"Hyperbitcoinization" — an astir apocalyptic word evoking end-of-days fiat illness and bitcoin’s parabolic emergence to planetary reserve presumption — is progressively being discussed successful much superior circles.

For hardcore bitcoin maximalists, it's agelong been the eventual scenario: a fiscal utopia wherever individuals, institutions and adjacent nations are all-in connected a bitcoin-only strategy arsenic the fiat-based system collapses.

While we aren't determination yet, the caller events mightiness suggest thing is brewing.

Bitcoin is trading astatine record highs supra $119,000. The marketplace headdress of bitcoin is near that of the tech giants. The U.S. dollar is continuing its dilatory bleed successful existent purchasing power. Major institutions are allocating superior to BTC with the aforesaid risk-adjusted lens they use to accepted assets. If hyperbitcoinization erstwhile sounded similar ideological fiction, it’s present apt approaching early-stage reality.

"In anterior BTC bull markets, the hyperbitcoinization thesis would person been constricted to crypto enthusiasts. More recently, hyperbitcoinization-adjacent conversations person go overmuch much palatable for the broader public," FRNT Capital said successful an emailed note.

From trenches to the beforehand line

Just a fewer years ago, nary 1 thought the likes of BlackRock would beryllium creating an exchange-traded money for the masses to bargain billions successful bitcoin.

Today, the iShares Bitcoin Trust (IBIT) is simply a juggernaut with 706,008 bitcoin nether its belt, worthy $82 billion, according to BitcoinTreasuries.Net data.

Large companies are raising funds to bargain bitcoin for their equilibrium sheets. Political leaders, including a pro-crypto U.S. president, are floating the thought of nationalist bitcoin reserves (whether that volition come to fruition is inactive up for debate).

Even a U.S. lodging regulator is considering whether crypto holdings could beryllium considered for owe applications — a imaginable awesome that integer assets are becoming portion of halfway fiscal infrastructure, oregon astatine slightest that those presently successful powerfulness would similar to spot that happen.

And of course, Wall Street has already claimed bitcoin with "Tradification" of the integer assets.

The ownership shift

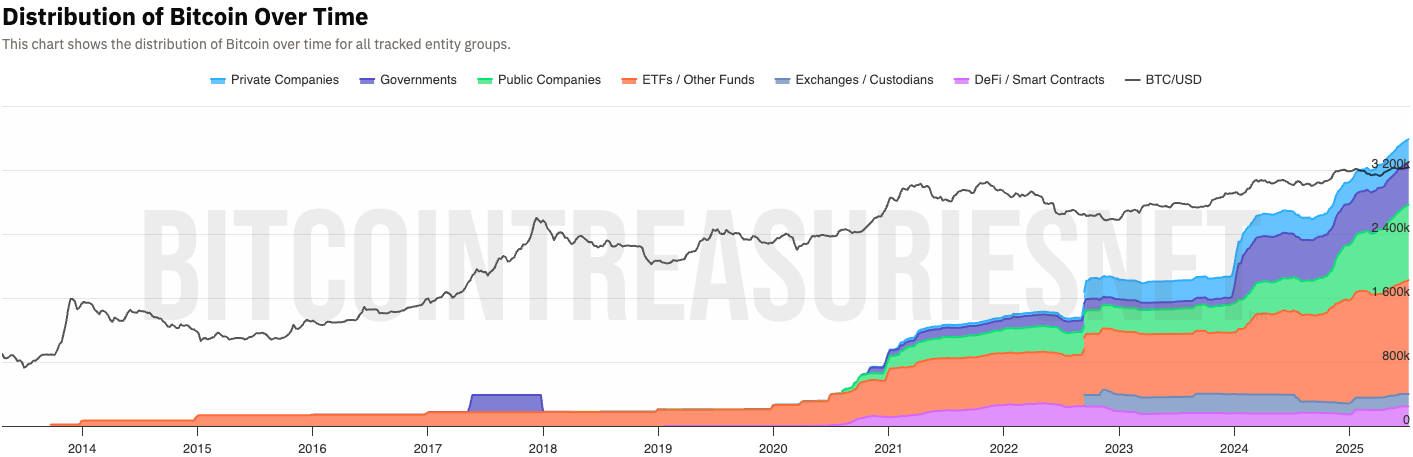

The illustration beneath makes an absorbing reflection astir a imaginable "hyperbitcoinization" that whitethorn already beryllium good underway.

From 2014 till astatine slightest 2020, bitcoin has been held by mostly individuals. But accelerated guardant to today, a monolithic fig of companies, funds and adjacent governments, arsenic opposed to idiosyncratic crypto enthusiasts, are holders of bitcoin portion prices proceed to rally to caller highs.

This displacement successful wallet organisation suggests that hyperbitcoinization, portion not afloat realized, is progressing from an ideological thesis to a imaginable observable marketplace behavior.

In a marketplace that is progressively driven by communicative momentum and liquidity rotation, hyperbitcoinization whitethorn not conscionable beryllium a taxable — it mightiness go the trade.

"Conceivably, arsenic the hyperbitcoinization thesis is validated successful signifier and gains further mainstream attention, much BTC investors volition beryllium motivated to HODL. This does not use conscionable to individuals, but to institutions and nations alike," said FRNT.

3 months ago

3 months ago

English (US)

English (US)