The cryptocurrency assemblage is excited astir the Hong Kong authorities reportedly weighing the motorboat of a spot cryptocurrency exchange-traded fund (ETF) amid the ongoing regulatory pushback against specified products successful the United States.

Hong Kong’s imaginable entranceway into spot crypto ETFs could beryllium a important improvement successful the discourse of the economical confrontation betwixt the U.S. and China, BitMEX co-founder Arthur Hayes believes.

Hayes took to X (formerly Twitter) connected Nov. 6 to explicit excitement implicit contention betwixt the 2 economies, emphasizing that this contention volition yet beryllium bully for Bitcoin (BTC).

“Competition is amazing. If the U.S. has its proxy plus manager, BlackRock, launching an ETF, China needs its proxy plus manager to motorboat one, too,” helium wrote.

Competition is amazing. If the US has its proxy plus mngr, BlackRock, launching an ETF, China needs its proxy plus mngr to motorboat 1 too.

The US v China economical warfare is large for $BTC. pic.twitter.com/ok7xipN4M5

Cryptocurrency marque Coin Bureau was besides speedy to respond to the imaginable spot crypto ETF motorboat successful Hong Kong. According to the Coin Bureau, the U.S. Securities and Exchange Commission (SEC) mightiness beryllium getting immoderate unit amid different jurisdictions similar Hong Kong jumping connected the bandwagon of a spot Bitcoin ETF.

“It’s a cursory communicative to the SEC that if they proceed to stifle superior marketplace innovation successful the United States, different countries are going to capable the void,” Coin Bureau wrote connected X.

Crypto influencer Lark Davis besides stressed that the latest spot crypto ETF quality from Hong Kong shows that the Chinese authorities doesn’t privation to miss retired connected crypto opportunities.

“Hong Kong going to get spot Bitcoin ETFs now! Chinese wealth does not privation miss out,” Davis stated.

Hong Kong is considering allowing retail investors to entree spot ETFs linked to cryptocurrencies similar Bitcoin, providing regulatory concerns are met, Securities and Futures Commission CEO Julia Leung said, according to a Bloomberg study connected Nov. 5. The SFC did not instantly respond to Cointelegraph’s petition for comment.

Hong Kong’s imaginable determination into spot Bitcoin ETFs comes arsenic astatine slightest a dozen concern firms successful the U.S. seek to motorboat akin products successful the state contempt long-running pushback from the Securities and Exchange Commission (SEC).

Although some Hong Kong and the U.S. person permitted crypto ETFs linked to futures contracts, the jurisdictions are yet to o.k. a spot crypto ETF. Unlike a futures Bitcoin ETF, which tracks futures contracts to replicate BTC prices, a spot Bitcoin ETF straight holds BTC, allowing investors to summation vulnerability to the asset.

