Bitcoin miners play a pivotal relation successful the cryptocurrency ecosystem. They validate transactions, unafraid the network, and circulate caller Bitcoins. Their behavior, particularly successful holding oregon selling mined coins, tin supply penetration into marketplace sentiment and aboriginal terms movements.

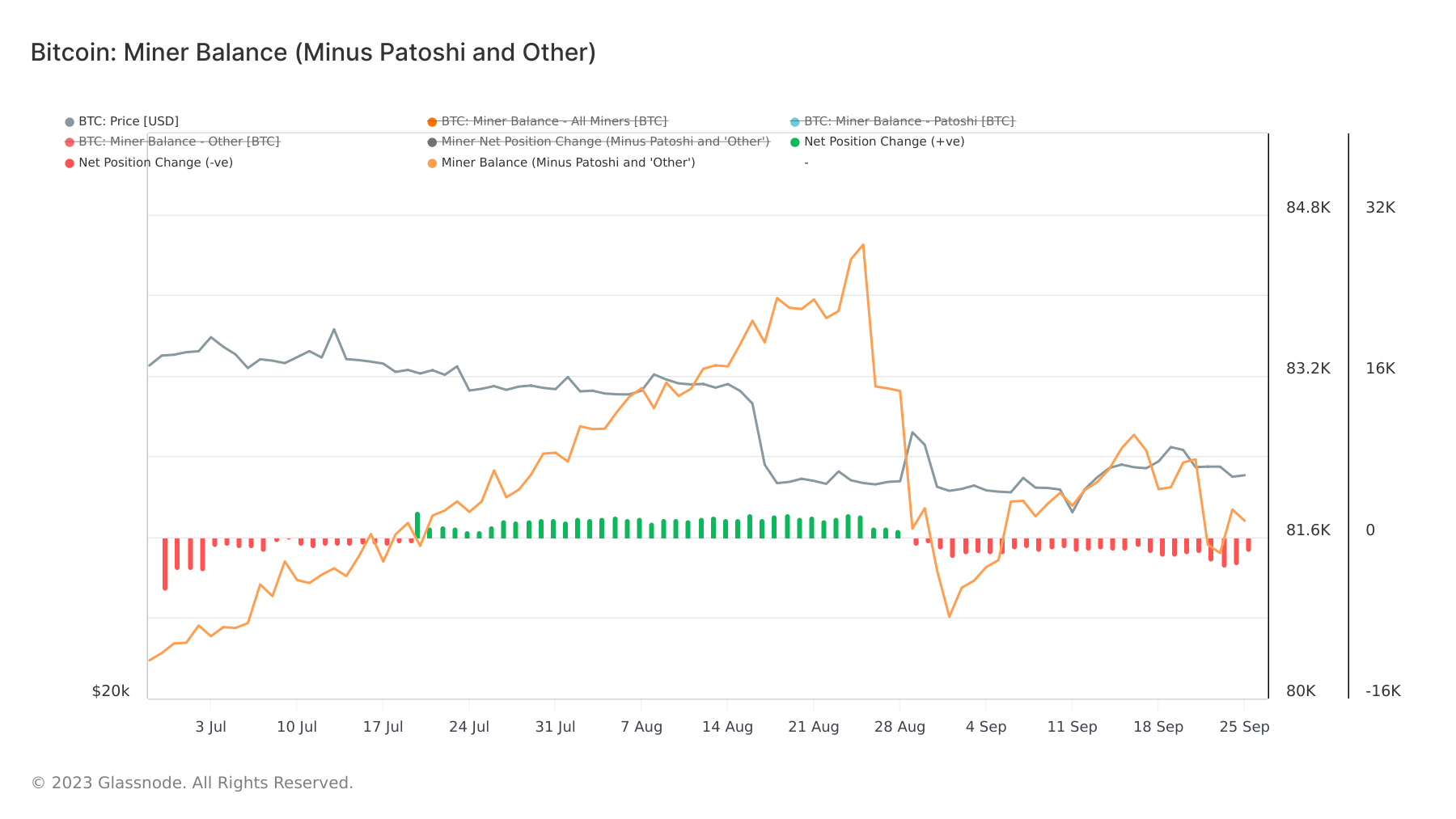

Data from Glassnode has shown that determination has been a antagonistic nett presumption alteration successful miner balances successful September. This means miners person been selling much Bitcoin than they’ve been mining. This could effect from galore antithetic factors — miners mightiness beryllium selling BTC for USD oregon different fiat currencies to screen operational costs oregon instrumentality profits. Some mightiness besides beryllium offloading their BTC successful anticipation of a terms slump.

