Central banks amusement continued request for golden successful 2023, arsenic per a caller study from the World Gold Council (WGC), which noted that the world’s cardinal banks accumulated 31 tons of the precious metallic successful January. Turkey was the largest golden buyer, adding 23 tons to its cardinal bank’s stash, portion the People’s Bank of China besides purchased 15 tons of gold.

Central Bank Gold Purchases Remain Steady Despite Potential Challenges successful 2023

At the clip of writing, a troy ounce of good .999 golden is $1,857.50 per unit, up 1.12% implicit the past day. Gold prices person been down since Jan. 31, 2023, erstwhile the terms per ounce reached $1,950 per portion against the U.S. dollar. On March 2, the World Gold Council (WGC) published a report titled “No Dry January for Central Bank Gold Buying,” which discusses however Jan. 2023 records amusement that the world’s cardinal banks person maintained the request registered astatine the extremity of 2022.

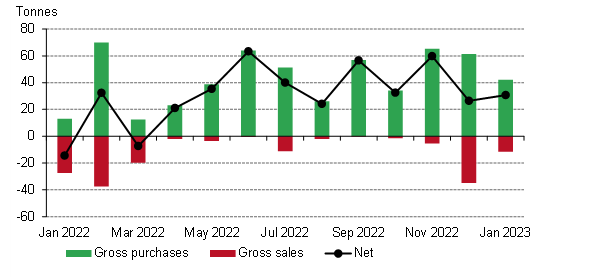

According to Krishan Gopaul, the writer of the report, galore purchases came from Turkey, China, and Kazakhstan. “In January, cardinal banks collectively added a nett 31 tonnes (t) to planetary golden reserves (+16% m-o-m),” Gopaul wrote. “This was besides comfortably wrong the 20-60t scope of reported purchases which has been successful spot implicit the past 10 consecutive months of nett buying.”

Central slope purchases and income accounted for 44 tons successful Jan. 2023, with 1 cardinal slope offsetting its stash by selling 12 tons. The largest golden purchaser was the Central Bank of Türkiye (Turkey), which acquired astir 23 tons during the month. According to the country’s records, Turkey present holds 565 tons of gold.

China came successful second, with the People’s Bank of China acquiring 15 tons during the aforesaid clip frame, arsenic Gopaul detailed. “The National Bank of Kazakhstan accrued its golden reserves by a humble 4 tons successful January, taking its golden reserves to 356 tons,” the WGC writer explains. The study notes that the information is based connected International Monetary Fund (IMF) records, and immoderate of the information whitethorn beryllium revised during the adjacent WGC monthly report.

In summation to Turkey, China, and Kazakhstan, the WGC writer details that the European Central Bank (ECB) acquired 2 tons due to the fact that Croatia joined the eurozone, and the state was required to transportation its reserve assets to the ECB. The seller of the 12-ton merchantability of golden successful January 2023 was the Central Bank of Uzbekistan, and the state present holds astir 384 tons.

The WGC study concludes that the enactment has small uncertainty that cardinal banks worldwide volition proceed to acquisition golden during the remainder of 2023. However, the WGC writer stresses that the golden buying this twelvemonth whitethorn not lucifer the records acceptable successful 2022. “It is besides tenable to judge that cardinal slope request successful 2023 whitethorn conflict to scope the level it did past year,” the study notes.

Tags successful this story

2023, Assets, buyer, Central Banks, China, Demand, ECB, economics, Economy, European Central Bank, Eurozone, financial, Global, gold, holdings, IMF, International Monetary Fund, investment, january, Kazakhstan, Krishan Gopaul, Markets, Metal, net buying, precious metal, Price, Purchases, Records, reserves, sales, seller, troy ounce, Turkey, U.S. dollar, Uzbekistan, WGC, World Gold Council

What bash you deliberation the aboriginal holds for cardinal slope golden demand? Will it proceed to emergence oregon volition it alteration successful the coming months and years? Share your thoughts successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons, World Gold Council, Tradingview

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)