In the satellite of fiscal markets, Bitcoin and crypto, fearfulness and uncertainty often predominate the headlines. Over the past fewer months, determination has been increasing speculation astir an impending recession and the anticipation of a large clang successful hazard assets. Theses specified arsenic Bitcoin volition emergence to $40,000 and past clang are presently successful abundance.

While the bulk of analysts expect a recessionary crash, with the timing being hotly disputed, macro expert Alex Krueger presents a compelling lawsuit for wherefore specified fears whitethorn beryllium unfounded. In his probe report, Krüger debunks prevalent bearish theses and sheds airy connected wherefore helium remains bullish connected hazard assets, including Bitcoin and cryptocurrencies.

1/ A recession is imminent, hazard assets are expensive, and stocks ever bottommost during deleveraging driven recessions.

Is a large clang inevitable?

Not astatine all

In this probe study we research however prevalent bearish theses are flawed and wherefore we are bullish connected hazard assets. pic.twitter.com/6b456Pvz2l

— Alex Krüger (@krugermacro) July 3, 2023

Debunking Bearish Theses For Risk Assets Like Bitcoin

According to Krüger, the upcoming recession, if any, has been 1 of the astir wide anticipated successful history. This anticipation has led to marketplace participants and economical actors preparing themselves, thereby reducing the probability and imaginable magnitude of the recession. As Krüger astutely points out, “What genuinely matters is not if information comes successful affirmative oregon negative, but if information comes successful amended oregon worse than what is priced in.”

One flawed conception often associated with recessions is the content that hazard assets indispensable bottommost retired erstwhile a recession occurs. Krüger highlights the constricted illustration size of US recessions and provides a counterexample from Germany, wherever the DAX has reached all-time highs contempt the state being successful a recession. This serves arsenic a reminder that the narration betwixt recessions and hazard assets is not arsenic straightforward arsenic immoderate mightiness assume.

Valuations, different cardinal facet of marketplace analysis, tin beryllium subjective and babelike connected assorted factors. The expert emphasizes that biases successful information and timeframe enactment tin importantly interaction valuations. While immoderate metrics mightiness suggest overvaluation, Krüger suggests looking person astatine just pricing indicators, specified arsenic the guardant price-to-earnings ratio for the S&P 500 ex FAANG. By taking a nuanced approach, investors tin summation a much close knowing of the marketplace landscape.

Furthermore, the emergence of artificial quality (AI) presents a revolutionary opportunity. Krüger highlights the ongoing AI revolution, comparing it to the transformative powerfulness of the net and concern revolution. He notes that AI has the imaginable to regenerate a important information of existent employment and boost productivity growth, yet driving planetary GDP higher. Krüger says, “Is an AI bubble forming? Likely so, and it is conscionable getting started!”