However, contempt the persistent antagonistic nett presumption change, the full miner equilibrium hasn’t decreased this month. Miner balances person grown from 80,810 BTC connected Sep. 1 to 81,760 BTC connected Sep. 25. This uptick suggests that miners are offloading immoderate of their holdings but aren’t parting ways with their recently minted coins. Instead, they’re inactive successful accumulation mode, albeit astatine a perchance slower rate.

Graph showing the full miner equilibrium and nett presumption changes from June 28 to Sep. 26, 2023 (Source: Glassnode)

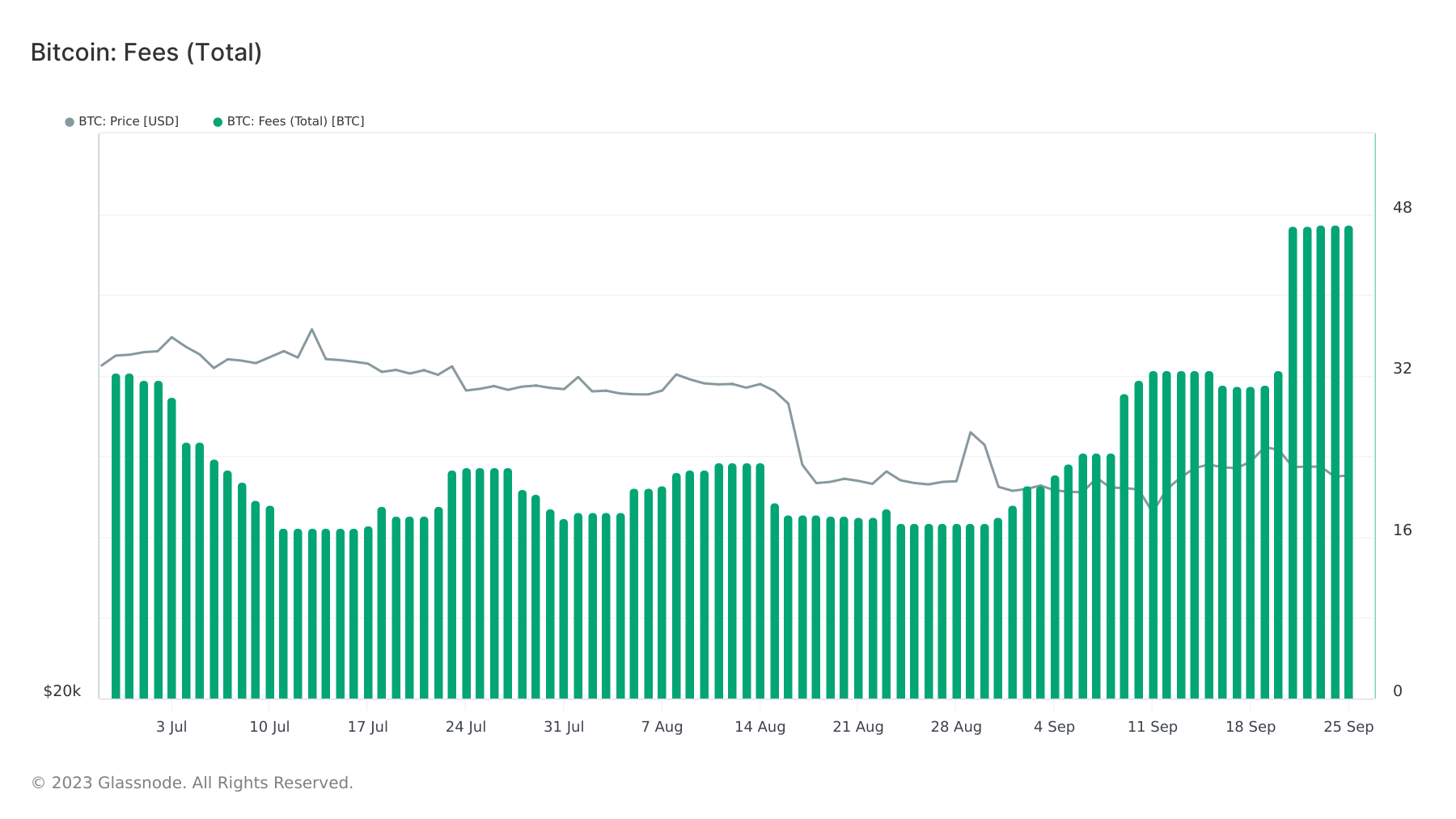

Graph showing the full miner equilibrium and nett presumption changes from June 28 to Sep. 26, 2023 (Source: Glassnode)There has besides been a notable summation successful Bitcoin transaction fees this month, which jumped from 19 BTC connected Sep. 1 to 46.9 BTC by Sep. 25. This uptrend points to heightened request for transactions, perchance owed to a bustling Inscriptions marketplace oregon an influx of users. However, the spike successful fees could besides beryllium attributed to web congestion, thing the Inscriptions marketplace has agelong been criticized for. A afloat Bitcoin mempool means galore transactions are piling up, waiting to beryllium included successful a block, starring users to fork retired higher fees to expedite their transaction confirmations.

Graph showing the regular transaction fees connected the Bitcoin web from June 28 to Sep. 26, 2023 (Source: Glassnode)