Related: Spot Bitcoin ETF hype reignited zest for blockchain games: Yat Siu

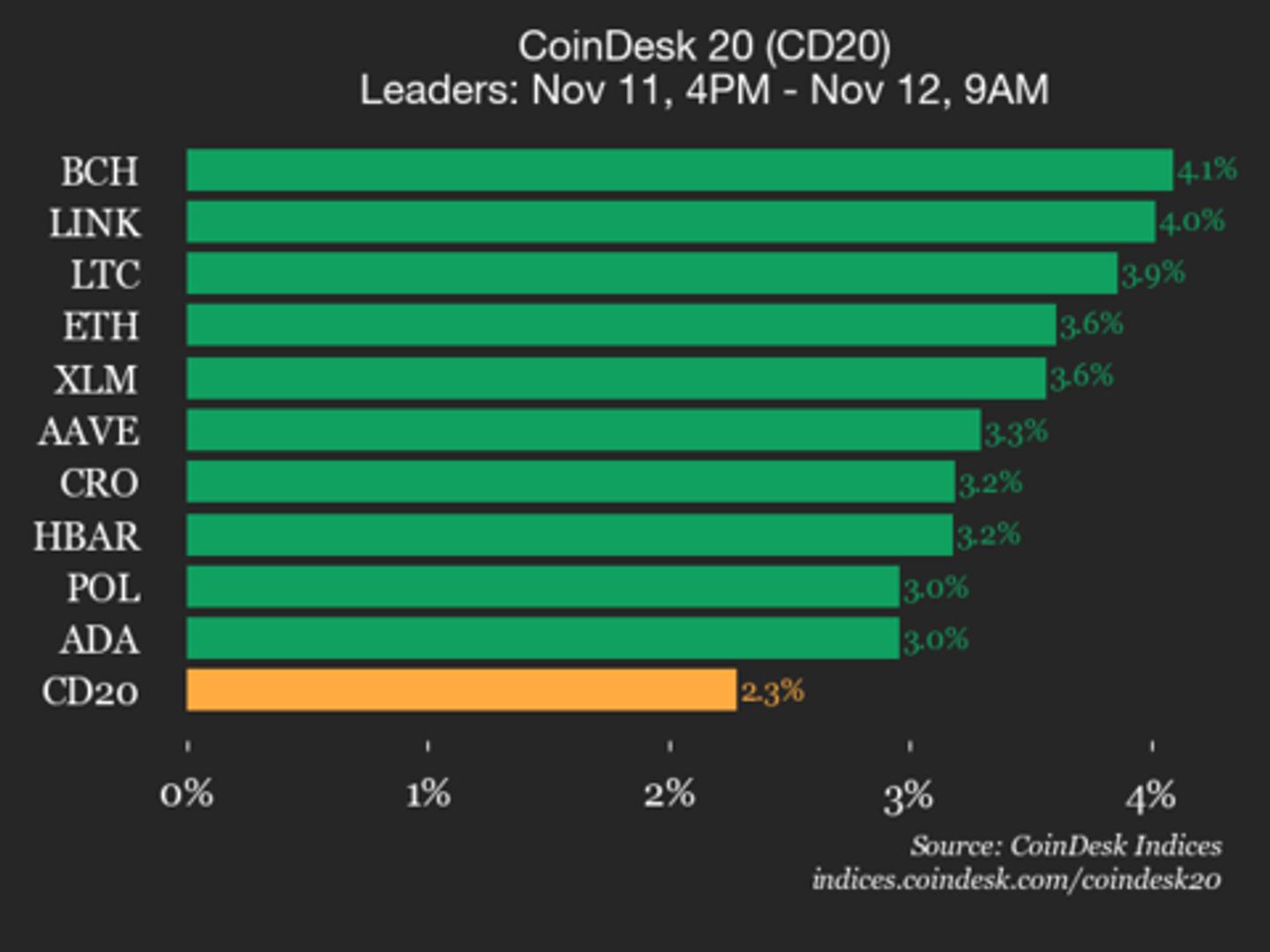

The U.S. was the archetypal to launch futures-linked crypto ETFs successful 2021, with Hong Kong following in its footsteps successful precocious 2022 with the motorboat of CSOP cryptocurrency futures products. Combined with the Samsung Bitcoin Futures Active ETF, Hong Kong has astir $65 cardinal successful crypto ETF assets, according to Bloomberg. The futures crypto ETFs person seen debased request successful Hong Kong, with their stock inactive being tiny compared to different planetary crypto funds.

Geographical divided of assets successful publically listed crypto funds. Source: Bloomberg Intelligence

Geographical divided of assets successful publically listed crypto funds. Source: Bloomberg IntelligenceHong Kong and Shanghai Banking Corporation — the biggest slope successful Hong Kong — reportedly enabled its customers to bargain and merchantability Bitcoin and Ether (ETH)-based ETFs successful June 2023.

Crypto regularisation — Does SEC Chair Gary Gensler person the last say?

2 years ago

2 years ago

English (US)

English (US)