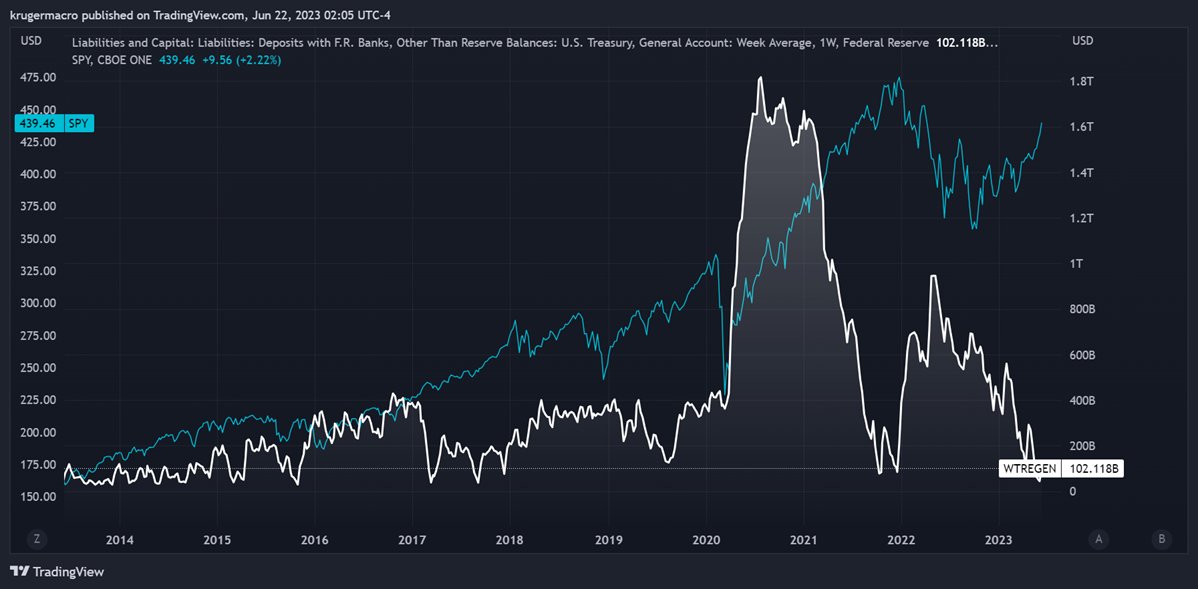

Addressing concerns implicit liquidity, Krüger challenges the content that liquidity unsocial drives hazard plus prices. He argues that positioning, rates, growth, valuations, and expectations collectively play a much important role. While the refilling of the Treasury General Account (TGA) has been presently viewed by a fewer analysts arsenic a imaginable headwind for Bitcoin and crypto, Krüger points retired that humanities grounds suggests the TGA’s interaction connected the marketplace has been minimal. He argues:

The TGA is known to beryllium decorrelated from hazard assets for precise agelong periods of time. In fact, the 4 largest TGA rebuilds implicit the past 2 decades person had a minimal interaction connected the market.

SPDR S&P 500 ETF Trust vs. TGA | Source: Twitter @krugermacro

SPDR S&P 500 ETF Trust vs. TGA | Source: Twitter @krugermacroThe Best Is Yet To Come

Considering the monetary argumentation landscape, Krüger notes that the tightening rhythm by the US Federal Reserve is nearing its end. With the bulk of complaint hikes already down us, the imaginable interaction of a fewer further hikes is improbable to origin a important shift. Krüger reassures investors that the Fed’s tightening rhythm is astir 90% complete, frankincense reducing the perceived hazard of a clang successful hazard assets.

Positioning is different origin that Krüger highlights arsenic being cash-heavy, arsenic indicated by record-high wealth marketplace funds and organization holdings. This suggests that a important information of marketplace participants person adopted a cautious approach, which could service arsenic a buffer against immoderate imaginable downside. Krüger states:

According to the ICI, wealth marketplace funds deed a grounds $5.4 trillion, portion institutions clasp $3.4 trillion arsenic of June 28th, astir 2% supra the anterior highest level connected record, which happened successful May 2020, the darkest constituent of the pandemic.

All successful all, Krüger’s investigation provides a refreshing position amidst a question of bearish sentiment. While marketplace conditions stay unpredictable, Krüger concludes:

Everyone is bearish. But the recession has been front-run, AI gyration is real, the Fed is astir done, and the marketplace is currency heavy. We spot nary crushed for changing our bullish stance, which we’ve held for each of 2023. The inclination is your friend. And the inclination is up.

At property time, the Bitcoin terms was up 1.2% successful the past 24 hours, trading astatine $31,050.

Bitcoin terms hovers beneath yearly high, 2- hr illustration | Source: BTCUSD connected TradingView.com

Bitcoin terms hovers beneath yearly high, 2- hr illustration | Source: BTCUSD connected TradingView.comFeatured representation from iStock, illustration from TradingView.com

2 years ago

2 years ago

English (US)

English (US)