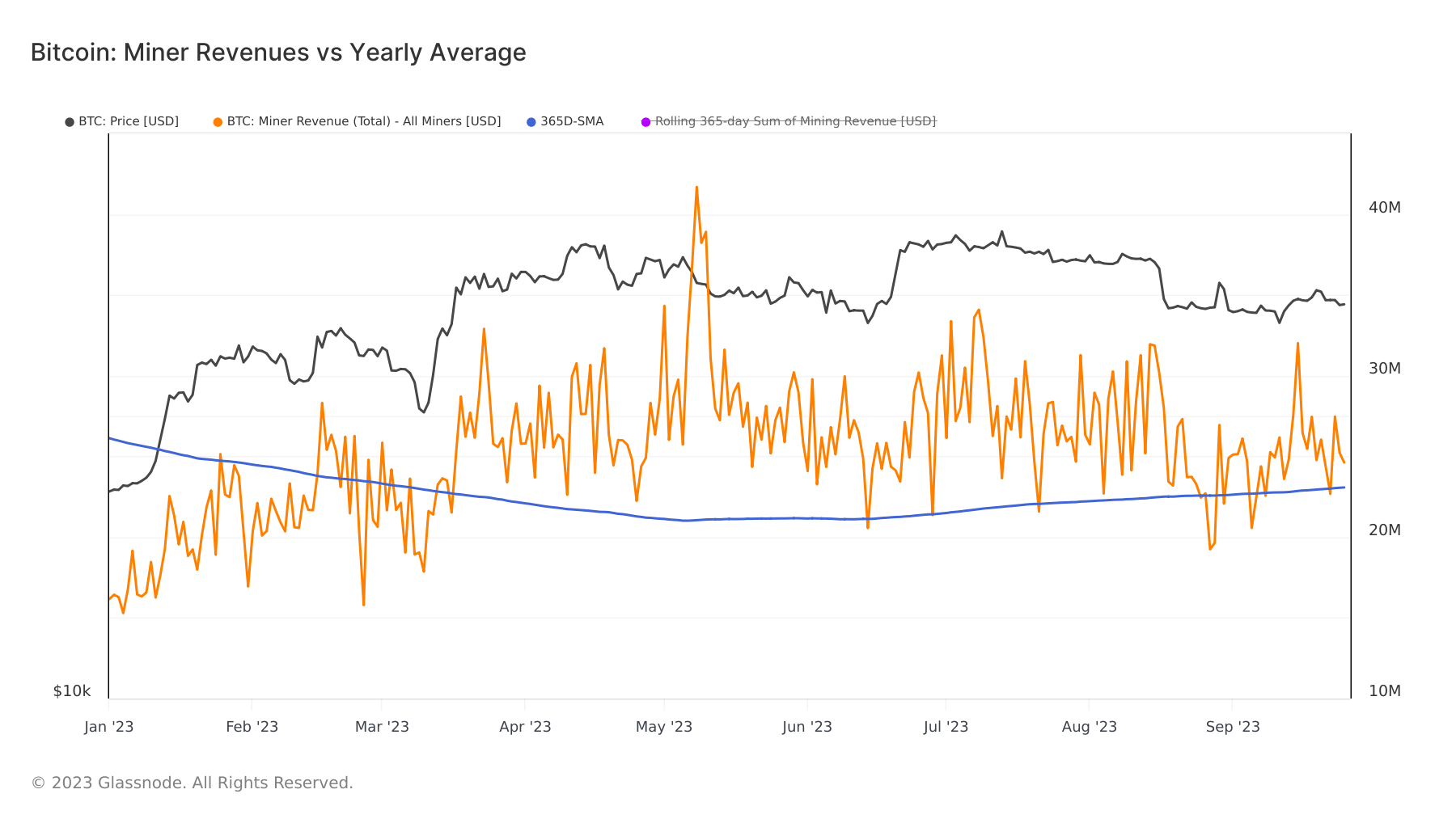

Graph showing the regular transaction fees connected the Bitcoin web from June 28 to Sep. 26, 2023 (Source: Glassnode)Comparing the existent mining gross with the yearly mean indicates a favorable situation for miners. According to information from Glassnode, miner gross has been supra the yearly mean for astir of September. This is simply a continuation of a inclination that began successful March erstwhile the yearly mean dropped beneath the existent gross aft respective months of divergence. This could beryllium owed to a operation of rising Bitcoin prices, the above-mentioned accrued transaction fees, oregon both. This inclination began successful March and has since suggested sustained request and enactment successful the Bitcoin network.

Graph comparing the existent USD-denominated miner gross to the yearly mean successful 2023. Note that the bluish enactment represents the yearly mean (365D SMA) (Source: Glassnode)

