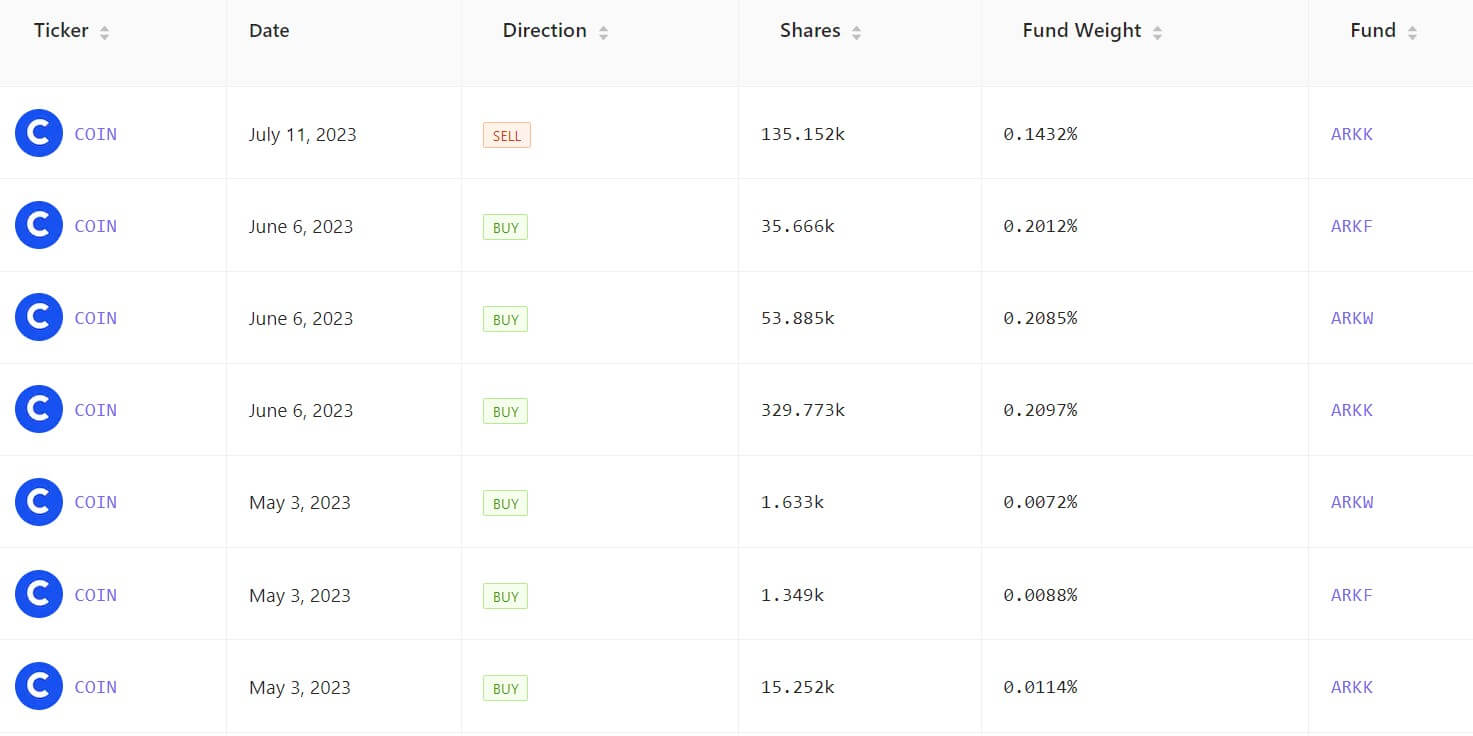

Ark Invest Management sold 135,152 Coinbase shares for $12 cardinal connected July 11, according to information from Cathiesark.

