Despite the relation it has played successful narrowing the fiscal inclusion gap, the e-naira cardinal slope integer currency inactive poses a hazard to fiscal stability. In summation to bolstering the fiscal inclusion rate, the cardinal slope claimed that the CBDC would “widen the size and stableness of banks’ deposit base.”

Nigeria’s Financial Inclusion Rates

According to a caller Central Bank of Nigeria (CBN) study, the country’s astir two-year-old e-naira cardinal slope integer currency (CBDC) poses a hazard to fiscal stability. This is contempt the information that specified a integer currency tin perchance assistance amended Nigeria’s “financial inclusion complaint from 64.1 percent recorded successful 2021 to the 95.0 percent people for 2024.”

Launched successful precocious October 2021, the e-naira, which was championed by erstwhile CBN politician Godwin Emefiele, has not been widely received by the Nigerian population. As antecedently reported by Bitcoin.com News successful August 2022, determination were less than 1 cardinal downloads of the e-naira app immoderate 12 months aft the CBDC was launched.

Many observers person argued that the fig of downloads versus Nigeria’s 130 cardinal positive adults whitethorn beryllium an denotation of the public’s little than lukewarm effect to the CBDC’s launch. However, the Nigerian public’s evident snub of the e-naira has not stopped the CBN from promoting it oregon offering incentives to prospective users.

Stabilizing the Banks’ Deposit Base

The deepening of fiscal inclusion is 1 of the cardinal advantages the CBN has repeatedly highlighted erstwhile making the lawsuit for the CBDC. Similarly, successful its report titled “Economics of Digital Currencies,” the CBN again discusses however the unveiling of the e-naira USSD codification for non-smartphone users has helped to summation the fig of e-naira transactions. In summation to bolstering the fiscal inclusion rate, the cardinal slope claimed that the CBDC would “widen the size and stableness of banks’ deposit base.”

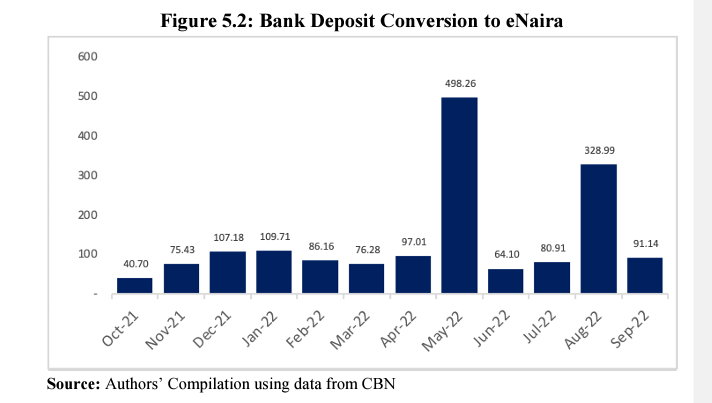

However, contempt these and different benefits that a CBDC volition apt bring, the CBN states successful the study that the conversion of slope deposits to e-naira whitethorn airs risks to the stableness of the banking system. To backmost this argument, the study points to the fig of slope deposit conversions since the instauration of the CBDC.

“Since its inception, slope deposit conversion to e-naira has exhibited an mean monthly maturation of 78.3 percent and totaled astir N1.66 cardinal [$2.1 million]. Furthermore, e-naira successful circulation arsenic a ratio of mean banking strategy liquidity has averaged 0.1 percent, reaching highs of 0.2 percent successful each of the months of May and August 2022,” the CBN study noted.

According to the cardinal bank, the e-naira tin besides negatively impact banks’ wide profitability via reduced non-interest income. A CBDC besides comes with accrued cyberattack risks, the CBN study said.

What are your thoughts connected this story? Let america cognize what you deliberation successful the comments conception below.

2 years ago

2 years ago

English (US)

English (US)