Stablecoin issuer Circle Internet Financial has started buying U.S. Treasury bills arsenic a reserve plus for its $28 cardinal USD Coin (USDC) aft ditching each holdings amid the U.S. indebtedness ceiling standoff past month.

The Circle Reserve Fund (USDXX), which is managed by plus absorption elephantine BlackRock (BLK), has started “building up our nonstop holdings of Treasuries,” main fiscal serviceman Jeremy Fox-Geen said Wednesday during a institution telephone that CoinDesk attended.

The money volition besides support repurchase agreements (repos) arsenic portion of the reserves, Fox-Geen added.

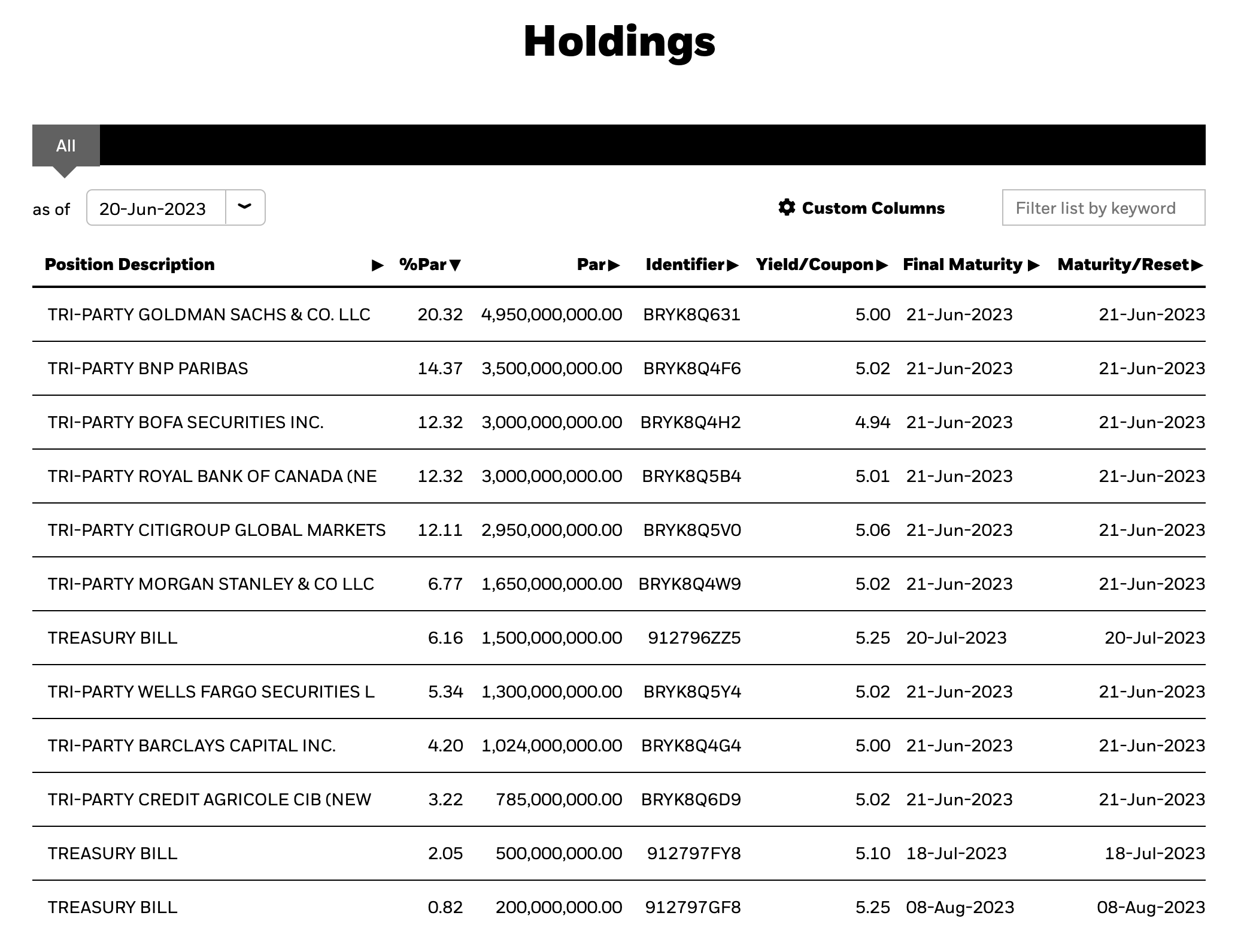

Circle Reserve Fund holdings (BlackRock)

Circle Reserve Fund holdings (BlackRock)The improvement came aft Circle reshuffled the backing of its stablecoin past period to support USDC from a imaginable fallout if the U.S. authorities failed to summation its quality to get and default connected its debt.

CEO Jeremy Allaire said successful aboriginal May that the steadfast would not clasp bonds maturing beyond the extremity of the month. By June, CoinDesk reported that the reserve money rotated each holdings into tri-party repos involving systemically important banks specified arsenic Goldman Sachs, BNP Paribas, Bank of America and Royal Bank of Canada.

Eventually, U.S. lawmakers struck a woody to summation the nation’s indebtedness bounds and President Joe Biden signed the authorities connected June 3, averting calamity connected fiscal markets.

As of June 20, Circle added $2.2 cardinal of T-bills to the fund, portion repos constituted immoderate 90% of the fund’s $24.7 cardinal successful assets, according to BlackRock’s website. The institution held an further $3.5 cardinal successful bank deposits, the “vast majority, implicit 90%” stored astatine the Bank of New York Mellon, Fox-Geen said.

Edited by James Rubin.

2 years ago

2 years ago

English (US)

English (US)