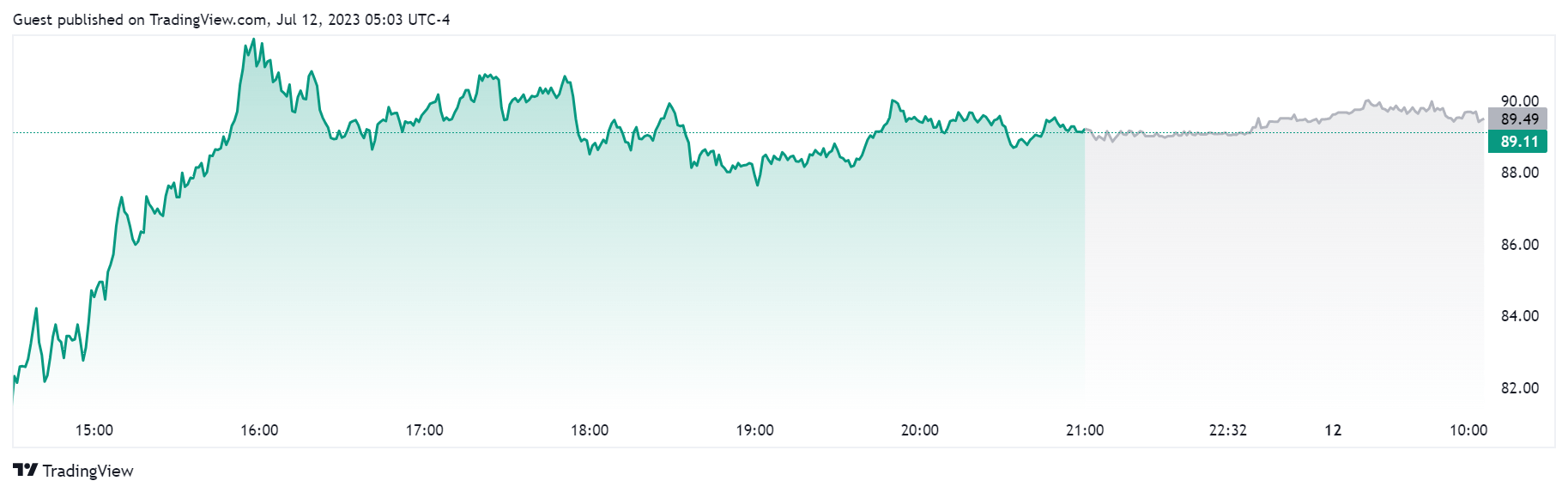

On July 11, COIN rallied to a one-year precocious of $90, continuing its mostly affirmative terms show of a caller while. During the past 30 days, Coinbase banal has outperformed Bitcoin’s (BTC) price, expanding by implicit 60%, portion BTC gained little than 20% during the aforesaid period.

Source: Tradingview

Source: TradingviewCoinbase relation successful Bitcoin ETF applications

With respective accepted fiscal institutions applying for a Bitcoin exchange-traded money (ETF), astir person chosen the speech arsenic a spouse for their surveillance-sharing agreement.

The U.S. Securities and Exchange Commission (SEC) returned the applications filed successful June implicit a lack of clarity and comprehensiveness. The regulator stated that the proposals did not place oregon item the spot Bitcoin speech that would supply a surveillance-sharing agreement, forcing astir applicants to refile and sanction Coinbase arsenic their partner.

Despite the SEC lawsuit, marketplace observers person argued that these partnerships underscore Coinbase’s legitimacy arsenic a U.S. fiscal institution.

Cathie Wood bullish connected Coinbase

Since the opening of the year, Cathie Wood has maintained a bullish stance connected Coinbase stocks contempt the regulatory uncertainty surrounding the exchange.

Source: Cathieark

Source: CathiearkWood stated that the SEC enactment against Binance could indirectly payment Coinbase, as, dissimilar Binance, Coinbase is not accused of immoderate transgression activity.

In a motion of her conviction, Wood’s concern money acquired implicit 400,000 Coinbase shares pursuing the regulatory scrutiny. According to Cathiesark data, Ark Invest is 1 of the largest shareholders of the exchange, holding implicit 11 cardinal COIN stocks crossed each funds.

The station Cathie Wood’s Ark Invest unloads $12M Coinbase shares arsenic COIN rallies to one-year high appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)