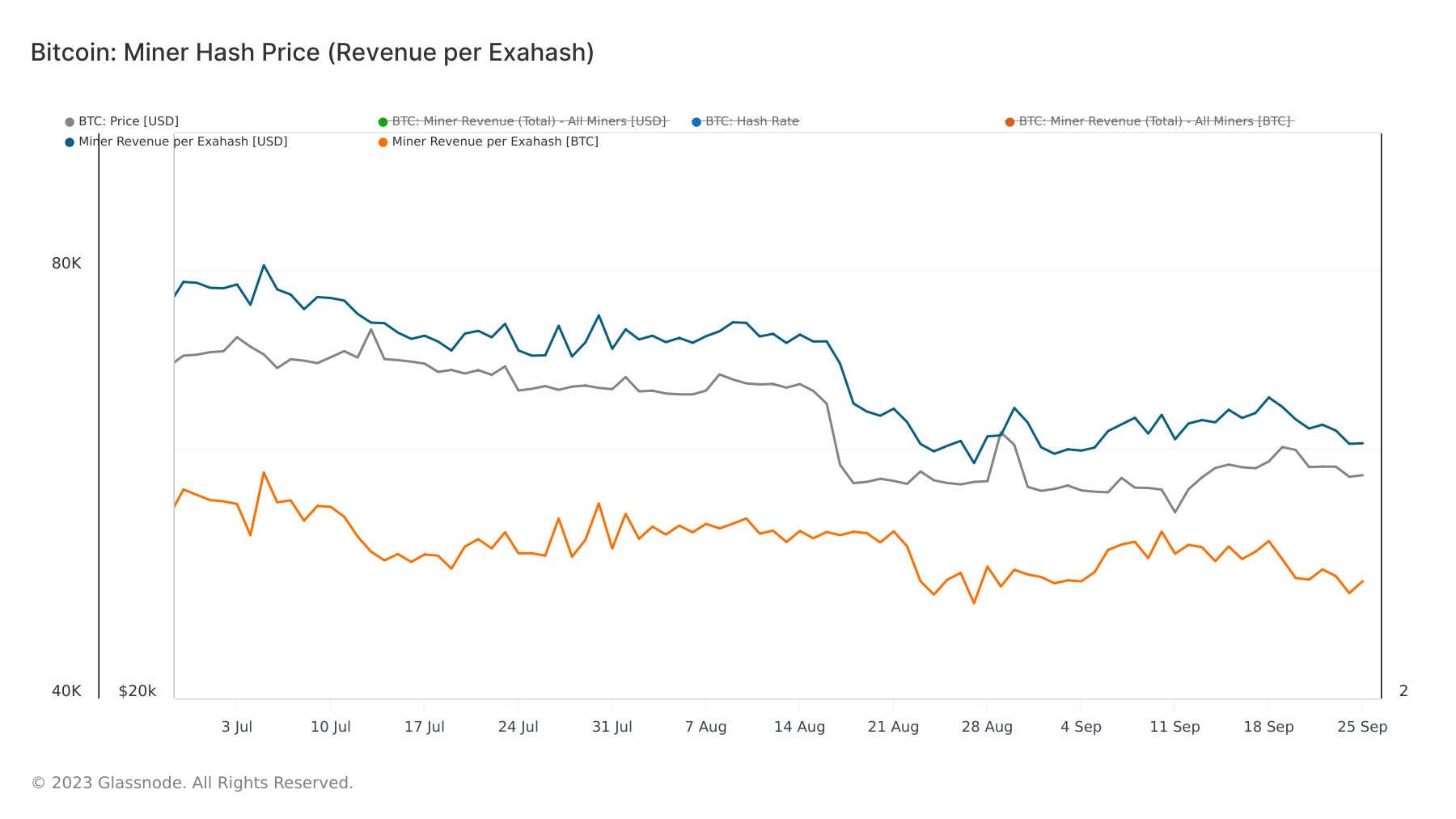

Graph comparing the existent USD-denominated miner gross to the yearly mean successful 2023. Note that the bluish enactment represents the yearly mean (365D SMA) (Source: Glassnode)A person introspection of miner gross per exahash reveals a flimsy dip successful Bitcoin-denominated revenue, moving from 2.32 BTC to 2.30 BTC since the month’s inception. This suggests that miners are pocketing a tad little Bitcoin for each portion of computational effort. Potential culprits could beryllium escalating contention among miners oregon insignificant web inefficiencies. However, erstwhile viewed done the lens of USD, the gross per exahash has climbed from $60,120 connected Sep. 1 to $60,505 connected Sep. 25, signaling an appreciation successful Bitcoin’s dollar value.

Graph showing the BTC-denominated (orange) and USD-denominated (blue) miner gross per exahash from June 28 to Sep. 26, 2023 (Source: Glassnode)

Graph showing the BTC-denominated (orange) and USD-denominated (blue) miner gross per exahash from June 28 to Sep. 26, 2023 (Source: Glassnode)The sentiment successful the Bitcoin marketplace appears to beryllium a blend of optimism and caution. Miners, portion selling, proceed to accumulate. The uptick successful fees underscores a bustling network, and the sustained above-average miner gross since March hints astatine a conducive situation for mining, perchance luring much miners to the fray. The dip successful Bitcoin-denominated gross per exahash raises eyebrows, but the uptick successful its USD counterpart shows a affirmative summation successful Bitcoin’s valuation.

The station Cautious optimism successful Bitcoin miner enactment arsenic accumulation tentatively continues appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)