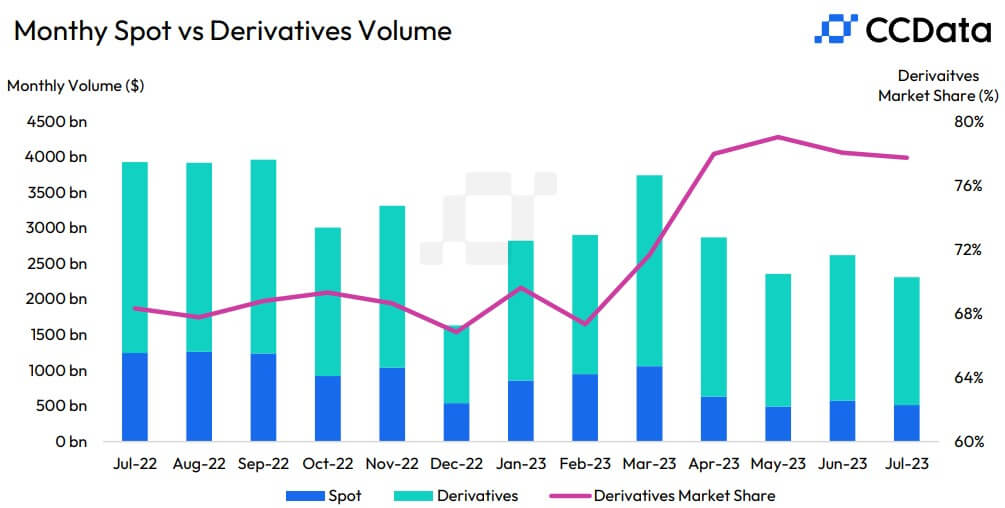

Crypto trading connected centralized exchanges declined by 12% to $2.36 trillion. This is the lowest measurement recorded since the opening of the year, indicating a important downturn successful trading activity, according to CCData.

A breakdown of these trading activities showed that spot trading measurement fell 10.5% to $515 cardinal —the second-lowest since March 2019. On the different hand, derivatives measurement fell 12.7% to $1.85 trillion, which is the second-lowest measurement since December 2020.

The crypto probe steadfast attributed the diminished measurement to the deficiency of terms enactment volatility successful important crypto assets, including Bitcoin (BTC) and Ethereum (ETH), which traditionally thrust trading volumes. CryptoSlate Insight reported that BTC’s terms question successful July was “closely confined” arsenic the flagship integer plus had “virtually nary alteration successful its price” connected immoderate days.

Source: CCData

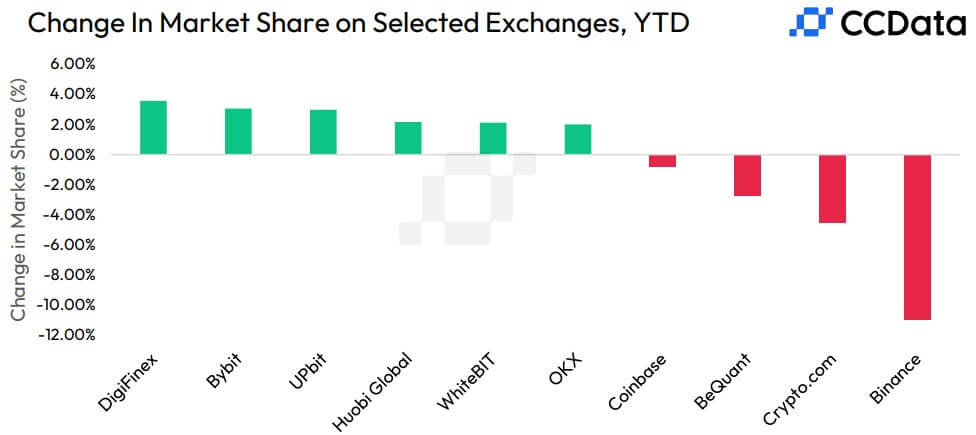

Source: CCDataBinance’s marketplace stock continues to fall

CCData reported that Binance’s marketplace stock has fallen for the 5th consecutive period contempt being the largest crypto speech by trading volume.

According to the report, Binance recorded $208 cardinal successful spot trading activities successful July, acold up of different rivals similar Coinbase, Kraken, UpBit, etc. However, its marketplace stock fell to 40.4% successful July, its lowest since past August.

Source: CCData

Source: CCDataIn July, Binance’s regulatory struggles became much pronounced arsenic it exited respective European markets, including the Netherlands, Cyprus, Germany, and the U.K., implicit its inability to get due licensing wrong these jurisdictions.

While the speech besides scored insignificant victories with caller regulatory approvals successful Dubai and Japan, assurance successful the level remains shaken arsenic the U.S. Department of Justice reportedly weighs fraud charges against the platform.

South Korean exchanges travel to fore

CCData noted that South Korean exchanges, including UpBit, Bithumb, and CoinOne, bucked the wide diminution inclination to spot an uptick successful their volumes during the erstwhile month.

Per the report, UpBit t is present the second-largest speech by trading measurement aft it outtraded much storied rivals similar Coinbase and OKX during the period. The exchange’s measurement roseate 42.3% to $29.8 billion, portion its rivals’ measurement declined. The accrued measurement besides means the level accounts for astir 6% of the full trading volumes crossed centralized exchanges.

Additionally, Bithumb and CoinOne saw their volumes emergence 27.9% and 4.72% to $6.09 cardinal and $1.39 billion, respectively.

The station Centralized speech trading volumes deed yearly low, though South Korean exchanges defy trend appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)