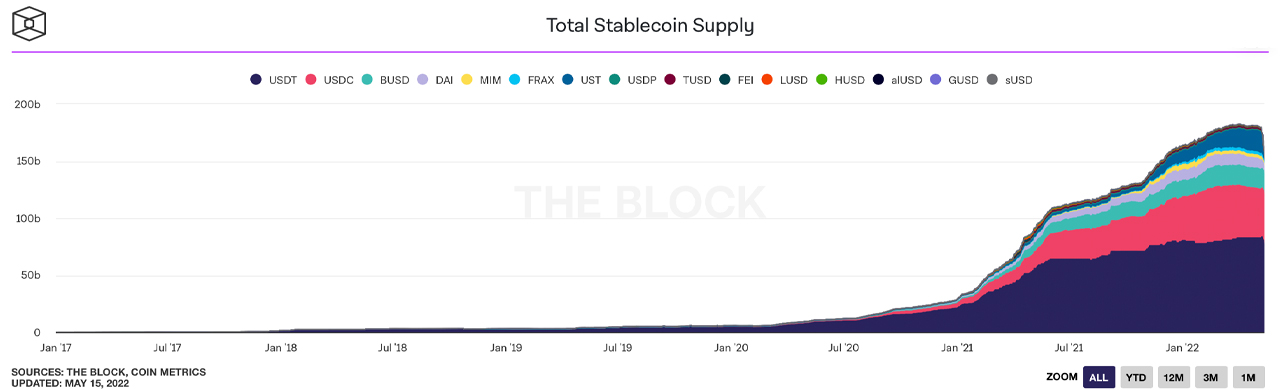

For a fewer years now, stablecoin assets person been a fashionable hedging conveyance among galore participants wrong the cryptocurrency community. In much caller times, stablecoins are being loaned retired successful large numbers successful bid to stitchery involvement and precocious output returns. In the aboriginal days, stablecoins were centralized projects and these days determination are a fewer decentralized and algorithmic stablecoin tokens among the giants.

Tether (USDT) and usd coin (USDC) are the 2 largest stablecoin projects successful presumption of marketplace valuation. Both of them are centralized, which means the institution guarantees the stablecoins are redeemable for the $1 parity by holding reserves that screen the funds successful circulation. Even earlier Terra’s stablecoin de-pegging event, much assurance has been placed successful the apical 2 stablecoins due to the fact that they are centralized.

Three days ago, Bitcoin.com News reported connected the stablecoin shuffle aft the caller editorial our newsdesk published, showing that for the archetypal clip successful history, 3 stablecoins entered the crypto apical ten. That is inactive the lawsuit today, but that terrausd (UST) has been knocked retired of the top-ten largest crypto marketplace caps and the stablecoin BUSD has replaced the token’s position. After the terrausd (UST) implosion, Circle Financial’s CEO Jeremy Allaire has been speaking to the press astir what makes USDC different, and helium believes determination needs to beryllium “more regulatory model astir stablecoins.”

We are ramping up our efforts astir spot and transparency with USDC, truthful enactment tuned for more, but getting started here's a caller blog station from @circlepay CFO Jeremy Fox-Geen, arsenic good arsenic a thread beneath breaking it down: https://t.co/SYNpwYxUif

— Jeremy Allaire (@jerallaire) May 13, 2022

Circle CEO Says Company Is Ramping Up Trust and Transparency Efforts, Firm Says ‘USDC Is Always Redeemable 1:1 for US Dollars’

On Friday, Allaire tweeted that Circle was “ramping up our efforts” erstwhile it comes to USDC “trust and transparency.” Allaire besides shared a blog station written by the firm’s CFO Jeremy Fox-Geen, who gives a summary of what Allaire means astir transparency. Fox-Geen’s blog post explains “USDC has ever been backed by the equivalent worth of U.S. dollar-denominated assets.” The CFO further notes that the funds are held by America’s starring fiscal institutions specified arsenic Bank of New York Mellon and Blackrock. The Circle executive’s study adds:

The USDC reserve is held wholly successful currency and short-dated U.S. authorities obligations, consisting of U.S. Treasuries with maturities of 3 months oregon less.

Circle’s CFO elaborate that the institution has been publishing monthly attestations from the starring accounting steadfast Grant Thornton International. “The USDC reserve is worthy astatine slightest arsenic overmuch arsenic the fig of USDC successful circulation, providing reputable third-party assurance of this information to the USDC ecosystem,” Fox-Geen summarized successful the blog post. “USDC is ever redeemable 1:1 for U.S. dollars,” the Circle enforcement adds. The blog station concludes that determination are thousands of projects and entities that enactment and facilitate the speech of USDC successful 190 countries.

Yes, @DoveyWan, we would yet similar to spot Cash held astatine the Fed. https://t.co/MHTjjveveQ

— Jeremy Allaire (@jerallaire) May 15, 2022

While Terra’s Algorithmic Stablecoin Shuddered, a Few Decentralized Fiat-Pegged Tokens Still Exist, Many Crypto Supporters Believe They Are Needed

Meanwhile, determination are a fewer decentralized and algorithmic stablecoin assets that beryllium contiguous similar LUSD, DAI, FEI, MIM, USDV, and USDD. For instance, the Ethereum-based Makerdao task leverages an over-collateralization method to backmost the stablecoin DAI. Tron precocious introduced an algorithmic stablecoin token called USDD, and a blockchain task called Vader has a autochthonal algorithmic stablecoin called USDV. Another stablecoin asset, dubbed magic net wealth (MIM), is built connected apical of Avalanche (AVAX) and is issued by the decentralized lending level Abracadabra.

This is an important point!

LUSD is technically an algorithmic stablecoin.

Not each algorithmic stables are created equal.

We request to beryllium cautious with however we explicate these concepts to the noobs with guns who are trying to tyrannize us. https://t.co/GHe3lH4bt1

— Chris Blec (@ChrisBlec) May 15, 2022

Decentralized and algorithmic stablecoin proponents judge they are needed among the centralized heavyweights similar USDT and USDC. Supporters of specified assets deliberation that centralized stablecoins are taxable to the aforesaid failure, and others judge decentralized and algorithmic stablecoins trump centralized models due to the fact that they cannot beryllium frozen by the issuer. Despite these benefits, centralized stablecoins person ruled the roost and crypto users, astatine slightest for now, person much assurance successful them.

Tags successful this story

Blog Post, Cash, cash reserves, Circle CEO, Circle CFO, DAI, FEI, fiat-pegged tokens, Jeremy Allaire, Jeremy Fox-Geen, LUSD, MIM, report, Short-Term Paper, stablecoin assets, Stablecoin Economy, Stablecoin Tokens, Stablecoins, Tether (USDT), Transparency, Treasuries, trust, us bonds, USDC, USDD, USDV

What bash you deliberation astir centralized stablecoins and Circle’s caller blog station astir transparency and the token’s reserve backing? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 5,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

3 years ago

3 years ago

English (US)

English (US)