Quick Take

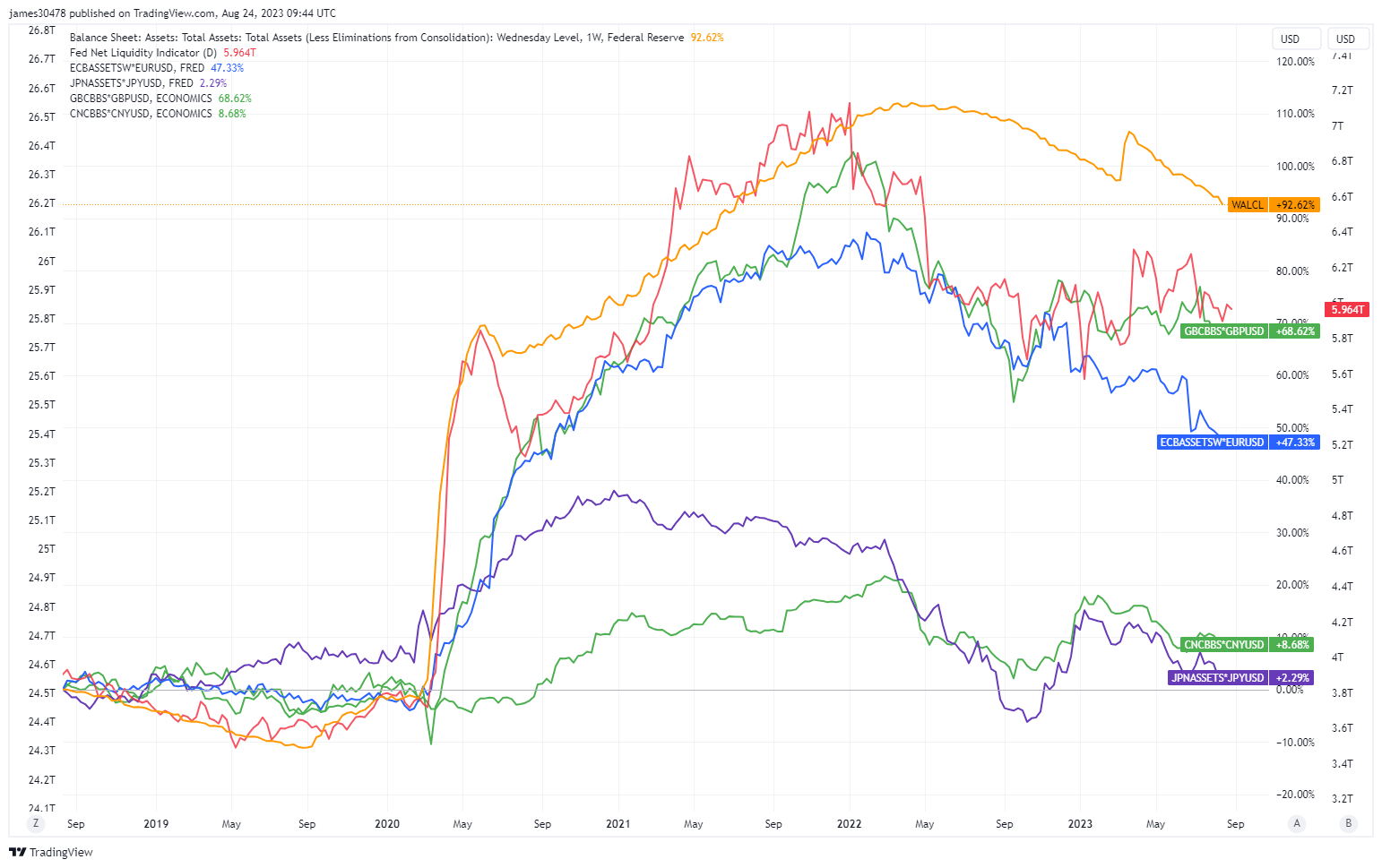

Global cardinal banks are decidedly rolling backmost connected their respective equilibrium sheets, indicating an assertive stride successful quantitative tightening for 2023.

The Bank of England’s (BOE) equilibrium expanse downsized by 3%, portion the Federal Reserve reported a 4% reduction. Notably, the People’s Bank of China charts a 5% diminution successful its equilibrium sheet.

The European Central Bank (ECB) and the Bank of Japan are starring the battalion with a diminution of 8.5% and 9%, respectively.

Analyst Holger Zschaepitz highlighted that the ECB’s equilibrium expanse has deed its lowest constituent since March 2021. Zschaepitz goes connected further to accidental the full assets of these banks are important fractions of their corresponding GDPs.

The ECB’s assets relationship for 53% of the EU’s GDP, with the Federal Reserve and BOE representing 30% and 33% of the US and UK GDPs, respectively. The Bank of Japan stands out, with its assets equating to 126% of Japan’s GDP.

This inclination is indicative of the cardinal banks’ persistent efforts to alleviate the inflationary pressures and stabilize their economies pursuing the pandemic-induced fiscal upheaval.

Balance Sheet: (Source: Trading View)

Balance Sheet: (Source: Trading View)The station Central banks globally rotation backmost equilibrium sheets – quantitative tightening gait heightened appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)