This week’s on-chain information study by the analytics institution Glassnode looks into 3 large events — the depegging of the USDC stablecoin, nett superior outflows and futures unfastened involvement data.

(Source: Glassnode insights)

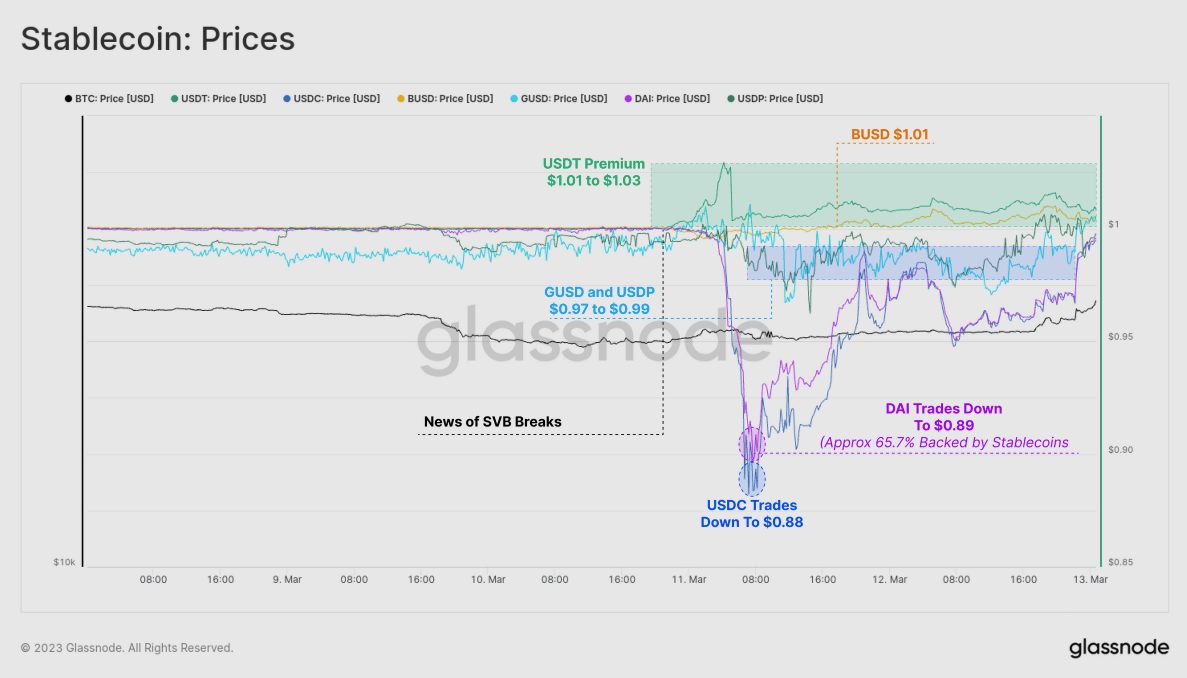

(Source: Glassnode insights)This has caused USDC and DAI to commercialized astatine little values of $0.88 and $0.89 respectively. DAI’s worth driblet is due to the fact that it is backed by stablecoin collateral of lone astir 65.7%. Gemini’s GUSD and Paxos’ USDP besides dipped beneath their $1 peg, portion BUSD and Tether traded astatine a premium.

Tether, successful particular, traded astatine a premium betwixt $1.01 and $1.03 during the weekend, which is ironic due to the fact that it is seen arsenic a harmless haven successful the look of imaginable risks successful the heavy regulated US banking sector. This is the archetypal clip since the LUNA-UST task illness that determination has been volatility successful stablecoin prices.

