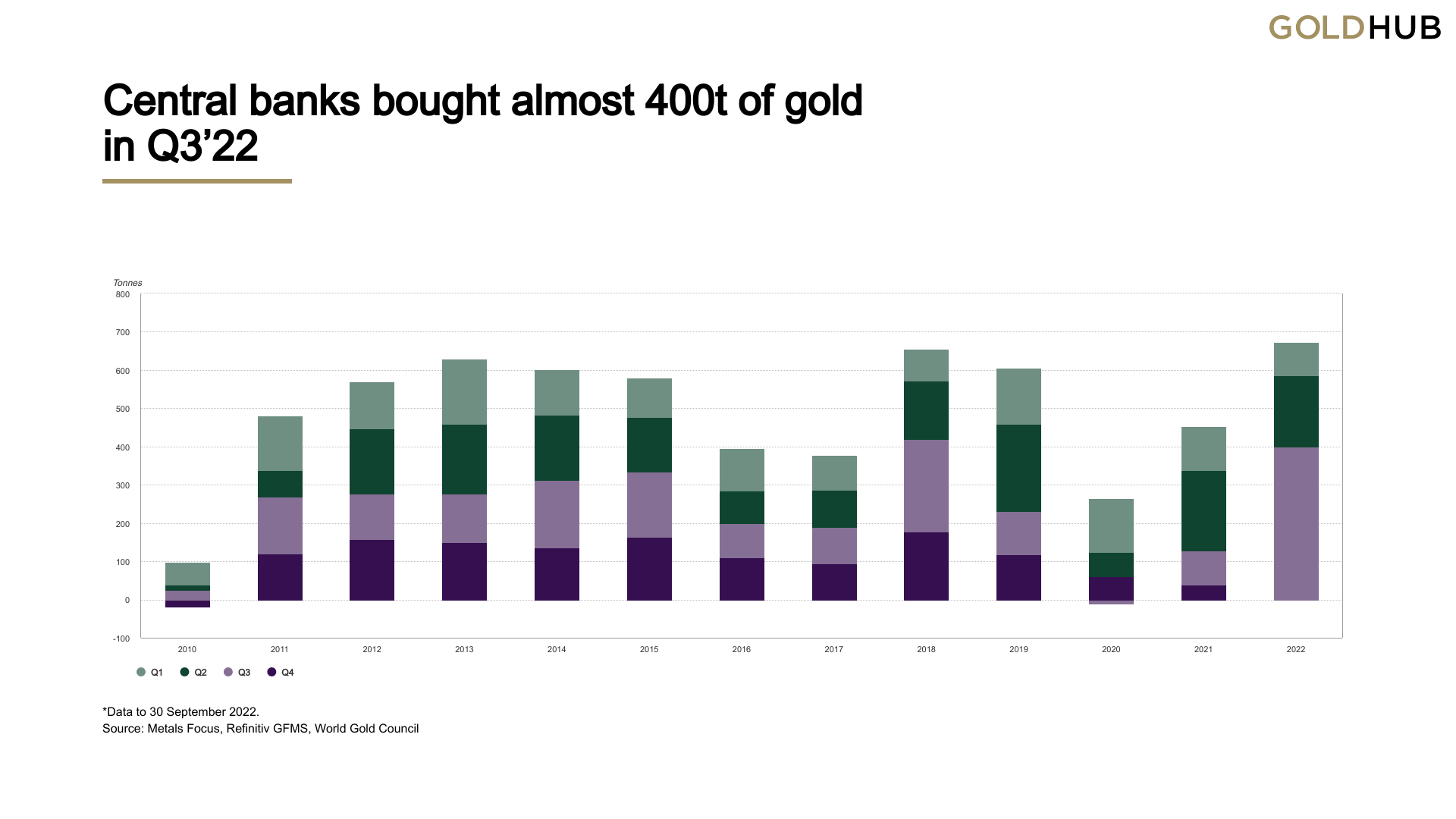

According to the World Gold Council’s (WGC) latest quarterly report, worldwide golden demand, excluding over-the-counter (OTC) markets, was 28% higher year-over-year. While request jumped higher than past twelvemonth successful the 3rd quarter, cardinal slope golden buying tapped an all-time quarterly grounds successful Q3 2022. The quarterly study indicates that the world’s cardinal banks purchased adjacent to 400 tons of golden and the WGC survey says that it’s the “most connected record.”

