California-based Silicon Valley Bank (SVB), a portion of SVB Financial Group, has been unopen down, according to an announcement from fiscal regulators connected March 10.

Silicon Valley Bank closed by regulators

The Federal Deposit Insurance Corporation (FDIC) said that the California Department of Financial Protection and Innovation closed SVB today.

The FDIC said that it has been designated arsenic the receiver and added that eligible slope customers volition person entree to insured deposits by March 13.

Though the FDIC did not picture the people of events starring up to SVB’s closure, the bank’s illness was prompted by a March 8 merchantability connection done which it aimed to screen a $1.8 cardinal loss. The firm’s stock worth fell by 60% from $267.83 to $106.4 wrong a day.

This led to a slope tally aft 3rd parties advised companies to retreat funds connected March 10. Trading connected the company’s shares has since been halted.

Executives, including CEO Gregory Becker, CFO Daniel Beck, and CMO Michelle Draper collectively sold millions of dollars of banal successful the weeks starring up to these events.

The institution had $209 cardinal of assets, which makes it the second-largest U.S. slope nonaccomplishment successful past and the largest slope nonaccomplishment since the 2008 fiscal crisis.

Crypto companies whitethorn person exposure

Though Silicon Valley Bank is not straight related to the crypto industry, immoderate crypto companies whitethorn person vulnerability to the failed bank.

Circle held funds with assorted banks, including Silicon Valley Bank arsenic recently arsenic January. However, the institution has precocious moved funds betwixt banks, according to TechCrunch, and it whitethorn oregon whitethorn not clasp funds with SVB astatine present.

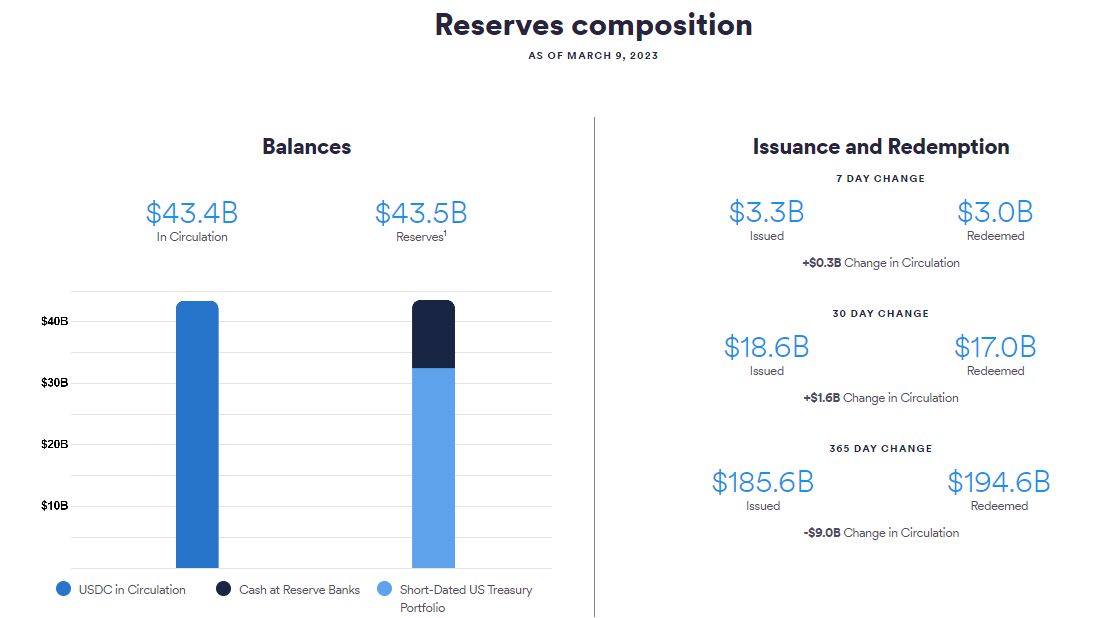

Though it is unclear however overmuch wealth Circle mightiness clasp with Silicon Valley Bank specifically, it presently holds a 4th of its USDC reserves ($11 billion) successful banks.

Circle USDC Reserves

Circle USDC ReservesElsewhere, bankrupt lending steadfast BlockFi was reported to person vulnerability to SVB. The U.S. Trustee said successful a March 10 filing that BlockFi holds $227 cardinal with the bank. It says these funds are “unprotected” and requires a enslaved oregon deposit nether the bankruptcy code.

Other companies contradict exposure

Binance CEO Changpeng Zhao said that his speech institution does not person vulnerability to Silicon Valley Bank. He tweeted: “Funds are #SAFU.”

John Wu, president of Avalanche steadfast Ava Labs, has besides commented connected the situation. During the archetypal slope tally connected March 9, Wu said that Silicon Valley Bank was 1 slope that his institution relies upon. Rather than pulling each funds from the bank, helium said Ava Labs diversified and held little with SVB than it did successful erstwhile weeks and months.

Immutable Labs co-founder Robbie Ferguson said that his institution has nary vulnerability to Silicon Valley Bank, nor does it person vulnerability to the failing Silvergate Bank. Immutable is known for its Immutable X blockchain and absorption connected Web3 gaming.

Elsewhere, the plus manager Valkyrie said that it has nary vulnerability oregon banking narration with Silicon Valley Bank. It nevertheless called the quality “devastating.”

The Blockchain Intelligence Group (BIGG) and its related Canadian crypto trading level Netcoins have besides denied immoderate vulnerability to the failed bank.

The station Circle, BlockFi whitethorn person vulnerability to Silicon Valley Bank; different firms contradict exposure appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)