DAI / USDC

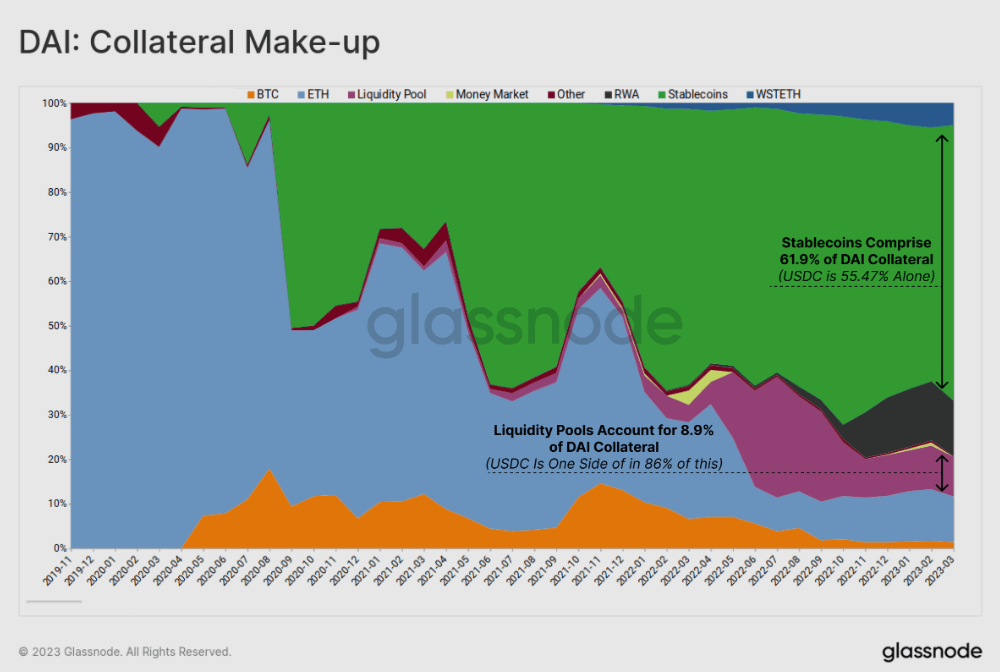

Stablecoins, peculiarly USDC, person go the superior signifier of collateral supporting DAI. This inclination has been accordant since mid-2020, with USDC making up astir 55.5% of nonstop collateral and a important information of Uniswap liquidity positions, totaling to astir 63% of each collateral.

According to Glassnode data, dependence connected stablecoins for collateral raises questions astir the decentralized quality of DAI. This caller lawsuit highlights however DAI’s terms is intimately tied to the accepted banking strategy owed to its collateral mix, which besides includes 12.4% successful tokenized real-world assets.

(Source: Glassnode Insights)

(Source: Glassnode Insights)Tether USDT dominance

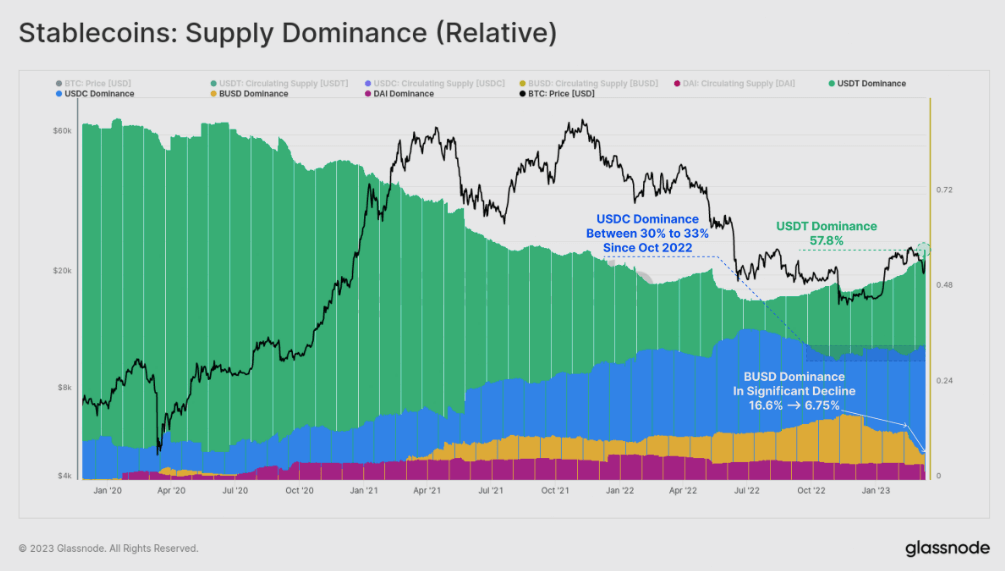

In mid-2022, Glassnode reported that Tether’s ascendant presumption successful the stablecoin marketplace had been declining structurally since mid-2020. However, owed to regulatory actions against BUSD and concerns regarding USDC stemming from its caller depegging, Tether’s dominance has rebounded to implicit 57.8%, it’s highest level successful 18-months.

Since October 2022, USDC has maintained a ascendant marketplace stock of betwixt 30% and 33%. However, it remains to beryllium seen whether its proviso volition alteration arsenic the redemption model reopens connected March 20. On the different hand, BUSD has experienced a important diminution successful caller months, with issuer Paxos ceasing caller minting, and its dominance falling from 16.6% successful November to lone 6.8% astatine present.

