Circle's USDC, the second-largest stablecoin connected the market, roseate to a grounds marketplace capitalization implicit $56 cardinal this week arsenic stablecoin maturation showed signs of reaccelerating.

USDC added $10.2 cardinal to its marketplace headdress implicit the past month, driven chiefly by rising Solana-based DeFi trading volumes, Artemis information shows. That's much than treble the $4.6 cardinal maturation of Tether's USDT, the largest stablecoin successful the marketplace and Circle's biggest competitor, during the aforesaid period. USDT inactive dominates the stablecoin abstraction with a $142 cardinal marketplace cap.

With the latest maturation spurt, USDC surpassed its 2022 highest and afloat recovered from the 2023 U.S. regional-banking crisis, which dealt a serious blow to the cryptocurrency. At the time, Circle held a portion of stablecoin reserves successful slope deposits astatine Silicon Valley Bank, which suffered a slope tally and led to USDC temporarily losing its peg to the U.S. dollar. Many token holders fled to USDT, helping Tether to surpass its 2022 highest marketplace capitalization arsenic aboriginal arsenic May 2023.

Stablecoins are a peculiar benignant of cryptocurrencies with prices anchored to an outer asset, predominantly to the U.S. dollar. USDT and USDC are wide utilized for trading connected crypto exchanges and service arsenic a cardinal root of liquidity. Thus, their expanding proviso is simply a cardinal indicator of capitalist request and wide wellness of crypto markets.

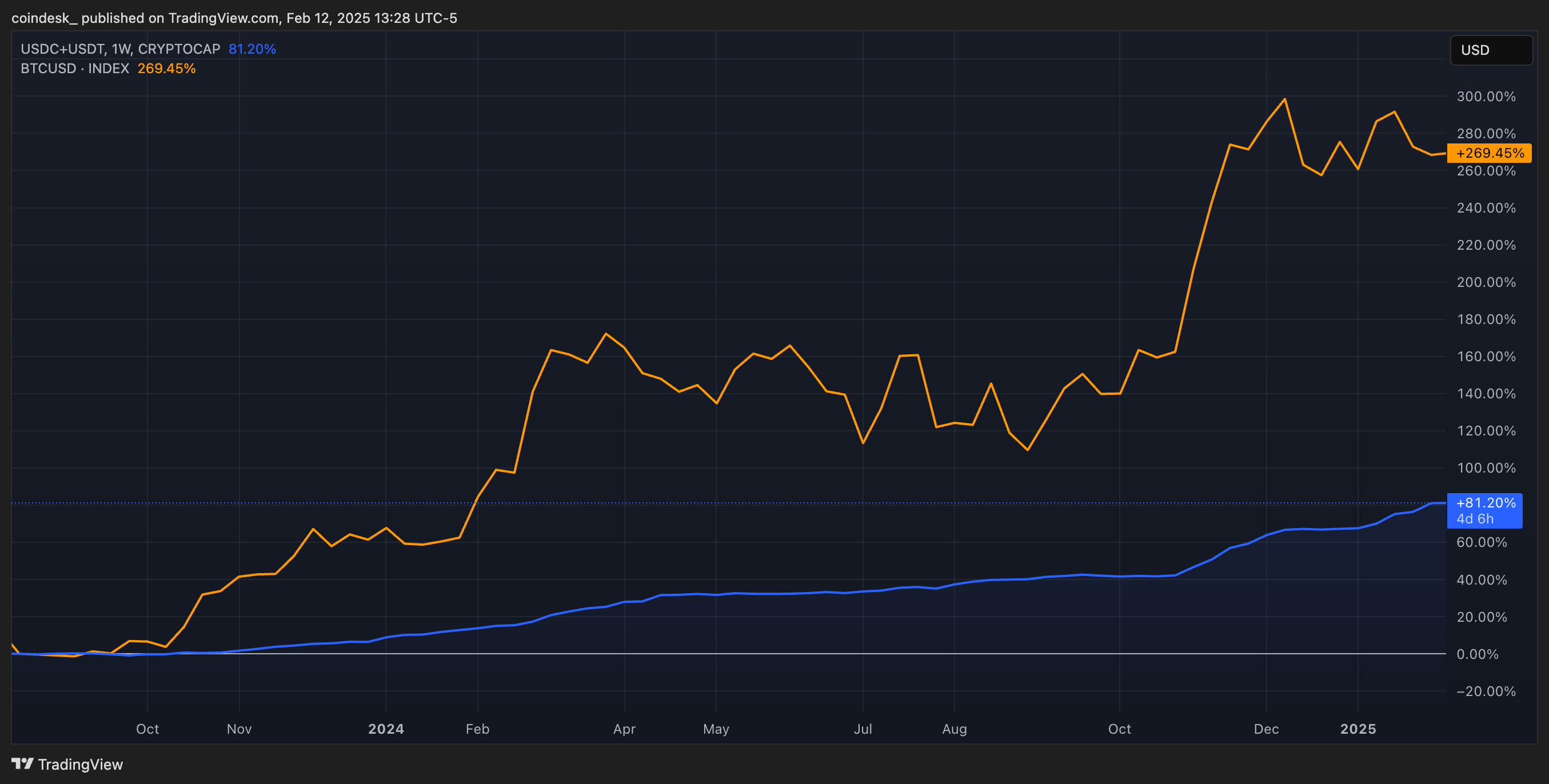

After a play of tepid enactment successful December and aboriginal January, USDT and USDC maturation accelerated successful the past weeks, information shows. Previous maturation spurts, specified arsenic betwixt precocious October and aboriginal December and October 2023 to April 2024, coincided with steep rallies successful bitcoin (BTC) and altcoin prices.

Accelerating stablecoin growth, portion it's lone 1 of the factors influencing crypto markets, offers a affirmative awesome for the wide marketplace wellness amid macro headwinds and consolidating prices.

8 months ago

8 months ago

English (US)

English (US)