Crypto bulls nursed astatine slightest $1.2 cardinal successful losses implicit the past 24 hours arsenic the marketplace slump from Monday worsened during the Asian hours connected Tuesday, driving bitcoin (BTC) to nether $89,000, its lowest since mid-November.

Apart from Bybit, crypto exchanges study lone 1 liquidation per second, meaning the wide losses are overmuch higher than the recorded $1.35 cardinal crossed agelong and abbreviated trades.

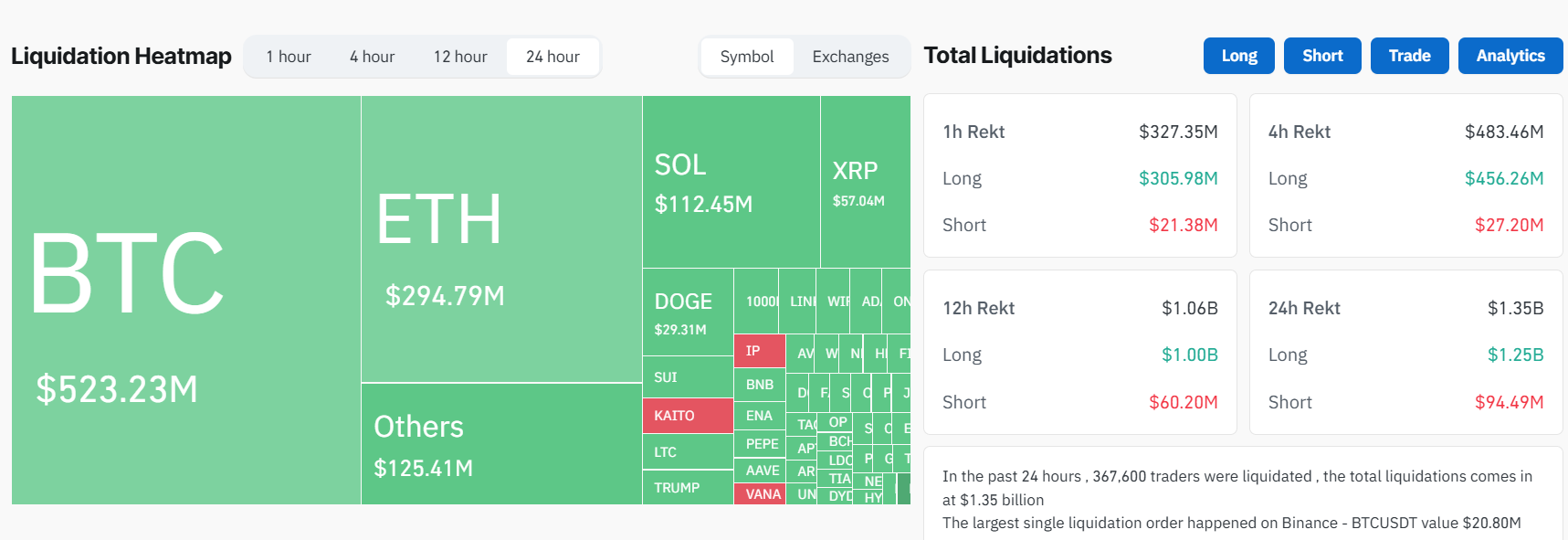

Futures tracking bitcoin registered implicit $530 cardinal successful liquidations, portion ether (ETH) bets saw implicit $294 cardinal evaporated. Solana (SOL) futures mislaid $112 cardinal arsenic the token slumped much than 15%, portion a 14% dive successful XRP and doge (DOGE) led to implicit $80 cardinal successful losses cumulatively.

Liquidations hap erstwhile an speech forcefully closes a trader's leveraged presumption owed to a partial oregon full nonaccomplishment of the trader's archetypal margin. It happens erstwhile a trader cannot conscionable the borderline requirements for a leveraged position, that is, they don't person capable funds to support the commercialized open.

Crypto speech Bybit — which has afloat recovered assets aft a $1.4 cardinal hack past week — led liquidation figures with implicit $600 cardinal mislaid connected the exchange, followed by Binance astatine $300 cardinal and OKX astatine $147 million.

Nasdaq futures pointed to continued losses successful exertion stocks and spot successful the Japanese yen sparked fears of an August-like hazard aversion.

Investors thin to flock to the yen during economical uncertainty oregon marketplace accent arsenic it is seen arsenic a harmless haven, overmuch similar the U.S. dollar oregon gold. This risk-off sentiment usually pressures riskier assets — similar bitcoin oregon equities — arsenic investors propulsion wealth retired of speculative investments and parkland it successful safer bets.

8 months ago

8 months ago

English (US)

English (US)