(Source: Glassnode insights)

(Source: Glassnode insights)Aggregate Capital Outflows

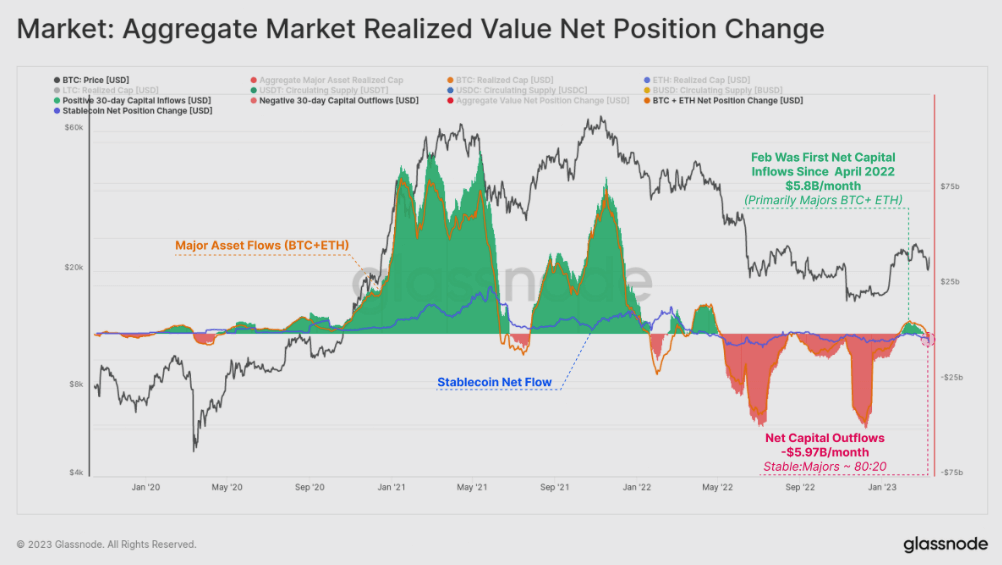

Estimation of the existent superior inflows and outflows, Glassnode estimates that the past month, the marketplace has seen a reversal outflow of -$5.97B, with 80% of that a effect of stablecoin redemption (BUSD primarily), and 20% from realized losses crossed BTC and ETH.

(Source: Glass node insights)

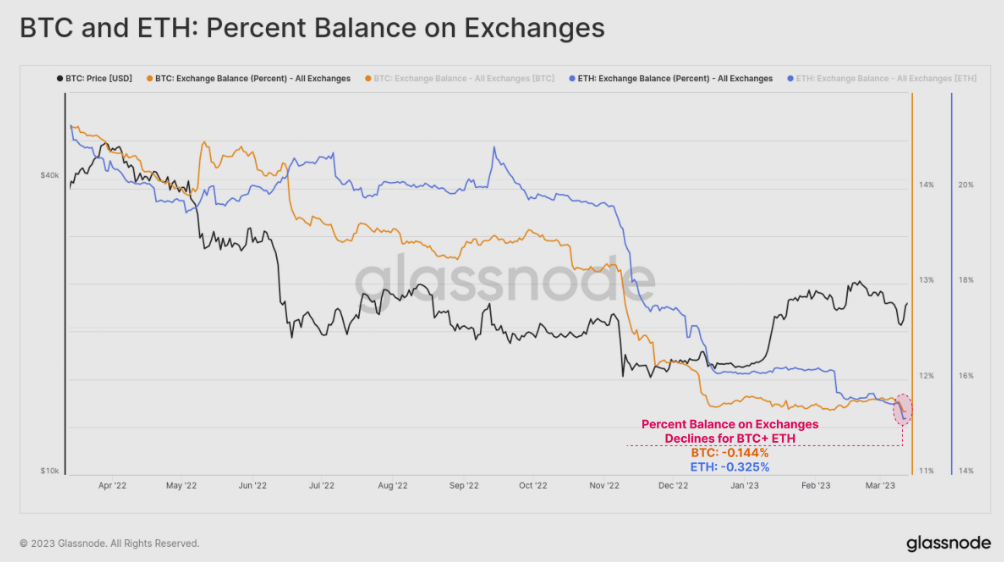

(Source: Glass node insights)SVB autumn retired connected percent of BTC and ETH connected exchanges

Approximately 0.144% of each BTC, and 0.325% each ETH successful circulation was withdrawn from speech reserves, demonstrating a akin self-custody effect signifier to the FTX collapse. On a USD basis, the past period saw implicit $1.8B successful combined BTC and ETH worth travel retired of exchanges.

(Source: Glass node analytics)

(Source: Glass node analytics)

The station Capital outflows, stablecoin play and realized loses – caller Glassnode information connected a brainsick week successful crypto appeared archetypal connected CryptoSlate.

2 years ago

2 years ago

English (US)

English (US)