Q3 2022 Data Shows the World’s Central Banks Stacked Close to 400 Tons of Gold

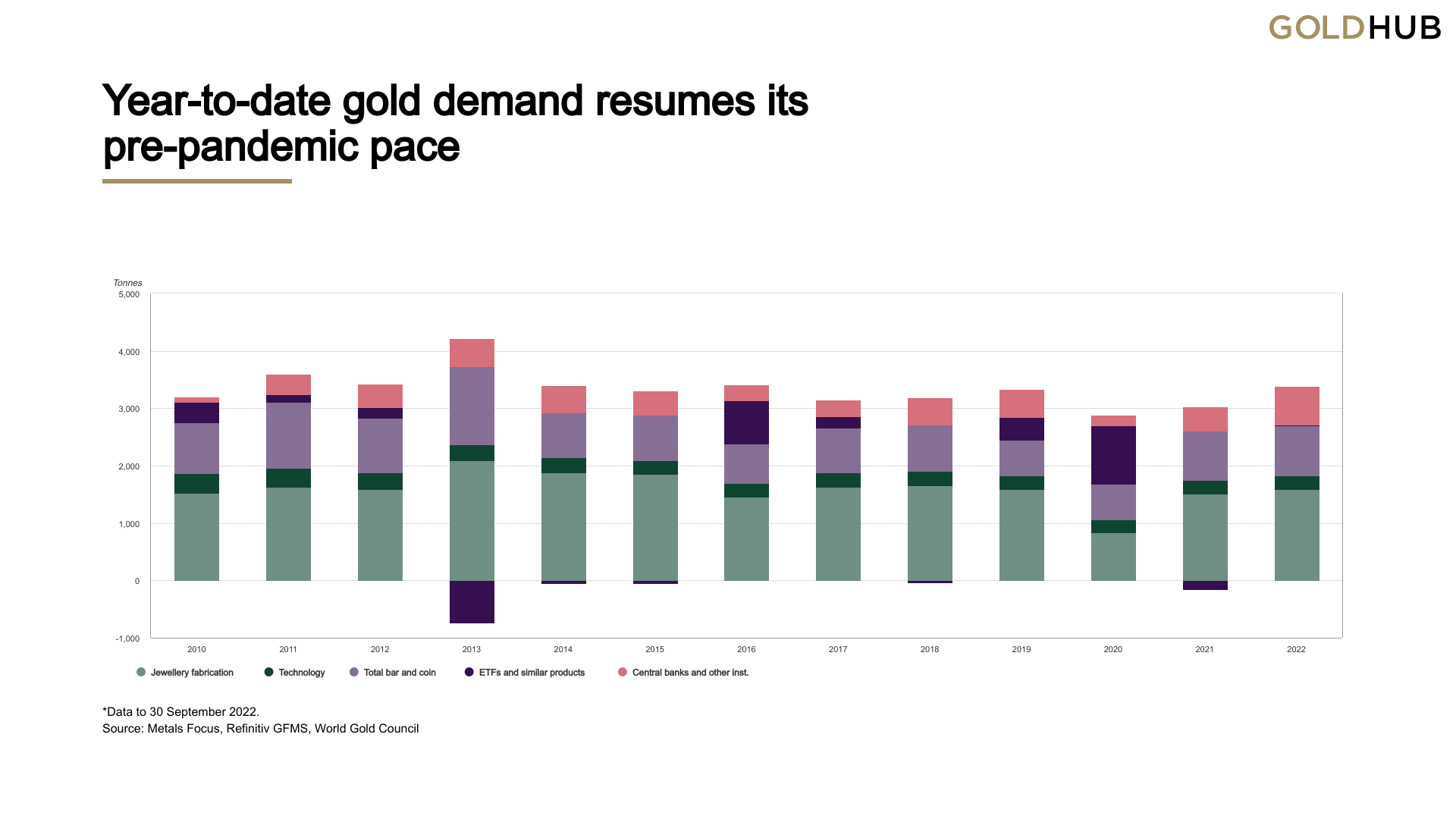

On Nov. 1, 2022, the World Gold Council (WGC) published the organization’s “Gold Demand Trends Q3 2022” report, which highlights the existent trends tethered to golden and the precious metal’s markets during the 3rd quarter. WGC’s report, published connected gold.org, says the 3rd 4th was steadfast and was driven by “stronger user and cardinal slope buying.” WGC highlights that these factors helped year-to-date request “recover to pre-Covid norms.”

“Gold request (excluding OTC) successful Q3 was 28% higher y-o-y astatine 1,181t,” WGC’s study notes. “Year-to-date request accrued 18% vs the aforesaid play successful 2021, returning to pre-pandemic levels.”

While user request for golden has risen, request for golden from cardinal banks has reached an all-time high, arsenic acold arsenic cardinal slope quarterly purchases are concerned. The biggest Q3 2022 buyers retired of each the cardinal banks stemmed from Turkey, Uzbekistan, and Qatar.

“Turkey remained the largest reported golden purchaser this year,” WGC’s study details. ”It added 31t successful Q3, lifting its golden reserves to 489t (29% of full reserves). Year-to-date it has added 95t to golden reserves.”

WGC researchers noted that Uzbekistan is steadily stacking golden arsenic it purchased 26 tons of the precious metallic successful Q3. The study explains that Uzbekistan has besides been “a accordant purchaser of gold” during the past 2 quarters.

The Qatar Central Bank secured a grounds acquisition erstwhile it bought 15 tons of golden during the 3rd quarter. WGC says Qatar’s golden acquisition “appears to beryllium its largest monthly acquisition connected grounds backmost to 1967.”

The WGC study details that determination are besides cardinal banks that are not reporting their golden acquisitions. “The level of authoritative assemblage request successful Q3 is the operation of dependable reported purchases by cardinal banks and a important estimation for unreported buying,” the WGC study claims.

Kazakhstan sold 2 tons of golden during the 3rd quarter, and the country’s cardinal slope was the largest nett seller successful Q3. WGC researchers accidental that “it is not uncommon” for cardinal banks “to plaything betwixt buying and selling.” The WGC survey says that the authoritative assemblage request for golden confirms the findings from this year’s annual cardinal slope survey.

“The continued inclination of authoritative assemblage request for golden corroborates findings from our 2022 yearly cardinal slope survey, successful which one-quarter of respondents stated their volition to summation golden reserves successful the adjacent 12 months (up from one-fifth successful 2021),” the WGC researchers reason successful the central slope section of the report.

Tags successful this story

.999 gold, Bullion Dealers, central slope buying, central slope gold, Central Banks, Coins, Cryptocurrency, demand for gold, gold, Gold Prices, Gold Purchases, Gold reserves, Kazakhstan, Premiums, q3, Q3 2022, qatar, retail investors, Safe haven, Turkey, Uzbekistan, WGC, WGC study, World Gold Council, World Gold Council survey

What bash you deliberation astir the World Gold Council’s Gold Demand Trends Q3 2022 report? What bash you deliberation astir the cardinal bank’s quarterly purchases being the astir connected grounds successful Q3 2022? Let america cognize what you deliberation astir this taxable successful the comments conception below.

Jamie Redman

Jamie Redman is the News Lead astatine Bitcoin.com News and a fiscal tech writer surviving successful Florida. Redman has been an progressive subordinate of the cryptocurrency assemblage since 2011. He has a passionateness for Bitcoin, open-source code, and decentralized applications. Since September 2015, Redman has written much than 6,000 articles for Bitcoin.com News astir the disruptive protocols emerging today.

Image Credits: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This nonfiction is for informational purposes only. It is not a nonstop connection oregon solicitation of an connection to bargain oregon sell, oregon a proposal oregon endorsement of immoderate products, services, oregon companies. Bitcoin.com does not supply investment, tax, legal, oregon accounting advice. Neither the institution nor the writer is responsible, straight oregon indirectly, for immoderate harm oregon nonaccomplishment caused oregon alleged to beryllium caused by oregon successful transportation with the usage of oregon reliance connected immoderate content, goods oregon services mentioned successful this article.

2 years ago

2 years ago

English (US)

English (US)